Moscow has been quietly pursuing a two-pronged approach to finance its escalating conflict prices. Along with the publicly scrutinized protection price range, it has arrange a device of state-directed, off-budget comfortable loans the place the Kremlin badgers banks into making simple credit to defense-sector corporations to unofficially fund its conflict gadget.

However with the hovering price of borrowing this is now changing into an issue that might result in a debilitating disaster, consistent with a record from the Davis Heart at Harvard College.

This lesser-known mechanism, instituted in a while after the invasion of Ukraine, has ballooned, with the amount of loans operating into loads of billions of greenbacks. Corporations that had been pressured to take out those loans are beginning to squeal from the ache of servicing the hastily emerging hobby bills after rates of interest climbed into double digits.

Inflation took off, forcing the Central Financial institution to opposite its loosening of financial coverage in the second one quarter of 2023. Since then, high rates of interest have climbed relentlessly to the present all-time top of 21%, implementing crushing hobby bills on Russian corporates that experience historically have shyed away from credit, who prefer to make nearly all of their investments from retained profits.

Pastime bills consuming into income

The debt burden is now consuming up one ruble in 4, consistent with Rostec CEO Sergei Chemezov, and is main some analysts to expect a wave of bankruptcies later this yr, even if different economists have argued that Russia’s economic system is so much extra tough than it seems to be.

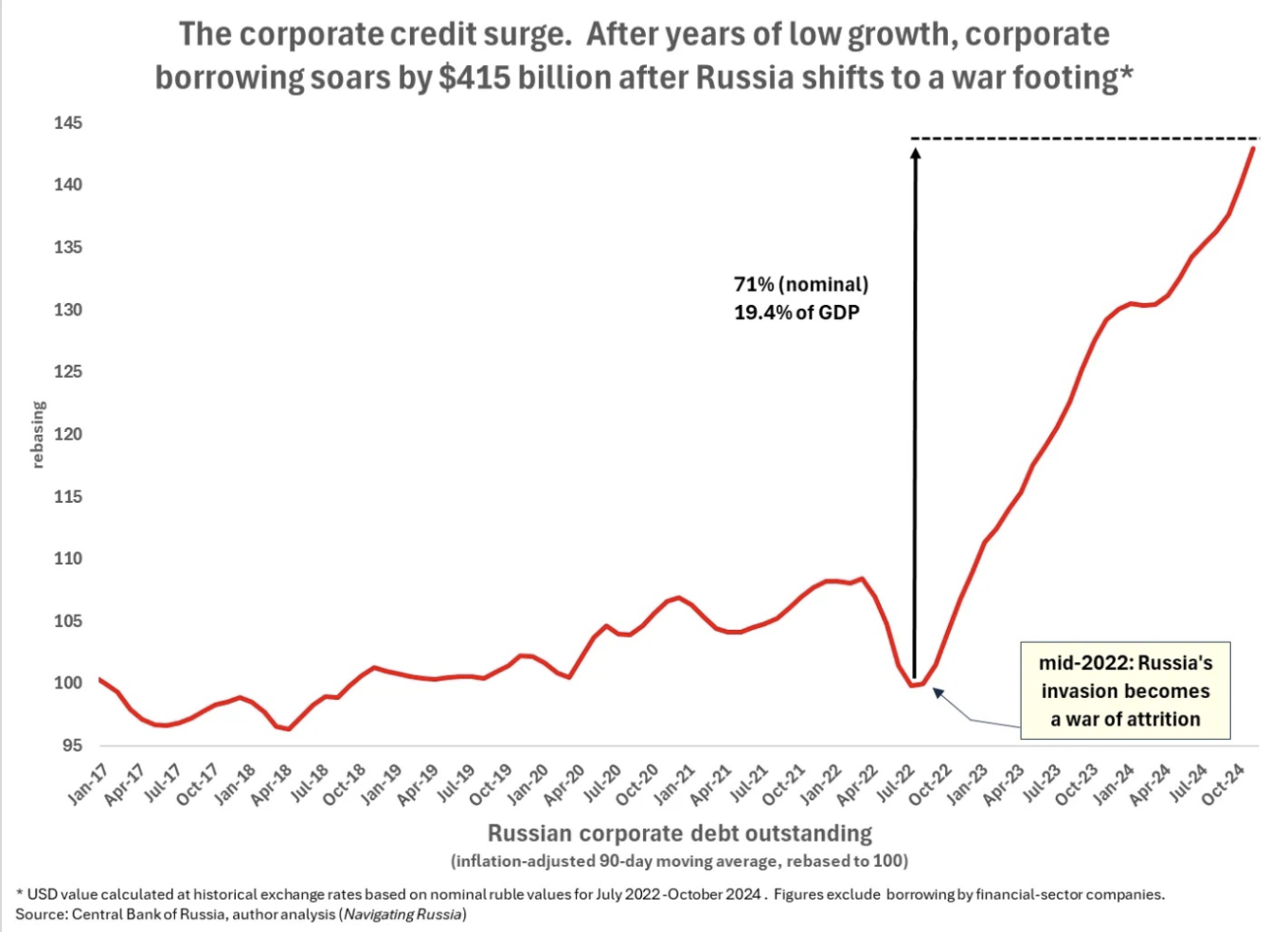

Since mid-2022, this off-budget financing has resulted in a report $415 billion surge in company borrowing, with an estimated $210-250 billion (21-25 trillion rubles) as obligatory loans to protection contractors, mentioned Craig Kennedy, a former funding banker and now an affiliate of the Davis Heart, in a social media submit.

For the reason that Russia’s overall protection spending used to be simply over 10 trillion rubles in 2024, this casual state-directed lending to protection corporations, consistent with those estimates, is double the entire reliable army spending — a considerable quantity.

Central Financial institution Governor Elvia Nabiullina has been suffering to carry down inflation as rate of interest hikes are obviously no longer running, so on the finish of ultimate yr she teamed up with the Finance Ministry to introduce a chain of non-monetary coverage strategies. Amongst those used to be successfully decreasing retail borrowing via expanding financial institution macroprudential limits, however she had much less good fortune with chopping company borrowing, even if even that began to sluggish within the autumn.

opinion

Russia’s Financial Gamble: The Hidden Prices of Warfare-Pushed Enlargement

Learn extra

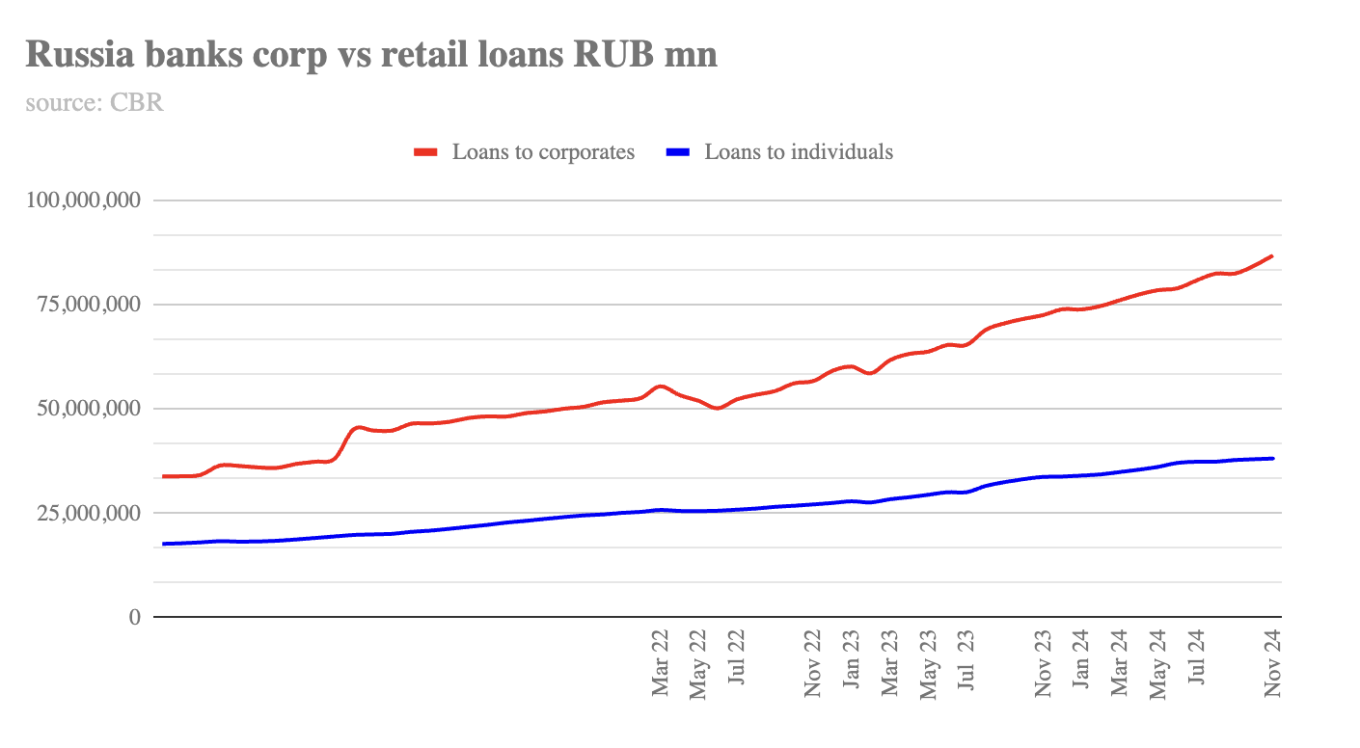

The expansion of company lending slowed to 0.8% yr on yr in November 2024, down from 2.3% in October 2024, as Nabiullina’s tightening of lending stipulations perceived to ship some effects.

Nonetheless, even consistent with the reliable Central Financial institution company borrowing determine stays increased at a complete exceptional company borrowing of 86.7 trillion rubles ($852 billion) in November, up via virtually two-thirds (65%) from 52.6 trillion rubles firstly of the conflict in February 2022. The rise used to be in large part pushed via ruble-denominated government-backed loans to business, consistent with the Central Financial institution’s personal reporting.

Kennedy estimates that 30% of all this borrowing is because of state-directed lending for military-related contracts.

bne IntelliNews

Kennedy argues that if off-budget lending is added in, the rise in company borrowing is a lot more dramatic.

“This off-budget investment circulation is permitted underneath a brand new regulation, quietly enacted on Feb. 25, 2022, that empowers the state to compel Russian banks to increase preferential loans to war-related companies on phrases set via the state. Since mid-2022, Russia has skilled an anomalous 71% growth in company debt, valued at 41.5 trillion rubles ($415 billion) or 19.4% of GDP,” Kennedy says.

“Briefly, Russia’s overall conflict prices a long way exceed what reliable price range expenditures would counsel. The state is stealthily investment round part those prices off-budget with really extensive quantities of debt via compelling banks to increase credit score on ‘off-market’ (non-commercial) phrases to companies offering items and products and services for the conflict,” writes Kennedy.

Govt resources of investment

Financial institution loans to protection corporations aren’t the principle supply of investment for Russia’s protection spending. The formal price range expenditure stays the supply of budget and because of the conflict spice up, revenues rose once more in 2024.

For the January-November 2024 length, overall revenues reached 32.65 trillion rubles, with oil and fuel revenues up via 1 / 4 to ten.3 trillion rubles ($103 billion), whilst non-oil revenues had been additionally up via 1 / 4 to 22.3 trillion rubles — the Kremlin earned two times as a lot from non-oil taxes because it did from gasoline exports. Recently the oil and fuel revenues virtually duvet all the protection spending of 10.8 trillion rubles.

Having a look forward, the 2025 price range signifies an additional build up in protection spending, with plans to allocate just about 13.5 trillion rubles (13 billion euros), representing virtually a 3rd of federal spending.

The opposite important supply of price range investment is the roughly 4.5 trillion rubles of Russian OFZ treasury expenses issued via the Finance Ministry in 2024 — virtually double the volume it used to factor once a year pre-war. The full quantity of OFZ bonds lately exceptional is round 20 trillion rubles, however this is virtually solely coated via the nineteen trillion rubles of liquidity within the banking sector, which could also be the principle purchaser of OFZ.

After all, the federal government can faucet the Nationwide Welfare Fund (NWF), Russia’s rainy-day fund. The amount of money within the liquid portion of the fund has fallen via part because the get started of the conflict, however in 2024 the Finance Ministry if truth be told controlled to extend the volume in reserve relatively. The liquid a part of the fund halved from a pre-war 9 trillion rubles to a low of four.8 trillion rubles in 2023. However this yr, the federal government began with simply over 5 trillion rubles and ended the yr with 5.8 trillion rubles ($580 billion), leaving the Finance Ministry with a relaxed cushion that may duvet the projected price range deficit this yr two times over.

Banking disaster at the playing cards?

Now analysts warn that the volume of accrued debt might start to resolve, posing dangers to Russia’s monetary steadiness. Via keeping up its reliable protection price range at ostensibly sustainable ranges, the Finance Ministry has misled observers and fooled them into considerably underestimating the stress the so-called particular army operation is having at the company and banking sectors. The off-budget investment scheme is most effective fueling extra inflation, pushing up rates of interest, and weakening Russia’s financial transmission mechanism.

“The Kremlin’s reliance on preferential loans is now riding liquidity and reserve shortfalls in banks and dangers a cascading credit score disaster,” notes the record. “Rates of interest and inflation have surged, with knock-on results threatening the wider economic system,” says Kennedy.

information

Russian Economic system Presentations Indicators of Slowdown, Best Banker Warns

Learn extra

This covert investment means has additionally left Moscow grappling with an rising catch 22 situation: lengthen a ceasefire and possibility credit score occasions, akin to large-scale financial institution bailouts, or negotiate whilst nonetheless conserving financial leverage. Those dangers are of accelerating fear to Russian policymakers, who’re rising cautious of a possible credit score disaster undermining home steadiness and their bargaining place in any long run peace talks.

The Kremlin’s fiscal fragility supplies Ukraine and its allies with a novel alternative to press for effective phrases in negotiations. “The monetary pressure on Moscow has shifted the dynamics, providing surprising leverage to Ukraine,” the record suggests.

The Russian giant industry lobbying workforce, the Russian Union of Industrialists and Marketers (RSPP), has been baying for Nabiullina’s blood for months and on the finish of ultimate yr prompt that the Central Financial institution “coordinate” its financial coverage with the federal government and industry leaders, suggesting the long-standing independence of the central financial institution be undermined.

And Nabiullina perceived to collapse December, giving into the force, when in a unprecedented dovish wonder resolution she stored rates of interest on cling at 21%, in spite of the very fashionable expectancies of a 200bp price hike.

NPLs solid however inflation emerging

Simply prior to the assembly, Nabiullina defended herself in a speech prior to the Duma, pronouncing that the CBR used to be at the verge of an “inflation price leap forward” that may grow to be obvious within the first quarter of this yr.

Russia’s off-budget protection investment schemes have became poisonous two times prior to – in 2016-17 and once more in 2019-20, the record mentioned. Each instances the state needed to think extensive quantities of unhealthy debt. Will it occur once more?

She additionally pointed to the non-performing mortgage (NPL) effects which quantity to just 4% of the mortgage e-book and which even declined relatively in October to a few.8%, or RUB3.1 trillion, that have remained in large part unchanged all yr. Certainly, the extent of non-performing debt is now not up to 5.51% in 2022 and six.1% in 2021.

Additionally, company NPLs stay adequately coated via prudential reserves at 72% in October, which the CBR mentioned stays a “solid stage” in comparison to the former month in its November banking replace. Banks and corporations is also underneath force, however they aren’t struggling any exact injury – but. On the other hand, a couple of, like Gazprom, are already in peril; the state-owned fuel massive has been borrowing closely within the ultimate yr to hide historical losses after its pipelines had been blown up in 2022.

The comfortable loans aren’t going to spark a disaster quickly. The wear and tear it’s doing is extra oblique: riding up inflation. The Ukrainian protection price range is a few 20% of GDP — 10 instances upper than maximum NATO individuals. In opposition to that, Russia’s 6% of GDP or circa 10 trillion rubles seems to be prudent given the dimensions of the struggle. On the other hand, if you happen to upload in an additional clandestine 20 trillion rubles of spending by way of the comfortable loans the real stage of army spending is nearer to 18% of GDP — on a par with Ukraine — this is pumping the economic system filled with cash.

It’s this torrent of cash this is inflicting Nabiullina’s inflation downside and no quantity of price hikes will make any distinction, as emerging rates of interest are meant to take money out of the device and funky the economic system. However conventional financial insurance policies don’t paintings when it’s the Kremlin, no longer the Central Financial institution, that has its hand at the money spigot.

“In the second one part of 2024, the Central Financial institution started figuring out the state’s preferential company lending scheme as an important risk to Russia’s financial steadiness,” says Kennedy. “As the principle contributor to financial growth, it’s been riding Russia’s emerging inflation. Worse nonetheless, as a result of this lending is strategic reasonably than advertisement in nature, the Central Financial institution observes that it’s been in large part “insensitive” to rate of interest hikes, blunting the CBR’s primary software for preventing inflation.”

Credit score issues are a present for Ukraine

“Via overdue 2024, the Kremlin had grow to be conscious about the systemic credit score dangers unleashed via its off-budget protection investment scheme. This has created a catch 22 situation this is more likely to weigh on Moscow’s conflict calculus: the longer it depends on this scheme, the better the chance a disruptive credit score match happens that undermines its symbol of economic resilience and weakens its negotiating leverage,” Kennedy argues.

As bne IntelliNews has reported, Ukraine is hastily operating out of males, cash and materiel, even if it lately has sufficient to litter thru 2025. However the looming credit score issues imply the clock is ticking for Russia too. The army Keynesianism spice up to the economic system has already worn off and the Central Financial institution issued a pessimistic medium-term macroeconomic outlook firstly of August that predicts expansion will stumble and fall to an insignificant 0.5% this yr. Russia gained’t have a disaster this yr, however President Vladimir Putin may also’t come up with the money for to stay the conflict gadget going indefinitely and from 2025 will probably be underneath rising force to carry the hostilities to a halt.

On Oct. 28, Putin convened a gathering of senior officers, together with the pinnacle of the Central Financial institution, to talk about issues across the “construction and dynamics” of Russia’s “company debt portfolio.” Since then, he has publicly proven heightened sensitivity to protection spending ranges and the state’s use of preferential lending to reach “strategic duties.” This chain of occasions used to be capped in December with Nabiullina’s wonder resolution to stay charges on cling.

“In contrast to the slow-burn possibility of inflation, credit score match possibility — akin to company and financial institution bailouts — is seismic in nature: it has the prospective to materialize abruptly, unpredictably and with important disruptive power, particularly if it turns into contagious,” the record says.

The Kremlin nonetheless has the assets with the intention to deal with a credit score disaster, however what’s going to be way more harmful is a disaster would strip away the veneer of normality in moderation constructed up via the Kremlin, which has strived to insulate the lives of standard Russians from the consequences of the conflict. That can undermine its hand in mooted talks with Kyiv as neatly.

“Moscow now faces a catch 22 situation: the longer it places off a ceasefire, the better the chance that credit score occasions uncontrollably get up and weaken Moscow’s negotiating leverage,” says Kennedy.

Western ways going into the talks will have to come with making it transparent it’s ready to pull the struggle out so long as it takes till a Russian credit score disaster arrives with appropriate commitments to a long-term fortify bundle for Ukraine. Additionally to refuse to even talk about sanctions reduction that Russia must generate extra revenues to take care of a mounting pile of deteriorating debt except there’s a complete and “simply” peace deal, says Kennedy.

This newsletter used to be initially printed via bne IntelliNews.

A Message from The Moscow Instances:

Expensive readers,

We face extraordinary demanding situations. Russia’s Prosecutor Basic’s Place of job has designated The Moscow Instances as an “unwanted” group, criminalizing our paintings and striking our body of workers liable to prosecution. This follows our previous unjust labeling as a “overseas agent.”

Those movements are direct makes an attempt to silence unbiased journalism in Russia. The government declare our paintings “discredits the choices of the Russian management.” We see issues otherwise: we attempt to supply correct, impartial reporting on Russia.

We, the reporters of The Moscow Instances, refuse to be silenced. However to proceed our paintings, we’d like your assist.

Your fortify, regardless of how small, makes an international of distinction. If you’ll, please fortify us per 30 days ranging from simply $2. It is fast to arrange, and each contribution makes an important affect.

Via supporting The Moscow Instances, you might be protecting open, unbiased journalism within the face of repression. Thanks for status with us.

Proceed

![]()

Now not able to fortify lately?

Take me back to the fact later.

×

Take me back to the fact subsequent month

Thanks! Your reminder is about.

We can ship you one reminder e-mail a month from now. For main points at the non-public knowledge we accumulate and the way it’s used, please see our Privateness Coverage.