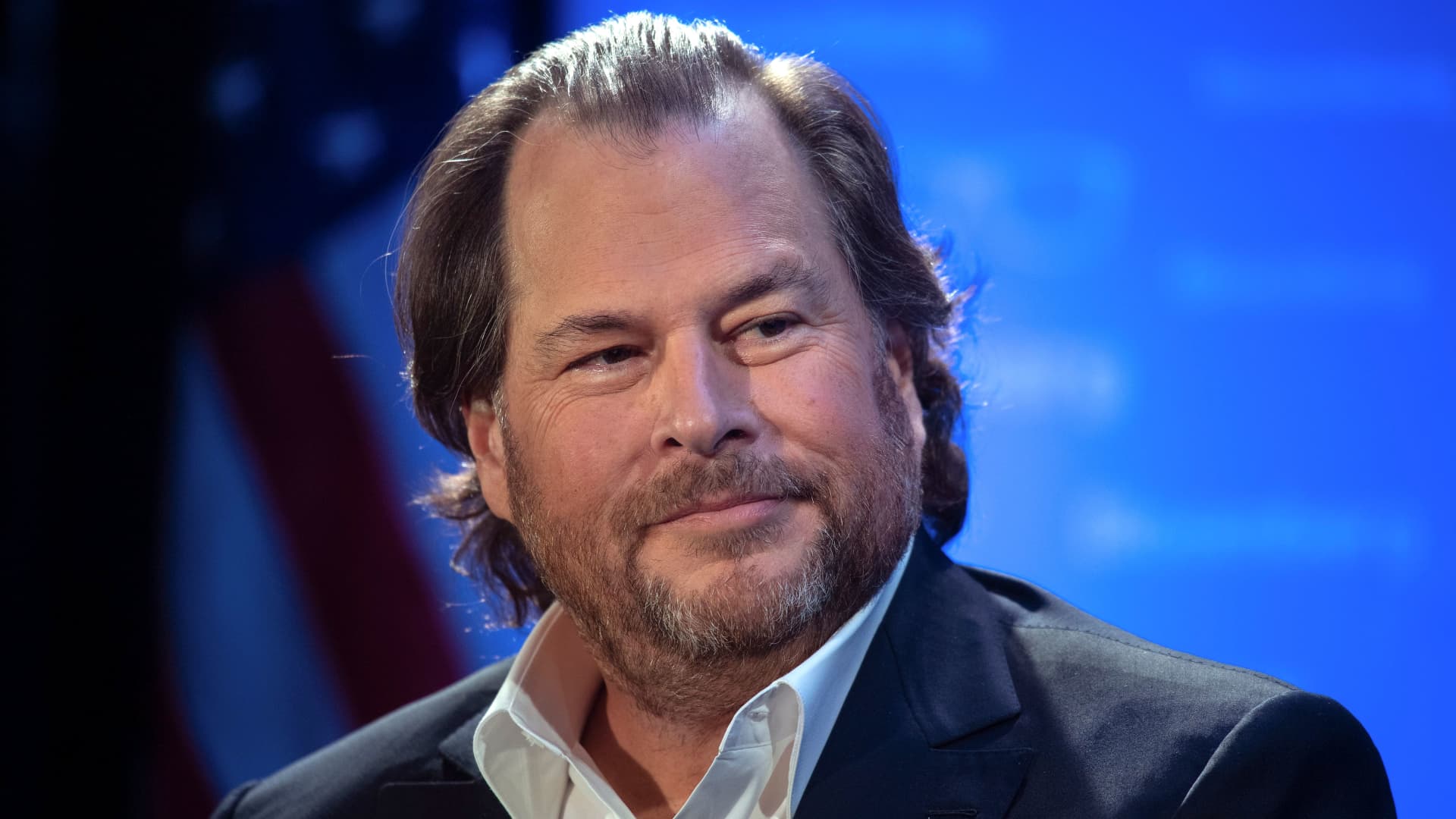

Salesforce ‘s (CRM) fiscal 2024 3rd quarter as soon as once more confirmed how the cloud instrument corporate has discovered the proper steadiness between rising gross sales and bettering margins. Wall Boulevard preferred what it noticed. Income for the 3 months ended Oct. 31 higher 11% year-over-year to $8.72 billion, exceeding the $8.72 billion anticipated, in step with the analysts’ consensus estimate compiled by way of LSEG, previously referred to as Refinitiv. Non-GAAP earnings-per-share of $2.11 grew 51% from remaining yr and beat the $2.06 predicted by way of analysts, LSEG records confirmed. GAAP stands for usually accredited accounting rules. Non-GAAP running margin endured to increase to 31.2%, beating estimates of 30.26%, in step with FactSet. On a GAAP foundation, quarterly running margin 17.2% exceeded the 15.7% anticipated. Running money go with the flow higher 390% from the former yr to $1.53 billion, beating estimates of $313 million, FactSet records confirmed. Unfastened money go with the flow of $1.36 billion outpaced the $681 million forecast by way of analysts, in step with FactSet. CRM YTD mountain Salesforce YTD On best of quarterly beats just about around the board Wednesday night, a cast fiscal This autumn profitability information helped ship stocks greater than 8% upper to $249 each and every in after-hours buying and selling. If the ones beneficial properties had been to carry at Thursday’s open, the inventory would simply best its new 52-week prime. Final analysis It was once every other terrific quarter from Salesforce with secure, double-digit income expansion and a endured running margin uplift, resulting in an enormous build up in revenue in line with percentage. Whilst some imagine the margin tale has in large part performed out already, the corporate is adamant that 30% is the ground and no longer the ceiling, suggesting extra beneficial properties are forward. Moreover, the topline expansion tale has some sport to it, due to the surge in pastime in its Knowledge Cloud. An bettering deal setting sooner or later will best fix things, and we’re upbeat concerning the long run because of the “inexperienced shoots” CEO Marc Benioff stated he is seeing. The corporate is anticipated to develop income across the present 10% tempo for a while, accompanied by way of much more margin beneficial properties sooner or later. Subsequently, it is relatively conceivable we see Salesforce develop its EPS at a 20% charge over the following a number of years. That is what makes the inventory compelling at this sub-30 price-to-earnings a couple of. Quarterly observation Salesforce beat throughout many key metrics regardless of what is still a measured macroeconomic setting for undertaking instrument firms. Salesforce continues to peer sturdy adoption of its so-called cocktail of cloud choices from consumers who’re consolidating their era platforms to cut back complexity and power potency and expansion. As proof, 9 of its best 10 offers within the quarter incorporated six or extra clouds, which can be reported as 5 devices. Salesforce additionally noticed an 80% build up in offers valued at greater than $1 million, exceeding control’s expectancies. Geographically, on a relentless foreign money foundation, gross sales higher 9% yr over yr within the Americas, 10% in EMEA (Europe, the Heart East, and Africa), and 21% within the Asia Pacific area (APAC). The corporate’s luck resulted in an acceleration in its cRPO (present last efficiency legal responsibility) expansion to fourteen%, topping estimates of an 11% acquire, as observed within the Companywide segment of the above revenue desk. On the similar time, the corporate’s income attrition charge stayed low at 8%, an indication that undertaking consumers can not possibility losing Salesforce’s buyer courting control answers. That comes even with the corporate’s fresh 9% charge build up, the primary time its hiked costs in seven years. Via Cloud unit, probably the most thrilling efficiency within the quarter got here from the Knowledge Cloud. This a real-time buyer records platform made from Analytics (from the Tableau acquisition) and Integration (from the Mulesoft acquisition.) Income expansion speeded up to 22% from 16% within the prior quarter, and the corporate stated it added 1,000 new consumers within the quarter on my own. Synthetic intelligence is using the pastime within the Knowledge Cloud, as extra consumers search to make use of Mulesoft’s integration era to free up records throughout legacy programs, cloud apps, and gadgets. In the meantime, Tableau helps consumers higher perceive records and make data-driven choices. Salesforce could also be seeing sturdy traction in its Einstein GPT Copilot product, which necessarily is a conversational AI chatbot. The corporate claims 17% of the Fortune 100 are already the use of the software, with many extra anticipated to shop for. At the margin facet, the 850-basis-point non-GAAP development within the quick span of 365 days confirmed control’s endured self-discipline throughout each a part of its trade, particularly advertising and marketing. It is fascinating to peer the corporate pull margin beneficial properties even with an uptick in headcount. After lowering its headcount for a couple of quarters in a row as a part of a profitability push, Salesforce’s headcount ended the quarter at 70,843, up from 70,456 in July. Nonetheless, this can be a a long way cry from the 79,824 staff it had three hundred and sixty five days in the past. Unfastened money go with the flow continues to develop, hovering an astounding 1,088% to $1.37 billion. That provides Salesforce an more uncomplicated time to make just right on its dedication to repurchase inventory to offset dilution from stock-based reimbursement. The corporate purchased again $1.93 billion value of stocks within the quarter, in step with the extent of repurchasing process we’ve got observed in fresh quarters. Salesforce’s buyback program has resulted in a more or less 2% decline in diluted percentage rely from remaining yr. The corporate nonetheless has about $10 billion last on a $20 billion percentage repurchase program. Steerage For its fiscal 2024 fourth quarter, Salesforce guided income to be in a variety of $9.18 billion to $9.23 billion as opposed to estimates of $9.22 billion, with GAAP EPS of one.26 to $1.27 and non-GAAP EPS at $2.25 to $2.26 in comparison to estimates of $1.01 and $2.18, respectively. Salesforce additionally expects its cPRO to develop more or less 10% from remaining yr, implying a determine of about $26.4 billion. That is best simply somewhat underneath estimates of 10.4% expansion to $27 billion. For the overall fiscal yr, with the present quarter last, Salesforce nudged up its income outlook to $34.75 billion to $34.8 billion, consistent with the $34.78 billion consensus estimate. It higher its non-GAAP running margin outlook to 30.5%, above the consensus estimate and former information of 30%. And, on the base line, the corporate expects to earn on a non-GAAP foundation $8.18 to $8.19 in line with percentage, above the $8.04 consensus estimate and better than prior steerage of $8.04 to $8.06. (Jim Cramer’s Charitable Believe is lengthy CRM. See right here for a complete checklist of the shares.) As a subscriber to the CNBC Making an investment Membership with Jim Cramer, you are going to obtain a business alert prior to Jim makes a business. Jim waits 45 mins after sending a business alert prior to purchasing or promoting a inventory in his charitable agree with’s portfolio. If Jim has talked a few inventory on CNBC TV, he waits 72 hours after issuing the business alert prior to executing the business. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.Marc Benioff, co-founder and CEO of Salesforce, speaks at an Financial Membership of Washington luncheon in Washington, DC, on Oct. 18, 2019.Nicholas Kamm | AFP | Getty ImagesSalesforce’s (CRM) fiscal 2024 3rd quarter as soon as once more confirmed how the cloud instrument corporate has discovered the proper steadiness between rising gross sales and bettering margins. Wall Boulevard preferred what it noticed.

Salesforce stocks are deservedly rewarded after a stellar quarter and a rosy outlook