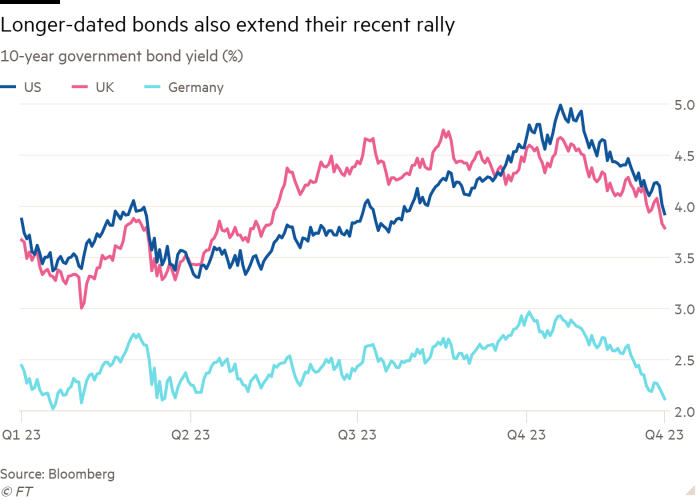

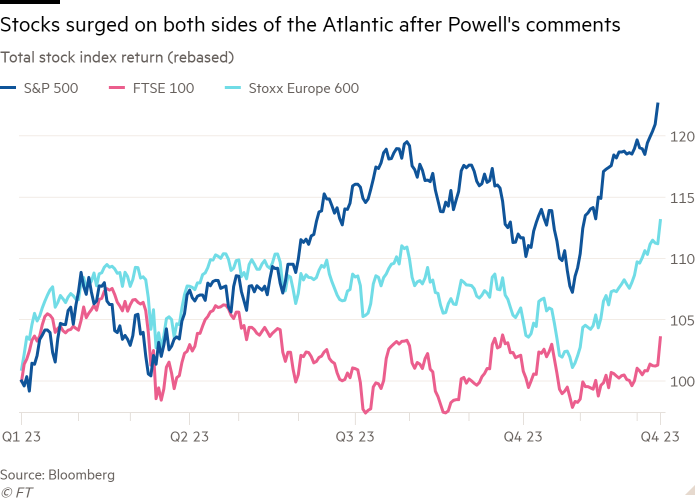

Release the Editor’s Digest for freeRoula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.Shares and govt bonds complex on Thursday as central banks in Europe diverged from the USA, pushing again in opposition to marketplace predictions of competitive charge cuts early subsequent 12 months.In New York the S&P 500 rose 0.4 in step with cent and the Nasdaq used to be up 0.4 in step with cent, main a world fairness marketplace rally. Treasury yields fell sharply as new forecasts from Federal Reserve officers pointed to 0.75 proportion issues of cuts subsequent 12 months, excess of traders had anticipated. Bond yields transfer inversely to costs.“It’s a bumper early Christmas provide” from the Fed, stated Charles Hepworth, funding director at GAM Investments.However Ecu stocks pared positive factors after the Financial institution of England and Ecu Central Financial institution rejected rising marketplace expectancies that they have been in a position to chop charges.BoE governor Andrew Bailey stated there used to be “nonetheless some method to move” earlier than inflation hit its goal, whilst his ECB counterpart Christine Lagarde stated there used to be “paintings to be performed” to tame inflation and “we must completely now not decrease our guard” in opposition to shopper value pressures.Alternatively, buyers have been having a bet on Ecu charges following the USA decrease in 2024. Swaps markets have been nonetheless pricing in round six 0.25 proportion level charge cuts for each the Fed and the ECB subsequent 12 months, and no less than 4 from the BoE. The Europe Stoxx 600 index used to be 0.5 in step with cent upper whilst the FTSE 100 traded 1 in step with cent upper in London. In bond markets, the yield on rate-sensitive two-year Treasuries fell 0.1 proportion issues to 4.38 in step with cent whilst two-year German Bund yields, the eurozone benchmark, fell 0.09 proportion issues to two.56 in step with cent.Ten-year Bund yields fell 0.03 proportion issues to two.14 in step with cent, the bottom degree since March, whilst 10-year gilt yields have been 0.06 proportion issues decrease at 3.77 in step with cent.“However the BoE and ECB looking to chase away on early charge lower expectancies, Powell’s feedback as a result ruled over Lagarde and Bailey,” stated Mark Dowding, leader funding officer for RBC BlueBay fastened source of revenue.The greenback weakened 0.9 in step with cent in opposition to a basket of associates whilst gold added 0.5 in step with cent to $2,037 in step with troy ounce. Buyers drew self assurance from the Fed’s forecasts and feedback from Fed chair Jay Powell that the central financial institution used to be “most likely at or close to its height for this tightening cycle”.Seema Shah, leader international strategist at Main Asset Control, stated the Fed had delivered “an important about-turn . . . from emphasising upper for longer to, now, upper for shorter”.

The Europe Stoxx 600 index used to be 0.5 in step with cent upper whilst the FTSE 100 traded 1 in step with cent upper in London. In bond markets, the yield on rate-sensitive two-year Treasuries fell 0.1 proportion issues to 4.38 in step with cent whilst two-year German Bund yields, the eurozone benchmark, fell 0.09 proportion issues to two.56 in step with cent.Ten-year Bund yields fell 0.03 proportion issues to two.14 in step with cent, the bottom degree since March, whilst 10-year gilt yields have been 0.06 proportion issues decrease at 3.77 in step with cent.“However the BoE and ECB looking to chase away on early charge lower expectancies, Powell’s feedback as a result ruled over Lagarde and Bailey,” stated Mark Dowding, leader funding officer for RBC BlueBay fastened source of revenue.The greenback weakened 0.9 in step with cent in opposition to a basket of associates whilst gold added 0.5 in step with cent to $2,037 in step with troy ounce. Buyers drew self assurance from the Fed’s forecasts and feedback from Fed chair Jay Powell that the central financial institution used to be “most likely at or close to its height for this tightening cycle”.Seema Shah, leader international strategist at Main Asset Control, stated the Fed had delivered “an important about-turn . . . from emphasising upper for longer to, now, upper for shorter”. Marketplace expectancies for rate of interest cuts have very much shifted in fresh weeks after softer than anticipated inflation and financial knowledge higher convictions that central banks have now tightened financial coverage sufficient to convey inflation again to their 2 in step with cent goals. Markets were anticipating the Fed to chase away in opposition to the collection of cuts priced in for subsequent 12 months. As an alternative, “the complete opposite took place”, stated Richard McGuire, head of charges technique at Rabobank. “Unsurprisingly”, shares have been “loving lifestyles”, he stated. “The Fed’s blindsiding of the marketplace the previous day should for sure be a watershed second” for bond traders, he added.Sterling rose 0.8 in step with cent to $1.2720 after the BoE stated inflation “had some method to move” till it hit its goal, whilst dangers to its inflation forecast remained “skewed to the upside”.“Whilst the Fed is beginning to talk about the potential of charge cuts, the selection for the BoE remains to be only between protecting or climbing,” stated Matthew Landon, international marketplace strategist at JPMorgan Non-public Financial institution.“Markets have been beginning to scent a world pivot by way of central banks after the Fed shifted decidedly dovish remaining evening. The BoE didn’t reasonably practice swimsuit.”

Marketplace expectancies for rate of interest cuts have very much shifted in fresh weeks after softer than anticipated inflation and financial knowledge higher convictions that central banks have now tightened financial coverage sufficient to convey inflation again to their 2 in step with cent goals. Markets were anticipating the Fed to chase away in opposition to the collection of cuts priced in for subsequent 12 months. As an alternative, “the complete opposite took place”, stated Richard McGuire, head of charges technique at Rabobank. “Unsurprisingly”, shares have been “loving lifestyles”, he stated. “The Fed’s blindsiding of the marketplace the previous day should for sure be a watershed second” for bond traders, he added.Sterling rose 0.8 in step with cent to $1.2720 after the BoE stated inflation “had some method to move” till it hit its goal, whilst dangers to its inflation forecast remained “skewed to the upside”.“Whilst the Fed is beginning to talk about the potential of charge cuts, the selection for the BoE remains to be only between protecting or climbing,” stated Matthew Landon, international marketplace strategist at JPMorgan Non-public Financial institution.“Markets have been beginning to scent a world pivot by way of central banks after the Fed shifted decidedly dovish remaining evening. The BoE didn’t reasonably practice swimsuit.”

Shares and bonds achieve in spite of BoE and ECB warning on charges

:max_bytes(150000):strip_icc()/PLTRChart-71ec74b79d4442c2a8719bc71da59b23.gif)

)