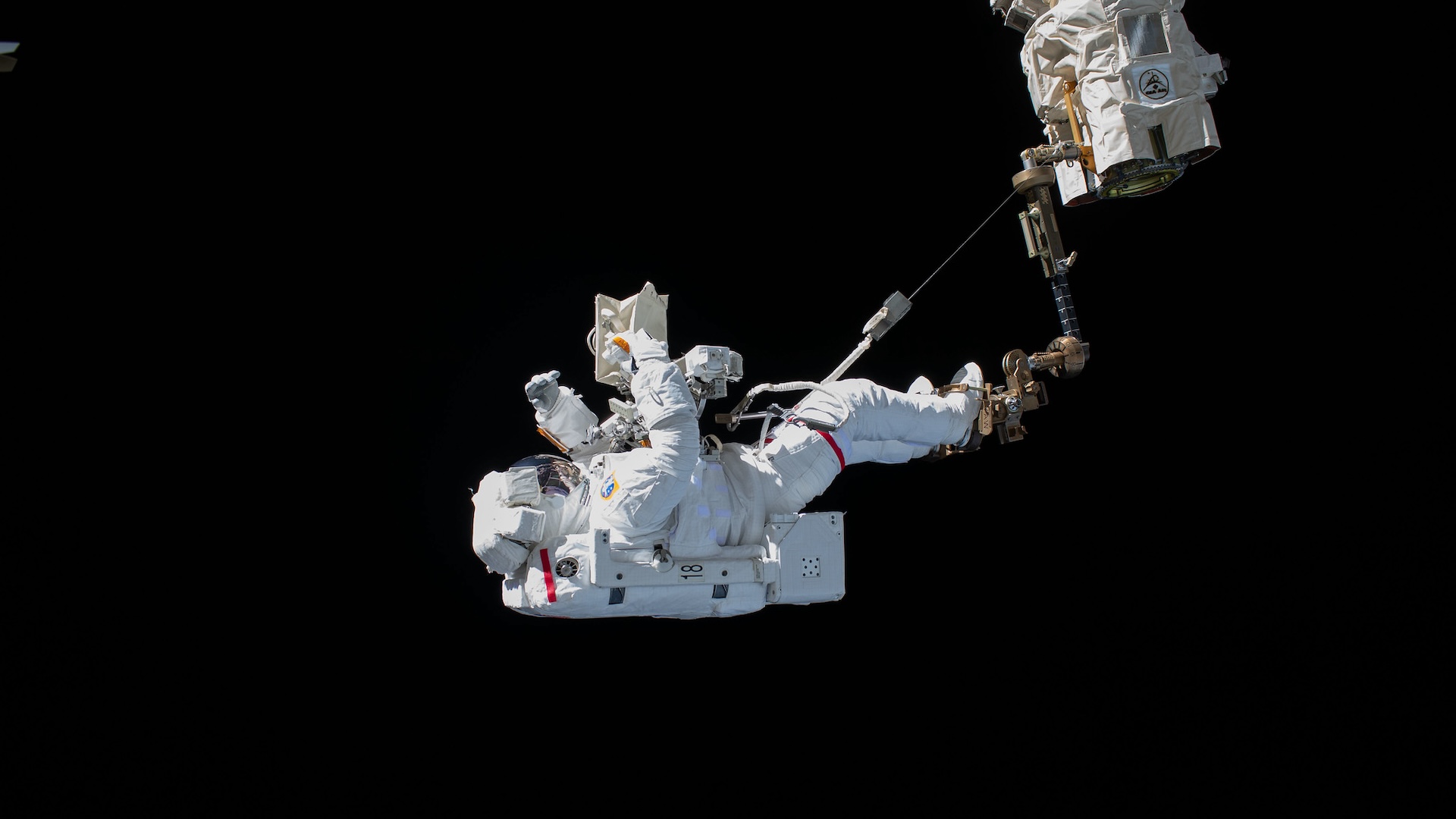

Bull statues are positioned in font of displays appearing the Dangle Seng inventory index and inventory costs out of doors Change Sq., in Hong Kong, China, August 18, 2023. REUTERS/Tyrone Siu/Report Photograph Gain Licensing RightsSINGAPORE, Oct 13 (Reuters) – Asian stocks slid on Friday and had been on target for his or her steepest one-day share decline in every week after stronger-than-expected U.S. client costs figures reinforced the case for the Federal Reserve to stay charges upper for longer.MSCI’s broadest index of Asia-Pacific stocks out of doors Japan (.MIAPJ0000PUS) fell 1.2%, having scaled a three-week top on Thursday.It’s, then again, nonetheless set for a good acquire of one.4% for the week, snapping a three-week shedding streak.The bitter temper used to be set to proceed in Europe, with Eurostoxx 50 futures down 0.19%, German DAX futures shedding 0.14% and FTSE futures 0.05% decrease.Inflation reviews from Sweden, Spain and France due later within the day will probably be in center of attention.An building up in U.S. client costs for September contained a marvel surge in apartment prices and investors now see a more potent likelihood that the Fed will finally end up handing over some other hike this 12 months.Futures contracts that settle to the Fed coverage fee replicate a couple of 40% likelihood of a fee hike in December, when put next with a couple of 28% likelihood noticed sooner than the CPI document.Ryan Brandham, head of world capital markets, North The usa at Validus Chance Control, stated the knowledge highlights the demanding situations the Fed will face bringing inflation all the way down to its 2% goal.Separate knowledge additionally confirmed the collection of American citizens receiving advantages after an preliminary week of help, a proxy for hiring, higher 30,000 to a still-low 1.702 million all the way through the week ended Sept. 30.”The labour marketplace softening is essential to the Fed reaching its objective of returning inflation to focus on, and the hawks calling for no less than some other hike will probably be supported in response to those numbers,” Brandham stated.The inflation document together with deficient call for for an public sale of U.S. 30-year bonds despatched Treasury yields upper on Thursday.In Asian hours on Friday, the yield on 10-year Treasury notes used to be down 4.1 foundation issues at 4.670% however remained a long way off the two-week low of four.5300% it touched an afternoon previous.Contemporary features in shares and a slide in Treasury yields had adopted feedback from Federal Reserve officers suggesting that U.S. rates of interest – which generally tend to power international borrowing prices – could have in the end peaked.”A lot of the ‘just right’ paintings carried out up to now week within the type of bull pulling down of america yield curve has been undone through the most recent US CPI document,” stated Ray Attrill, head of FX technique at Nationwide Australia Financial institution.Information on Friday confirmed China’s client costs had been flat in September, whilst factory-gate costs shrank at slower tempo, indicating deflationary pressures persist.However China’s exports and imports shrank at a slower tempo for a moment month in September, including to indicators of a steady stabilisation on this planet’s second-biggest economic system.China’s blue-chip inventory index CSI300 (.CSI300) fell 1.1%, whilst the Dangle Seng Index (.HSI) sank 2%. Japan’s Nikkei (.N225) used to be 0.53% decrease, whilst Australia’s S&P/ASX 200 index (.AXJO) misplaced 0.47%.The week’s sharp escalation of Heart East tensions has additionally ensured the temper stays wary throughout markets.Buyers will subsequent center of attention on remarks through Federal Reserve Chair Jerome Powell who’s because of discuss on Oct. 19, simply sooner than the U.S. central financial institution’s blackout length starts forward of its subsequent interest-rate determination. The Fed subsequent meets Oct. 31-Nov. 1.The danger-off temper additionally prevailed within the forex marketplace, with the greenback conserving directly to in a single day features. In opposition to a basket of currencies, the greenback eased 0.103% to 106.40, having won 0.8% in a single day.The euro climbed 0.19% to $1.0548, whilst sterling used to be at $1.2204, up 0.24%. The greenback’s ascent has once more put the Eastern yen beneath force, with the yen at 149.60 in keeping with greenback.Gold costs edged up on Friday however remained beneath two-week highs hit within the earlier consultation. Spot gold added 0.4% to $1,876.79 an oz.Oil costs rose on Friday after the U.S. tightened its sanctions programme towards Russian crude exports, elevating provide issues in an already tight marketplace. U.S. crude complicated 0.95% to $83.70 in keeping with barrel and Brent used to be at $86.66, up 0.77% at the day.Brent is about for a weekly acquire of over 2%, whilst WTI is about to climb about 1% for the week as traders stay a cautious eye on the potential of disruptions to Heart Jap exports because of the Gaza disaster.Reporting through Ankur Banerjee; Modifying through Edwina GibbsOur Requirements: The Thomson Reuters Accept as true with Ideas. Gain Licensing Rights, opens new tab

Bull statues are positioned in font of displays appearing the Dangle Seng inventory index and inventory costs out of doors Change Sq., in Hong Kong, China, August 18, 2023. REUTERS/Tyrone Siu/Report Photograph Gain Licensing RightsSINGAPORE, Oct 13 (Reuters) – Asian stocks slid on Friday and had been on target for his or her steepest one-day share decline in every week after stronger-than-expected U.S. client costs figures reinforced the case for the Federal Reserve to stay charges upper for longer.MSCI’s broadest index of Asia-Pacific stocks out of doors Japan (.MIAPJ0000PUS) fell 1.2%, having scaled a three-week top on Thursday.It’s, then again, nonetheless set for a good acquire of one.4% for the week, snapping a three-week shedding streak.The bitter temper used to be set to proceed in Europe, with Eurostoxx 50 futures down 0.19%, German DAX futures shedding 0.14% and FTSE futures 0.05% decrease.Inflation reviews from Sweden, Spain and France due later within the day will probably be in center of attention.An building up in U.S. client costs for September contained a marvel surge in apartment prices and investors now see a more potent likelihood that the Fed will finally end up handing over some other hike this 12 months.Futures contracts that settle to the Fed coverage fee replicate a couple of 40% likelihood of a fee hike in December, when put next with a couple of 28% likelihood noticed sooner than the CPI document.Ryan Brandham, head of world capital markets, North The usa at Validus Chance Control, stated the knowledge highlights the demanding situations the Fed will face bringing inflation all the way down to its 2% goal.Separate knowledge additionally confirmed the collection of American citizens receiving advantages after an preliminary week of help, a proxy for hiring, higher 30,000 to a still-low 1.702 million all the way through the week ended Sept. 30.”The labour marketplace softening is essential to the Fed reaching its objective of returning inflation to focus on, and the hawks calling for no less than some other hike will probably be supported in response to those numbers,” Brandham stated.The inflation document together with deficient call for for an public sale of U.S. 30-year bonds despatched Treasury yields upper on Thursday.In Asian hours on Friday, the yield on 10-year Treasury notes used to be down 4.1 foundation issues at 4.670% however remained a long way off the two-week low of four.5300% it touched an afternoon previous.Contemporary features in shares and a slide in Treasury yields had adopted feedback from Federal Reserve officers suggesting that U.S. rates of interest – which generally tend to power international borrowing prices – could have in the end peaked.”A lot of the ‘just right’ paintings carried out up to now week within the type of bull pulling down of america yield curve has been undone through the most recent US CPI document,” stated Ray Attrill, head of FX technique at Nationwide Australia Financial institution.Information on Friday confirmed China’s client costs had been flat in September, whilst factory-gate costs shrank at slower tempo, indicating deflationary pressures persist.However China’s exports and imports shrank at a slower tempo for a moment month in September, including to indicators of a steady stabilisation on this planet’s second-biggest economic system.China’s blue-chip inventory index CSI300 (.CSI300) fell 1.1%, whilst the Dangle Seng Index (.HSI) sank 2%. Japan’s Nikkei (.N225) used to be 0.53% decrease, whilst Australia’s S&P/ASX 200 index (.AXJO) misplaced 0.47%.The week’s sharp escalation of Heart East tensions has additionally ensured the temper stays wary throughout markets.Buyers will subsequent center of attention on remarks through Federal Reserve Chair Jerome Powell who’s because of discuss on Oct. 19, simply sooner than the U.S. central financial institution’s blackout length starts forward of its subsequent interest-rate determination. The Fed subsequent meets Oct. 31-Nov. 1.The danger-off temper additionally prevailed within the forex marketplace, with the greenback conserving directly to in a single day features. In opposition to a basket of currencies, the greenback eased 0.103% to 106.40, having won 0.8% in a single day.The euro climbed 0.19% to $1.0548, whilst sterling used to be at $1.2204, up 0.24%. The greenback’s ascent has once more put the Eastern yen beneath force, with the yen at 149.60 in keeping with greenback.Gold costs edged up on Friday however remained beneath two-week highs hit within the earlier consultation. Spot gold added 0.4% to $1,876.79 an oz.Oil costs rose on Friday after the U.S. tightened its sanctions programme towards Russian crude exports, elevating provide issues in an already tight marketplace. U.S. crude complicated 0.95% to $83.70 in keeping with barrel and Brent used to be at $86.66, up 0.77% at the day.Brent is about for a weekly acquire of over 2%, whilst WTI is about to climb about 1% for the week as traders stay a cautious eye on the potential of disruptions to Heart Jap exports because of the Gaza disaster.Reporting through Ankur Banerjee; Modifying through Edwina GibbsOur Requirements: The Thomson Reuters Accept as true with Ideas. Gain Licensing Rights, opens new tab

Shares in Asia droop on fee jitters