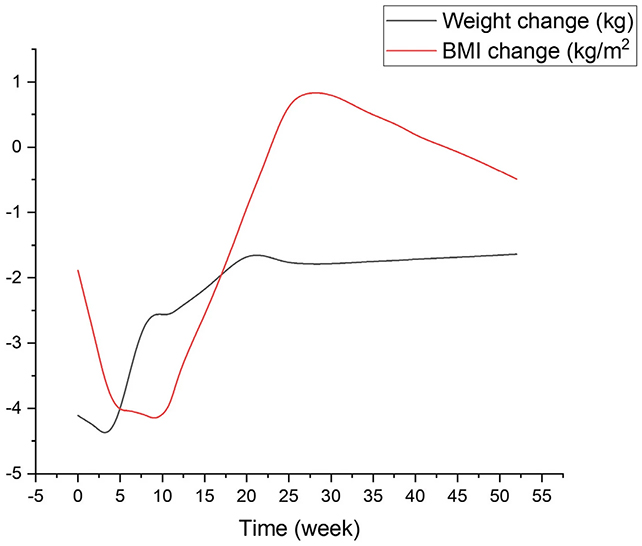

Take a look at the firms making headlines in noon buying and selling. Eli Lilly — Stocks added 5% after Eli Lilly, maker of the Mounjaro diabetes and weight reduction drug, beat analysts’ expectancies for first-quarter adjusted income. The Indianapolis-based drugmaker additionally lifted its full-year steering for adjusted income and earnings. 3M — Stocks jumped 4% after the maker of commercial merchandise and adhesives posted income of $2.39 in keeping with percentage on earnings of $7.72 billion, topping analysts’ estimate of $2.10 in keeping with percentage on earnings of $7.63 billion, in step with LSEG. PayPal — Stocks won 3.6% after the cost corporate posted $7.70 billion in first-quarter earnings, beating analysts’ estimates for $7.51 billion, in step with LSEG. PayPal reported annual expansion throughout general cost volumes and transactions. McDonald’s — Stocks have been little modified after previous falling up to 4% after the short meals chain neglected quarterly income estimates as same-store gross sales fell in need of expectancies. Upper costs helped McDonald’s earnings, however scared away some low-income shoppers. Chegg — Stocks sank 20% sooner or later after the net schooling corporate issued disappointing steering for the second one quarter. Chegg forecast earnings will are available in between $159 million to $161 million, less than the LSEG consensus estimate of $174 million. In a downgrade to underperform following the consequences, Jefferies mentioned unfastened AI gear have turn out to be an “horny choice.” Tesla — The electrical automobile maker slid 5.5%, giving up a few of Monday’s 15% rally on information that it had cleared a key hurdle in rolling out complicated driver-assistance generation in China. Goldman Sachs warned that Tesla nonetheless faces stumbling blocks offering complete self-driving generation within the nation. NXP Semiconductor — The inventory climbed round 4% after income beat analyst estimates. The chipmaker posted adjusted income of $3.24 in keeping with percentage, upper than the consensus estimate of $3.16 in keeping with percentage, in step with LSEG. Earnings of $3.13 billion matched analysts’ expectancies. Guiding principle Healthcare — Stocks added 9.8% at the again of robust income. Guiding principle earned $3.22 in adjusted income in keeping with percentage on $5.37 billion in earnings, whilst analysts polled by way of FactSet forecast $1.45 in keeping with percentage and $5.15 billion. Guiding principle additionally raised its interior forecasts on each measures for the whole yr. Corning — The maker of fiber optic cable surged 6.2% after beating income and gross sales estimates. Corning reported 38 cents in income in keeping with percentage and $3.26 billion in core earnings, topping consensus estimates of 35 cents in keeping with percentage and $3.12 billion from analysts polled by way of FactSet. Present-quarter earnings is anticipated to return in upper than analysts watch for. Amkor Generation — The semiconductor packaging corporate climbed just about 7% after income and earnings crowned analyst estimates. Profits of 24 cents in keeping with percentage on $1.37 billion in earnings exceeded consensus forecasts of eleven cents and $1.36 billion, in step with FactSet. 2d quarter income and earnings steering additionally crowned expectancies. Sysco — The wholesale eating place provider slipped 2.5% after posting vulnerable fiscal third-quarter earnings of $19.38 billion towards analysts’ consensus expectation of $19.74 billion, in step with FactSet. Houston-based Sysco’s in keeping with percentage income of 96 cents excpkuding one-time pieces exceeded Wall Side road estimates by way of 1 cent. GE Healthcare Applied sciences — Stocks plunged virtually 12% after the clinical tool maker neglected analysts’ first-quarter earnings estimates, harm by way of weaker gross sales in China and decrease imaging call for. The corporate’s general gross sales got here in at $4.65 billion, whilst analysts polled by way of LSEG forecast $4.8 billion. Yum China — Stocks of the Taco Bell and KFC operator slid greater than 7% after first-quarter earnings of $2.96 billion neglected the Side road’s $3.05 billion estimate, in step with LSEG. Adjusted income of 71 cents in keeping with percentage crowned expected income of 65 cents in keeping with percentage. Medifast — The diet and weight reduction corporate tumbled just about 23% after lacking income expectancies and announcing it is going to change into a product to improve customers the usage of blockbuster weight-loss medicine. Medifast earned 66 cents a percentage aside from pieces within the first quarter, less than analysts’ 80-cent estimate, in step with FactSet. Ahead steering for current-quarter income and earnings used to be vulnerable. Coursera — The web schooling inventory shed just about 10% sooner or later after announcing it expects second-quarter earnings between $162 million and $166 million, underneath the $178 million anticipated from analysts polled by way of LSEG. Paccar — Stocks dropped 6.6% after the truckmaker’s newest effects beat expectancies. The inventory had climbed greater than 16% to this point in 2024 thru Monday, outperforming the S & P 500. Paccar posted first-quarter income of $2.27 in keeping with percentage, greater than the FactSet consensus estimate of $2.20. Earnings of $8.74 billion crowned an anticipated $8.25 billion. Paramount World — The CBS tv mother or father and film studio proprietor shed greater than 3% after CEO Bob Bakish stepped down as merger talks with Skydance proceed. He’s going to get replaced by way of 3 executives in what the corporate referred to as the “Administrative center of the CEO.” Needham downgraded Paramount to carry from purchase following the scoop, mentioning an excessive amount of uncertainty. — CNBC’s Tanaya Macheel, Michelle Fox, Yun Li, Lisa Kailai Han, Pia Singh and Sarah Min contributed reporting

Shares making the most important strikes noon: Eli Lilly, 3M, PayPal, Tesla and extra

:max_bytes(150000):strip_icc()/KFheadshot-9fe00fcb29c24a589a05cb7dea9ca150.jpeg)