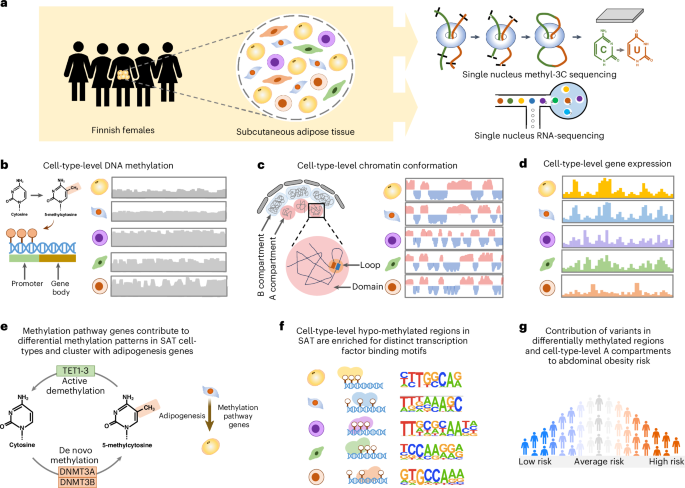

Many older American citizens be apologetic about some occupation possible choices that affected retirement plans and process potentialities.Regrets come with now not prioritizing schooling, common process adjustments, and involvement in place of work drama.This is a part of an ongoing sequence about older American citizens’ regrets.For hundreds of thousands of American citizens, retiring at 65 is only a dream.Since September, BI has heard from older American citizens about their occupation regrets in two surveys it carried out.Over 3,000 folks between the ages of 48 and 96 finished a voluntary BI survey or emailed newshounds about their lifestyles regrets. In a separate survey, over 300 not too long ago laid-off American citizens over 50 shared their occupation regrets. We adopted up with 13 interviews to be informed extra. This is a part of an ongoing sequence.Some not unusual topics folks mentioned incorporated now not prioritizing schooling, switching jobs too continuously, and suffering to navigate place of work politics. Many additionally cited age discrimination — knowledge from AARP discovered that 64% of the ones over 50 have both observed or skilled age discrimination within the office. Just about all stated they had been handed over for some roles in prefer of more youthful candidates with decrease pay expectancies, in particular in white-collar roles the place hiring has slowed.We wish to listen from you. Are you an older American with any lifestyles regrets that you’d be at ease sharing with a reporter? Please fill out this fast shape.Bureau of Exertions Statistics knowledge discovered that 18.9% of American citizens 65 and older — about 11.4 million folks — nonetheless paintings, many for monetary or social causes. Some returned to paintings after retiring, bringing up monetary considerations.No longer prioritizing or getting the fallacious roughly educationLou Nelson, 63, was once an government assistant within the scientific gadgets business for 25 years however confronted two layoffs since 2021. She hasn’t had success securing paintings since January.For many of her occupation, she had few regrets about now not having a bachelor’s stage as a result of she labored for best healthtech corporations and stated she was once neatly revered. Alternatively, after sending out over 50 programs, she suspects now not having some extent has impeded her seek.”No person desires to rent any person that is 63 years previous, and I have no idea if it is on account of pay or revel in,” stated Nelson, who lives in Texas.A school stage continues to be a large boon to discovering and protecting a task. The Bureau of Exertions Statistics’ newest jobs file confirmed that American citizens with a bachelor’s stage or larger had an unemployment price of two.4% in November 2024, whilst the ones with just a high-school degree had an unemployment price just about two times as excessive, at 4.6%.Grover McBeath, 79, stated now not having both restricted his occupation choices. He struggled thru faculty and dropped out in 8th grade.He joined the Air Power and labored in electronics for many of his occupation, however he lacked process delight. Even though he traveled the sector for paintings and his wage peaked at $38,000 a yr, he stated he had an “volatile, nomadic way of life.” McBeath took Social Safety at 62 and will depend on the $1,108 a month he receives. He lives in inexpensive housing in Nevada and receives SNAP advantages to assist pay for meals.”I used to be in a occupation box that I did not have a flair for, and lots of occasions, I simply felt so misplaced in what I used to be doing, which is why I bounced round so much,” McBeath stated, including he wanted he prioritized schooling.Nonetheless, many consider a faculty stage is not well worth the monetary burden. A Pew Analysis Middle survey of US adults carried out on the finish of 2023 discovered that simply 22% of respondents believed a four-year faculty stage could be price it in the event that they needed to take out loans.Some older American citizens BI spoke with agreed that their levels have not helped additional their careers. Lynda Namey, 54, was once a healthcare industry supervisor for 20 years, making $62,000 a yr at her top. Alternatively, after a divorce that put her in debt, she stated she panicked and returned to university for her grasp’s and doctorate levels in counseling from Liberty College. She had no robust want to pursue the levels however did it as a result of she anticipated them to assist her land higher-paying roles.That hasn’t panned out. The Alabama resident got rid of her doctorate from her résumé not to seem overqualified. Whilst in search of a full-time process, she’s held part-time consulting, lifestyles training, and impartial contractor roles. She additionally teaches meditation.”I am a middle-aged girl who has to fully improve myself. I pay for my very own insurance coverage, and I have were given to take into accounts my long term,” Namey stated. “I will be able to’t find the money for to take a task that will pay $17 or $18 an hour. However the ones are the one jobs I am getting interviewed for.”Switching jobs continuously as a substitute of establishing a cohesive careerThough a couple of process seekers regretted now not taking a look sufficient for brand spanking new roles, dozens stated they regretted bouncing between jobs and occupation paths and now not being extra intentional about rising their networks.After running in quite a lot of industries, Morning time Habbena, 63, fell in love with human assets. However after her corporate was once bought, she took a task in compliance for a wealth control corporate, which wasn’t as pleasurable as HR.When Habbena confronted a layoff all through the pandemic, she struggled to get again into HR. Six months later, she were given an HR process for a producing plant, however she took some other HR function after shifting to assist her ageing mom. She described that function as “completely terrible,” and he or she’s since struggled to search out some other place — whilst a grocery checker — after sending out over 1,000 programs.Habbena wanted she’d stayed involved in HR to accrue extra revel in and stored development her laptop talents. She lives in a one-bedroom condominium together with her 86-year-old mom and drives for DoorDash to stick afloat.”I want I had extra self assurance in what I did as a result of I used to be simply knocked off,” stated Habbena, who lives in Texas.

Chuck Smith labored for far of his lifestyles in advertising.

Chuck Smith

Many older American citizens, like Chuck Smith, 60, could not regulate how lengthy they stayed in roles on account of layoffs however wanted they’d settled someplace extra strong. Smith, from Massachusetts, labored in tech advertising for many of his occupation, making up to six figures.

Comparable tales

Smith was once laid off in June 2023 and stated he is since implemented to over 2,700 roles and landed about 100 interviews. Even though he and his spouse are financially at ease, Smith stated he is anxious about how briefly he is spending down his financial savings with no strong revenue.Even though hiring has remained secure for lower-income employees, the process marketplace for six-figure earners has slumped. New LinkedIn knowledge discovered hiring has fallen 27% in IT and 23% in product control and advertising since 2018. Heart managers have additionally confronted hiring demanding situations — hiring ranges fell 42% between April 2022 and October 2024, knowledge from Revelio Labs discovered.To make certain, fresh knowledge unearths that switching jobs steadily yields monetary good points. A September Leading edge file discovered that the median process switcher won a ten% build up in pay. Nonetheless, it additionally confirmed a zero.7 percentage-point decline in folks’s retirement financial savings price when switching jobs as a result of 401(ok) plan advantages can range and folks steadily make errors when rolling over retirement accounts.AARP discovered that older employees who voluntarily alternate roles or industries of their 40s and 50s have a tendency to retire later and feature higher paintings results than their friends who keep in a single function.”They have got higher salary expansion. They have got skilled the next luck price of staying within the office over those that would possibly had been pressured to switch jobs later of their occupation,” stated Carly Roszkowski, the vp of monetary resilience programming at AARP.Taking a possibility on a industry, contract roles, or an ‘place of work bully’Some respondents took dangers that harm them financially.

Comparable tales

Michael R., 70, opened toy retail outlets in New York during the 2000s, pondering they might develop sufficient that he may retire with ease. Alternatively, when his companies crashed amid the 2008 recession, he misplaced over $650,000 and declared chapter.”If I did not do the industry, I might have purchased a area,” Michael stated, including that during that situation, he may’ve helped his complete circle of relatives by means of promoting his mother’s area and gifting his siblings the cash.Alternatively, he needed to transfer in along with his mom, and after she died, he rented a studio condominium. He stated he works just about each day of the week at his buddy’s toy retailer and earns about $8,000 a month between his paycheck and his Social Safety advantages.”I am nonetheless suffering simply to pay my hire, my groceries, and my automotive. We do not get a carry. We do not get an advantage,” Michael stated. “I am thankful I am hired, however I will be able to’t pass out searching for some other process. No person’s going to rent any person who is 70 years previous.”

Mauricia Day continues to be running into her 70s.

Mauricia Day

Some regretted taking dangers running in contract roles as a substitute of prioritizing full-time paintings. Mauricia Day, 74, by no means completed her stage and stated she’s held over 40 jobs — many shriveled — in radio, tailoring, and place of work management, making $30,000 a yr at maximum. After a layoff in 2020, she hasn’t discovered protected paintings. She works at a nonprofit in a part-time contract function that results in December.Day stated as a result of she knew little about saving and making an investment, she lived paycheck to paycheck. She wanted she’d involved in securing full-time employment in a single box as a substitute of depending on volatile revenue. She receives $1,136 in Social Safety and $317 from her pension every month, which is relatively greater than her area cost.”I want I had targeted extra on a occupation; it will have most likely helped higher with retirement and making an investment,” Day stated, including she stayed house for just about 18 years elevating her youngsters. “I’ve a large number of buddies who’ve been retired for 10 years, 15 years. I am undecided why I am nonetheless taking a look, however I do know I am nonetheless taking a look.”A couple of wanted they took fewer dangers navigating office dynamics. Robbi Sera, 59, stated she had a strong occupation as a biotech mission supervisor and made just right monetary selections, similar to maxing out her 401(ok). Alternatively, she stated she took a couple of dangers at paintings that backfired.Sera stated she gave optimistic comments to a “corporate bully,” which she stated contributed to her layoff in February. She wanted she’d stayed quiet till she locked down a unique process, as she stated the hiring panorama is “dismal.”Sera, who splits her time between California and Hawaii, stated even supposing she’s financially strong, she and her husband have reduce on spending considerably, hardly consuming out or touring. She earns $20 an hour as a shriveled customer support agent for the aviation business whilst in search of higher-paying roles.”You simply stay swimming and hope that one thing will get higher,” Sera stated.

Robbi Sera has struggled to discover a process after a up to date layoff.

Robbi Sera

Are you an older American with any lifestyles regrets that you’d be at ease sharing with a reporter? Please fill out this fast shape or e mail nsheidlower@businessinsider.com.