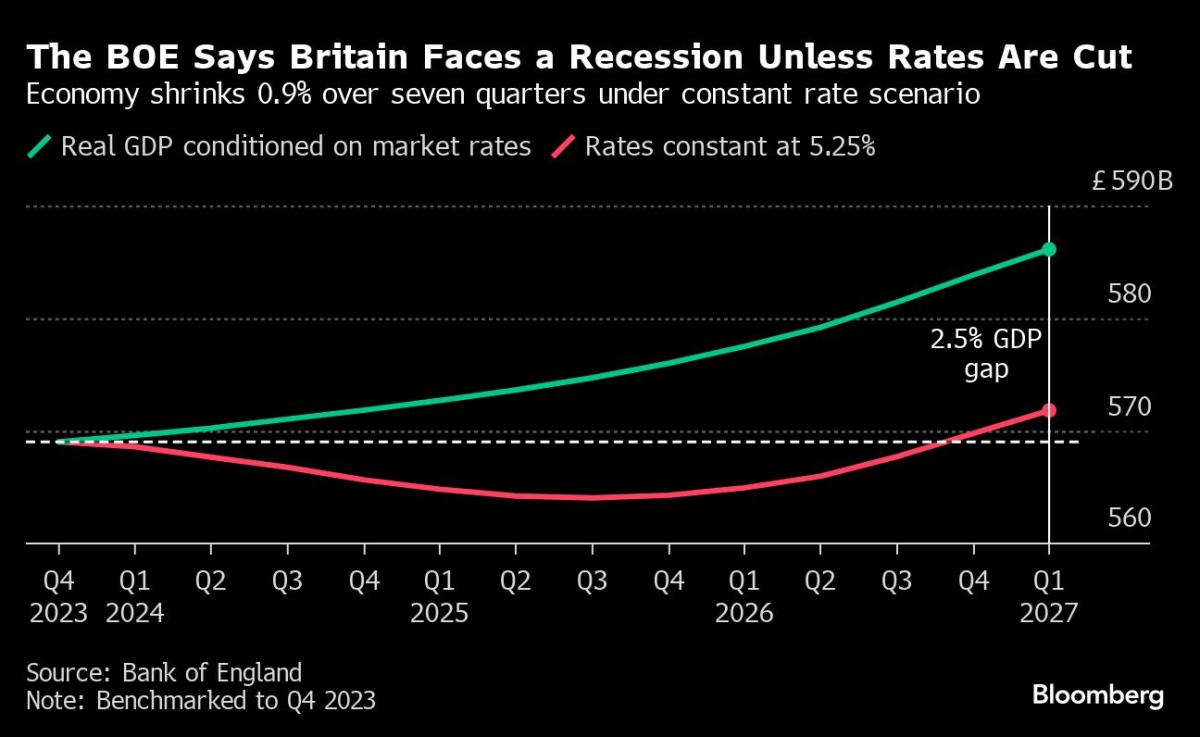

(Bloomberg) — The heartbeat of US inflation most likely persevered to sluggish in the beginning of the yr, serving to to feed expectancies that the Federal Reserve will to find interest-rate cuts extra palatable within the coming months.Maximum Learn from BloombergThe core person charge index, a measure that excludes meals and gasoline for a greater image of underlying inflation, is observed expanding 3.7% in January from a yr previous.That may mark the smallest year-over-year advance since April 2021, and underscore the inroads Fed Chair Jerome Powell and his colleagues have made in beating again inflation. The whole CPI most definitely rose not up to 3% for the primary time in just about two years, economists forecast Tuesday’s document to turn.Whilst acknowledging that growth, policymakers were cool to the concept that charges could also be decreased once subsequent month.Learn Extra: Fed Officers Upload to Refrain Tempering Hopes for Fee Cuts SoonTheir endurance has roots in an financial system that’s flashing inexperienced lighting, the most important of which is the hard work marketplace. Sturdy employment enlargement has saved shoppers spending. A separate document on Thursday is projected to expose every other build up in retail gross sales, apart from motor cars and fuel.The cooling of inflation, at the side of expectancies that borrowing prices will head decrease this yr, explains the new growth in person self assurance. A College of Michigan survey scheduled for free up on Friday is forecast to turn an index of sentiment keeping close to the absolute best degree since July 2021.Traders may also observe Fed officers talking within the days following the CPI information, to gauge the timing of any long run charge lower. Amongst the ones at the agenda are regional financial institution presidents Raphael Bostic of Atlanta and Mary Daly of San Francisco, who each vote on coverage this yr.Tale continuesWhat Bloomberg Economics Says:“In deciding when to begin slicing charges, the Fed should reconcile the knowledge they have got in hand – which display inflation on a quick observe to the two% goal — with dangers that inflation may just flare up once more or the hard work marketplace may just weaken extra sharply. Knowledge within the coming week will issue into that call — however received’t supply a definitive resolution.”— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For complete research, click on hereTurning north, Canadian house gross sales will expose whether or not the marketplace continues to warmth up forward of anticipated mid-year charge cuts. Housing begins and production information can also be launched.Amongst world highlights this week, Eastern gross home product, UK inflation and wages, and testimony through the euro-zone central financial institution leader will characteristic.Click on right here for what came about remaining week and under is our wrap of what’s bobbing up within the world financial system.AsiaJapan’s financial system is predicted to rebound from its dismal efficiency over the summer season, offering every other sign for the Financial institution of Japan because it prepares to finish its destructive charge coverage.Figures out Thursday also are set to verify that Japan has slipped to the fourth-largest financial system on this planet, at the back of the United States, China and Germany.China’s markets can be closed for Lunar New Yr celebrations, and no main releases are scheduled.Reserve Financial institution of India Governor Shaktikanta Das, who saved a hawkish stance at Thursday’s charge assembly, might see some growth in his inflation battle in the beginning of the week with person costs anticipated to have grown at a slower tempo in January. That most definitely received’t be sluggish sufficient to steered communicate of a pivot, then again.The Philippine central financial institution is observed keeping charges stable on Thursday after costs persevered to weaken there too.Australian jobs figures previous within the day are observed appearing a go back to enlargement after the losses in December.Singapore will revise its gross home product figures forward of business information the next day to come.RBNZ Governor Adrian Orr units out his newest place on coverage and a couple of% inflation in a speech Friday morning, with Malaysian GDP numbers ultimate out the week.Europe, Heart East, AfricaUK information will take the limelight. On Tuesday, salary numbers might display the weakest pay pressures since 2022, cheering Financial institution of England officers who — like world friends — are pivoting towards charge cuts.Policymakers may also scrutinize an expected blip upper in inflation at the headline gauge, and the core measure that strips out unstable components equivalent to power, in information due Wednesday.The next day to come, GDP will level to how BOE tightening is hitting enlargement. Economists reckon the United Kingdom stagnated within the fourth quarter, narrowly heading off a recession for now.Inflation information for January can also be launched across the wider area this week:Swiss consumer-price enlargement most definitely slowed to one.6%, whilst Denmark will free up identical numbers.In Jap Europe, inflation is expected to have weakened markedly in Poland and the Czech Republic, whilst edging upper in Romania.In Ghana, the velocity is more likely to have eased from 23.2% a month previous, whilst Nigeria’s studying can have speeded up from 28.9% amid forex weak spot.And in Israel, inflation is predicted to have slowed to two.7%.A sequence of fourth-quarter GDP numbers also are scheduled, with enlargement in Jap Ecu economies and Norway as smartly more likely to have stayed subdued.Euro-zone business manufacturing on Thursday is a spotlight within the forex area, with a fourth per thirty days drop in December predicted through economists amid falling manufacturing unit output in economies together with Germany.Policymaker appearances will draw consideration. Ecu Central Financial institution President Christine Lagarde testifies to lawmakers on Thursday, whilst more than one occasions that includes her colleagues also are scheduled.Talking this weekend, ECB Governing Council member Fabio Panetta mentioned “the time for reversal of the financial coverage stance is speedy drawing near,” caution towards ready too lengthy on charge cuts.In Norway, Governor Ida Wolden Bache will make her annual cope with to Norges Financial institution’s supervisory council.A handful of charge selections are at the calendar during the broader area:In Romania on Tuesday, the central financial institution will most definitely stay its charge at 7% as buyers wait for clues on doable cuts.Zambian officers are poised to lift borrowing prices on Wednesday to enhance a battered forex and curb mounting charge pressures.The similar day, Namibia’s policymakers will most likely go away borrowing prices unchanged consistent with South Africa’s pause remaining month.And on Friday, the Financial institution of Russia might keep on grasp after Governor Elvira Nabiullina indicated in December that the important thing charge will stay increased for a longer length to take on inflation working at nearly double the 4% goal.Latin AmericaThe Carnival vacation makes for a quiet begin to the week, however Argentina returns on Wednesday to put up its January inflation document.Shopper costs most likely rose 21.9% remaining month, consistent with economists surveyed through the central financial institution, down from 25% in December. That forecast implies an annual charge of over 250%, up from 211% at year-end 2023.Inflation has surged within the wake of President Javier Milei’s 54% peso devaluation and removal of charge controls on loads of on a regular basis person merchandise.Colombia publishes a raft of information, underscoring the precipitous slowdown in what were one among Latin The us’s post-pandemic vivid lighting.Business output, production and retail gross sales have all been destructive since March, whilst fourth-quarter output most definitely shrank from the former 3 months. Complete-year GDP enlargement might best simply best 1%, smartly off the 2021 and 2022 readings of eleven% and seven.5%.Brazil posts December GDP-proxy figures forward of the quarterly and full-year document due March 1, whilst Peru publishes December financial job information at the side of January unemployment for Lima, the capital and biggest town.Finally, Chile’s central financial institution serves up the mins of its January determination to ship a 100 basis-point lower, to 7.25%. Economists surveyed through the central financial institution see that hitting 4.75% through year-end with inflation again at 3%.–With the aid of Piotr Skolimowski, Robert Jameson, Monique Vanek, Brian Fowler, Abeer Abu Omar, Tony Halpin and Laura Dhillon Kane.(Updates with Panetta in EMEA segment)Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Slower US Inflation Is Set to Gas Fed Fee-Minimize Optimism

:max_bytes(150000):strip_icc()/KristieReed-4ae479357d8f43fca79fe87772168a8c.png)