Solana’s TVL greater via greater than 1000% YoY in Q2.

SOL was once up via over 3% within the remaining 24 hours.

We have now concluded the primary week of the 3rd quarter and Q2 efficiency of a number of cash like Solana [SOL] have arrived. The newly printed document discussed the blockchain’s efficiency on a number of fronts all through the remaining quarter. Let’s take a look at how SOL did.

Solana’s Q2 efficiency

Coin98 Analytics posted a tweet citing Solana’s efficiency on many fronts. To start with, the document discussed that Solana’s charges and earnings skilled important enlargement in the second one quarter, producing over $26 million.

This was once commendable because it’s a 42 fold year-on-year enlargement. The entire SOL buying and selling quantity reached $292 billion, just about 7 occasions upper in comparison to the similar length remaining yr.

Aside from that, Solana done greater than 15.3 billion transactions. Its day-to-day lively addresses have been over 900k, which was once a 499% YoY build up.

The sphere the place SOL’s efficiency was once atypical was once the DeFi house.

As in step with the document SOL’s TVL greater via greater than 1000% YoY. Moreover, over 98 million new NFTs have been created, a 54x build up YoY.

In Q2 2024, Solana’s distinctive NFT patrons and dealers stood at 1.4 million, and 678k, respectively.

SOL’s state in Q3

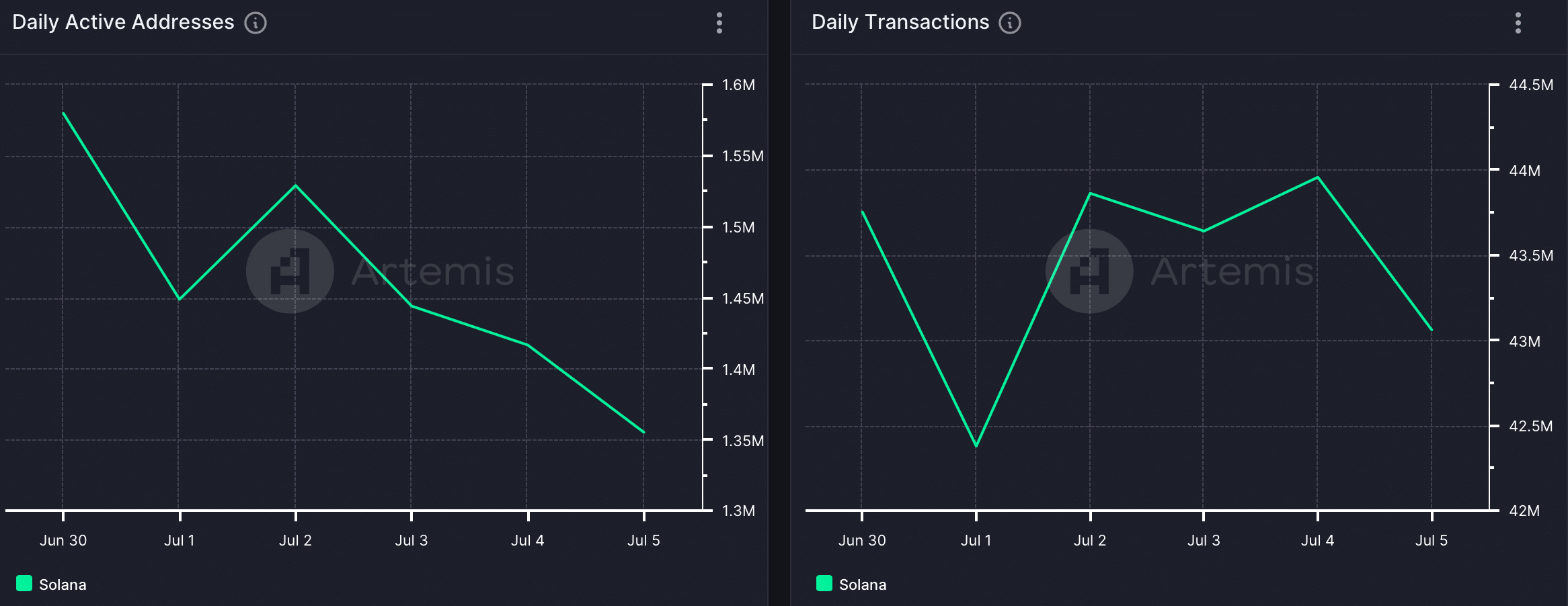

Now, let’s take a look at Artemis’ knowledge to learn the way SOL has been doing all through the primary week of this contemporary quarter.

In contrast to Q2, the 3rd quarter didn’t start on a just right be aware as a couple of key stats fell. For example, SOL’s day-to-day lively addresses declined sharply remaining week. Due to that, the blockchain’s day-to-day transactions additionally fell.

Supply: Artemis

Supply: Artemis

A identical declining pattern could also be noticed on the subject of the blockchain’s charges and earnings. Nevertheless, SOL’s efficiency within the DeFi house remained promising as its TVL endured to upward push over the past week.

SOL’s value is on par

After a couple of days of decline remaining week, the token’s value as soon as once more received bullish momentum.

Consistent with CoinMarketCap, SOL’s value greater via greater than 3% within the remaining seven days. On the time of writing, SOL was once buying and selling at $140.57 with a marketplace capitalization of over $65 billion, making it the fifth greatest crypto.

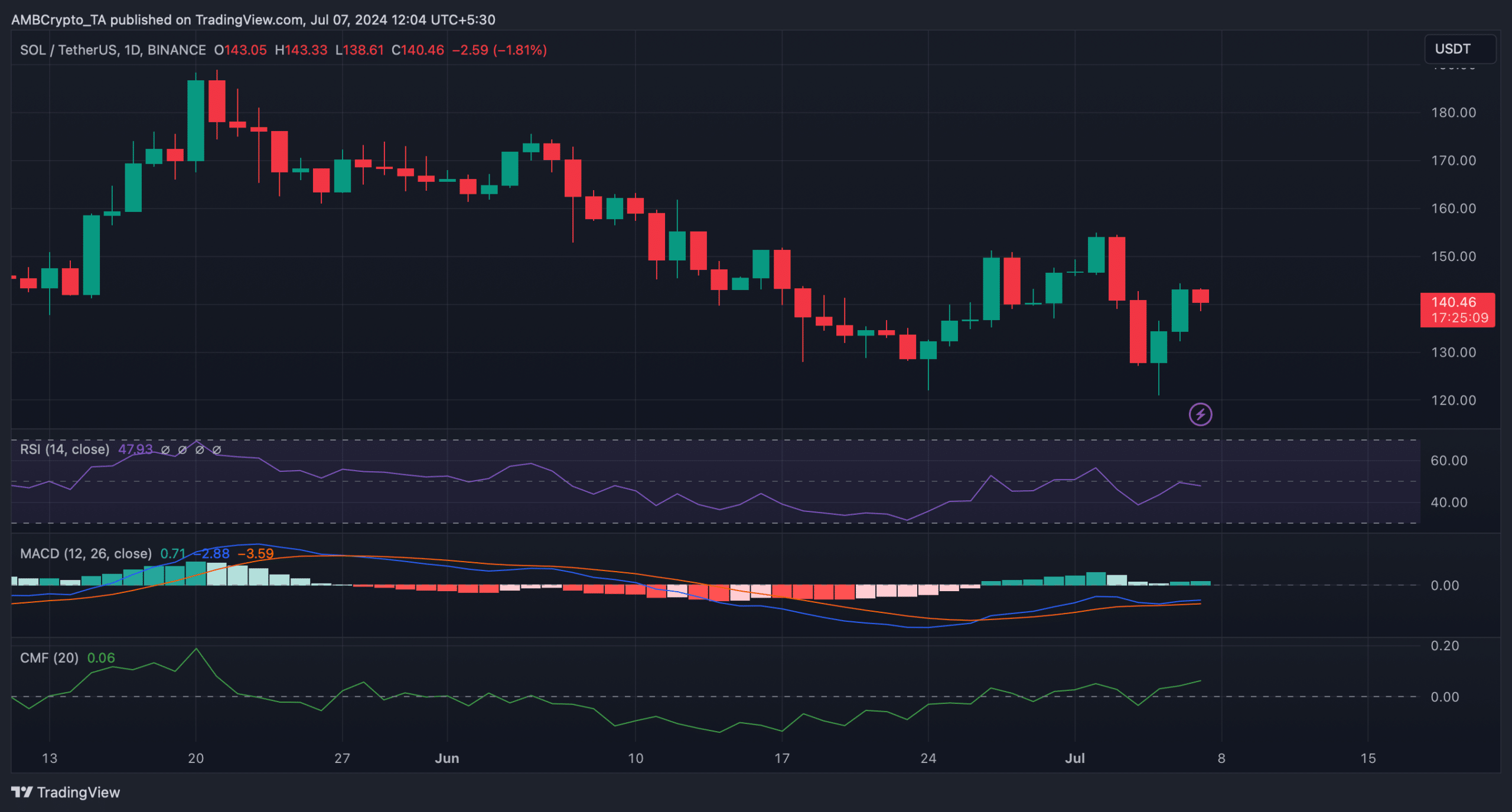

AMBCrypto then checked Solana’s day-to-day chart to raised perceive whether or not this bull rally would maintain itself.

Learn Solana’s [SOL] Value Prediction 2024-25

The technical indicator MACD displayed a slight bullish higher hand out there. SOL’s Chaikin Cash Glide (CMF) registered an uptick, which prompt that the possibilities of a endured value upward push have been prime.

Nevertheless, the Relative Energy Index (RSI) appeared bearish because it went southward.

Supply: TradingView

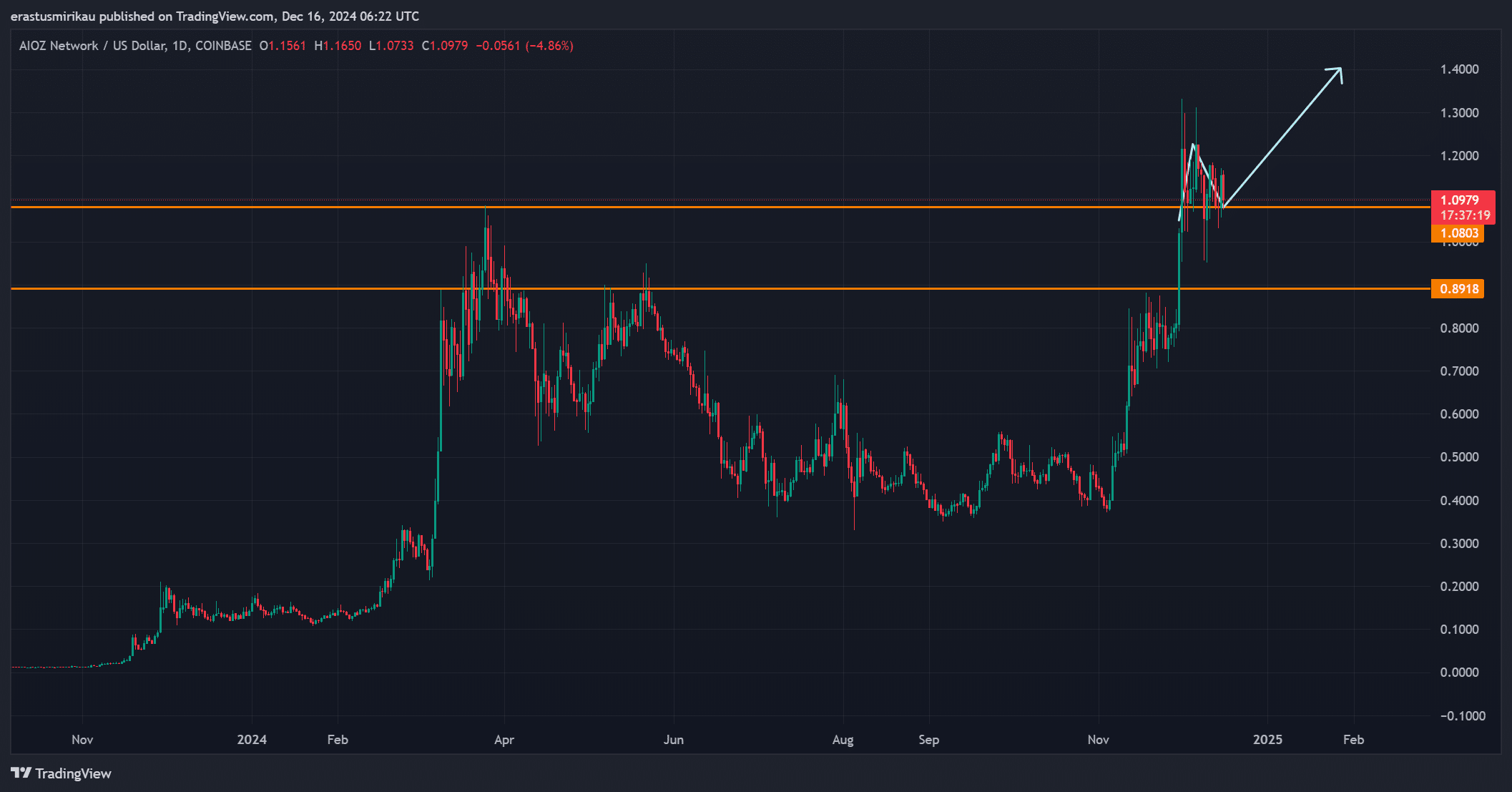

Supply: TradingView