In response to the historic value momentum, there’s a top risk that Solana’s value may leap by way of 25% to the $160 stage.

$25 million price of quick positions will likely be liquidated if SOL hits the $131 stage.

Amid the bearish marketplace sentiment, Solana [SOL] seems poised for an enormous upside rally because of its bullish value motion development and robust on-chain metrics. Prior to now few days, in spite of a notable value decline around the cryptocurrency marketplace, SOL has been consolidating close to a an important make stronger stage of $125.

Solana technical research and upcoming ranges

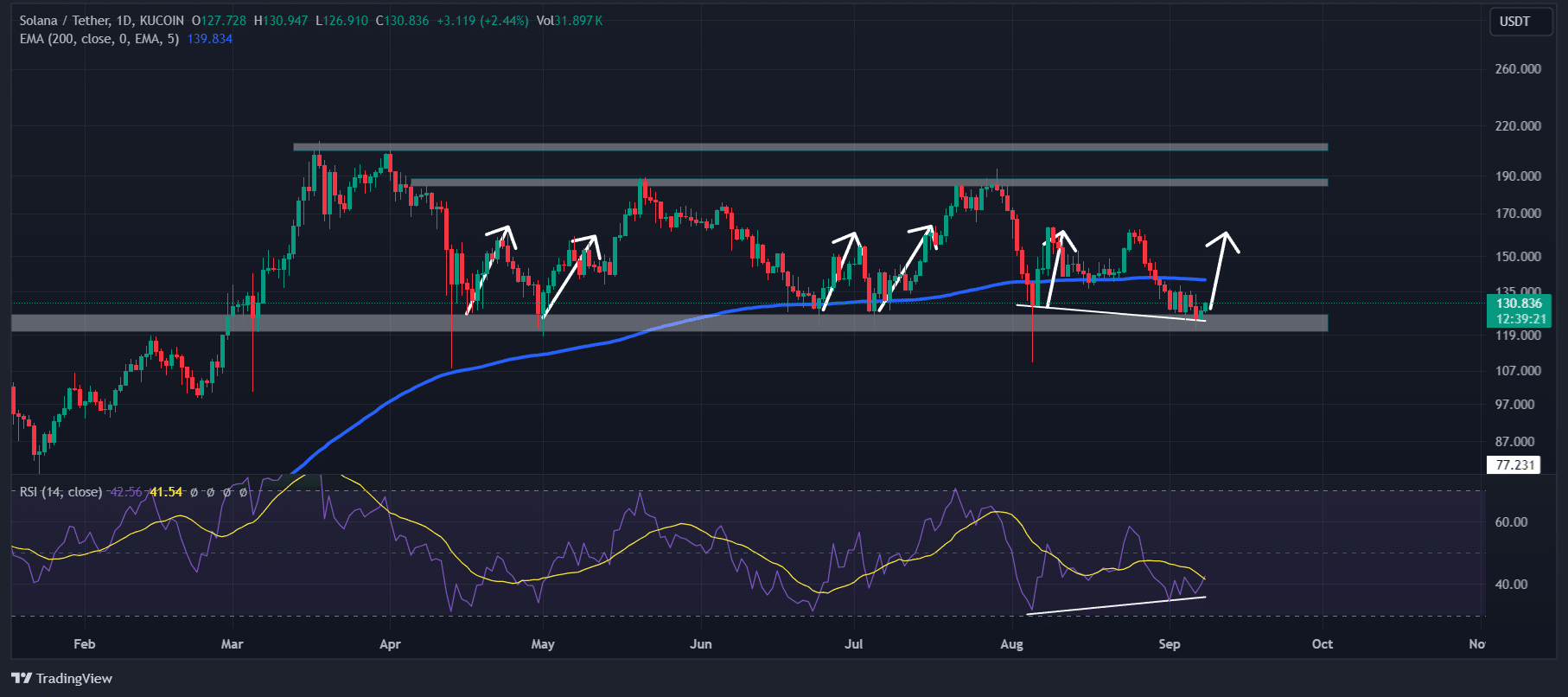

In response to knowledgeable technical research, SOL seemed bullish at press time. Its Relative Energy Index (RSI) has shaped a bullish divergence that indicators a possible development reversal from a downtrend to an uptrend.

This divergence happens when the asset’s value continues to shape decrease lows, whilst the technical indicator paperwork upper lows right through the similar duration.

Supply: TradingView

Supply: TradingView

In response to the historic value momentum, on every occasion SOL reaches its present make stronger stage, it has a tendency to revel in an enormous value surge. This time, with bullish value motion there’s a top risk that SOL value may leap by way of 25% to the $160 stage.

Bullish on-chain metrics

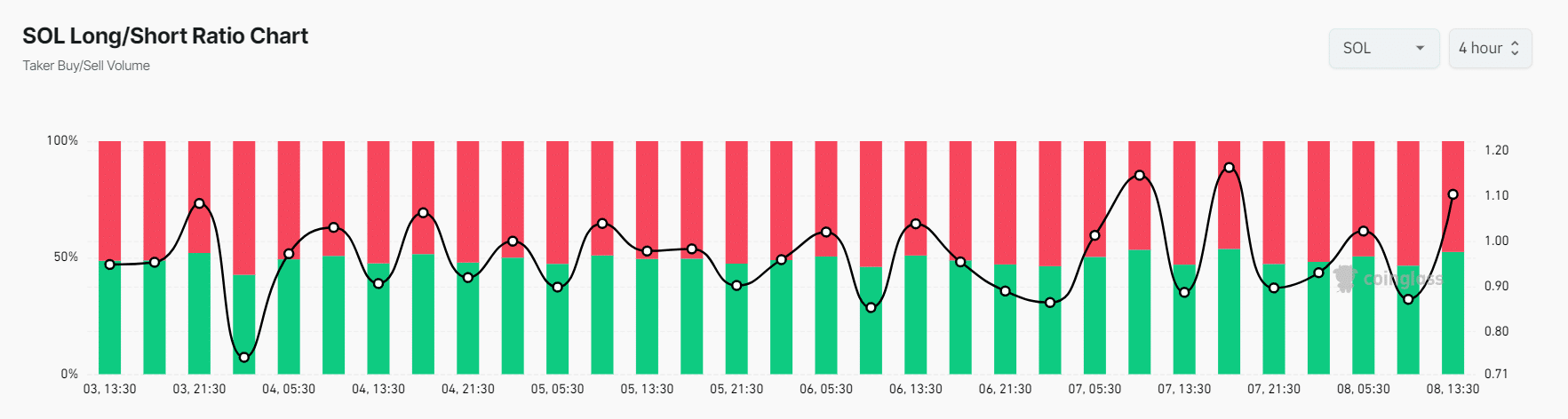

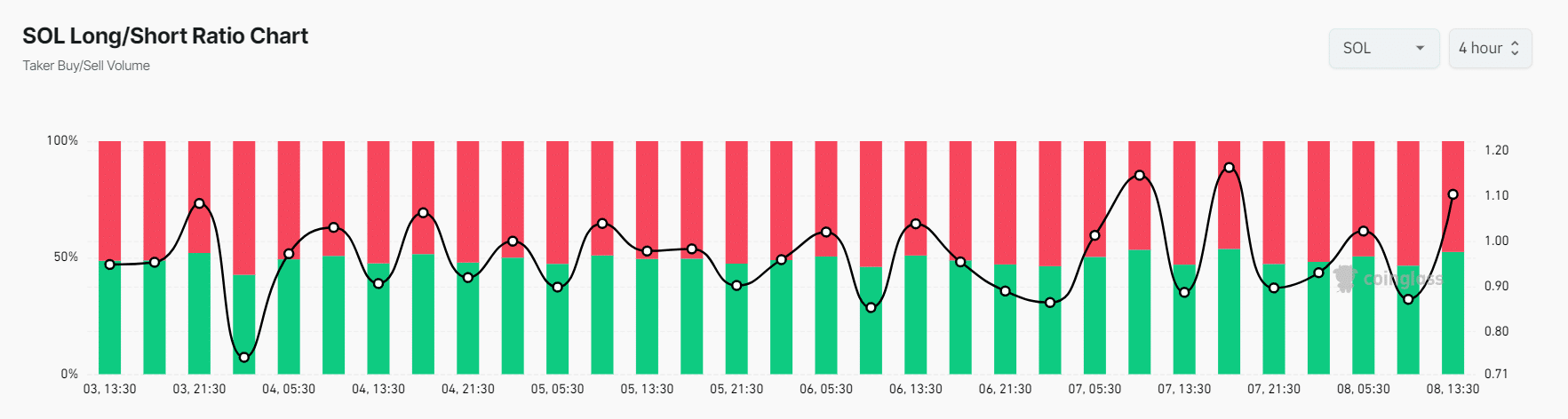

CoinGlass’s SOL Lengthy/Brief ratio chart indicators bullish marketplace sentiment. In line with the knowledge, the ratio lately stands at 1.103, indicating that investors are extra positive (A price above 1 indicators bullishness).

In the meantime, SOL’s open passion has higher by way of 3% within the final 24 hours, and it’s been emerging constantly during the last 3 days.

Supply: Coinglass

Supply: Coinglass

A mix of emerging open passion and a Lengthy/Brief ratio above 1 suggests a possible purchasing alternative. Buyers regularly use this to construct lengthy/quick positions.

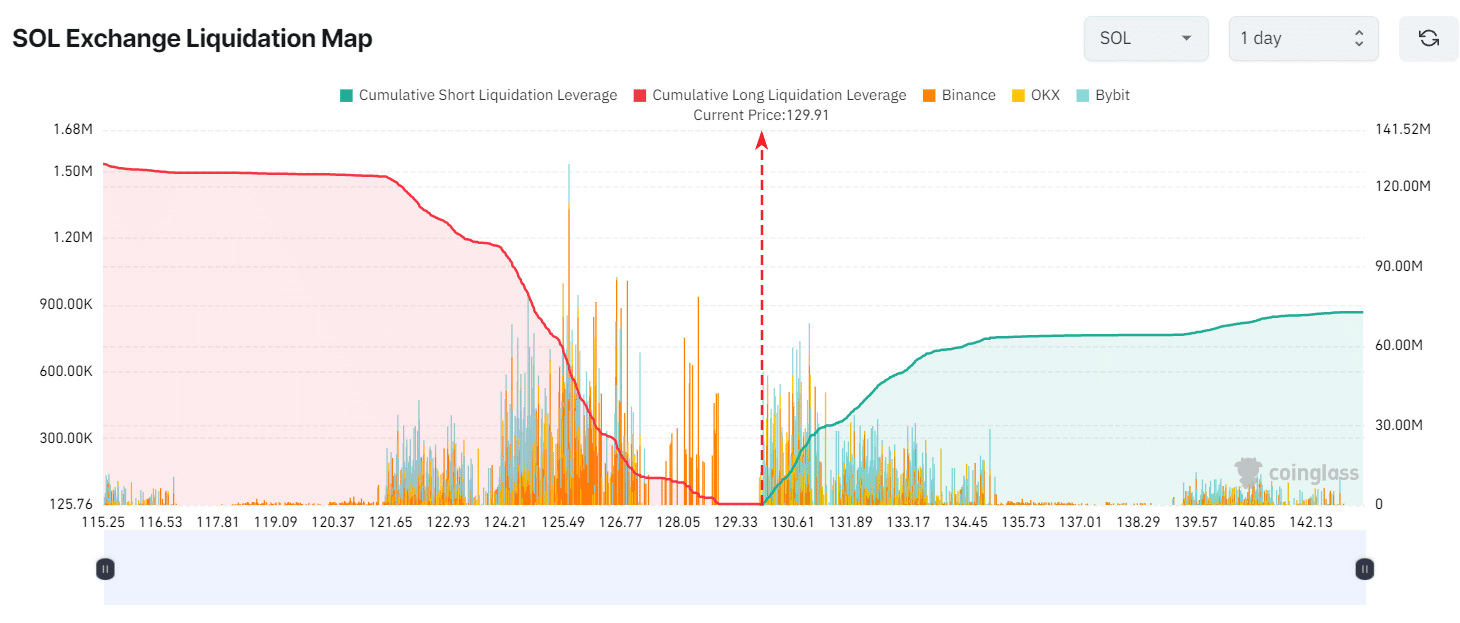

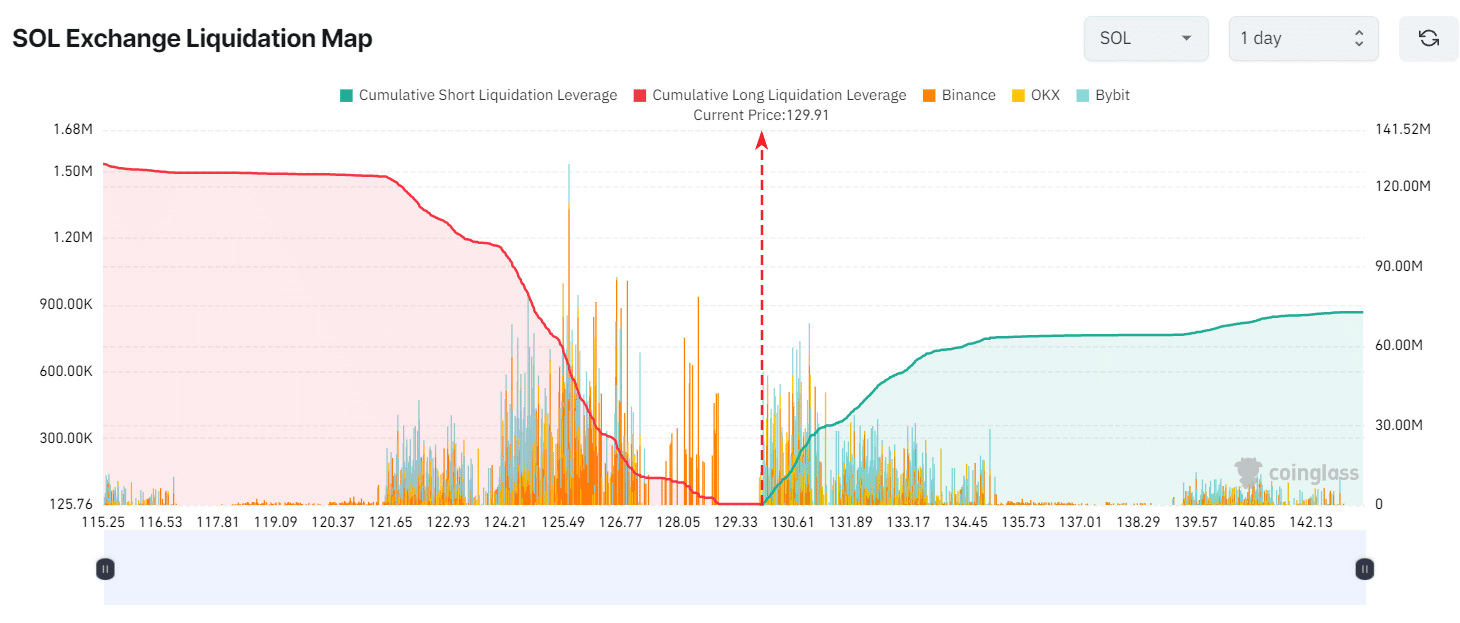

As of press time, the main liquidation ranges have been close to $125 at the decrease facet and $131 at the higher facet, as investors seem over-leveraged at those ranges, in line with the CoinGlass knowledge.

Supply: Coinglass

Supply: Coinglass

If the dealer’s bullish sentiment fails and the SOL value drops to the $125.61 stage, just about $56 million price of lengthy positions will likely be liquidated.

Conversely, if sentiment stays bullish and the fee reaches the $131 stage, roughly $25 million price of quick positions will likely be liquidated.

Real looking or no longer, right here’s SOL’s marketplace cap in BTC’s phrases

Having a look at those knowledge, apparently that bulls are lately dominating and feature a top possible to liquidate quick positions.

At press time, SOL was once buying and selling close to the $130.40 stage and has skilled a value surge of over 2.5% within the final 24 hours. In the meantime, its buying and selling quantity declined by way of 65% right through the similar duration, indicating decrease dealer participation because of the hot value drop.

Subsequent: Gold or Bitcoin? Peter Schiff, Jack Mallers debate which is ‘higher cash’

:max_bytes(150000):strip_icc()/TSLAChart-d38c73adfc1948d7a7a6508f684bdc81.gif)