SOL has surged via 7.01% over the last week as marketplace sentiment shift.

Spot CVD is the principle motive force as consumers dominant the marketplace.

Over the last week, Solana [SOL] has skilled a sustained uptrend. In reality, as of this writing, Solana was once buying and selling at $146.88. This marked a 7.01% building up over the last week.

Prior to those features, SOL noticed a sustained downtrend, hitting an area low of $120. Alternatively, since then, the altcoin has reached an area prime of $152.

Regardless of those features, Solana stays 43% beneath its ATH of $259.96. Subsequently, the present marketplace prerequisites elevate questions on whether or not Solana is at the verge of a extra sustained restoration and what’s riding the restoration.

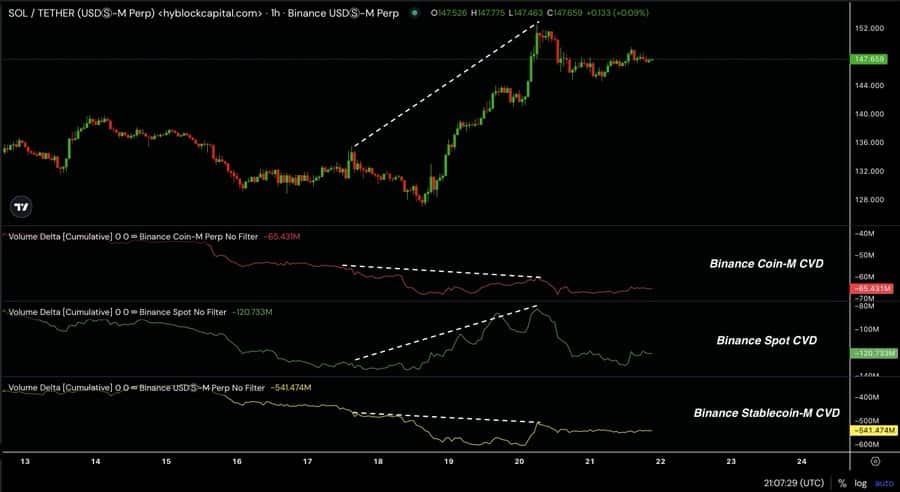

Inasmuch, HyblockCapital analysts have prompt greater purchasing power as the principle motive force of the new rally mentioning spot CDV and Perp CVD.

Prevailing marketplace sentiment

Of their research, Hyblockcapital cited purchasing pastime, particularly amongst spot consumers as a catalyst main the surge.

Supply: Hyblockcapital

Supply: Hyblockcapital

In line with this research, the call for for precise SOL tokens is the main issue pushing costs upper. This means that spot consumers are dominant and their call for for the altcoin is growing upward worth power.

Alternatively, the analysts additionally identified that Perp CVD is appearing divergence. Which means that perpetual futures buyers are appearing indicators of a distinct pattern.

As such, when costs are emerging on account of spot purchasing whilst Perp CVD is declining or flat, it signifies futures aren’t bullish like spot buyers.

Subsequently, since Spot CVD is the principle motive force, the cost is being driven via actual call for for SOL. This generally signifies the potential of a extra sustainable rally.

What SOL charts recommend

Without a doubt, the metrics highlighted via Hyblockcapital be offering a promising outlook for Sol’s attainable rally. Accompanied via prevailing marketplace prerequisites, they may set Solana for extra features on worth charts.

Supply: Santiment

Supply: Santiment

As an example, Solana’s Dydx trade investment fee has been sure for the ultimate 4 days, indicating that over the last few days, lengthy role holders had been paying investment to brief role holders.

This means that the marketplace sentiment is bullish as there’s a upper call for for lengthy positions.

Supply: Santiment

Supply: Santiment

Moreover, this call for for lengthy positions is supported via a good investment fee aggregated via trade. This presentations that long-position holders are prepared to pay a top class to carry their positions.

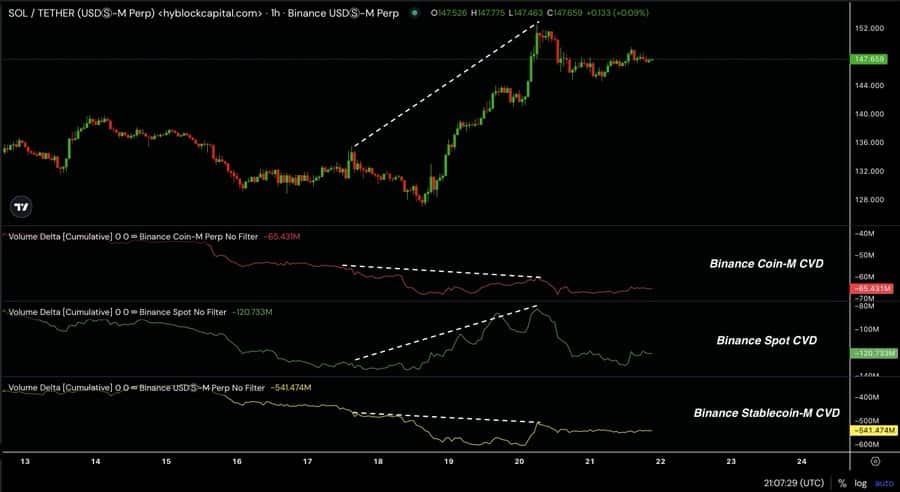

Supply: Coinglass

Supply: Coinglass

In the end, for the ultimate 4 days, liquidation for brief positions has skyrocketed whilst the ones for lengthy positions have declined. Brief role liquidation has reached a prime of $8.65 million whilst the ones for lengthy positions have hit a low of $185.7k over this era.

This presentations buyers making a bet towards the markets are compelled out in their positions.

Learn Solana’s [SOL] Value Prediction 2024–2025

Merely put, Solana is an increasing number of seeing a shift in marketplace sentiment. As famous via Hyblockcapital, there’s the next call for for Solana particularly for lengthy positions.

The sure marketplace sentiment positions the altcoins for additional worth enlargement. As such, if the present prerequisites grasp, SOL will strive a $160 resistance degree within the brief time period. A breakout from this degree will improve the altcoin to problem the $185 resistance.

Subsequent: AAVE to reclaim ATH amid DeFi renaissance, says crypto VC

/cdn.vox-cdn.com/uploads/chorus_asset/file/25462005/STK155_OPEN_AI_CVirginia_B.jpg)