Following the breakout from the H&S trend, there’s a sturdy chance SOL may just achieve $190 ahead of November 2024.

SOL’s open hobby jumped via 18%, suggesting the accumulation of recent positions amid the new breakout.

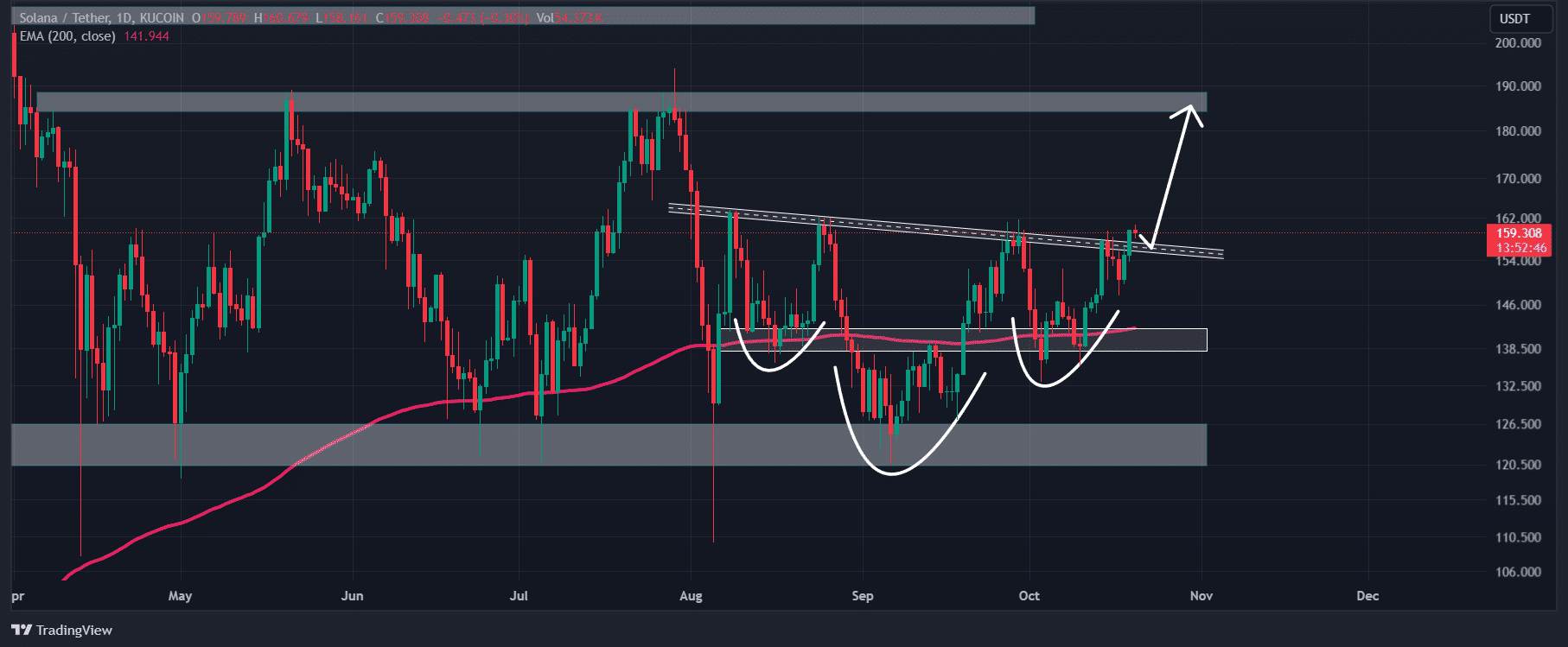

Solana [SOL], the sector’s 5th largest cryptocurrency, became bullish following the breakout of a bullish value motion trend. This breakout has now not simplest shifted sentiment amongst traders and investors, but additionally raised hopes that SOL may just quickly skyrocket within the coming days.

Solana technical research and key stage

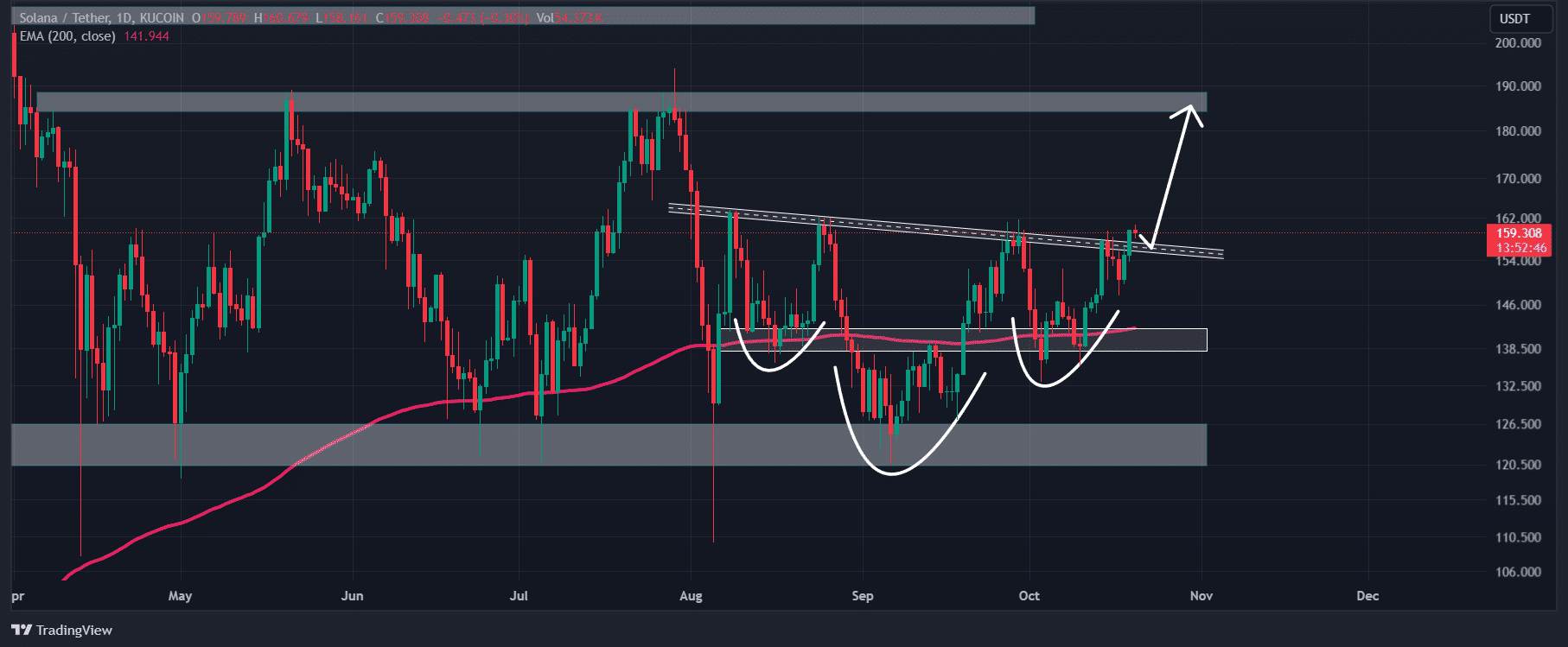

In step with AMBCrypto’s technical research, SOL just lately broke out from a bullish inverted Head-and-Shoulder trend at the day by day period of time. In accordance with historic information, on every occasion an asset breaks out from this H&S trend, it has a tendency to skyrocket considerably.

This time, SOL has skilled a bullish breakout over an extended duration and is aiming for the next rally within the coming days.

Supply: TradingView

Supply: TradingView

Solana’s prediction for November 2024

In spite of this bullish outlook, SOL’s rally might not be easy. Few resistance ranges may just pose hurdles to the asset’s upward momentum.

If SOL closes a day by day candle above the $161 stage, there’s a sturdy chance it might leap via 18%, attaining the following resistance stage of $190 within the coming days.

Then again, given the present marketplace sentiment, it sounds as if that SOL may just accomplish that stage ahead of November 2024.

SOL’s bullish on-chain metrics

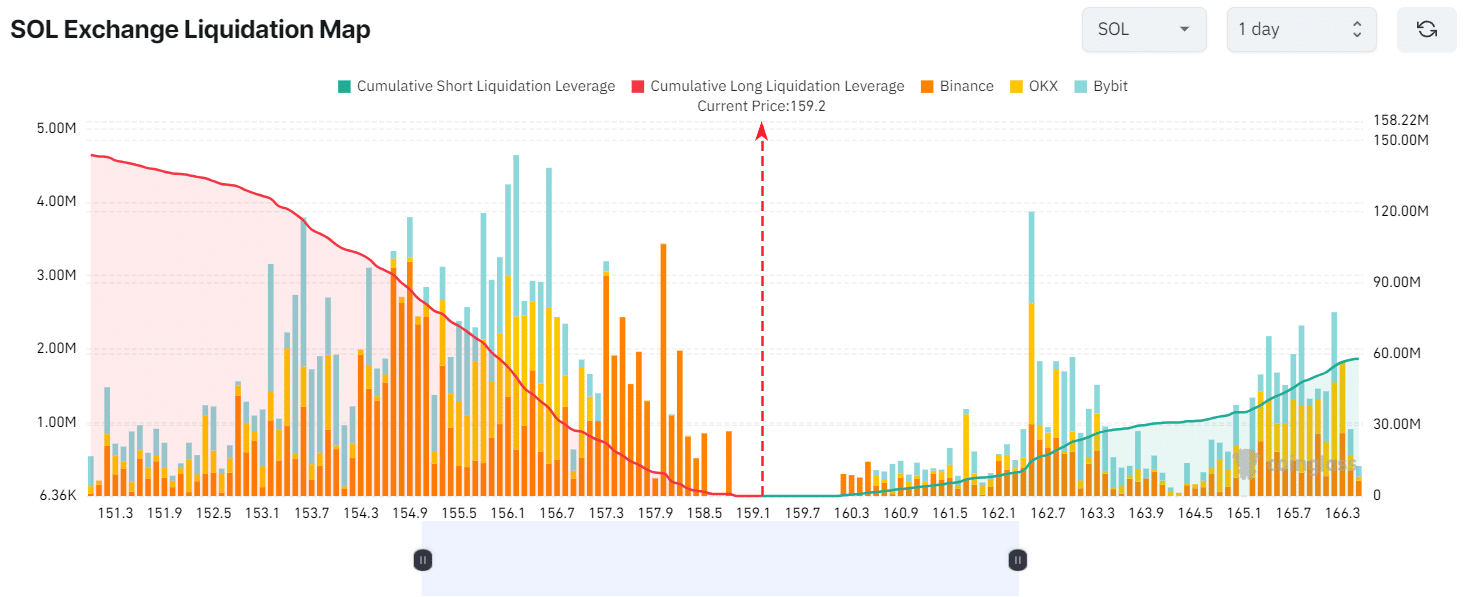

On-chain metrics additional fortify SOL’s sure outlook. In step with the on-chain analytics company Coinglass, the key liquidation ranges are recently at $156.6 at the decrease facet and $162.5 at the higher facet, with investors over-leveraged at those ranges.

Supply: Coinglass

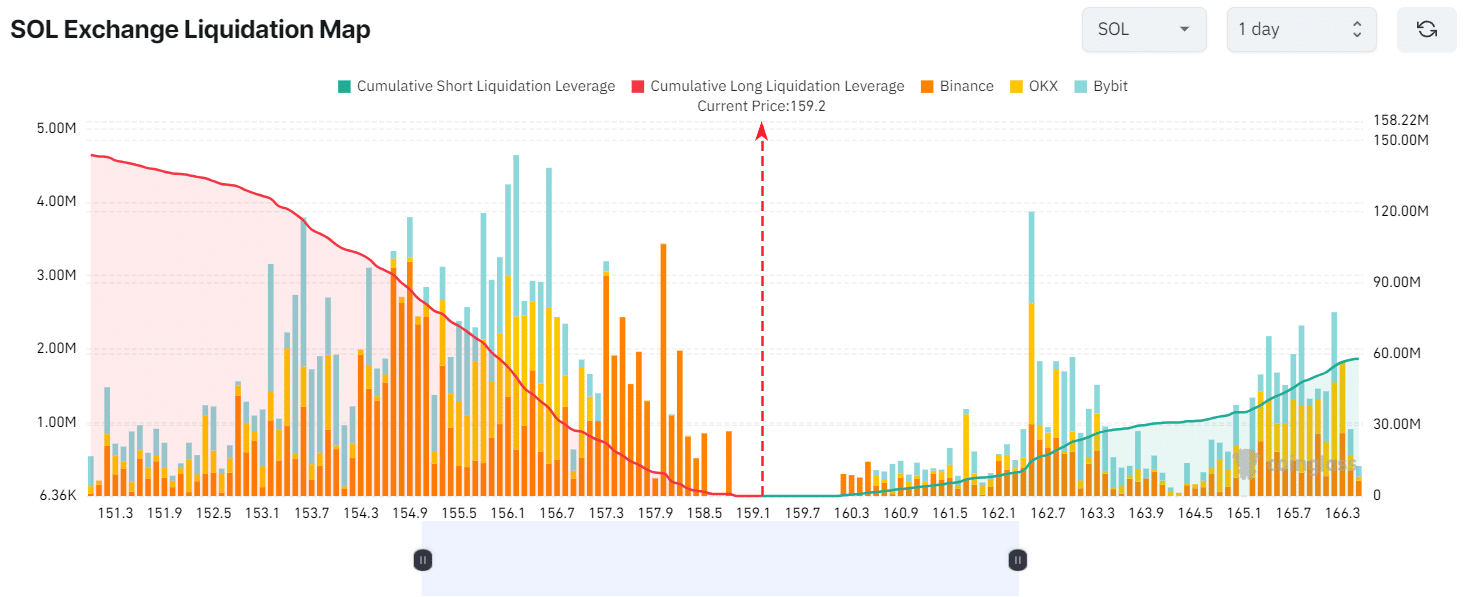

Supply: Coinglass

In step with the information, brief dealers have positioned bets value over $14.46 million at the $162.5 stage, believing that SOL’s value received’t surpass it. Bulls, then again, have positioned bets value $36.24 million at the $156.6 stage, believing that the asset’s value received’t fall beneath it.

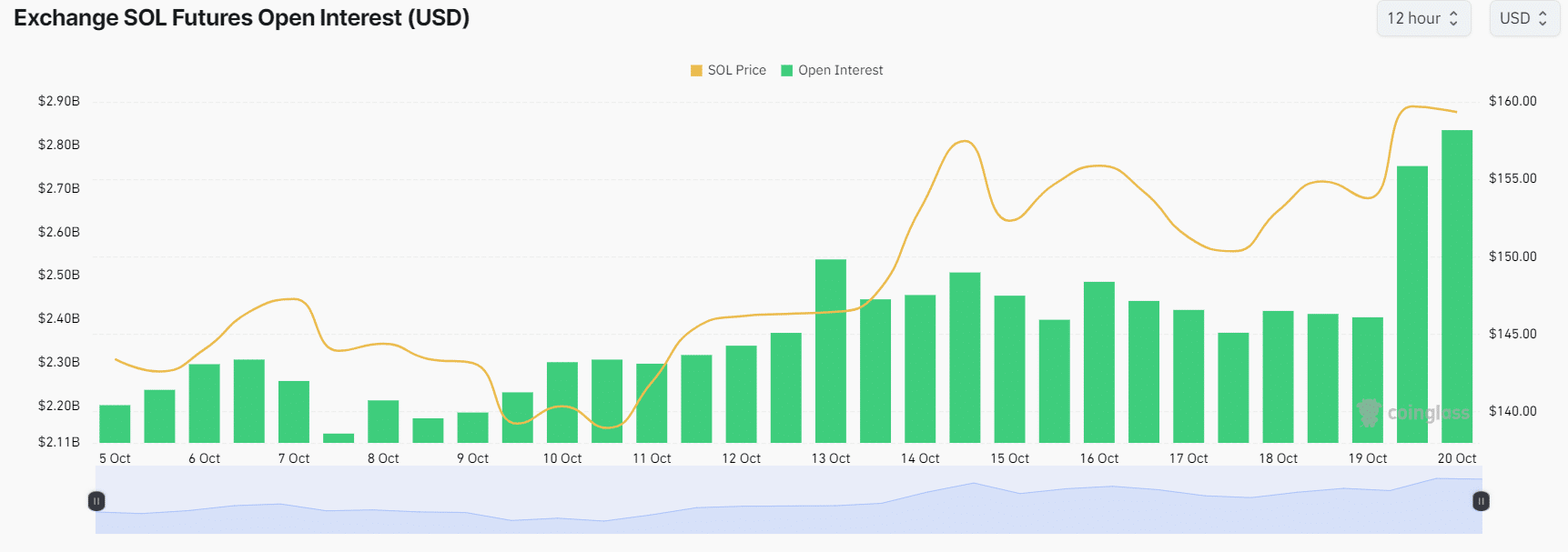

Emerging open hobby

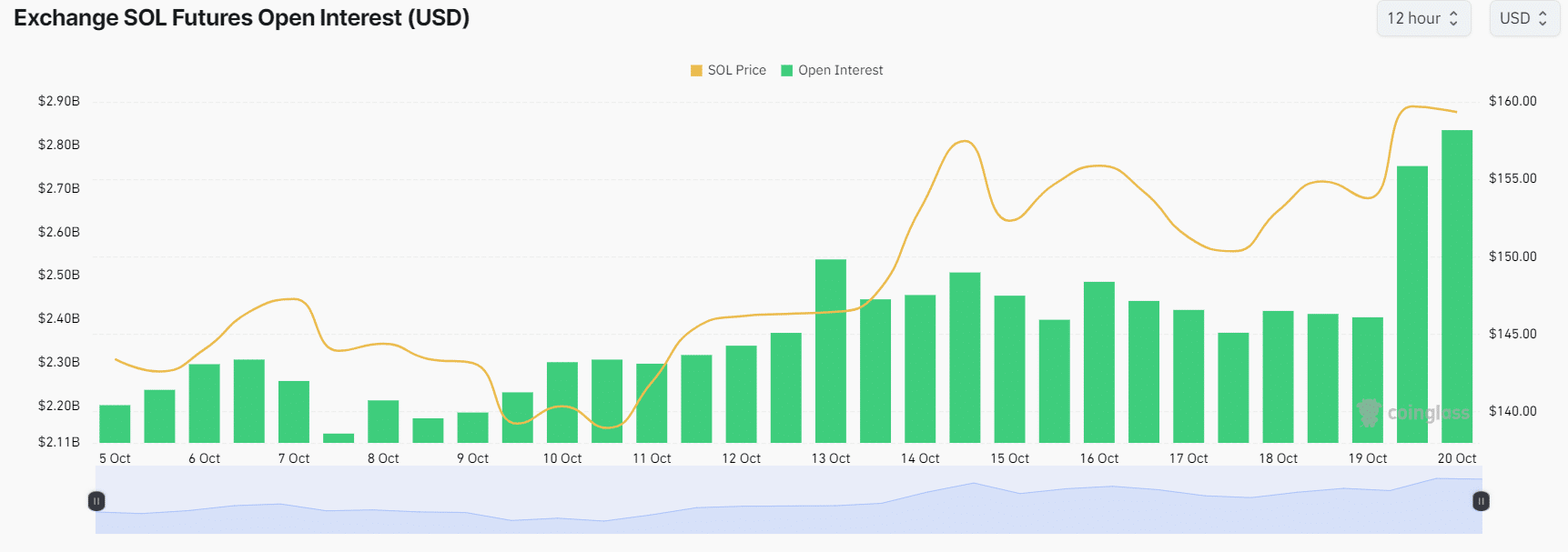

As of now, SOL’s open hobby has risen considerably, indicating sturdy hobby from investors following the breakout. Up to now 24 hours, its worth has larger via 17.8%.

This notable upward push in open hobby suggests the accumulation of recent positions throughout this era. Moreover, it marks the perfect stage for the reason that starting of October 2024.

Supply: Coinglass

Supply: Coinglass

In reality, SOL’s lengthy/brief ratio stood at 1.11 at press time, indicating sturdy bullish sentiment some of the investors.

Marketplace sentiment amongst investors

Combining a majority of these on-chain metrics with technical research, it sounds as if that bulls are recently dominating the asset. This might fortify SOL and lend a hand it achieve the $190 stage within the coming days.

Is your portfolio inexperienced? Take a look at the SOL Benefit Calculator

This bullish outlook is additional supported via the impending presidential election in america. Historic information presentations that October steadily brings bullish traits within the cryptocurrency marketplace, particularly main as much as primary occasions like elections.

This might additional deal with Solana’s upward momentum.

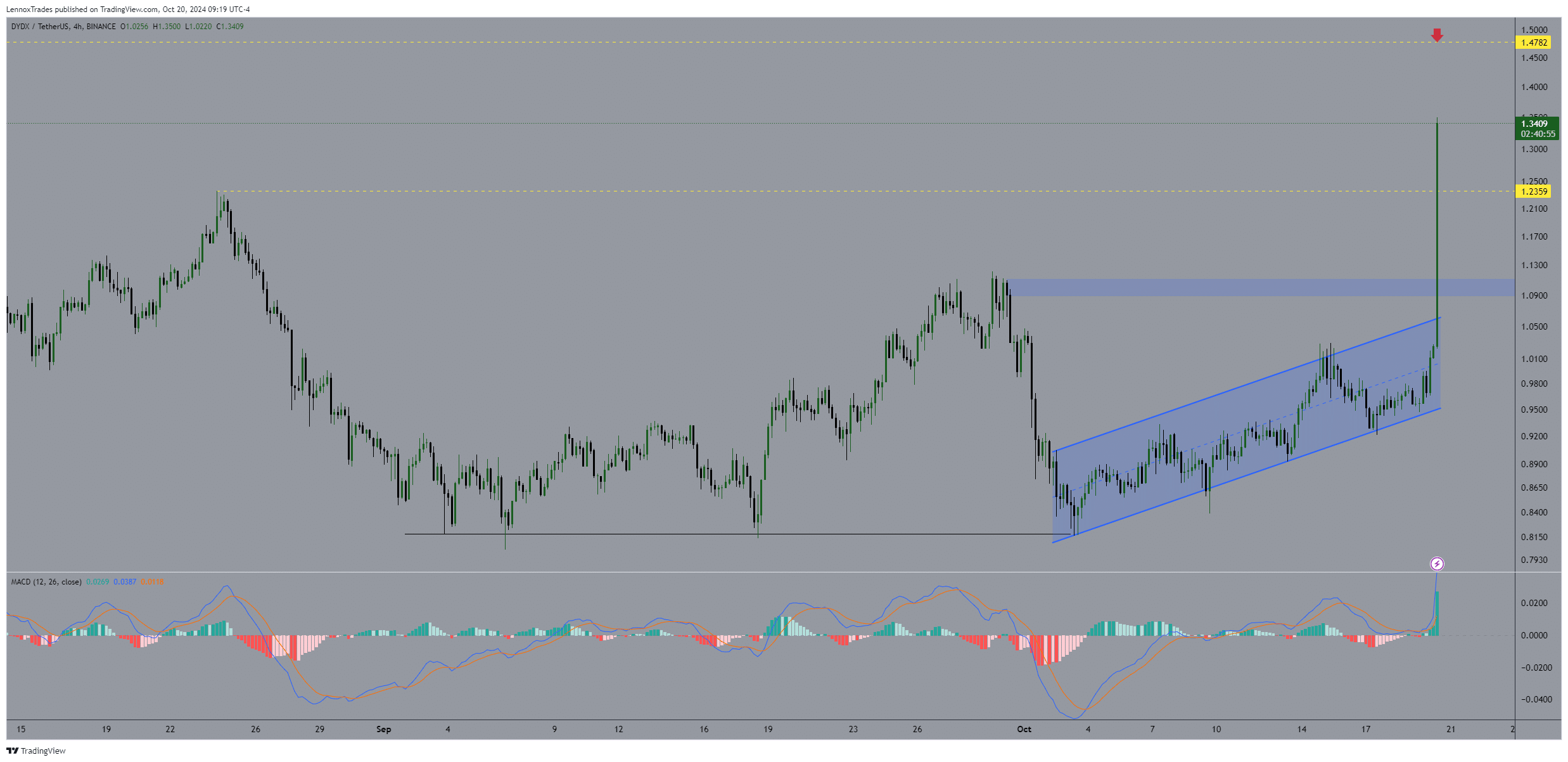

Earlier: dYdX crypto soars 38% in 24 hours: Key metrics level against $2 goal

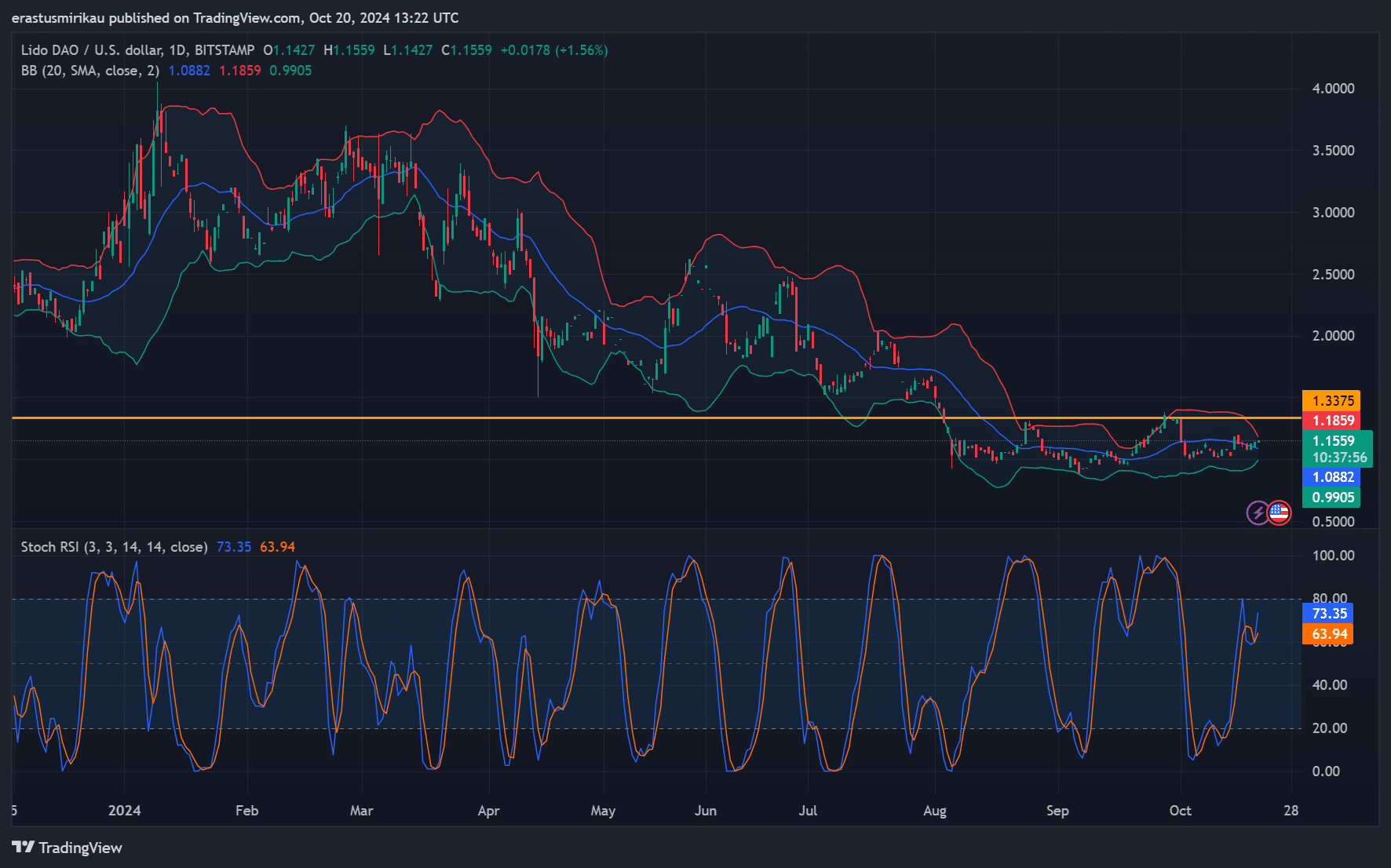

Subsequent: Can LDO smash previous the $1.33 resistance amid key traits?