AI has been answerable for riding enlargement among a lot of names within the semiconductor house, and made its presence felt once more in the newest quarterly readout from Micron (NASDAQ:MU).

In its Might quarter effects (FQ3), the reminiscence large beat expectancies on each the top-and bottom-line. Income got here in at $6.81 billion, amounting to a considerable 81.6% year-over-year building up whilst beating the Boulevard’s forecast by means of $140 million. The corporate put a lot of the gross sales enlargement right down to AI, with the call for boosting 50% of its quarter-over-quarter knowledge heart income enlargement. On the different finish of the dimensions, EPS of $0.62 outpaced the prognosticators’ forecast by means of $0.09.

As for the outlook, Micron guided for FQ4 revenues of $7.60 billion (± $200 million) in comparison to consensus at $7.58 billion, whilst adj. EPS is expected to achieve $1.08 (± $0.08) vs. the Boulevard’s name of $1.04.

In opposition to a backdrop of a constrained modern provide atmosphere, the corporate anticipates DRAM and NAND costs to upward push sequentially right through the second one part of the 12 months and into 2025, pushed by means of AI server call for boosting enlargement in HBM/DDR5 and endeavor SSDs.

That stated, the sturdy effects gained an preliminary lukewarm response from traders, in line with upper income expectancies for the FQ4 information. On the other hand, scanning the print, J.P. Morgan’s Harlan Sur, a 5-star analyst rated within the peak 1% of the Boulevard’s inventory execs, has most effective excellent issues to mention concerning the corporate’s potentialities.

“We consider the crew is well-positioned to seize reminiscence content material at the sturdy AI /speeded up compute server deployments with HBM3e capability already bought out via CY25 and we consider the crew is starting to have visibility into CY26 call for,” defined the 5-star analyst. “AI could also be fueling call for for his or her endeavor SSD (eSSD) merchandise. Gross margins for HBM3e and eSSD are each accretive to their respective segments and we consider that are meant to structurally increase their profitability profile together with cyclical call for/provide comparable pricing will increase.”

Because the marketplace continues to “cut price bettering income/margin/profits energy,” Sur thinks the inventory “must proceed to outperform” via 2024 and into 2025. As such, the analyst has raised his worth goal from the prior $130 to $180, suggesting the stocks may just achieve 36% over the following 12 months. Sur’s score remains an Obese (i.e., Purchase). (To observe Sur’s monitor file, click on right here)

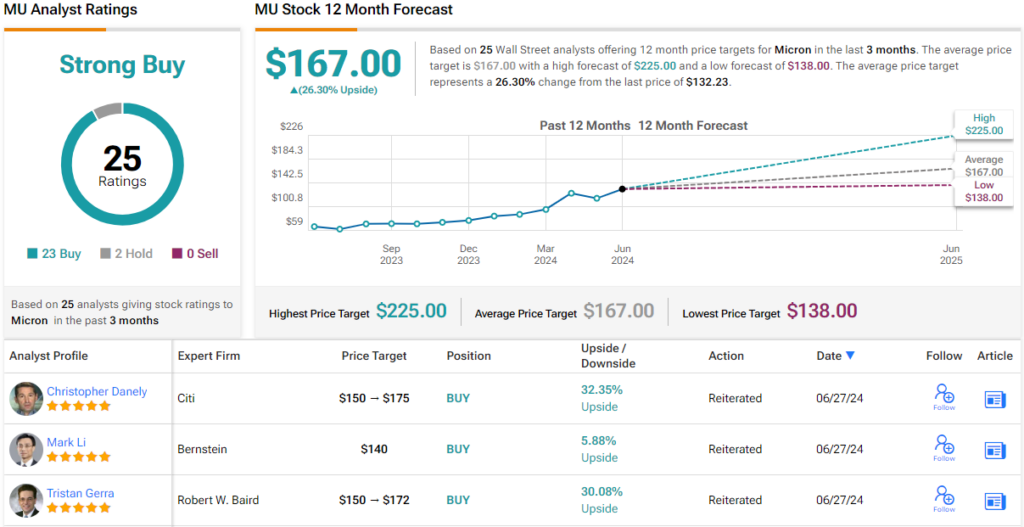

Sur is simply one of the analysts boosting their worth goal for Micron at the moment. The present Boulevard moderate worth goal stands at $167, making room for 12-month returns of 26%. According to a lopsided mixture of 23 Buys vs. 2 Holds, the inventory claims a Sturdy Purchase consensus score. (See Micron inventory forecast)

To seek out excellent concepts for shares buying and selling at sexy valuations, talk over with TipRanks’ Perfect Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The critiques expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions most effective. It is important to to do your individual research earlier than making any funding.