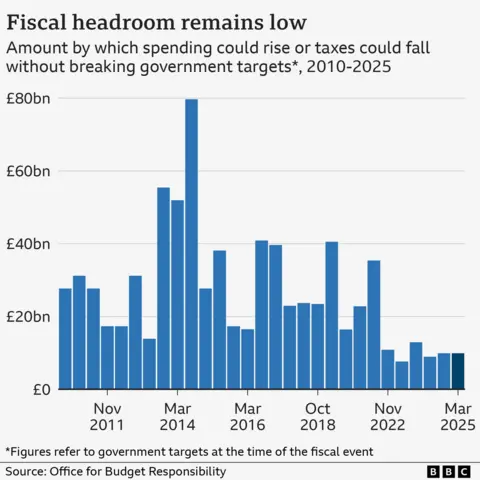

Shanaz MusaferBusiness reporter, BBC Information Getty ImagesTaxes could have to upward push within the autumn, economists have warned, regardless of giant welfare cuts and spending discounts in Wednesday’s Spring Remark.Chancellor Rachel Reeves is anticipated to fulfill her self-imposed rule not to borrow to fund daily spending with room to spare, in line with the federal government’s professional forecaster.However, it has warned that international uncertainty because of the affect of US President Donald Trump’s price lists, may just hit the United Kingdom economic system and derail Reeves’ plans.In that state of affairs, it will be tricky to chop spending additional or borrow extra so tax rises would most likely be had to meet her regulations, professionals say.”Non-defence spending can best be reduce up to now. And the United Kingdom’s uncomfortable concoction of low financial expansion and prime rates of interest method public borrowing can best upward push up to now,” mentioned Paul Dale, leader UK economist at Capital Economics”The inevitable conclusion is that one day the federal government could have to damage its election guarantees and lift taxes for families – the total Price range later this yr would be the subsequent flashpoint.”Paul Johnson, director of the Institute for Fiscal Research suppose tank, mentioned: “If you’re going to have ‘iron-clad’ fiscal regulations then leaving your self subsequent to no headroom in opposition to them leaves you on the mercy of occasions.”We will be able to undoubtedly now be expecting six or seven months of hypothesis about what taxes would possibly or will not be larger within the autumn,” he mentioned.The Place of business for Price range Duty (OBR) additionally halved its expansion forecast for the United Kingdom this yr to at least one%, down from its October prediction of two%.”I’m really not glad with those numbers,” mentioned Reeves, who has made rising the economic system one among her key guarantees.Alternatively, the OBR raised its expansion forecasts for the next years and Reeves mentioned by means of 2029-30 the economic system could be larger in comparison to the forecast on the time of the Price range in October.Price lists impactAhead of the Spring Remark, the chancellor have been below power, with a lot hypothesis over how she would have the ability to meet her self-imposed fiscal regulations. The 2 key ones are:To not borrow to fund daily public spendingTo get govt debt falling as a percentage of nationwide source of revenue by means of the tip of this parliamentIn October, the OBR mentioned that Reeves had £9.9bn headroom by means of 2029-30 on the subject of daily spending – the quantity left over after assembly the fiscal rule.The chancellor mentioned that adjustments within the international economic system had altered the image since then and he or she would have neglected that rule by means of £4.1bn because of an building up in govt borrowing prices.Alternatively, the measures introduced on Wednesday, together with adjustments to departmental spending and common welfare reforms, “restored in complete our headroom” to £9.9bn, she mentioned.The OBR stated that dangers across the international outlook had intensified since October. “If america levied an extra 20% price lists on the United Kingdom and the remainder of the arena, that might cut back the extent of UK output subsequent yr by means of 1% and in addition wipe out the headroom that the chancellor has retained in opposition to her fiscal regulations,” the OBR’s Richard Hughes informed the BBC.The £9.9bn is the 3rd lowest margin a chancellor has left themselves since 2010. The common headroom over that point has been £30bn.

Getty ImagesTaxes could have to upward push within the autumn, economists have warned, regardless of giant welfare cuts and spending discounts in Wednesday’s Spring Remark.Chancellor Rachel Reeves is anticipated to fulfill her self-imposed rule not to borrow to fund daily spending with room to spare, in line with the federal government’s professional forecaster.However, it has warned that international uncertainty because of the affect of US President Donald Trump’s price lists, may just hit the United Kingdom economic system and derail Reeves’ plans.In that state of affairs, it will be tricky to chop spending additional or borrow extra so tax rises would most likely be had to meet her regulations, professionals say.”Non-defence spending can best be reduce up to now. And the United Kingdom’s uncomfortable concoction of low financial expansion and prime rates of interest method public borrowing can best upward push up to now,” mentioned Paul Dale, leader UK economist at Capital Economics”The inevitable conclusion is that one day the federal government could have to damage its election guarantees and lift taxes for families – the total Price range later this yr would be the subsequent flashpoint.”Paul Johnson, director of the Institute for Fiscal Research suppose tank, mentioned: “If you’re going to have ‘iron-clad’ fiscal regulations then leaving your self subsequent to no headroom in opposition to them leaves you on the mercy of occasions.”We will be able to undoubtedly now be expecting six or seven months of hypothesis about what taxes would possibly or will not be larger within the autumn,” he mentioned.The Place of business for Price range Duty (OBR) additionally halved its expansion forecast for the United Kingdom this yr to at least one%, down from its October prediction of two%.”I’m really not glad with those numbers,” mentioned Reeves, who has made rising the economic system one among her key guarantees.Alternatively, the OBR raised its expansion forecasts for the next years and Reeves mentioned by means of 2029-30 the economic system could be larger in comparison to the forecast on the time of the Price range in October.Price lists impactAhead of the Spring Remark, the chancellor have been below power, with a lot hypothesis over how she would have the ability to meet her self-imposed fiscal regulations. The 2 key ones are:To not borrow to fund daily public spendingTo get govt debt falling as a percentage of nationwide source of revenue by means of the tip of this parliamentIn October, the OBR mentioned that Reeves had £9.9bn headroom by means of 2029-30 on the subject of daily spending – the quantity left over after assembly the fiscal rule.The chancellor mentioned that adjustments within the international economic system had altered the image since then and he or she would have neglected that rule by means of £4.1bn because of an building up in govt borrowing prices.Alternatively, the measures introduced on Wednesday, together with adjustments to departmental spending and common welfare reforms, “restored in complete our headroom” to £9.9bn, she mentioned.The OBR stated that dangers across the international outlook had intensified since October. “If america levied an extra 20% price lists on the United Kingdom and the remainder of the arena, that might cut back the extent of UK output subsequent yr by means of 1% and in addition wipe out the headroom that the chancellor has retained in opposition to her fiscal regulations,” the OBR’s Richard Hughes informed the BBC.The £9.9bn is the 3rd lowest margin a chancellor has left themselves since 2010. The common headroom over that point has been £30bn. Referring to the second one rule, Reeves mentioned the OBR had forecast it will be met two years early, with a headroom of £15.1bn by means of 2029-30.Having a look at expansion over the following couple of years, the OBR now expects the economic system to develop by means of 1.9% in 2026, by means of 1.8% in 2027, by means of 1.7% in 2028 and by means of 1.8% in 2029.Alternatively, Rob Wooden, leader UK economist at Pantheon Macroeconomics, mentioned he concept the OBR would “virtually definitely have to chop possible expansion forecasts” within the autumn.”And we think the federal government to have to spice up deliberate defence spending by means of every other 0.5% of GDP by means of 2027.”So additional tax hikes and borrowing are coming.”The chancellor mentioned the OBR had now taken under consideration making plans reforms and housebuilding goals the federal government introduced when it first took administrative center in July and had concluded those reforms would building up GDP by means of 0.2% by means of the tip of the parliament, and by means of 0.4% inside a decade.”The OBR have concluded that our reforms will result in housebuilding attaining a 40-year prime of 305,000 by means of the tip of the forecast length,” Reeves mentioned.Labour has pledged to construct 1.5 million properties in England by means of 2029-30, and Reeves mentioned the celebration’s reforms had been “taking us inside touching distance” of turning in that manifesto promise.The OBR additionally raised its forecast for inflation this yr to three.2% however expects the velocity of value rises to fall again to the Financial institution of England’s 2% goal in 2027.Actual family disposable source of revenue according to individual is anticipated to develop by means of a median of round 0.5% a yr, the OBR mentioned. The forecaster mentioned more potent salary expansion intended this determine was once moderately upper than in its earlier prediction in October.Reeves mentioned this intended that by means of 2029 families could be on reasonable greater than £500 a yr in comparison with what the OBR had anticipated in October.

Referring to the second one rule, Reeves mentioned the OBR had forecast it will be met two years early, with a headroom of £15.1bn by means of 2029-30.Having a look at expansion over the following couple of years, the OBR now expects the economic system to develop by means of 1.9% in 2026, by means of 1.8% in 2027, by means of 1.7% in 2028 and by means of 1.8% in 2029.Alternatively, Rob Wooden, leader UK economist at Pantheon Macroeconomics, mentioned he concept the OBR would “virtually definitely have to chop possible expansion forecasts” within the autumn.”And we think the federal government to have to spice up deliberate defence spending by means of every other 0.5% of GDP by means of 2027.”So additional tax hikes and borrowing are coming.”The chancellor mentioned the OBR had now taken under consideration making plans reforms and housebuilding goals the federal government introduced when it first took administrative center in July and had concluded those reforms would building up GDP by means of 0.2% by means of the tip of the parliament, and by means of 0.4% inside a decade.”The OBR have concluded that our reforms will result in housebuilding attaining a 40-year prime of 305,000 by means of the tip of the forecast length,” Reeves mentioned.Labour has pledged to construct 1.5 million properties in England by means of 2029-30, and Reeves mentioned the celebration’s reforms had been “taking us inside touching distance” of turning in that manifesto promise.The OBR additionally raised its forecast for inflation this yr to three.2% however expects the velocity of value rises to fall again to the Financial institution of England’s 2% goal in 2027.Actual family disposable source of revenue according to individual is anticipated to develop by means of a median of round 0.5% a yr, the OBR mentioned. The forecaster mentioned more potent salary expansion intended this determine was once moderately upper than in its earlier prediction in October.Reeves mentioned this intended that by means of 2029 families could be on reasonable greater than £500 a yr in comparison with what the OBR had anticipated in October.

Taxes may just nonetheless upward push regardless of welfare cuts, economists warn