Screenshot

Tesla has introduced a brand new site geared toward convincing shareholders to vote for reinstating Elon Musk’s $55 billion repayment plan.

Again in 2018, Tesla shareholders authorized one of the crucial greatest repayment plans of all-time: a $55 billion entirely stock-based CEO repayment plan for Elon Musk.

In January, a pass judgement on sided with attorneys representing a Tesla shareholder alleging that Tesla’s board misrepresented the repayment package deal when presenting it to shareholders.

It’s a sophisticated factor, however briefly, the pass judgement on discovered that Tesla’s board and Musk didn’t play via the foundations of a public corporate when it offered the plan to shareholders.

The pass judgement on discovered that Tesla had governance problems when arising with the repayment plan and the ones problems weren’t communicated to shareholders ahead of balloting at the plan.

As an alternative, Tesla claimed that the plan was once negotiated via “impartial board individuals” when it was once discovered that some board administrators had private monetary dealings with Musk outdoor of Tesla, among different issues.

The Delaware courtroom discovered that this invalidated the vote, and due to this fact, Tesla needed to rescind the repayment plan.

The day gone by, Tesla advised shareholders that it is going to ask them to vote on transferring Tesla’s state of incorporation to Texas after which revote for Musk’s repayment plan with out converting anything else.

Now, Tesla has introduced a brand new site known as ‘SupportTeslaValue.com‘ to persuade shareholders to vote for the package deal once more.

The site opens up via claiming that giving the stocks to Musk will “offer protection to your funding and Tesla’s long run”:

Screenshot

Screenshot

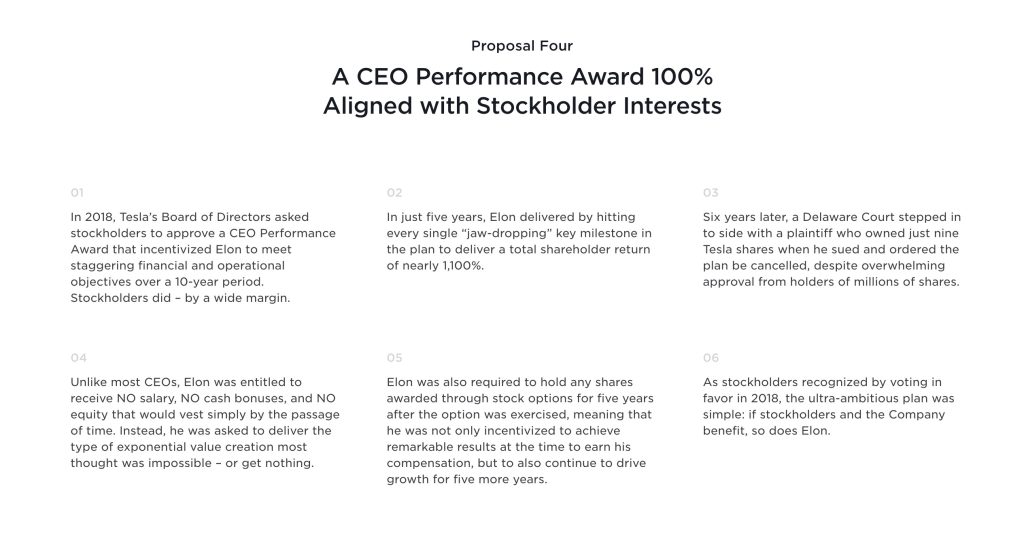

Lots of the site is devoted to the truth that the repayment plan was once aligned with shareholders’ pursuits, tremendous bold, and in reality accomplished the targets within the plan regardless of being tremendous bold.

Just about everybody can believe all of that, however it’s now not in reality what led the package deal to be rescinded.

Screenshot

Screenshot

The pursuits have been aligned, however the pass judgement on did query the desire for one of these prime repayment when Musk already owned greater than 20% of Tesla on the time.

From the pass judgement on’s determination:

At a prime degree, the “6% for $600 billion” argument has a large number of attraction. However that attraction briefly fades when one recalls that Musk owned 21.9% of Tesla when the board authorized his repayment plan. This possession stake gave him each and every incentive to push Tesla to ranges of transformative enlargement—Musk stood to achieve over $10 billion for each and every $50 billion in marketplace capitalization building up. Musk had no goal of leaving Tesla, and he made that transparent on the outset of the method and all through this litigation. Additionally, the repayment plan was once now not conditioned on Musk devoting any set period of time to Tesla since the board by no means proposed one of these time period. Swept up via the rhetoric of “all upside,” or most likely starry eyed via Musk’s famous person attraction, the board by no means requested the $55.8 billion query: Was once the plan even essential for Tesla to retain Musk and reach its targets?

However the actual factor is how the plan took place. The pass judgement on discovered that Musk was once in regulate of Tesla and the board – resulting in irregularities and the way the plan was once put in combination and negotiated.

That’s on the core of the pass judgement on determination and Tesla doesn’t in reality cope with it in its new SEC proxy observation and this new site.

That is the one phase that type of addresses it:

Screenshot

Screenshot

Then again, the testimonies from the Tesla board individuals, Musk, and everybody concerned, led the pass judgement on to consider the paintings from the board wasn’t in reality “tough”.

For instance, Todd Maron, a attorney who represented Musk and previously was once his divorce attorney, changed into Tesla’s normal recommend when this plan was once being negotiated:

The method resulting in the approval of Musk’s repayment plan was once deeply mistaken. Musk had in depth ties with the individuals tasked with negotiating on Tesla’s behalf. He had a 15-year dating with the repayment committee chair, Ira Ehrenpreis. The opposite repayment committee member positioned at the running staff, Antonio Gracias, had trade relationships with Musk courting again over two decades, in addition to any such private dating that had him vacationing with Musk’s circle of relatives frequently. The running staff integrated control individuals who have been beholden to Musk, akin to Basic Recommend Todd Maron who was once Musk’s former divorce lawyer and whose admiration for Musk moved him to tears right through his deposition. In truth, Maron was once a number one gobetween Musk and the committee, and it’s unclear on whose facet Maron seen himself. But most of the paperwork cited via the defendants as evidence of a good procedure have been drafted via Maron.

That on my own is a unusual factor: having your divorce attorney change into your auto corporate’s normal recommend.

The pass judgement on additionally argued that the board didn’t in reality negotiate the deal proposed via Musk. They made a couple of adjustments to align it with Tesla’s inner targets, however the pass judgement on believed the trade couldn’t be described as “concessions” via Musk:

On this litigation, the defendants touted as concessions positive options of the repayment plan—a five-year retaining length, an M&A adjustment, and a 12- tranche construction that required Tesla to extend marketplace capitalization via $100 billion greater than Musk had to start with proposed to maximise repayment underneath the plan. However the retaining length was once followed partially to extend the cut price at the publicly disclosed grant worth, the M&A adjustment was once business same old, and the 12-tranche construction was once reached with the intention to translate Musk’s fully-diluted-share proposal to the board’s most well-liked total-outstanding-shares metric. It’s not correct to refer to those phrases as concessions.

Tesla shareholders are going to vote at the plan once more in June, together with the transfer to Texas and the re-election of 2 board individuals, together with Musk’s brother, Kimbal Musk.

Electrek’s Take

Ahead of balloting, Tesla shareholders will have to take a look at greater than the proxy and Tesla’s new site.

You will have to in reality learn the pass judgement on’s determination, which incorporates excerpts from testimonies from principally everybody concerned. It does no doubt paint probably the most correct image of ways the plan took place – no doubt greater than the board pronouncing they met 15 occasions to speak about this plan.

That’s all I’m asking. Learn the pass judgement on’s determination.

Right here’s the pass judgement on’s determination in complete:

FTC: We use source of revenue incomes auto associate hyperlinks. Extra.