Tesla (NASDAQ:TSLA) is anticipated to announce its second-quarter deliveries on Tuesday. The EV primary’s automobile deliveries are projected to fall by means of 3.7%, marking the primary consecutive quarterly decline. The corporate is dealing with intensifying festival in China and a slowdown in call for for its automobiles.

Consistent with a Reuters document, analysts estimate that Tesla will ship 438,019 automobiles in the second one quarter.

Tesla Is Going through Emerging Demanding situations

Previous this 12 months, the corporate warned of decrease automobile deliveries because of demanding situations following years of speedy enlargement. As customers shift to less expensive hybrids, Tesla is left with upper stock, main TSLA to slash costs and be offering extra incentives like less expensive financing and rentals.

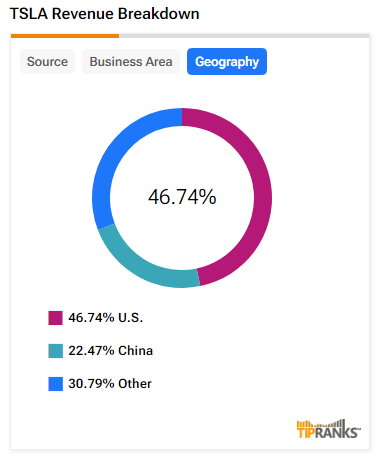

In China, Tesla faces stiff festival from native firms like XPeng (NYSE:XPEV) and a shopper shift to in the neighborhood manufactured EVs or hybrid automobiles. Tesla’s revenues from China declined by means of 6.1% year-over-year in Q1 to $4.6 billion. Within the first quarter, China’s proportion of TSLA’s revenues used to be greater than 20%.

Moreover, previous this 12 months, TSLA’s CEO Elon Musk shelved plans for a brand new, less expensive electrical automobile to concentrate on robotaxis, elevating investor considerations about whether or not the corporate will have the ability to highest independent generation.

Is Tesla a Purchase or Promote?

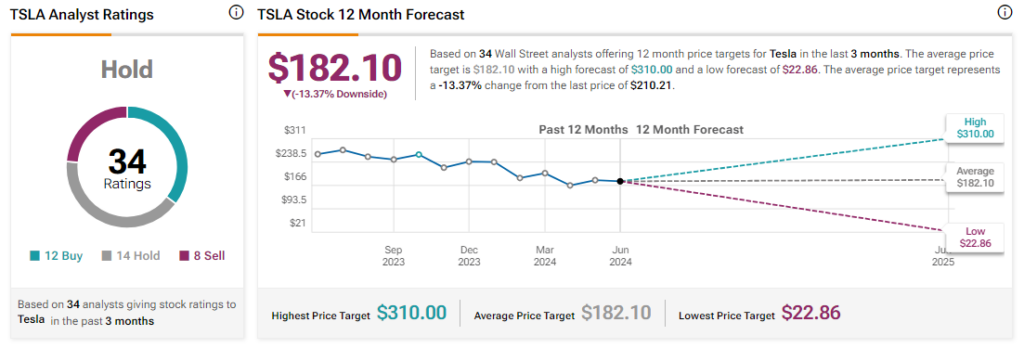

Analysts stay sidelined about TSLA inventory, with a Dangle consensus ranking in response to 12 Buys, 14 Holds, and 8 Sells. Over the last 12 months, TSLA has declined by means of greater than 20%, and the common TSLA worth goal of $182.10 implies a problem doable of 13.4% from present ranges.