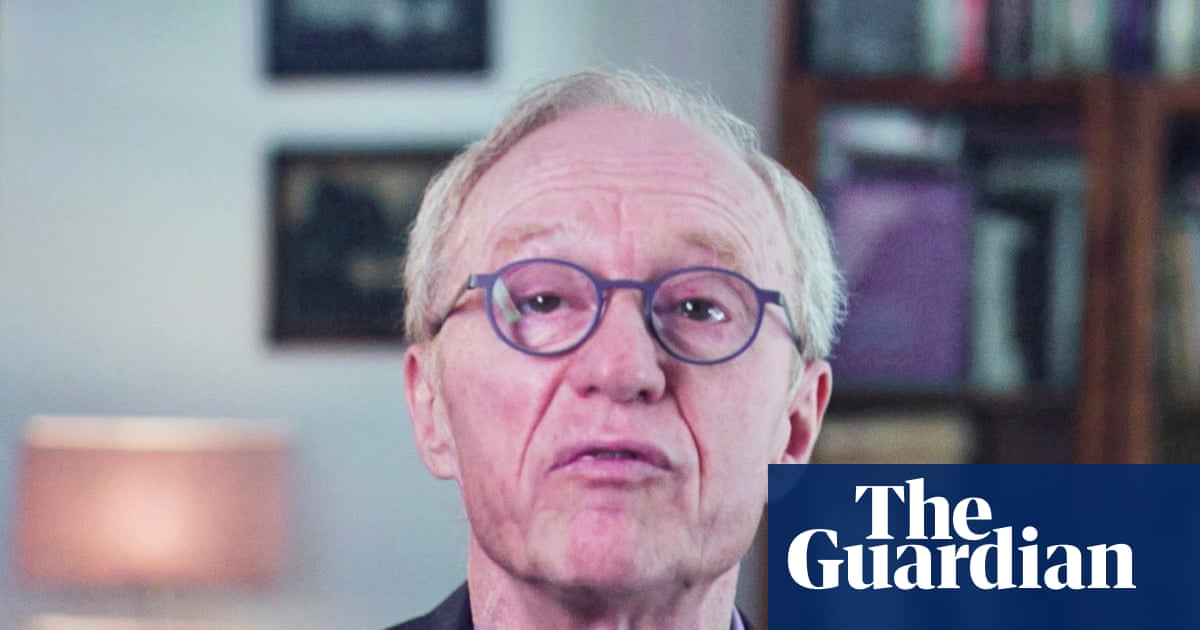

Tesla’s (TSLA) post-earnings inventory rally has value quick dealers billions. Tesla quick dealers misplaced $4.2 billion within the two days following the EV maker’s 3rd quarter income closing Wednesday, in line with information from S3 Companions. Tesla reported a higher-than-expected 3rd quarter benefit and stepped forward margins after the bell on Oct. 23. The ones beats helped Tesla inventory notch its largest single-day achieve in a decade. The inventory jumped 22% closing Thursday, its very best day since 2013, and stocks rose some other 3.3% Friday. Tesla inventory used to be up more or less 1% on Monday sooner than reversing course, finishing the day down 2.5%. This isn’t the primary time this yr that quick dealers paid dearly for having a bet in opposition to the Elon Musk-helmed corporate. Within the week following Tesla’s better-than-feared fiscal first quarter income file in April, quick dealers misplaced greater than $5 billion. Tesla’s inventory efficiency has been unstable over the last month. Stocks sank in early October because the automaker neglected Wall Boulevard estimates on its 3rd quarter deliveries, issued a recall, and discontinued a lower-priced type. Then, the inventory rose in anticipation of Tesla’s robotaxi unveiling, simplest to fall sharply when the development did not reside as much as the hype. Tesla’s most up-to-date rally closing week comes regardless of blended 3rd quarter effects. Whilst Tesla beat Wall Boulevard’s forecasts on its adjusted income in step with proportion and gross margin, its quarterly earnings of $25.18 billion used to be less than the $25.4 billion anticipated, in line with Bloomberg consensus estimates. A slew of Wall Boulevard analysts from Morgan Stanley (MS), Financial institution of The united states (BAC), and Deustche Financial institution (DB) to Wedbush, Canaccord Genuity, and William Blair have reiterated their Purchase rankings on Tesla inventory following the file. Financial institution of The united states additionally raised its worth goal at the inventory to $265 from $255. The company’s senior auto analyst John Murphy mentioned on Yahoo Finance’s Opening Bid podcast (video above) he’s eyeing some other worth goal hike on Tesla. A row of Tesla superchargers is proven at a supercharging location in Los Angeles, June 5, 2024. (REUTERS/Mike Blake) · Reuters / Reuters Whilst Tesla’s contemporary center of attention on its AI ambitions had left buyers feeling skittish, Morgan Stanley analyst Adam Jonas mentioned he used to be inspired via Tesla’s emphasis in its 3rd quarter income name on revving up its auto trade, which accounts for 80% of Tesla’s earnings. Jonas pointed to CEO Elon Musk’s feedback about concentrated on 20% to 30% enlargement in electrical car deliveries in 2025 whilst that specialize in decreasing manufacturing prices. “As buyers battle with the trade type shift from auto to AI, this print reminds us rising the automobile trade profitably stays a prime precedence,” Jonas wrote in a be aware to buyers. Tale Continues