Tesla (TSLA) is gearing as much as liberate its third-quarter 2024 income on October 23. Wall Side road analysts are forecasting income of $0.60 in keeping with proportion, marking a 9% decline from final yr’s Q3. The anticipated drop in earnings is most probably because of shrinking margins, brought about by way of Tesla’s value cuts in main markets because it offers with emerging pageant and broader demanding situations within the auto business.

This makes Tesla’s margin efficiency a essential metric to observe in its Q3 record. It’s essential to focus on that Tesla has already fallen by way of 13% within the final 3 months. If the corporate can record sturdy income and maintain more fit margins, it would spice up the inventory value.

On the other hand, there’s a silver lining: Q3 revenues are projected to develop by way of 9% year-over-year, achieving $25.46 billion, in line with information from TipRanks.

Fresh Occasions to Imagine Forward of Q3

Previous this month, Tesla shared its third-quarter supply numbers, reporting 462,890 cars. This marks a 6% build up from final yr, but it surely used to be rather beneath analysts’ expectancies of 463,310. The shortfall highlights ongoing demanding situations from the financial system and powerful pageant, in particular in China.

Some other essential match forward of the Q3 record used to be the Robotaxi show off on October 10, the place Tesla presented the Cybercab. Sadly, buyers had been left disillusioned, as the development lacked the detailed knowledge that they had was hoping for.

However, Elon Musk’s emphasis on new applied sciences like robotics can be a smart long-term technique as Tesla goals to enlarge past the aggressive electrical car marketplace.

Choices Investors Look forward to a Huge Transfer

The usage of TipRanks’ Choices instrument, we will be able to gauge choices investors’ expectancies for the inventory post-earnings record. According to a $207.5 strike value, with name choices priced at $13.49 and put choices at $0.01, the predicted value motion, according to the at-the-money straddle is 7.39%.

Is Tesla a Purchase, Promote, or Dangle?

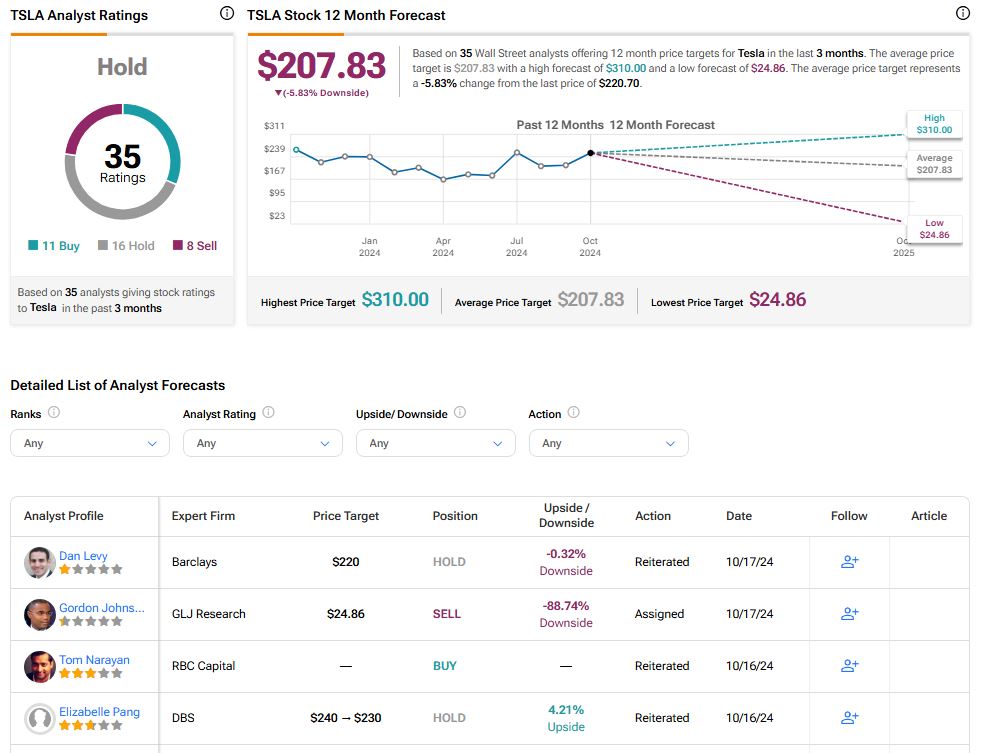

Turning to Wall Side road, Tesla inventory has a Dangle consensus ranking according to 11 Buys, 16 Holds, and 8 Sells assigned within the final 3 months. At $207.83, the reasonable TSLA value goal implies 5.83% problem doable.

See extra TSLA analyst scores

Disclosure