Tether faces an investigation over alleged ties to unlawful actions and sanctioned entities.

In spite of the scrutiny, Tether explores alternatives for enlargement within the commodity sector.

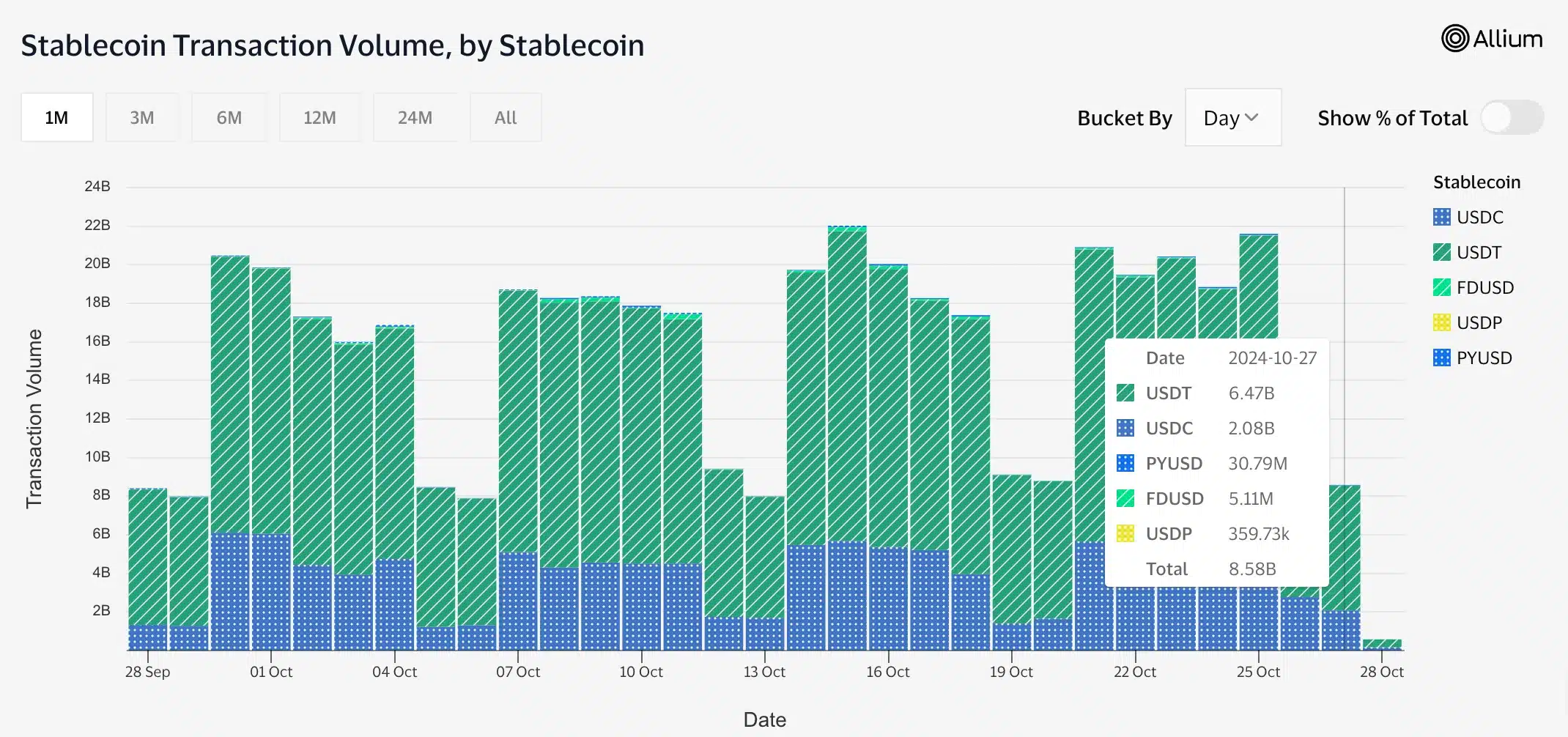

Stablecoins have emerged as a transformative drive within the cryptocurrency panorama this 12 months, specifically highlighted by means of the contest between Circle’s USDC and Tether’s USDT.

Visa on-chain analytics additional indicated that USDT recorded a transaction quantity of $6.47 billion, considerably overshadowing USDC’s $2.08 billion as of twenty seventh October.

Supply: Visa on-chain analytics

Supply: Visa on-chain analytics

Tether beneath risk?

Amid this surge in USDT’s recognition, the Wall Boulevard Magazine reported that the U.S. Lawyer’s Workplace in New york was once investigating USDT for doable involvement in unlawful actions, together with drug trafficking, terrorism financing, and cash laundering.

Alternatively, issues took a distinct flip when Tether’s CEO claimed that there have been no indicators of a federal probe.

Taking to X, Tether’s CEO Paolo Ardoino famous,

“As we instructed to WSJ there’s no indication that Tether is beneath investigation. WSJ is regurgitating previous noise. Complete prevent.”

Tether echoed this sentiment and asserted,

“Those tales are in keeping with natural rank hypothesis regardless of Tether confirming that it has no wisdom of this kind of investigations into the corporate.”

They added,

“The item additionally carelessly glosses over Tether’s well-documented and in depth dealings with regulation enforcement to crack down on unhealthy actors looking for to misuse tether and different cryptocurrencies.”

Alternatively, WSJ stood company suggesting that investigators had been analyzing whether or not the stablecoin has inadvertently facilitated transactions for sanctioned entities.

What’s happening with Tether?

For the ones unaware, the U.S. prosecutors had been investigating the stablecoin supplier’s over allegations of its involvement in illicit actions specifically in terms of sanctioned teams reminiscent of Russian hands sellers.

Moreover, the Treasury Division was once considering sanctions that might bar U.S. electorate from transacting with USDT, which boasts an outstanding buying and selling quantity averaging $190 billion day-to-day. Issues about Tether’s connections to nationwide safety problems, together with North Korea’s nuclear ambitions and ties to Mexican drug cartels, have intensified scrutiny of the stablecoin.

In mild of those accusations, Tether has firmly denied any wrongdoing, highlighting its dedication to cooperating with regulation enforcement and up to date compliance measures. This integrated freezing 1,850 wallets and bolstering its regulatory framework with knowledgeable hires.

What’s extra to it?

The investigation has drawn comparisons between Tether’s operational practices and the ones of FTX. Additional exacerbating doubts about its industry style and adherence to rules. Reviews additionally point out that USDT will have enabled customers in international locations like Venezuela and Russia to avoid sanctions. This raised alarms in regards to the doable misuse of USDT by means of state-owned enterprises and legal organizations.

In spite of the continuing scrutiny surrounding its operations, USDT was once actively pursuing a number of strategic tendencies for the impending 12 months.

Fresh reviews indicated that the stablecoin issuer is thinking about an access into the commodity sector, which might supply important alternatives for enlargement.

If a success, this project may permit USDT to capitalize on credit-starved companies. This may place Tether as a key participant in a brand new marketplace whilst doubtlessly bettering its earnings streams.

Subsequent: Is XRP primed for a breakout? Emerging job, robust metrics sign…