Boy that escalated briefly.

Markets bought off in a rush this week.

The S&P 500 is down nearly 6% from the hot highs. The Nasdaq 100 is in an 11% drawdown.

After an especially calm 12 months, the previous week or so has in any case noticed some volatility within the inventory marketplace.

Right here’s the item — it’s what took place sooner than this that was once now not standard:

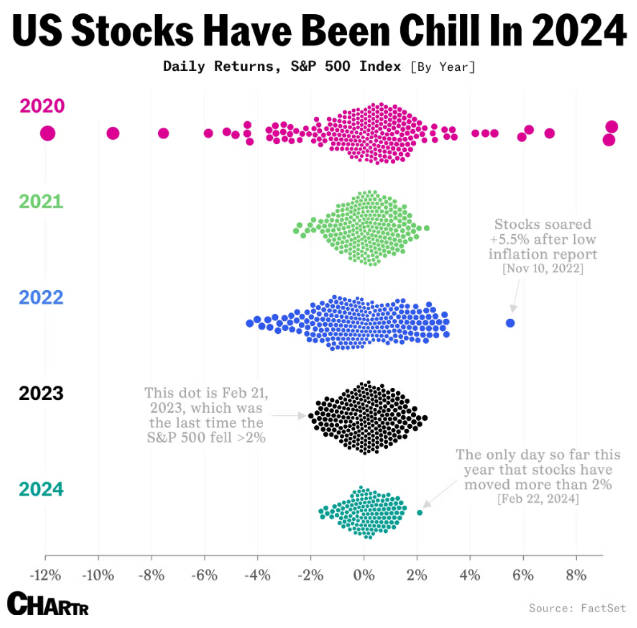

This in reality cool chart got here out a few weeks in the past (by means of Sherwood). It displays how abnormally calm the inventory marketplace was once in 2024 sooner than the present correction.

That scenario couldn’t remaining endlessly so it didn’t.

I hate like to be the fellow who supplies those reminders all through each and every unmarried correction however that is completely standard.

The inventory marketplace is meant to fall each and every every now and then. It will possibly’t simply stay going up endlessly.

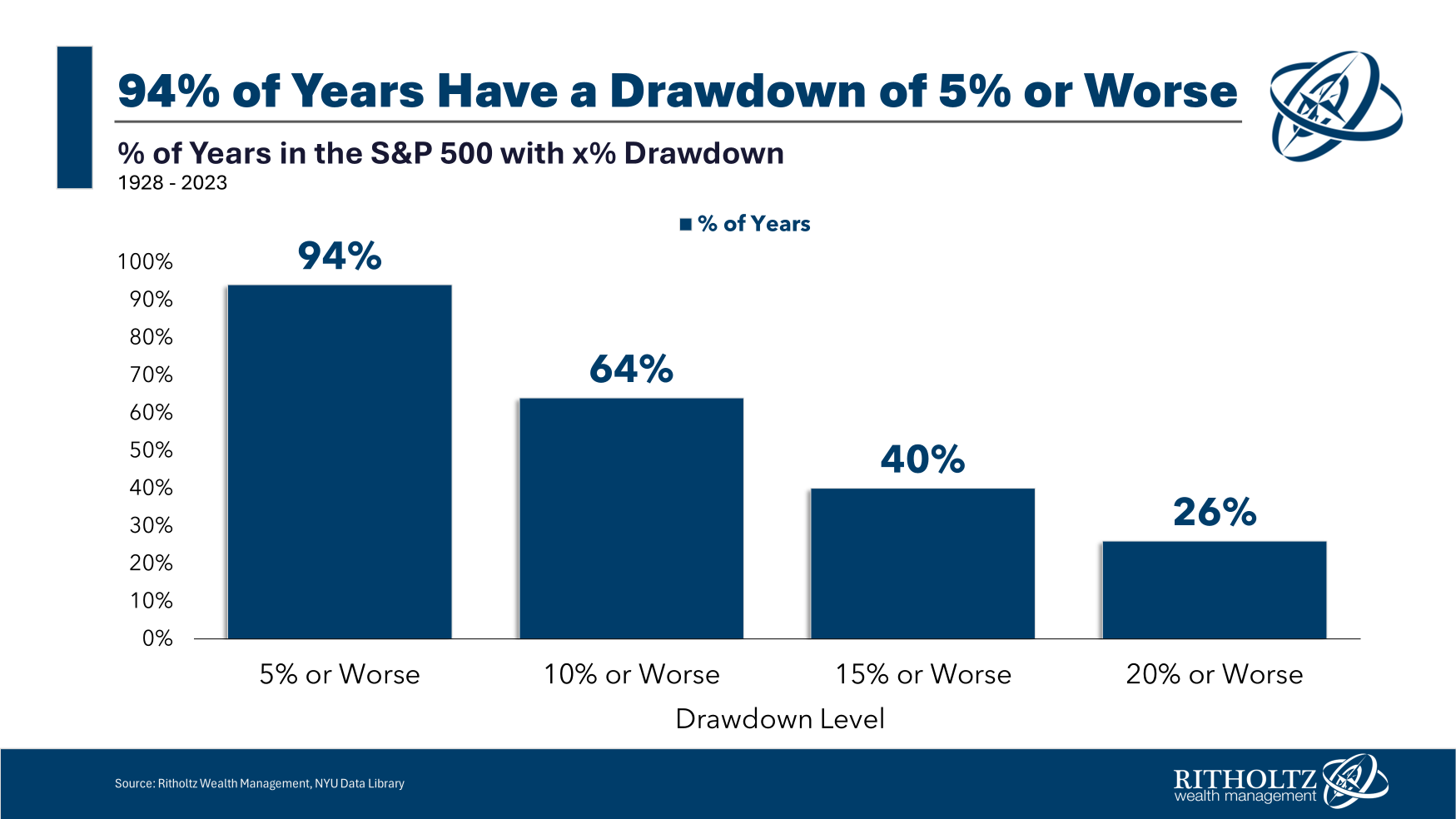

The U.S. inventory marketplace studies a correction nearly annually:

A 5% downturn is all however assured in maximum years.1

A double-digit drawdown occurs greater than two-thirds of all years since 1928.

The common intrayear drawdown from 1928 to 2023 was once -16.4%. Since 1950, the typical correction in a given 12 months was once -13.7%. This century it’s been -16.2%.

If anything else, the present correction is susceptible in keeping with ancient knowledge.

It will worsen. I don’t know what’s going to occur the remainder of the 12 months. One week does now not a marketplace make.

The S&P 500 continues to be up just about 13% at the 12 months. It was once up up to 20% at one level however we’re nonetheless having a look at a double-digit general go back in 2024 (up to now).

I don’t know if that may grasp for the rest of the 12 months nevertheless it’s completely standard to enjoy a decent-sized correction even if the marketplace finishes the 12 months with cast features.

From 1928 via 2023, the S&P 500 was once up 70 out of the 96 years (73% of the time). In 35 of the ones 70 years with certain returns, there was once a double-digit correction alongside the way in which. So part of all years with a acquire skilled double-digit losses to get there.

The inventory marketplace is going down even if it is going up.

That is true even if shares pass up so much.

The S&P 500 has completed the 12 months up double-digits in 56 out of 96 years since 1928 (nearly 60% of the time). In 24 of the ones 56 years with double-digit features, there was once a double-digit loss one day in the similar 12 months. That implies just about 45% of the time when the inventory marketplace has been up 10% or extra, there was a correction of 10% or worse at the trail to these features.

Possibly this 12 months finishes with but every other double-digit acquire, perhaps now not.

Possibly we see every other double-digit drawdown, perhaps now not.

When making an investment within the inventory marketplace it’s a must to be ready for each probabilities. Giant features and massive losses are par for the direction in relation to making an investment in shares.

Volatility is the cost of admission in relation to making an investment in equities.

That’s true when markets pass up or down.

Additional Studying:

What Does a Wholesome Correction Glance Like?

1The remaining 12 months the S&P 500 didn’t enjoy a drawdown of no less than 5% was once 2017. That was once an exceptionally uninteresting 12 months for the marketplace.

This content material, which incorporates security-related reviews and/or knowledge, is supplied for informational functions simplest and will have to now not be relied upon in any method as skilled recommendation, or an endorsement of any practices, merchandise or services and products. There will also be no promises or assurances that the perspectives expressed right here can be acceptable for any specific information or instances, and will have to now not be relied upon in any method. You will have to seek the advice of your individual advisers as to felony, trade, tax, and different linked issues relating to any funding.

The remark on this “submit” (together with any linked weblog, podcasts, movies, and social media) displays the non-public reviews, viewpoints, and analyses of the Ritholtz Wealth Control workers offering such feedback, and will have to now not be appeared the perspectives of Ritholtz Wealth Control LLC. or its respective associates or as an outline of advisory services and products supplied via Ritholtz Wealth Control or efficiency returns of any Ritholtz Wealth Control Investments consumer.

References to any securities or virtual property, or efficiency knowledge, are for illustrative functions simplest and don’t represent an funding advice or be offering to supply funding advisory services and products. Charts and graphs supplied inside are for informational functions only and will have to now not be relied upon when making any funding resolution. Previous efficiency isn’t indicative of long run effects. The content material speaks simplest as of the date indicated. Any projections, estimates, forecasts, objectives, possibilities, and/or reviews expressed in those fabrics are matter to switch with out understand and might range or be opposite to reviews expressed via others.

The Compound Media, Inc., an associate of Ritholtz Wealth Control, receives fee from quite a lot of entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials does now not represent or indicate endorsement, sponsorship or advice thereof, or any association therewith, via the Content material Writer or via Ritholtz Wealth Control or any of its workers. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here:

Please see disclosures right here.

![Ottocast elevates the hooked up vehicle enjoy with wi-fi CarPlay AI Field, CloudSIM, Automotive TV Mate Professional, extra [20% off] – 9to5Mac Ottocast elevates the hooked up vehicle enjoy with wi-fi CarPlay AI Field, CloudSIM, Automotive TV Mate Professional, extra [20% off] – 9to5Mac](https://9to5mac.com/wp-content/uploads/sites/6/2024/12/ottocast2.jpg?quality=82&strip=all&w=1500)