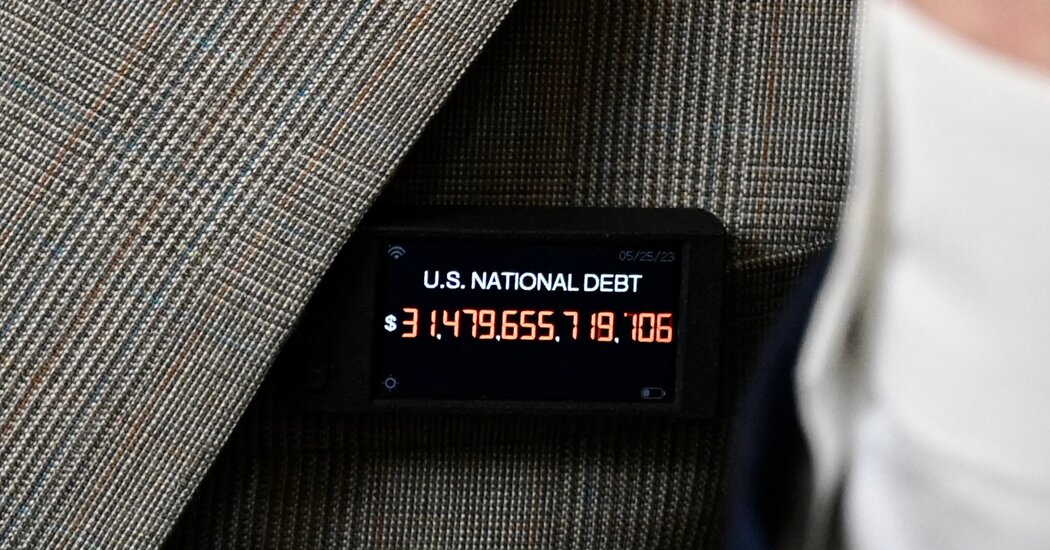

The recent bipartisan deal to avoid a government default made only minor cuts to a small portion of the federal budget, indicating that significant progress towards reducing the nation’s debt load may prove unattainable. While there is currently no clear indication that rising debt levels negatively impact economic growth, some economists argue that such levels could lead to inflation or decreased borrowing opportunities for businesses. Despite this, the debt burden remains a significant concern to Congress, with projected federal debt expected to exceed $50 trillion by the end of the decade. Both parties agree on the need for increased borrowing, with the recent debt-ceiling agreement providing evidence that the debt will not be decreasing anytime soon. Democrats are wary of reducing Social Security and Medicare benefits, while Republicans continue to refuse new tax increases. The current proposal provides only minor decreases in spending growth, meaning that federal debt is still expected to grow in the coming decade. At present, it appears unlikely that significant cuts to retirement programs or increases to tax revenues will take place, with both parties continuing to seek political advantage rather than compromise.

The Debt-Limit Deal Suggests Debt Will Keep Growing, Fast