Wall Side road’s “Barbarians on the Gate” are slowing down after just about 25 years of thrashing the inventory marketplace.Previous this month, funding company Hamilton Lane issued a file appearing that the MSCI Global Index, a number one inventory marketplace indicator, beat out deepest fairness returns for the primary time for the reason that dot-com bubble burst in 2000. Hamilton Lane’s information represents efficiency thru September 2024 for buyout finances that began making an investment in 2022.Previous to this, the leveraged buyout trade, often referred to as deepest fairness, have been on a tear. Positive, it felt some ache all over the housing crash and the next recession, however that still supposed that rates of interest stayed decrease for longer — paving the way in which for cash-rich corporations like Blackstone to select up belongings at the reasonable, which helped pressure returns and extra traders. In July 2023, Blackstone was the primary deepest fairness company to regulate $1 trillion in belongings — 3 years forward of the corporate’s prediction to traders.

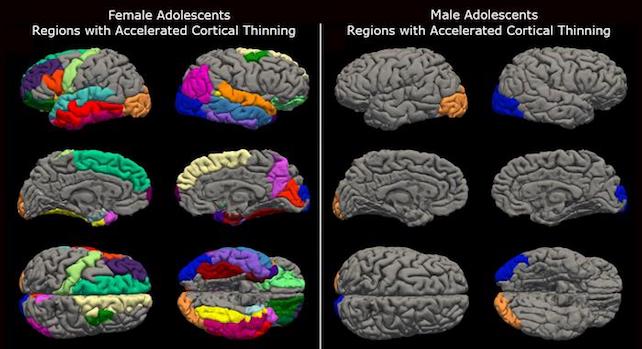

Hamilton Lane charts monitoring inside price of go back of personal funding finances in comparison to their public marketplace equivalents.

Hamilton Lane

As Apollo CEO Marc Rowan stated at a presentation remaining yr, a lot of the trade’s returns over the past 15 years (he excluded Apollo’s) “used to be now not the results of nice making an investment, however because of $1 trillion in cash printing. Smartly, wager what? We stopped printing that magnitude of cash.”Certainly, since rates of interest began ticking upper, monetary sponsor dealmaking has slowed, IPOs have floor to a halt, and dry powder (trade discuss for cash but to be invested) has stood at close to all-time highs at the same time as fundraising slowed by means of virtually part from its 2021 height.That isn’t to mention that the trade extensively referred to as “deepest fairness” is useless — or that every one buyout finances have underperformed shares in recent times. Rather the other. Corporations like Blackstone and Apollo were busy issuing loans and making an investment in massive infrastructure tasks (assume information facilities). Certainly, Apollo’s lending trade is now just about 10 occasions greater than its conventional buyout trade.What does all of it imply for budding masters of the universe searching for a profession in deepest fairness? We spoke with a spread of mavens, from trade insiders to specialists and recruiters, to know what’s forward for execs having a look to damage into the profitable box of private-market making an investment. “Personal fairness used to be ready to get lazy as a result of ZIRP.”They stated there’s no scarcity of alternatives for aspiring financiers who know the place to appear. Personal fairness’s loss has been deepest credit score’s achieve, and inside deepest fairness, there are extra alternatives than ever for pure-play operations mavens professional at operating companies.As Robin Judson, founding father of recruiting company Robin Judson Companions, put it: “I believe that individuals who wish to do deepest fairness will pursue it, whilst individuals who simply wish to make investments would possibly glance towards different methods.”Here is a information to a profession in deepest fairness because the golden age of company buybacks offers method to deepest credit score and different sorts of dealmaking.The upward push of the portfolio operatorWhen rates of interest began emerging in 2022, corporate valuations remained loft, making it more difficult for buyout companies, which depend closely on debt to make purchases, to seek out offers that might generate returns. This has resulted in a shift in call for for execs who know the way to pressure returns by means of converting how a trade is administered, stated Glenn Mincey, KPMG’s head of US deepest fairness.”This recalibration has given execs within the trade new focal point out of doors of shopping for and promoting corporations,” Mincey informed BI.Certainly, those execs was known as in to assist organize an organization after it used to be bought. An increasing number of, they’re getting concerned upfront of an acquisition as a result of they’re ceaselessly best possible situated to know the way to maximise efficiency thru operational enhancements.The biggest companies will rent groups of operational mavens with experience starting from technological transformation to provide chain and logistics to skill acquisition and control. Even conventional deal execs have transform extra operationally centered. “Personal fairness used to be ready to get lazy as a result of ZIRP,” a VP at a mid-market deepest fairness company informed BI, regarding the acronym for the Federal Reserve’s 0 rate of interest coverage reaction to monetary crises beginning in 2001. “That is long past away, it’s a must to know your shit now,” this individual added.This hands-on, entrepreneurial way will also be noticed within the rising upward push of so-called seek finances. Once in a while described as mini-private fairness, a seek fund is a small deepest fairness fund run by means of one or two people that is fascinated about buying one small trade like a carwash or HVAC corporate. As soon as bought, the fund works on streamlining operations and developing price.In keeping with a 2024 Stanford Industry College learn about, seek fund introduction hit an all-time prime in 2023, the newest yr with information, with greater than 90 first-time seek finances raised. This technique is attracting a more youthful team of pros proper into chapter 11 college, and even earlier than trade college, with Stanford discovering that just about 80% of first-time fundraisers in 2023 clock in at 35 or more youthful.

Comparable tales

The personal credit score boomThe similar prime rates of interest and world uncertainty that experience dampened the standard deepest fairness trade have made nonbank lending, often referred to as deepest credit score, extra sexy. Even in a tricky financial system, “corporations nonetheless want capitalization,” defined Judson. And with banks pulling again on riskier lending, deepest traders have stepped in to provide “extra inventive financing answers,” she stated.Blackstone, which made its identify in deepest fairness after which actual property making an investment, noticed its credit score trade develop to transform the most important trade in its portfolio by means of belongings underneath control remaining yr. Apollo now counts greater than 80% of its $751 billion in belongings underneath control as deepest credit score.As PWC’s chief of its deepest fairness advisory apply Kevin Desai informed BI in January, the non-public credit score activity marketplace is scorching partly as a result of there merely don’t seem to be sufficient other folks with direct enjoy to fill lenders’ wishes. One reason why is that non-public credit score companies need execs with lending enjoy.That suggests recruiting from the debt-raising or buying and selling hands of funding banks — or truly someone with lending wisdom who will also be educated.Nelson Chu, CEO and founding father of deepest credit score funding market P.c, informed BI that his company has additionally recruited skill from debt score businesses like Morningstar and Moody’s. Its ceaselessly labored out so smartly that the company has noticed its staff get briefly poached when they rise up to hurry, he added.What this implies for personal fairness jobsAnthony Keizner, cofounder and managing spouse of Odyssey Seek Companions, informed BI that hiring is “very buoyant” in sure deepest fairness companies, together with the preferred and dry-powder-rich niches of secondaries, purchasing and promoting of stakes in different deepest finances, and infrastructure.

This chart compares the efficiency of personal finances that began making an investment in 2022 to their public marketplace equivalents. Word the oversized efficiency of infrastructure.

Hamilton Lane

The slowdown within the conventional deepest fairness trade of buyouts is felt maximum acutely in midlevel and senior positions, he stated.”Maximum buyout companies have slowed their hiring plans in 2025 in comparison to the new growth years,” he stated. “Many deepest fairness companies really feel they’re adequately staffed at present deal quantity ranges.”Hiring on the junior stage stays lively, he stated — a sentiment echoed by means of Tim Roth, spouse at advisory company Armanino Advisory.”I do not consider junior hiring is lowering, however I believe it is changing into extra aggressive to get a shot,” Roth informed BI, noting that AI may just exacerbate the problem.For execs who’ve already damaged into the trade, there is much less pay however now not a large number of eagerness to leap send both. One reason why is that PE companies nonetheless have a ton of dry powder to take a position and portfolio corporations to promote when the time is correct.”I inform applicants to not go away their jobs at this time with no need some other activity,” Judson stated. “You probably have a task, assuming the portfolio is sustainable, you’re going to ultimately receives a commission.”The personal fairness VP agreed. “I have never heard of many of us at my stage having a look to run for the exits,” he informed BI. Even with realizations, and subsequently elevate and bonuses decrease, the trade nonetheless gives “the perfect upside” for reimbursement, he defined.Personal fairness, with its tie to rates of interest and the entire well being of the financial system, is a cyclical trade. Earlier golden ages, just like the Eighties or the early 2000s, additionally ended, and new ones rose up of their stead.”The important thing phrase at this time is stagnation,” Judson stated. “No one is aware of how lengthy this uncertainty goes to remaining. Is it going to remaining for months or years?”