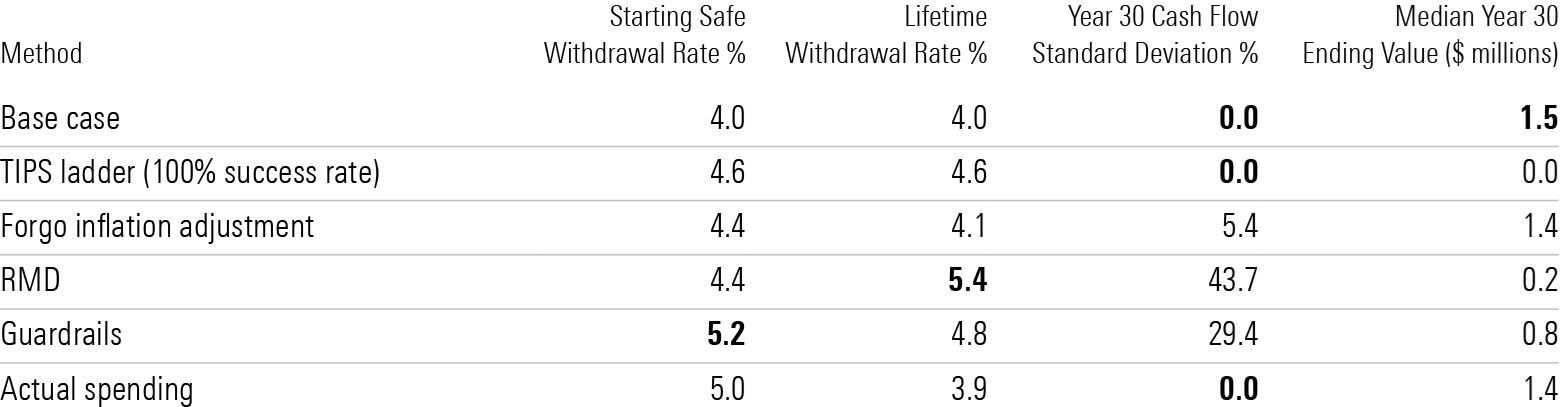

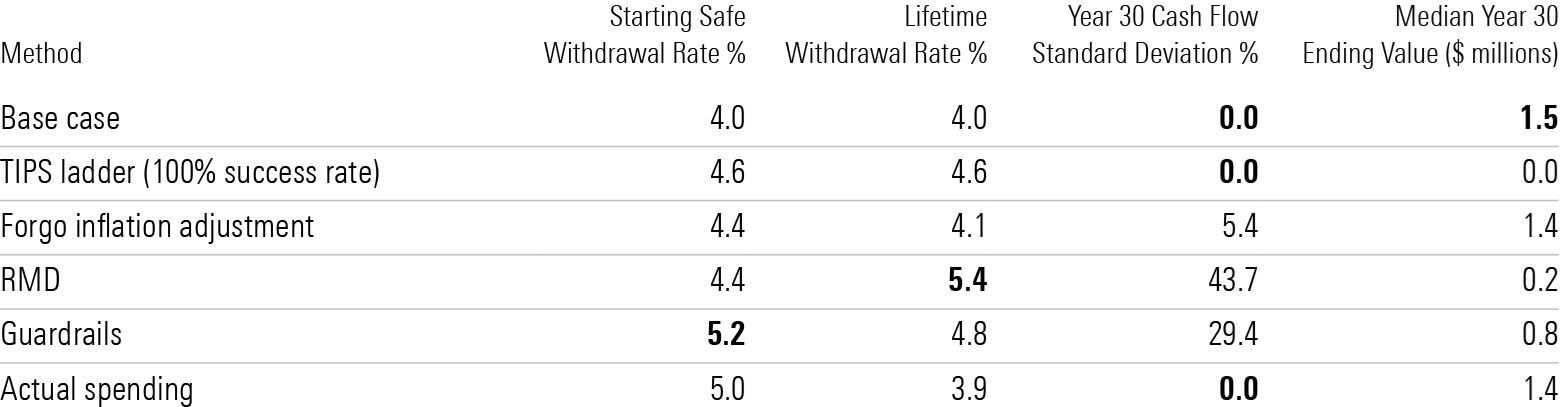

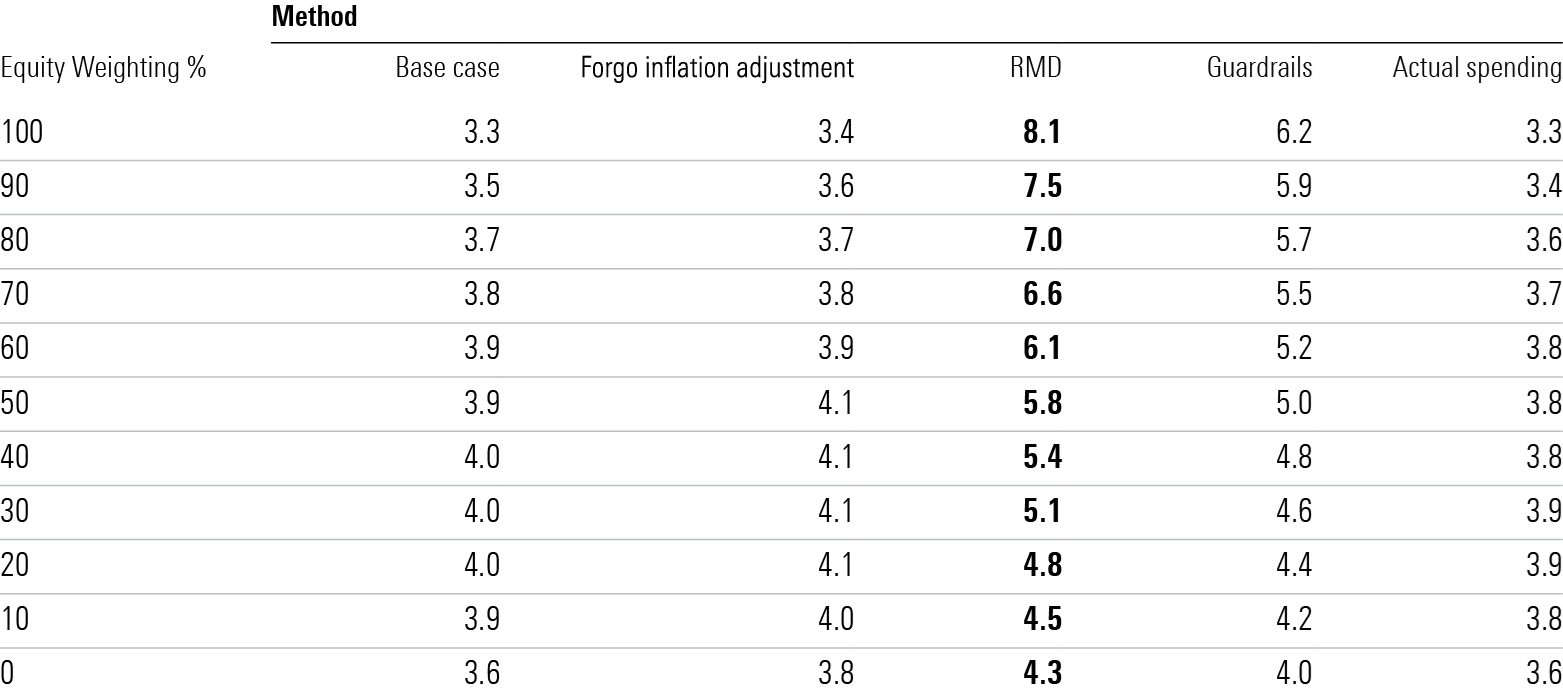

In our contemporary annual learn about on protected withdrawal charges, my colleagues Christine Benz, John Rekenthaler, and I discovered that retirees who wish to care for a constant spending quantity adjusted for inflation will want to stay their beginning withdrawals at 4.0% or decrease in the event that they wish to lock in a 90% likelihood of luck over a 30-year time horizon. The program of “constant actual” withdrawals gives the advantage of simplicity and maximum carefully approximates the constant paychecks that the general public develop aware of right through their running years.However some retirees would possibly discover a extra versatile option to retirement withdrawals extra interesting. Methods that contain converting withdrawal quantities from yr to yr—taking decrease withdrawals in susceptible marketplace environments and possibly upper paydays in very sturdy ones—in most cases permit for upper withdrawal charges. Versatile methods are efficient as a result of they assist to stop retirees from overspending during periods of marketplace weak point, whilst giving them a elevate in more potent marketplace environments.Get the total record: The State of Retirement IncomeTo assist determine how versatile methods stability lifetime revenue with concerns of high quality of existence and the volatility of money flows, we additionally examined one of the most generally used versatile methods, benchmarking them towards the baseline device.On this article, I’ll have a look at the professionals and cons of the 4 variable withdrawal methods we examined, in addition to the kind of retiree every one could be maximum suitable for. Manner 1: Forgoing inflation changes following annual portfolio loss.This technique, advocated by way of (amongst others) T. Rowe Worth, starts with the bottom case of constant actual withdrawals right through a 30-year time horizon. Alternatively, to maintain property following down markets, the retiree skips the inflation adjustment for the yr following a yr by which the portfolio has declined in price. As an example, an individual following this technique wouldn’t building up portfolio withdrawals after the 2022′s endure marketplace, regardless of the massive soar in inflation right through the yr. This would possibly look like a modest step, however the cuts in actual spending, whilst small, are cumulative. This is, the results of such cuts ripple into the long run, as those adjustments completely cut back the retiree’s spending trend. This technique may be conservative as it doesn’t spice up the true withdrawal quantity even after a big building up in portfolio price.Manner 2: Required minimal distributions. This is identical framework that underpins required minimal distributions from tax-deferred accounts like IRAs. In its most straightforward shape, the RMD approach is portfolio price divided by way of existence expectancy. For existence expectancy, we used the IRS’ Unmarried Lifestyles Expectancy Desk and assumed a 30-year retirement time horizon, from ages 65 to 94. (We hired the up to date RMD calculations that went into impact in 2022.)This technique is inherently “protected” and designed to be sure that a retiree won’t ever expend the portfolio since the withdrawal quantity is all the time a proportion of the remainder stability. (Against this to the opposite strategies within the paper, the odds withdrawn are according to the present portfolio price, now not the unique stability.) Alternatively, an RMD device comprises two key variables for retirement-spending plans: ultimate existence expectancy and ultimate portfolio price. Whilst adjustments in existence expectancy are slow, the truth that the remainder portfolio price can alternate considerably from yr to yr provides considerable volatility to money flows.Manner 3: Guardrails. In the beginning advanced by way of monetary planner Jonathan Guyton and pc scientist William Klinger, the guardrails approach units an preliminary withdrawal proportion, then adjusts next withdrawals every year according to portfolio efficiency and the former withdrawal proportion. The guardrails try to ship enough—however now not overly top—raises in upward-trending markets whilst adjusting downward after marketplace losses. In upward-trending markets, by which the portfolio plays smartly and the brand new withdrawal proportion (adjusted for inflation) falls beneath 20% of its preliminary stage, the withdrawal will increase by way of the inflation adjustment plus any other 10%.To make use of a easy instance, let’s say the beginning withdrawal proportion is 4% of $1 million, or $40,000. If the portfolio will increase to $1.4 million in the beginning of 12 months 2, the retiree may robotically take $40,000 plus an inflation adjustment—$40,968, according to a 2.42% inflation fee. Dividing that quantity by way of the present stability—$1.4 million—assessments for the share. The quantity of $40,968 is simply 2.9% of $1.4 million. As that 2.9% determine is 28% not up to the beginning proportion of four%, the retiree qualifies for an upward adjustment of 10%. The brand new withdrawal quantity turns into $45,065—the scheduled quantity of $40,968 plus the extra 10% of $4,097.The guardrails observe right through down markets, too. Particularly, the retiree cuts spending by way of 10% if the brand new withdrawal fee (adjusted for inflation) is 20% above its preliminary stage. As an example, let’s say the retiree chickening out 4% ($40,000) of the $1 million portfolio in 12 months 1 instantly moves an funding iceberg, dropping 30% of the portfolio price in 12 months 1. The portfolio drops to only $672,000 in the beginning of 12 months 2. The 12 months 2 withdrawal can be $40,968 on a pretest foundation. However as a result of $40,968 from $672,000 is a 6.1% withdrawal fee—a ways above the preliminary 4%—the retiree would want to cut back the scheduled $40,968 quantity by way of 10%, to $36,871.The Guyton-Klinger approach scraps the cutback regulations (following portfolio declines) right through the overall 15 years of retirement, in acknowledgment of the truth that susceptible returns are particularly unhealthy early in retirement however much less so in a while. Guyton-Klinger additionally comprises some portfolio-management regulations associated with the spending of more than a few property—for instance, if the fairness allocation exceeds its goal allocation on account of sturdy efficiency, the surplus fairness publicity is bought and added to money. Alternatively, for this workout, we targeted solely on adjustments to the withdrawal fee relatively than together with the portfolio leadership regulations.Manner 4 (new for 2023): Spending declines consistent with ancient information.We additionally examined a technique that comprises the typical decline in spending that happens over the retirement lifecycle. In previous research, we included this spending trend by way of assuming that the hypothetical retirees didn’t regulate their annual withdrawals by way of the total quantity of inflation however as an alternative by way of 1 proportion level not up to the once a year inflation fee.On this yr’s learn about, we additional delicate this system by way of incorporating extra explicit patterns observable in retiree spending at more than a few existence phases. Analysis from the Worker Advantages Analysis Institute [1] demonstrates that inflation-adjusted family spending has traditionally fallen by way of 19% from age 65 to 75, 34% from age 65 to 85, and 52% from age 65 to 95. We adjusted the once a year spending numbers to compare up with those longer-term declines. To replicate this, Manner 4 assumes that actual retirement spending declines by way of 1.9 proportion issues consistent with yr between age 65 and 75; 1.5 proportion issues consistent with yr between 75 and 85; and 1.8 proportion issues consistent with yr between 85 and 95.Checking out the 4 StrategiesFor every technique, we used stochastic (Monte Carlo) modeling to check how a hit withdrawal methods—which means {that a} given device ensured {that a} retiree didn’t run out of cash over a 30-year time horizon—fared on a couple of key metrics. As with the bottom case, we outlined luck as now not operating out of cash in 90% of the random trials. We hired a 40% fairness/60% fixed-income portfolio because the baseline case but in addition checked out different asset allocations.The metrics have been as follows:Beginning Protected Withdrawal Price: What beginning withdrawal fee would had been supported for 30-year classes with a 90% likelihood of luck (with “luck” outlined as a good account stability on the finish of the 30-year horizon)?Lifetime Portfolio Withdrawal Price (Interior Price of Go back): What used to be the typical lifetime withdrawal quantity, factoring in any upward or downward changes that the versatile technique entailed, that will had been supported for 30-year classes with a 90% likelihood of luck? We calculate this as the typical price of the once a year withdrawals (discounted by way of the two.42% inflation fee) for the 1,000 simulated trials.12 months 30 Money Go with the flow Same old Deviation: To what extent did withdrawals range on a year-to-year foundation? To approximate this variance, we read about the usual deviation of the withdrawals that happen in 12 months 30 around the 1,000 simulated trials. The upper the usual deviation, the larger doable variation in spending around the retirement horizon.Median Finishing Worth at 12 months 30: What’s the median portfolio stability that is still on the finish of the 30-year length? To reach at this determine, we discover the median stability for the 1,000 trials ultimate on the finish of the 30-year classes. This metric is important for many who need to care for (and even develop) their property to depart one thing at the back of for heirs or charity.Evaluating the MethodsEach approach includes its personal set of trade-offs. Underneath, we evaluate every approach according to the 4 analyzed metrics: beginning protected withdrawal charges, lifetime portfolio withdrawal charges, 12 months 30 money float same old deviation, and median finishing price at 12 months 30. The showcase beneath depicts how every approach fared on every metric, assuming 40% inventory/60% bond portfolios, a 30-year spending horizon, and a 90% luck fee. The spending approach that delivers the most productive consequence is famous in daring. Notice: The desk beneath additionally presentations how those metrics stack up for a TIPS ladder technique, which John Rekenthaler wrote about right here.  Supply: Morningstar. Knowledge as of Sept. 30, 2023. Beginning Protected Withdrawal RateEach versatile spending approach helps a better preliminary protected withdrawal fee than the constant actual withdrawal approach, as proven above. However the guardrails approach helps the best beginning protected withdrawal charges throughout maximum asset allocations. This displays the character of the manner, which is able to improve upper preliminary withdrawals by way of making probably vital year-to-year changes to greenback withdrawals by way of throttling spending down at inopportune instances.For the opposite strategies, beginning protected withdrawal charges are typically best with fairness allocations starting from 20%-40% and tended to be lowest in less-diversified allocations like 100% shares. Alternatively, as a result of our expectancies for fixed-income returns (basically money) have ticked up whilst assumptions for fairness returns have edged down, much less equity-heavy allocations pop out having a look higher than they did in closing yr’s learn about.

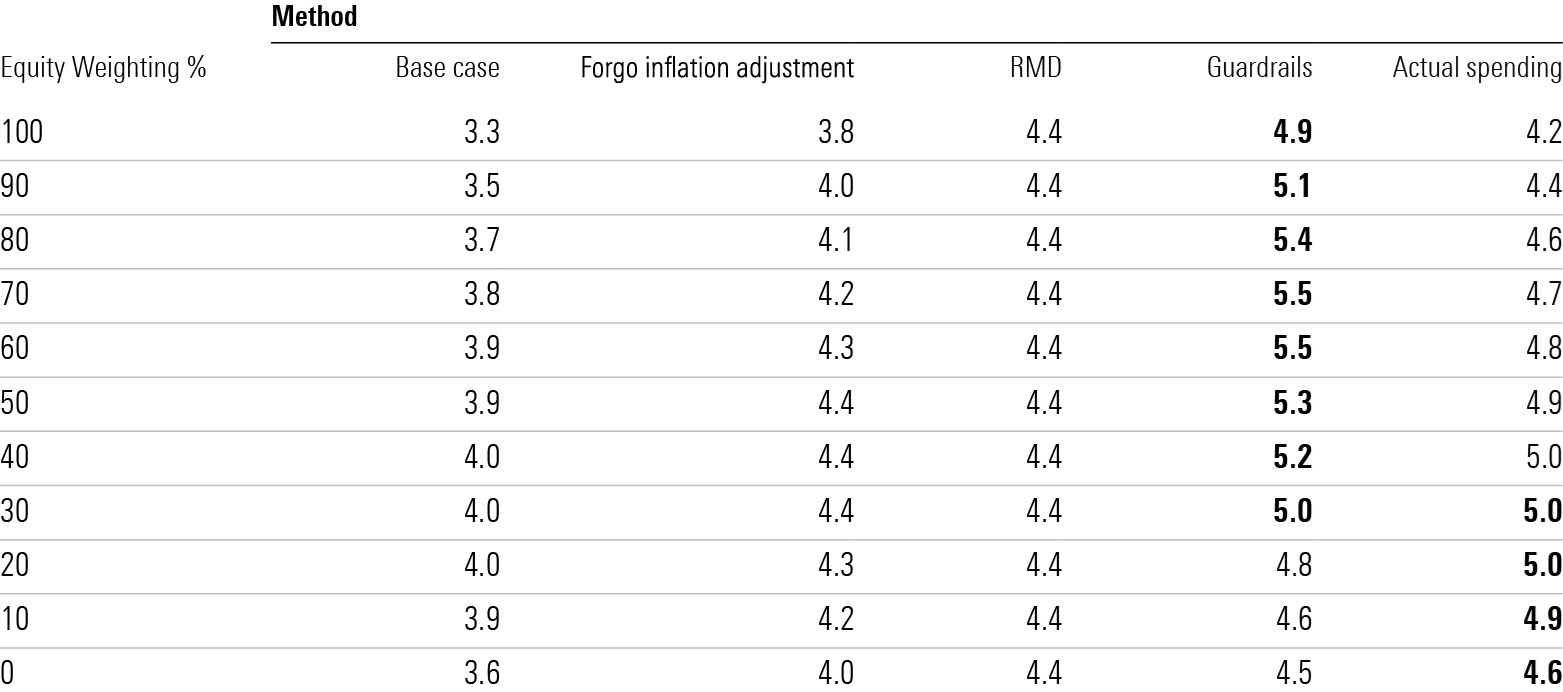

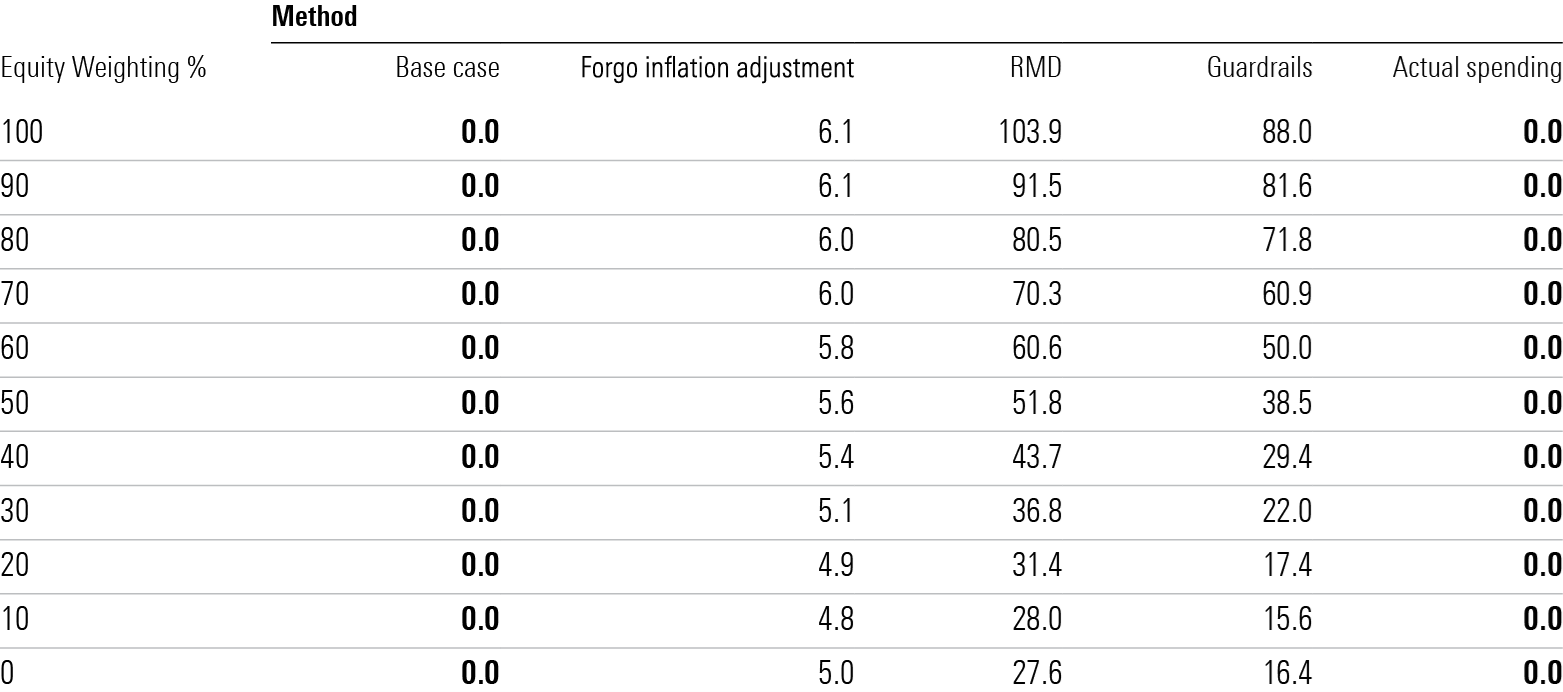

Supply: Morningstar. Knowledge as of Sept. 30, 2023. Beginning Protected Withdrawal RateEach versatile spending approach helps a better preliminary protected withdrawal fee than the constant actual withdrawal approach, as proven above. However the guardrails approach helps the best beginning protected withdrawal charges throughout maximum asset allocations. This displays the character of the manner, which is able to improve upper preliminary withdrawals by way of making probably vital year-to-year changes to greenback withdrawals by way of throttling spending down at inopportune instances.For the opposite strategies, beginning protected withdrawal charges are typically best with fairness allocations starting from 20%-40% and tended to be lowest in less-diversified allocations like 100% shares. Alternatively, as a result of our expectancies for fixed-income returns (basically money) have ticked up whilst assumptions for fairness returns have edged down, much less equity-heavy allocations pop out having a look higher than they did in closing yr’s learn about.  Supply: Morningstar. Knowledge as of Sept. 30, 2023. Lifetime Portfolio Withdrawal RateMost versatile spending approaches boast a better lifetime withdrawal fee than the constant actual withdrawal approach, around the asset-allocation spectrum. The RMD and guardrails strategies improve the best lifetime withdrawal charges, whilst forgoing an inflation adjustment within the yr following a portfolio loss additionally gives somewhat upper ranges of lifetime revenue than the baseline constant actual withdrawal manner.Particularly, equity-heavy allocations below the guardrails and RMD strategies improve upper lifetime withdrawal charges than bond-heavy allocations. This is since the portfolios with upper fairness allocations supplied better “raises” in annual withdrawals following just right years, thereby enlarging lifetime withdrawal quantities. As all the time, even though, there are trade-offs, because the will increase in portfolio spending cut back the portfolios’ finishing values.

Supply: Morningstar. Knowledge as of Sept. 30, 2023. Lifetime Portfolio Withdrawal RateMost versatile spending approaches boast a better lifetime withdrawal fee than the constant actual withdrawal approach, around the asset-allocation spectrum. The RMD and guardrails strategies improve the best lifetime withdrawal charges, whilst forgoing an inflation adjustment within the yr following a portfolio loss additionally gives somewhat upper ranges of lifetime revenue than the baseline constant actual withdrawal manner.Particularly, equity-heavy allocations below the guardrails and RMD strategies improve upper lifetime withdrawal charges than bond-heavy allocations. This is since the portfolios with upper fairness allocations supplied better “raises” in annual withdrawals following just right years, thereby enlarging lifetime withdrawal quantities. As all the time, even though, there are trade-offs, because the will increase in portfolio spending cut back the portfolios’ finishing values.  Supply: Morningstar. Knowledge as of Sept. 30, 2023. 12 months 30 Money Go with the flow Same old DeviationWith this measure, the trade-offs demanded by way of the RMD and guardrails strategies transform obvious. Each approaches have a ways larger variability of their annual withdrawal quantities. Such unpredictability is a herbal byproduct in their regulations, which is able to dictate upper or decrease spending below sure cases. Thus, retirees who’re attracted to those strategies’ top withdrawal charges will have to additionally reckon with the considerable uncertainty they may be able to impose. In contrast, the forgo-inflation and exact spending strategies entail rather little year-to-year spending alternate, making them extra helpful to retirees who prize steadiness and predictability.

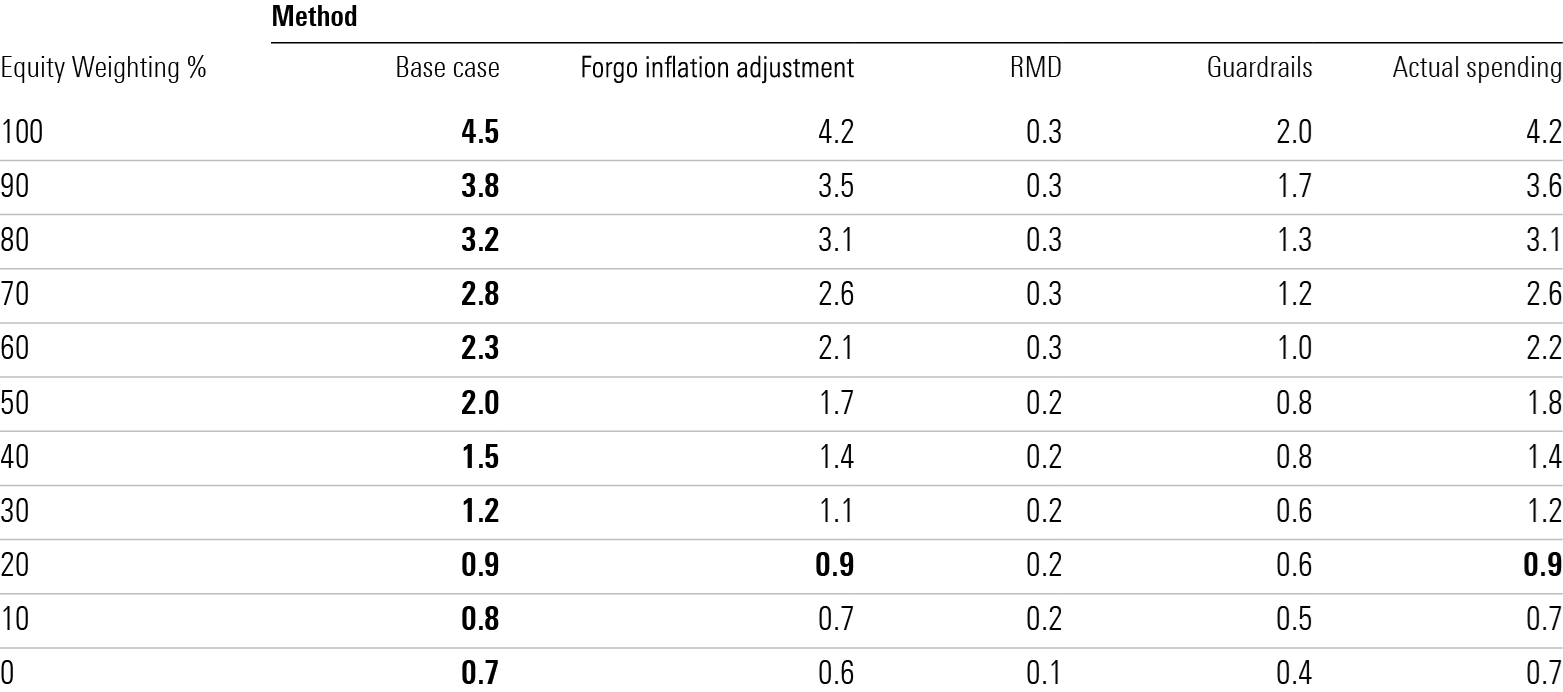

Supply: Morningstar. Knowledge as of Sept. 30, 2023. 12 months 30 Money Go with the flow Same old DeviationWith this measure, the trade-offs demanded by way of the RMD and guardrails strategies transform obvious. Each approaches have a ways larger variability of their annual withdrawal quantities. Such unpredictability is a herbal byproduct in their regulations, which is able to dictate upper or decrease spending below sure cases. Thus, retirees who’re attracted to those strategies’ top withdrawal charges will have to additionally reckon with the considerable uncertainty they may be able to impose. In contrast, the forgo-inflation and exact spending strategies entail rather little year-to-year spending alternate, making them extra helpful to retirees who prize steadiness and predictability.  Supply: Morningstar. Knowledge as of Sept. 30, 2023. Median Finishing Worth at 12 months 30The base case of taking constant actual withdrawals creates one of the best median balances at 12 months 30. In different phrases, retirees the usage of any such technique would possibly smartly underspend right through their lifetimes. That characteristic depresses doable spending however would possibly attraction to bequest-minded retirees. Some of the versatile withdrawal strategies, the true spending approach and the forgo inflation approach produced the best 12 months 30 values, on moderate. On the different excessive, the RMD approach resulted within the lowest finishing values.This result’s as it spends down lots of the retirement capital by way of design. The guardrails manner splits the adaptation between a extra competitive, freer-spending approach like RMD and thriftier strategies that curtail, however by no means building up, spending.

Supply: Morningstar. Knowledge as of Sept. 30, 2023. Median Finishing Worth at 12 months 30The base case of taking constant actual withdrawals creates one of the best median balances at 12 months 30. In different phrases, retirees the usage of any such technique would possibly smartly underspend right through their lifetimes. That characteristic depresses doable spending however would possibly attraction to bequest-minded retirees. Some of the versatile withdrawal strategies, the true spending approach and the forgo inflation approach produced the best 12 months 30 values, on moderate. On the different excessive, the RMD approach resulted within the lowest finishing values.This result’s as it spends down lots of the retirement capital by way of design. The guardrails manner splits the adaptation between a extra competitive, freer-spending approach like RMD and thriftier strategies that curtail, however by no means building up, spending.  Supply: Morningstar. Knowledge as of Sept. 30, 2023. Ultimate ThoughtsWhile the 4% rule according to ancient marketplace returns is probably the most well known approach for retirement withdrawals, there are lots of different approaches retirees can undertake. The guardrails device—versatile withdrawals with parameters, or guardrails, that save you withdrawals from being both too top or too low—does the most productive activity of enlarging payouts in a protected and livable method. However retirees would possibly wish to imagine different approaches relying on whether or not they wish to prioritize maximizing the beginning withdrawal fee, lifetime withdrawals, money float steadiness, or leaving at the back of a legacy for family members or charity.[1] Banerjee, S. “Expenditure Patterns of Older American citizens, 2001−2009,” EBRI Factor Temporary, No. 368, February 2012.

Supply: Morningstar. Knowledge as of Sept. 30, 2023. Ultimate ThoughtsWhile the 4% rule according to ancient marketplace returns is probably the most well known approach for retirement withdrawals, there are lots of different approaches retirees can undertake. The guardrails device—versatile withdrawals with parameters, or guardrails, that save you withdrawals from being both too top or too low—does the most productive activity of enlarging payouts in a protected and livable method. However retirees would possibly wish to imagine different approaches relying on whether or not they wish to prioritize maximizing the beginning withdrawal fee, lifetime withdrawals, money float steadiness, or leaving at the back of a legacy for family members or charity.[1] Banerjee, S. “Expenditure Patterns of Older American citizens, 2001−2009,” EBRI Factor Temporary, No. 368, February 2012.

The Highest Versatile Methods for Retirement Source of revenue