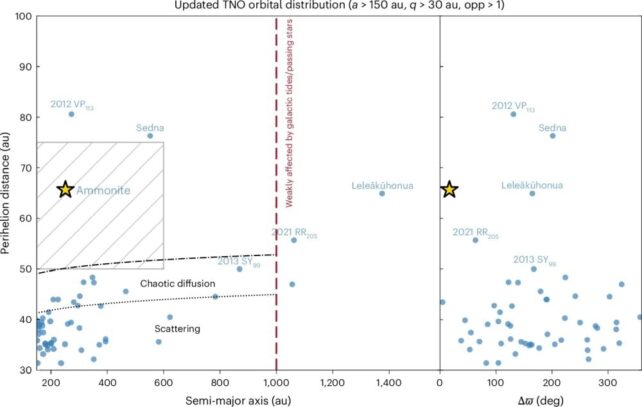

For a excellent few hours on April ninth, crisis beckoned. Percentage costs were falling for weeks. Then the marketplace for American Treasury bonds—generally some of the most secure belongings to be had—began convulsing, too. The yield on ten-year Treasuries leapt to 4.5% (see chart 1), up from 3.9% days previous. That supposed bond costs, which transfer inversely to yields, had cratered. The failure of each dangerous and supposedly secure belongings directly threatened to destabilise the monetary device itself.

The united states’s monetary device got here with regards to the threshold

:max_bytes(150000):strip_icc()/GettyImages-2224638745-363c64e682e24647ae869fb771abf397.jpg)