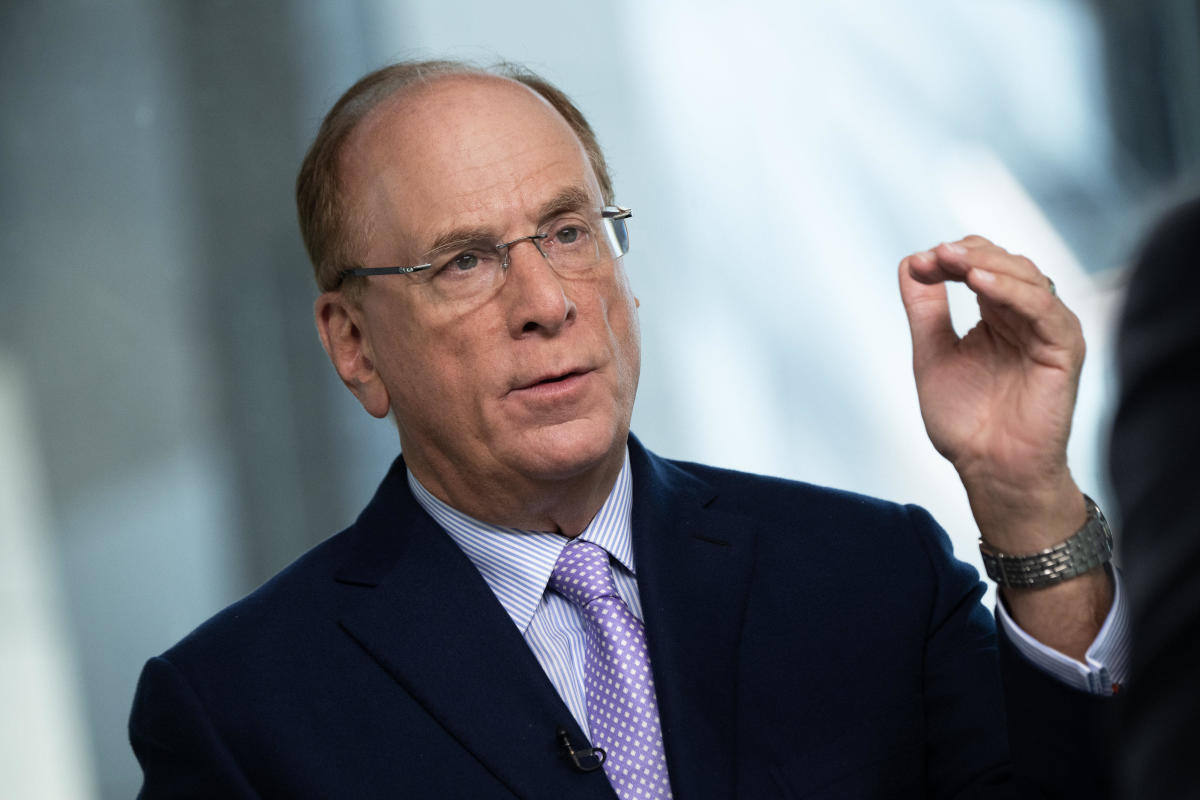

With American citizens residing longer and spending extra years in retirement, the country’s converting demographics are “placing the U.S. retirement gadget beneath immense pressure,” in keeping with BlackRock CEO Larry Fink in his annual shareholder letter.One option to repair it, he suggests, is for American citizens to paintings longer prior to they head into retirement.”No person will have to need to paintings longer than they wish to. However I do suppose it’s kind of loopy that our anchor thought for the suitable retirement age — 65 years previous — originates from the time of the Ottoman Empire,” Fink wrote in his 2024 letter, which in large part makes a speciality of the retirement disaster going through the U.S. and different international locations as their populations age.Fink’s ideas about addressing the country’s retirement disaster come amid a debate about the way forward for Social Safety, which is able to face a investment shortfall in lower than a decade. Some Republican lawmakers have proposed elevating the retirement age for claiming Social Safety advantages, arguing, like Fink, that as a result of American citizens reside longer, they will have to paintings longer, too.However that ignores the truth of growing older within the place of job, with the AARP discovering in a 2022 survey that almost all of employees over 50 say they face ageism at paintings. And as a result of unwell well being or an surprising activity loss, many older American citizens prevent running prior to they deliberate to. In truth, the median age of retirement within the U.S. is 62 — even not up to the “conventional” retirement age of 65.Fink is true in announcing that the retirement gadget is not running for many families, famous retirement skilled and New College of Analysis professor Teresa Ghilarducci instructed CBS MoneyWatch. However his evaluate that individuals will have to paintings longer misses the mark, she added.”After a 40-year-old experiment of a voluntary, do-it-yourself-based pension gadget, part of employees don’t have any simple option to save for retirement,” she mentioned. “And in wealthy international locations, why is not age 65 a excellent goal for many employees to forestall running for anyone else?”Tale continuesShe added, “Operating longer would possibly not get us out of this. The general public do not retire once they wish to, anyway.”Vested passion?To make sure, The usa’s retirement hole, or the gulf between what other folks want to fund their golden years as opposed to what they have in truth stored, is not new, neither is Social Safety’s looming investment emergency. But Fink’s feedback are noteworthy as a result of his standing as the pinnacle of the global’s greatest asset supervisor, with greater than $10 trillion in belongings, together with many retirement accounts.In fact, Fink has a vested passion in American citizens boosting their retirement belongings, for the reason that his company collects charges from the ones accounts. And in his letter, he additionally promotes a brand new target-date fund from BlackRock known as LifePath Paycheck, which is able to roll out in April.”He is guidance the dialog towards BlackRock — and numerous individuals who speak about Social Safety reform on Wall Side road wish to privatize it in some way and earn a living,” Boston College economist Laurence Kotlikoff, a professional on Social Safety, instructed CBS MoneyWatch.To make sure, Fink additionally praises public coverage luck tales for addressing retirement financial savings, corresponding to Australia’s gadget, which started within the early Nineties and calls for employers to position a portion of a employee’s source of revenue right into a fund. As of late, Australia has the sector’s 54th greatest inhabitants however the 4th greatest retirement gadget, he famous.”As a country, we will have to do the whole thing we will to make retirement making an investment extra automated for employees,” he famous.Can boomers repair the issue?Fink, who used to be born in 1952, mentioned that his era has a duty to assist repair the country’s retirement issues. The monetary lack of confidence going through more youthful American citizens, corresponding to millennials and Gen Z, are developing generations of disenchanted, nervous employees, he famous.”They consider my era — the child boomers — have eager about their very own monetary well-being to the detriment of who comes subsequent. And with regards to retirement, they are proper,” Fink wrote.He added, “And prior to my era totally disappears from positions of company and political management, we’ve got a duty to switch that.”Boomer (and older) lawmakers and politicians regularly do not see eye-to-eye on easy methods to repair the retirement disaster. However failing to mend the problem damages no longer most effective the retirements of particular person American citizens, however the nation’s collective trust sooner or later of the U.S., Fink famous.”We possibility turning into a rustic the place other folks stay their cash beneath the bed and their desires bottled up of their bed room,” he famous.New main points on Baltimore Key Bridge cave in, rescue efforts and moreBaltimore bridge cave in timeline: What took place prior to, all over and afterTimeline of Francis Scott Key Bridge cave in in Baltimore

The usa's retirement age of 65 is “loopy,” BlackRock CEO says