MicroStrategy (NASDAQ:MSTR) stocks’ improbable run has introduced its year-to-date features to ~540%, making it without equal Bitcoin play.Do not Omit our Black Friday Gives:

If truth be told, it’s not simplest the finest Bitcoin inventory, nevertheless it has additionally been the best-performing title among Fortune 500 companies for the reason that corporate carried out its Bitcoin acquisition technique in the summertime of 2020, recording a achieve of ~2,800% over the duration.

As Canaccord analyst Joseph Vafi notes, “Those oversized features have outpaced even main AI tales, together with NVDA.”

Vafi, who ranks among the highest 2% of Wall Side road analysts, says the valuation dialogue round MSTR stocks is “a singular one.” It’s uncommon to discover a device corporate the place the inventory worth is most commonly pushed by way of the present price and sentiment round investments held at the steadiness sheet. “Relating to MSTR,” the 5-star analyst went on to mention, “the Bitcoin-focused capital allocation technique undertaken has pushed subject matter shareholder price and is a testomony to this forward-thinking way, in our view.”

However, many traders were “scratching their heads” when having a look at MSTR the usage of “conventional valuation lenses.” Then again, Vafi thinks those approaches don’t totally seize the tale. Metrics like EV/EBITDA not observe to MSTR, as its device trade makes up just a small fraction of its present endeavor price. That stated, whilst the sum of the portions (SOTP) way, which provides within the price BTC at the steadiness sheet, is a greater way than benefit ratios, it nonetheless doesn’t give you the whole image.

That’s as a result of whilst an SOTP research presentations the top class or bargain at which MSTR’s inventory trades relative to its bitcoin holdings, it doesn’t account for the way MSTR’s ongoing bitcoin purchases are including price. “Thus,” says Vafi, “whilst fairness top class is certainly a possibility issue, additionally it is a possibility to shop for bitcoin accretively, and that’s what MSTR has been doing in greater and bigger amounts.”

So, Vafi’s new technique to “gauge MSTR price advent” is to concentrate on Bitcoin accretion according to proportion and the Bitcoin yield KPI.

Adequate, so what does that imply? Through leveraging each fairness and convertible debt whilst “exploiting its fairness top class,” MicroStrategy has been ready to develop its bitcoin holdings quicker than its proportion rely, which is being diluted. The corporate now stories its Bitcoin yield, a metric offered previous this yr, which measures the expansion in Bitcoin holdings according to proportion. As an example, as of November 18, MSTR’s 2024 year-to-date BTC yield used to be 41.8%, that means the selection of bitcoins according to proportion grew by way of that proportion. This expansion in bitcoin holdings, mixed with features within the spot worth of bitcoin, ends up in vital “dollarized” accretion according to proportion that isn’t mirrored within the P&L.

“We consider that this dollarized BTC accretion according to proportion captures the whole lot happening at MSTR (possibility/ praise from the fairness top class, spot worth of BTC, accretive fairness/debt purchases of BTC, the BTC KPI yield, and so on),” Vafi additional stated.

So, how does this all pan out for traders? Vafi offers MSTR stocks a Purchase ranking, whilst elevating his worth goal from $300 to $510, suggesting the inventory has room to climb 26% upper from right here. (To observe Vafi’s observe report, click on right here)

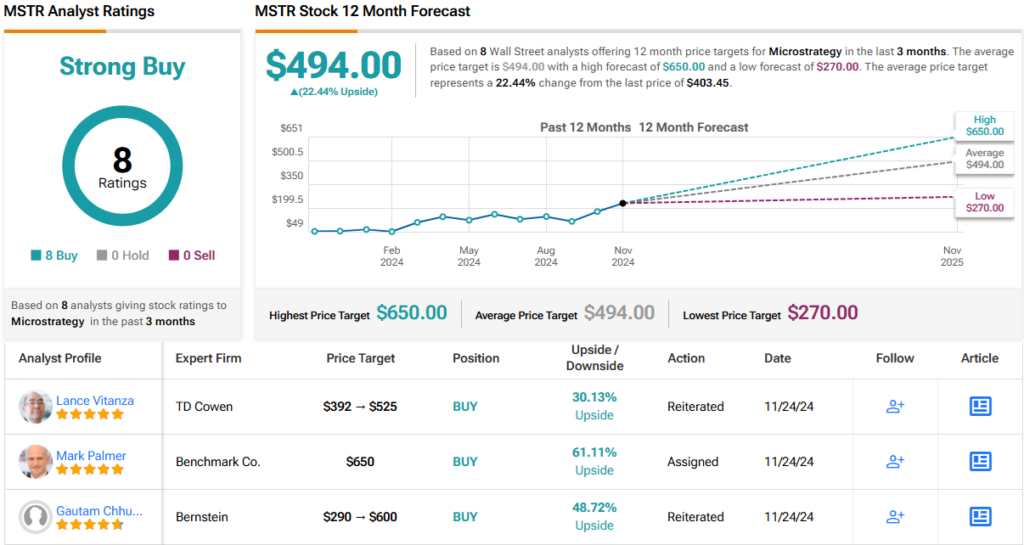

All in all, in keeping with a unanimous 8 Purchase suggestions, the inventory claims a Sturdy Purchase consensus ranking. In the meantime, the $494 moderate worth goal suggests the stocks will surge ~22% over the following 365 days. (See MSTR inventory forecast)

To seek out excellent concepts for shares buying and selling at horny valuations, consult with TipRanks’ Easiest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The evaluations expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions simplest. You will need to to do your individual research prior to making any funding.