Tremendous Micro Computer systems (NASDAQ:SMCI) has confronted a barrage of unfavourable press in fresh months. The U.S. Division of Justice introduced a probe into doable accounting improprieties, the corporate’s auditor impulsively resigned, and delays within the submitting of its 10-Ok document all mixed to ship each self belief and stocks plummeting.

The reversal of fortune has been specifically sharp for the corporate, whose inventory had soared an astonishing 2,800% within the two years main as much as March 2024. This makes the greater than 80% decline over the last 8 months the entire extra hanging.

Amidst the entire background noise, SMCI launched its initial FQ1 2025 effects, with revenues anticipated to extend just about 180% year-over-year to $5.9 to $6 billion. For the second one fiscal quarter, the corporate anticipates web gross sales between $5.5 billion and $6.1 billion, implying a strong 58% building up in comparison to the former 12 months.

In mild of those trends, one most sensible investor, recognized via the pseudonym KM Capital, is seizing the chance. Echoing Warren Buffett’s famed recommendation to “be grasping when others are worried,” KM Capital believes the present downturn may provide an opportunity for long-term positive factors.

“Tremendous Micro Laptop is considerably undervalued because of extremely most probably exaggerated fears of accounting manipulations and the reported DOJ investigation, presenting a powerful purchasing alternative,” posits the 5-star investor, who ranks within the most sensible 3% of TipRanks’ inventory execs.

KM Capital additionally highlights SMCI’s powerful strategic partnerships with business leaders comparable to Nvidia, AMD, and Intel. The partnership with Nvidia used to be just lately reinforced via a brand new collaboration introduced remaining month.

“This issue highlights Nvidia’s self belief in SMCI’s trustworthiness,” claims the investor, including that “it’s extremely not likely that Jensen Huang or Lisa Su would chance their reputations via supporting collaboration with an organization with questionable integrity or operational practices.”

And therein lies KM Capital’s greatest explanation why to price SMCI stocks a Robust Purchase; the investor merely does now not imagine that SMCI – which is beneath “intense public scrutiny” – would play rapid and free with its books. (To look at KM Capital’s monitor file, click on right here)

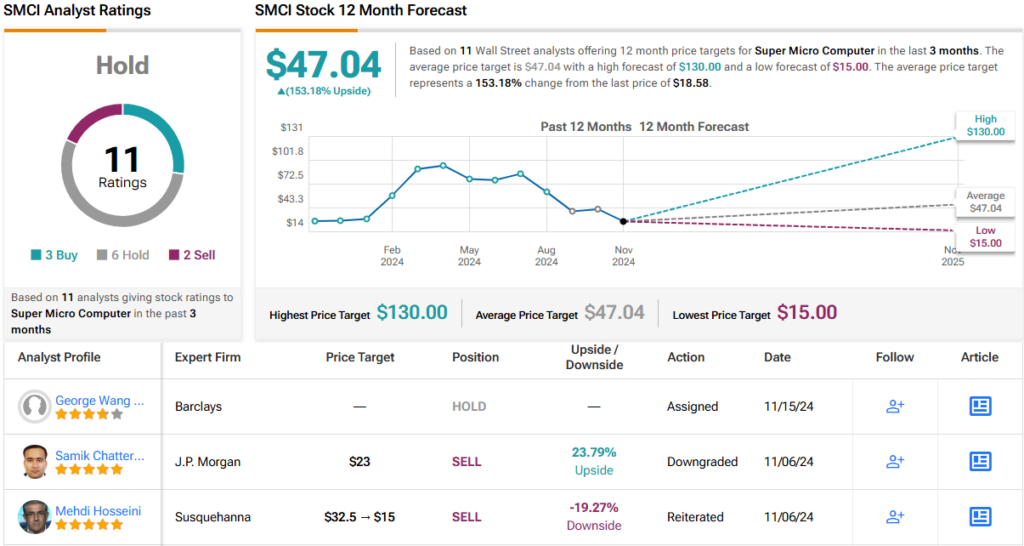

The perspectives on Wall Boulevard, regardless that just a little extra tempered, nonetheless envision wholesome positive factors at the horizon. With 3 Purchase, 6 Grasp, and a couple of Promote rankings, SMCI claims a consensus Grasp (i.e. Impartial) ranking. Its 12-month moderate value goal of $47.04 would indicate positive factors of ~153%. (See SMCI inventory ranking)

To seek out excellent concepts for shares buying and selling at horny valuations, consult with TipRanks’ Absolute best Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The reviews expressed on this article are only the ones of the featured investor. The content material is meant for use for informational functions best. It is important to to do your personal research prior to making any funding.