Toncoin technical research confirmed some bullishness.

The on-chain and futures marketplace metrics confirmed company bearish conviction for the near-term.

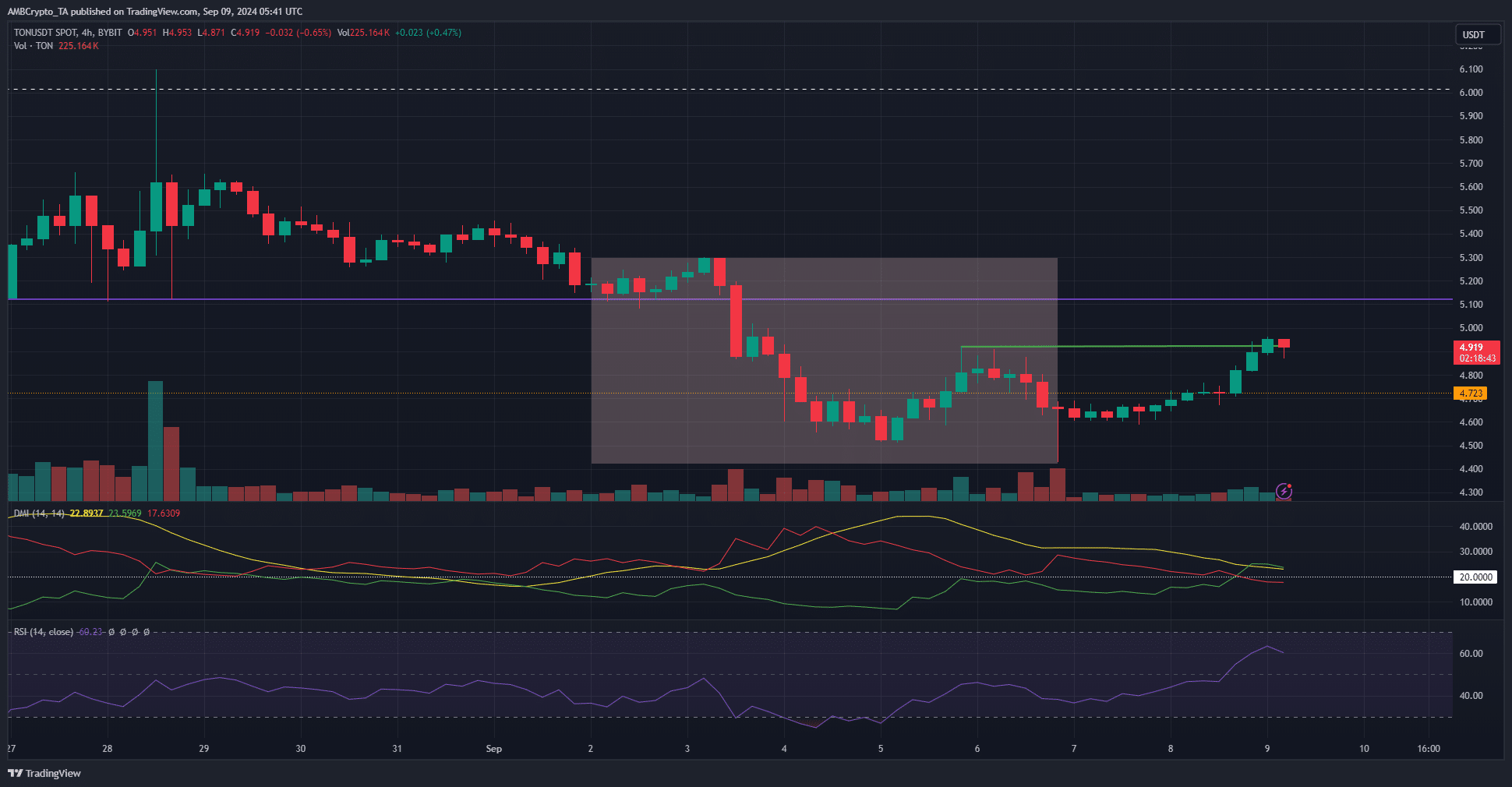

Toncoin [TON] was once starting to claw again a few of its losses remaining week. TON shaped a bullish marketplace construction at the 4-hour chart, however the potentialities of a non permanent restoration seemed not likely according to AMBCrypto’s investigation.

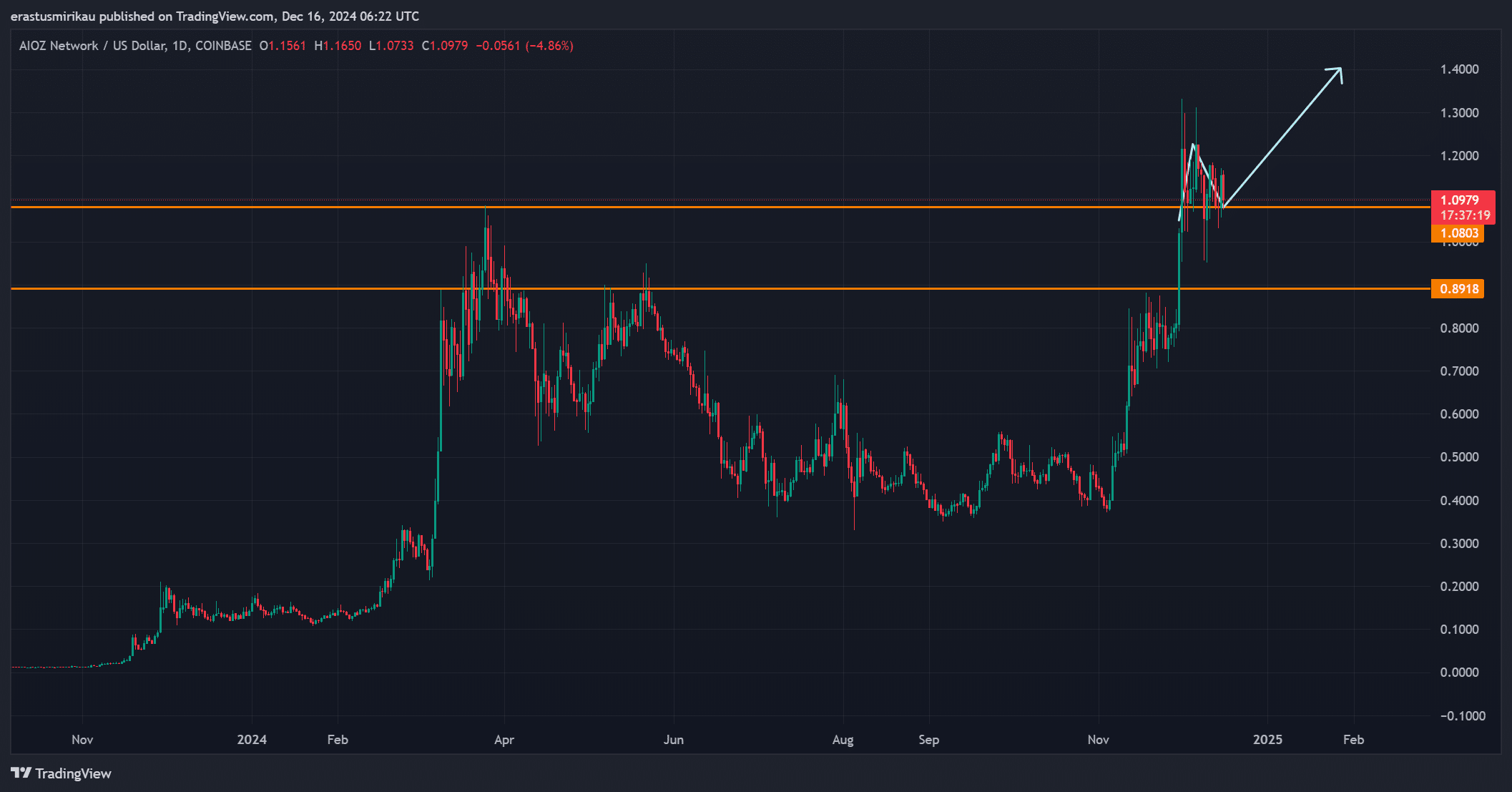

Supply: TON/USDT on TradingView

Supply: TON/USDT on TradingView

The shaded field represented the remaining week’s buying and selling. Over the weekend the cost was once in a position to push higher- however that is not likely to remaining. The downtrend of TON has been transparent because the latter part of July and on-chain metrics confirmed why a restoration is tricky.

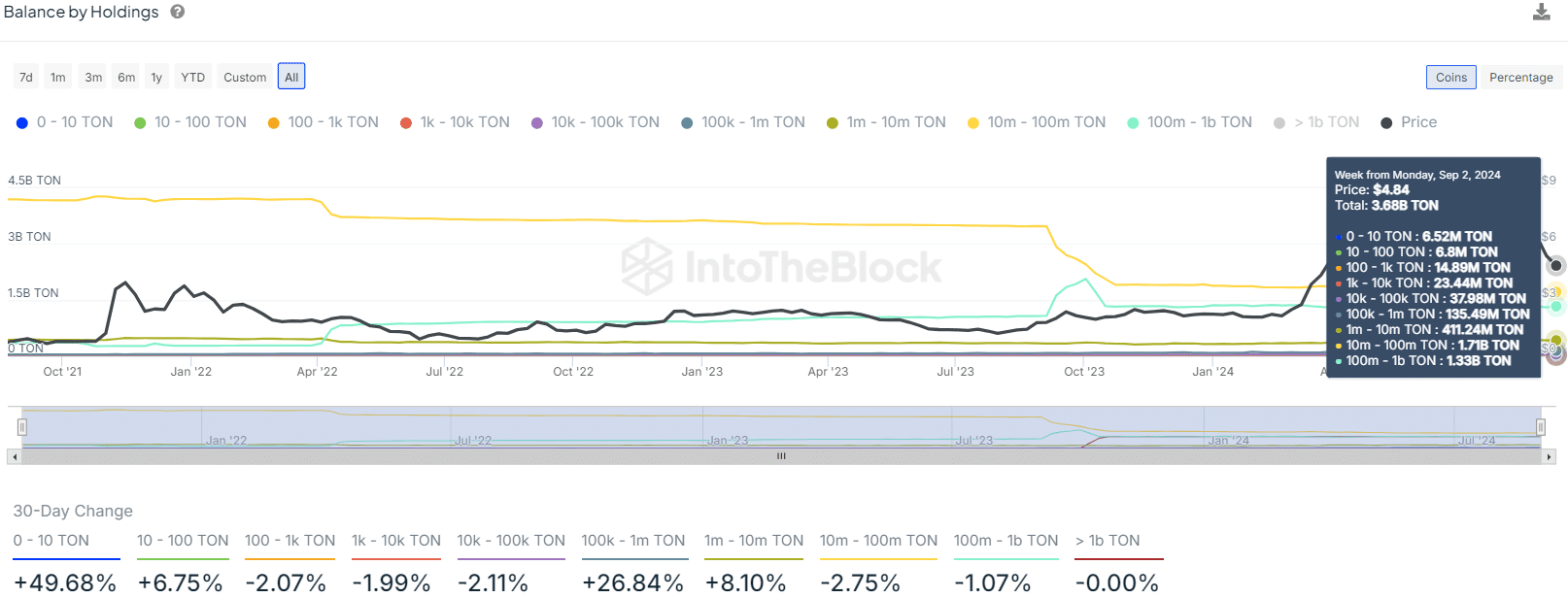

Accumulation and distribution among whales

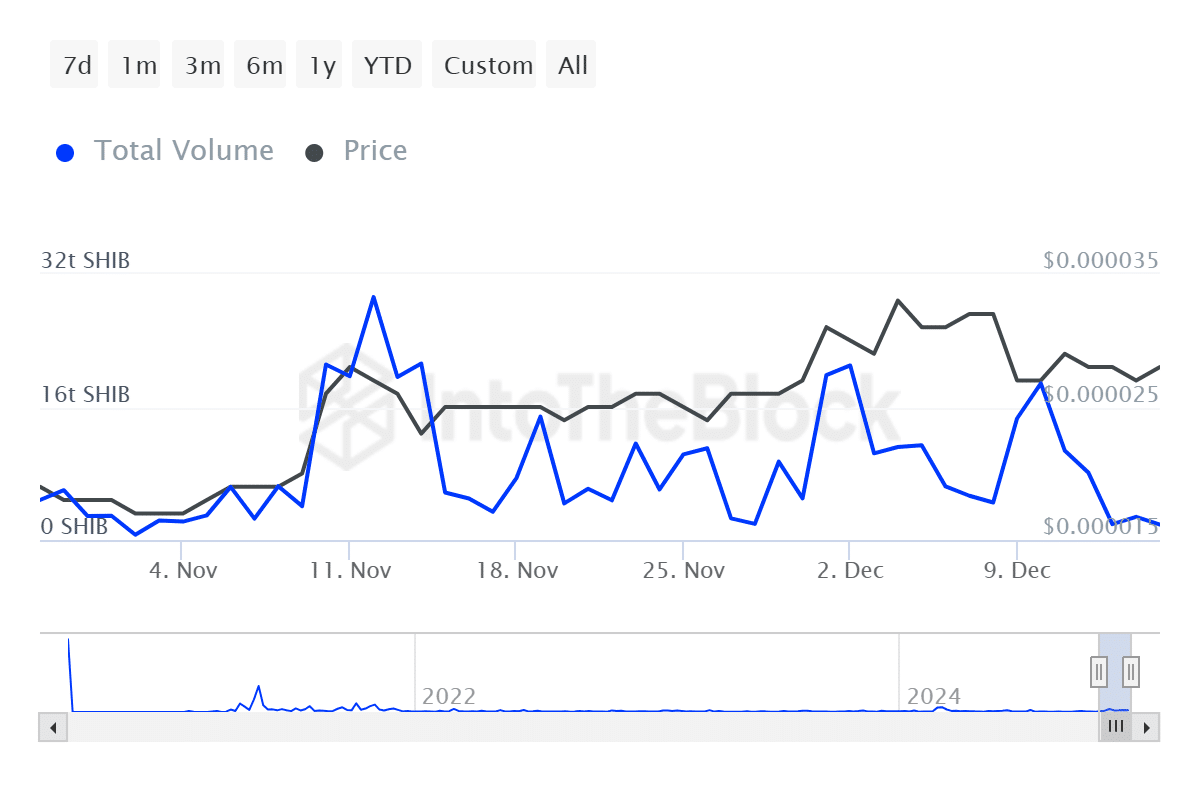

Supply: IntoTheBlock

Supply: IntoTheBlock

The 100K-1M TON maintaining wallets rose by way of 26.84% and eight.1% respectively, appearing that some sharks and smaller whales were collecting up to now 30 days. On the other hand, the bigger whale addresses noticed some distribution.

Steadiness of their addresses was once down by way of 2.75% and 1.07% respectively. This distribution supposed the promoting power on TON was once prone to stay.

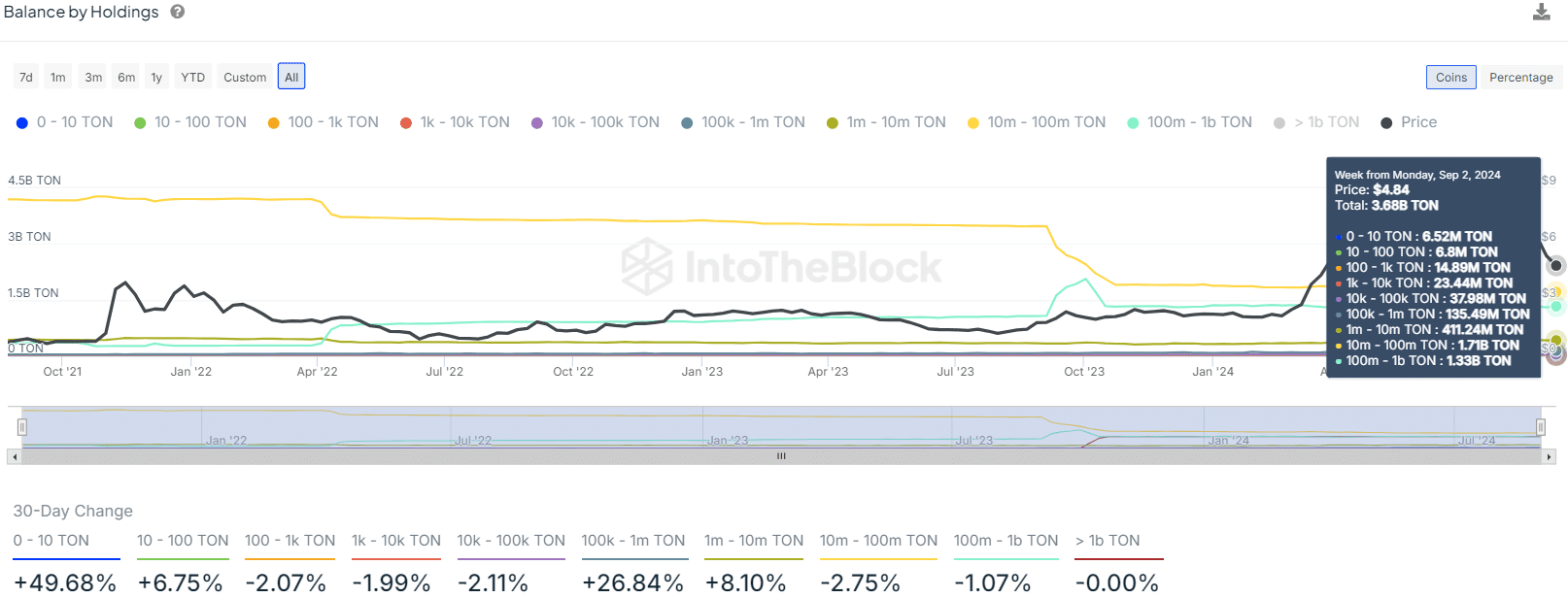

Supply: IntoTheBlock

Supply: IntoTheBlock

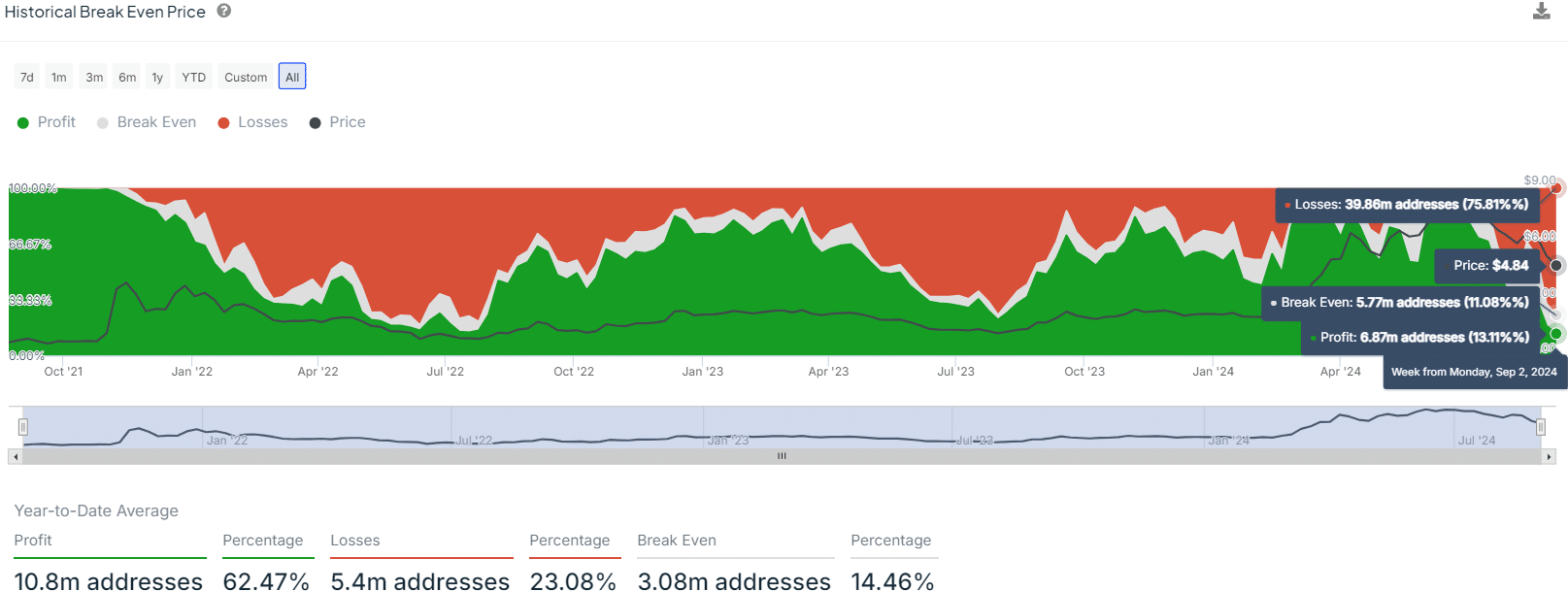

A have a look at the historic break-even worth confirmed that many addresses have been in benefit throughout the rally in April and Would possibly. Since then, the cost pattern has begun to opposite.

The addresses that purchased when the cost was once above $6 can be taking a look to get out at ruin even. Of the addresses that purchased TON over the last week, 75.81% of them have been at a loss. This supposed that any worth rallies would straight away run into heavy promoting power.

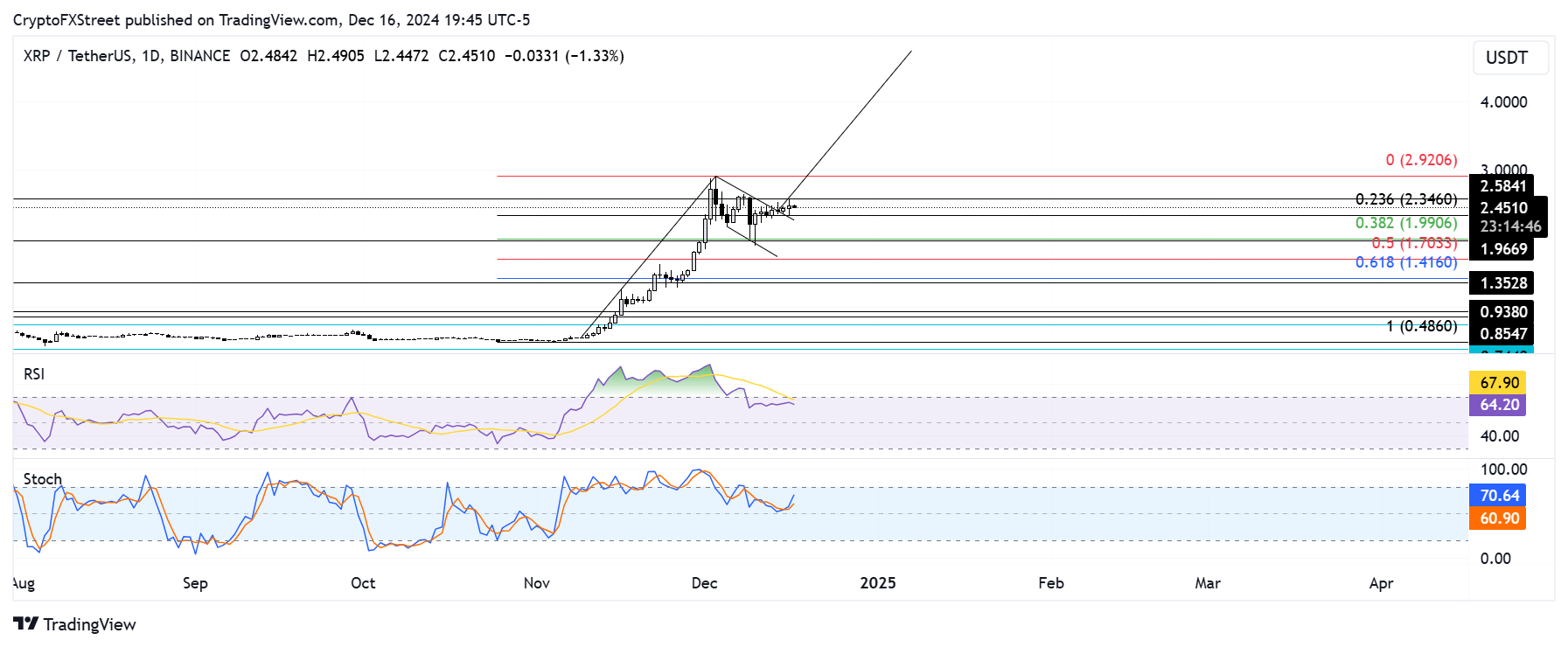

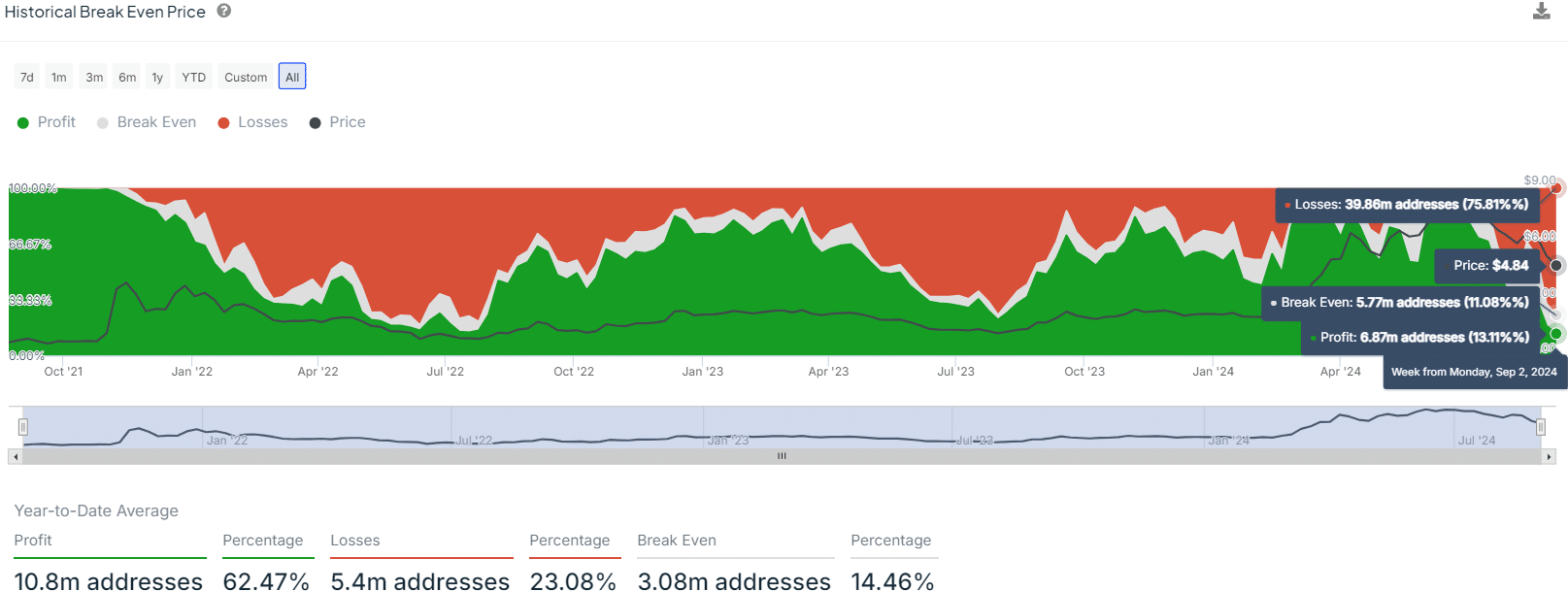

Additional proof {that a} non permanent TON restoration was once not likely

Supply: Coinalyze

Supply: Coinalyze

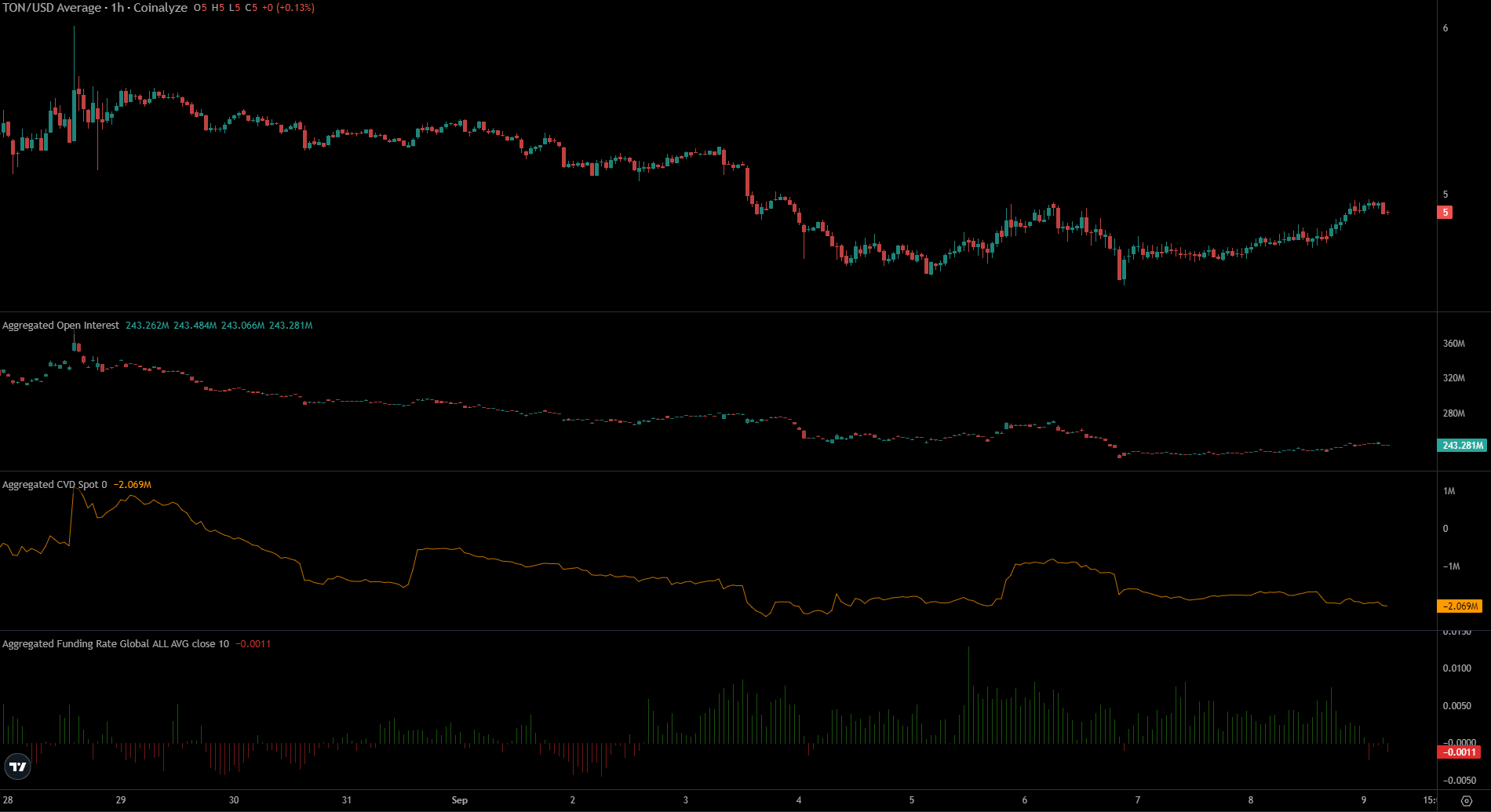

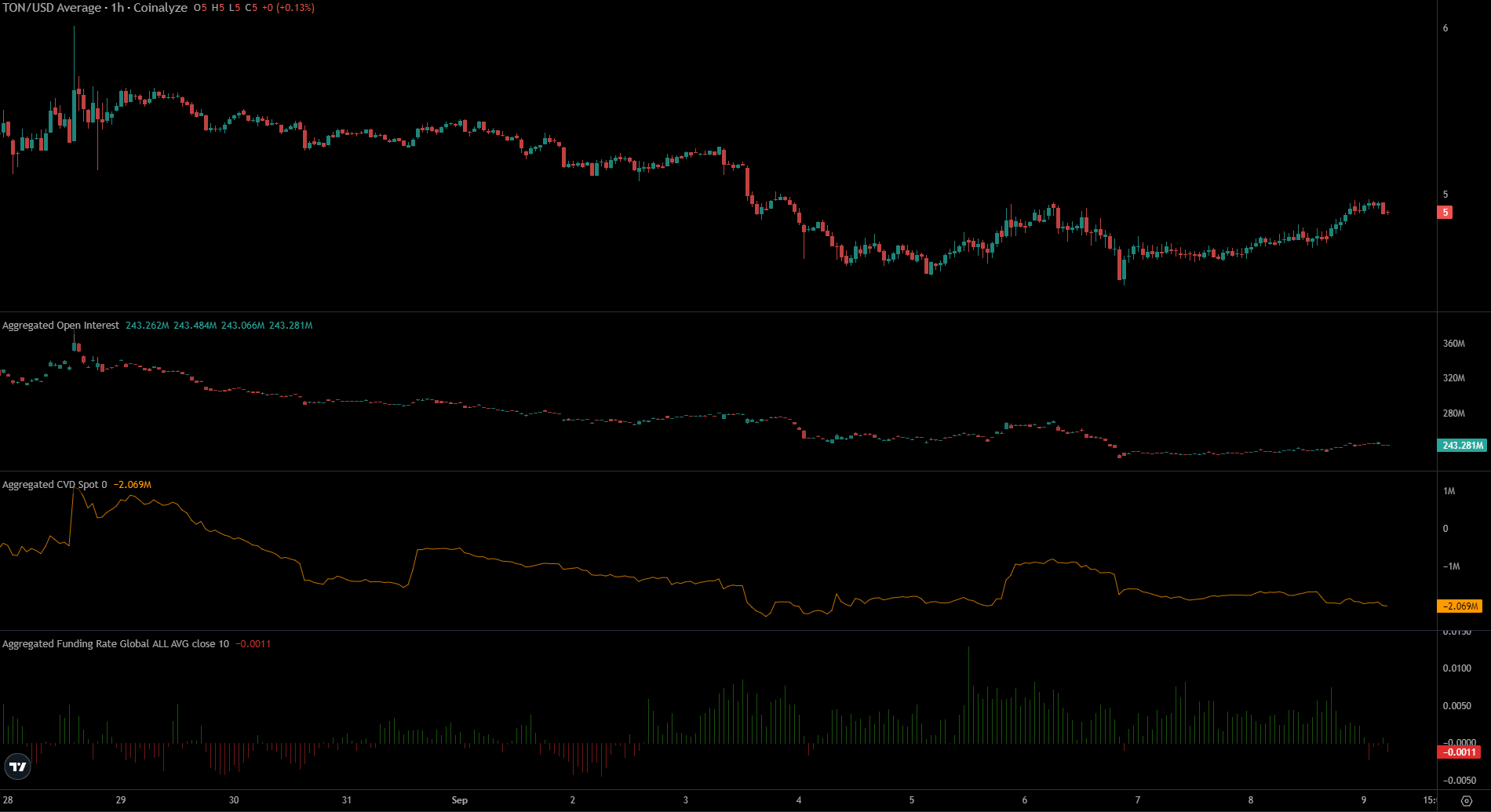

The Open Pastime rose by way of $13 million from the sixth of September as costs bounced from $4.4 to $4.92.

Learn Toncoin’s [TON] Value Prediction 2024-25

On the other hand, this didn’t point out bullish speculators. The investment charge was once turning bearish to turn the bulk have been beginning to promote Toncoin brief.

The spot CVD was once additionally in decline to mirror lowered purchasing power within the spot markets. Total, Toncoin is prone to have a difficult couple of weeks forward.

Earlier: Analyzing WIF’s bullish week: Memecoin up 9% as sentiment shifts

Subsequent: Bitcoin whales acquire $157.3 mln BTC in marketplace dip: Bullish indicators?