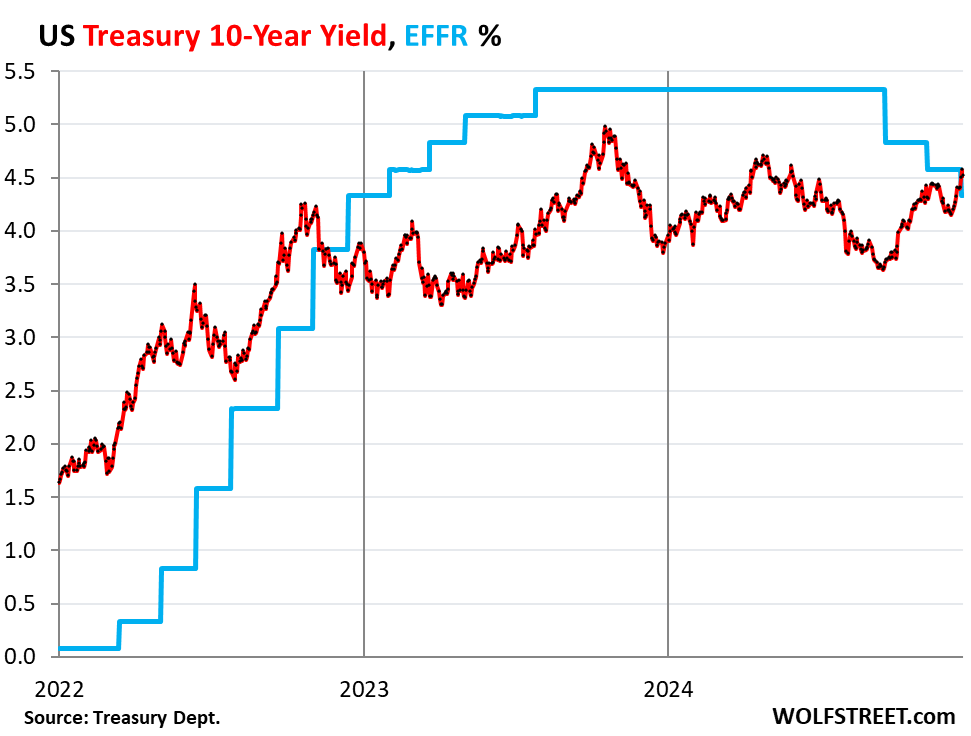

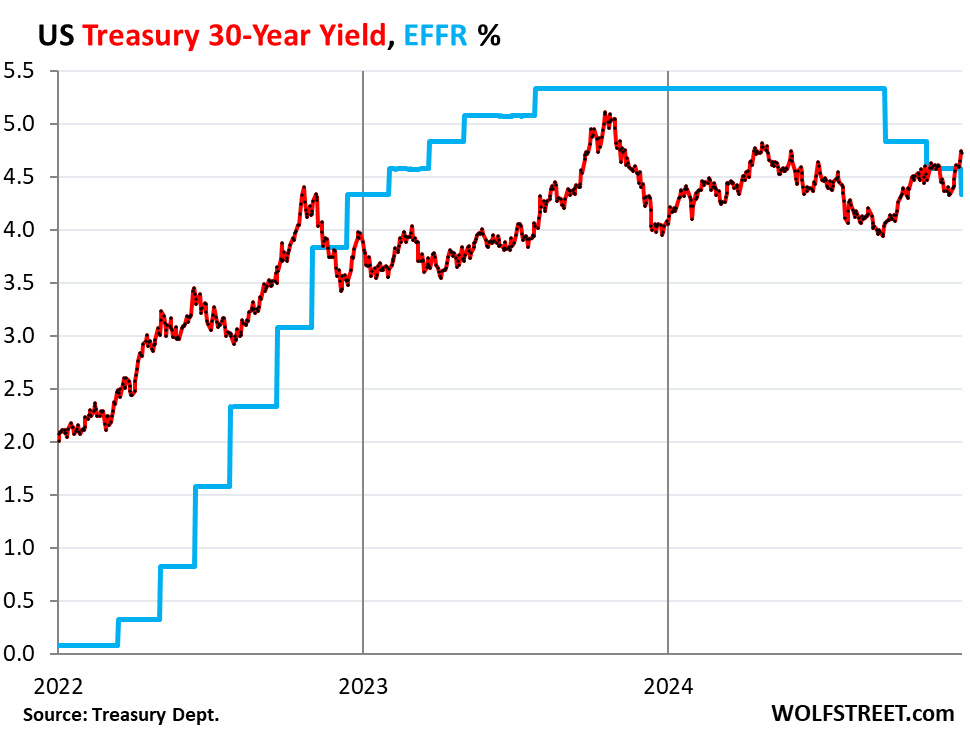

Since September, the Fed minimize by way of 100 foundation issues whilst the 10-year Treasury yield rose by way of 87 foundation issues! There at the moment are doubts about additional cuts.

By way of Wolf Richter for WOLF STREET.

When the Fed minimize its coverage charges on Wednesday by way of 25 foundation issues, it laid out a situation of upper inflation and better “longer-run” coverage charges, and projected simplest two charge cuts in 2025, part the speed cuts it projected 3 months in the past.

Then, to most sensible it off, individuals who listened to Powell on the press convention walked away pondering that there is probably not any charge cuts subsequent yr, that the “recalibration” section of the Fed’s financial coverage was once already completed after simplest 100 foundation issues in cuts, and that we could also be at the cusp of a brand new section.

As this emerged on Wednesday, the S&P 500 index tanked 3%. And the Treasury marketplace is appearing this pondering.

Brief-term yields didn’t fall in any respect this week. The speed minimize was once already 100% priced in, and now there is not any extra charge minimize priced in inside the temporary window of the ones securities. On Friday December 13, the yields of one to six months had been all at 4.30% to 4.33%. And that’s the place in addition they ended up on Friday December 20.

And so they’re now proper on the Efficient Federal Price range Charge (4.33% after the speed minimize), which the Fed objectives with its coverage charges.

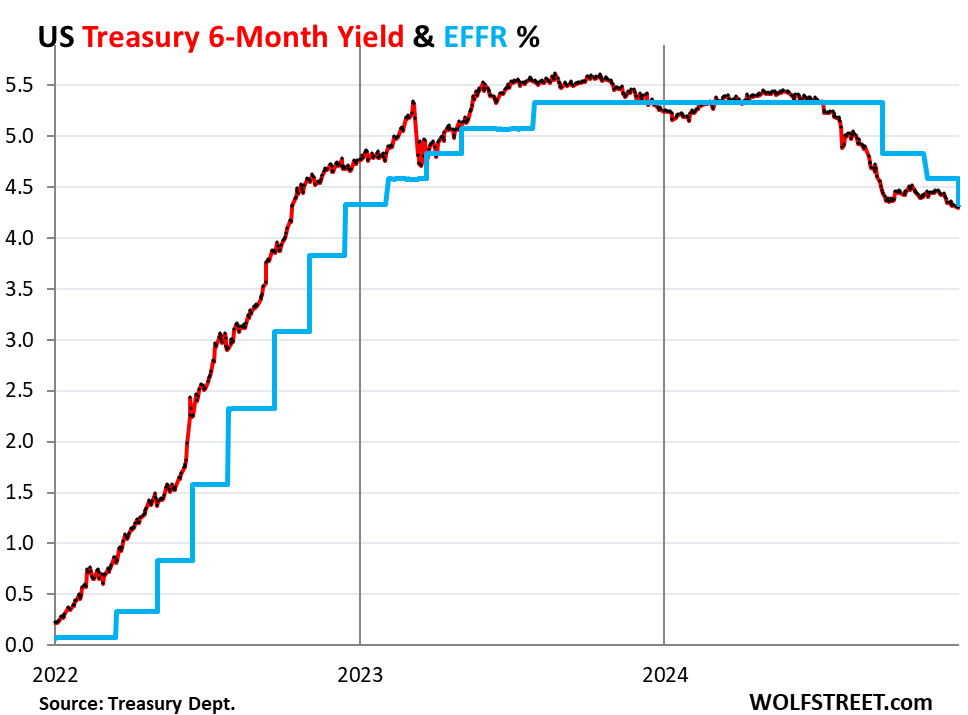

The 6-month Treasury yield sees no charge minimize inside of its window. It had priced in each and every of the 3 charge cuts about two months upfront. It additionally priced within the charge hikes in 2022 and 2023 with a an identical advance. All over the March 2023 banking disaster, it in brief noticed a pause that didn’t come. And in January 2024, it began pricing in a charge minimize however then gave up on it. Now it has settled right into a no-rate minimize situation inside of its window over the following couple of months:

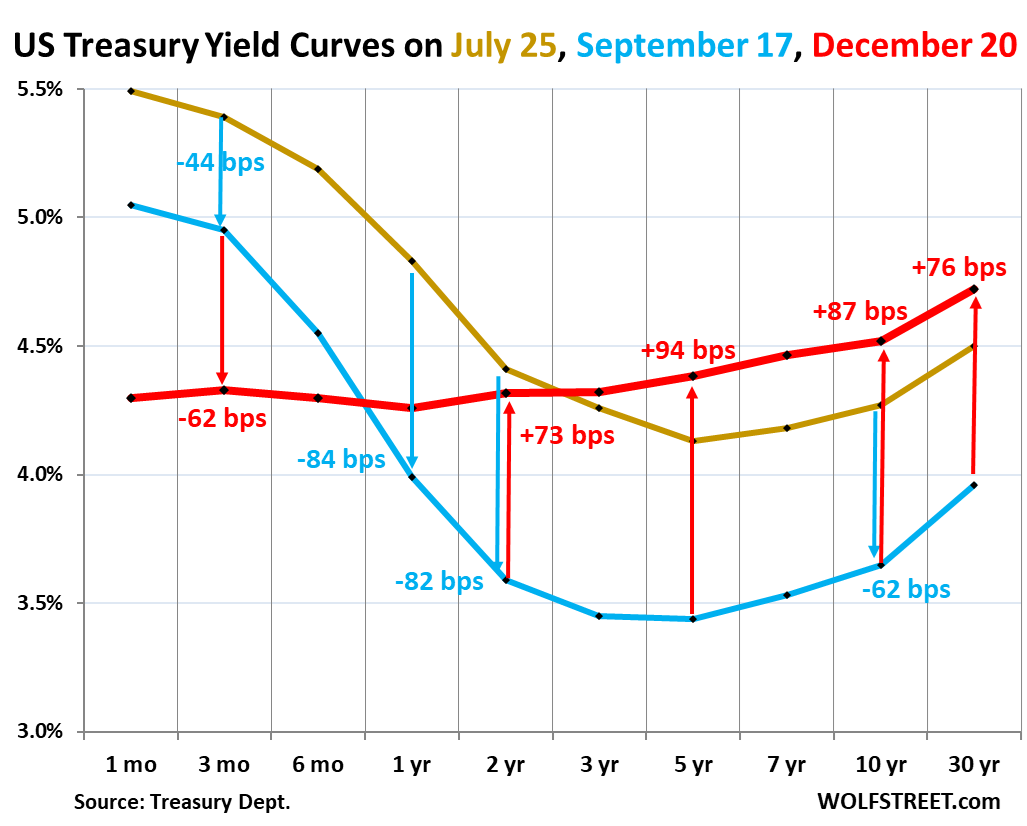

All the yield curve un-inverted completely.

Whilst temporary yields stayed kind of put all through the week, the whole lot from the 1-year yield and longer rose. On the lengthy finish, the 10-year yield rose by way of 12 foundation issues to 4.52% and the 30-year yield rose by way of 11 foundation issues to 4.72%.

The chart underneath displays the yield curve of Treasury yields around the adulthood spectrum, from 1 month to 30 years, on 3 key dates:

Gold: July 25, 2024, ahead of the hard work marketplace information spiraled down (which was once a false alarm).

Blue: September 17, 2024, the day ahead of the Fed’s charge cuts began.

Purple: Friday, December 20, 2024.

The yield curve had inverted in July 2022, when the Fed’s large charge hikes driven up temporary Treasury yields very rapid, however longer-term yields rose extra slowly, and so the temporary yields blew previous them.

However the yield curve continues to be moderately flat, with just a 22-basis level unfold between the 2-year yield and the 10-year yield. Through the years, because the yield curve normalizes, it’ll steepen, and the 2-to-10-year unfold will widen. This may occur in two techniques: With shorter-term yields falling or with long-term yields emerging, or each.

Yields v. the Efficient Federal Price range Charge.

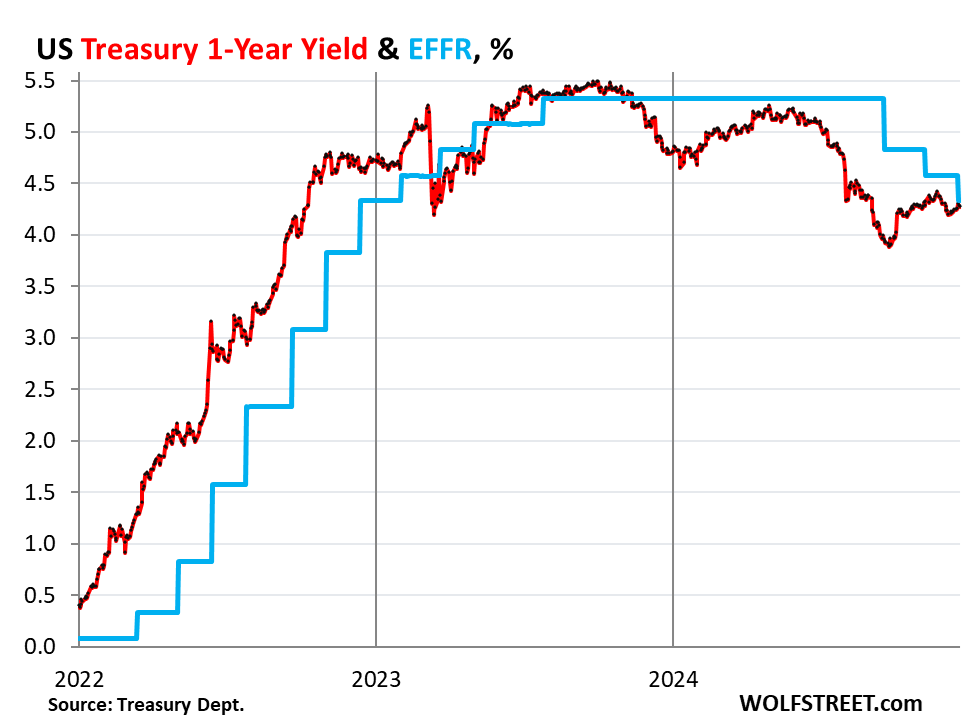

On Wednesday, the Fed minimize its goal vary for the EFFR to 4.25% to 4.50%. The EFFR then dropped from 4.58% to 4.33% (blue within the charts underneath). And this is how Treasury yields of 1-year and longer reacted.

The 1-year Treasury yield, 4.26%, 7 foundation issues underneath EFFR:

The two-year Treasury yield, 4.32%, at concerning the EFFR:

The ten-year Treasury yield, 4.52%, 19 foundation issues above EFFR:

The 30-year Treasury yield, 4.72%, 39 foundation issues above the EFFR:

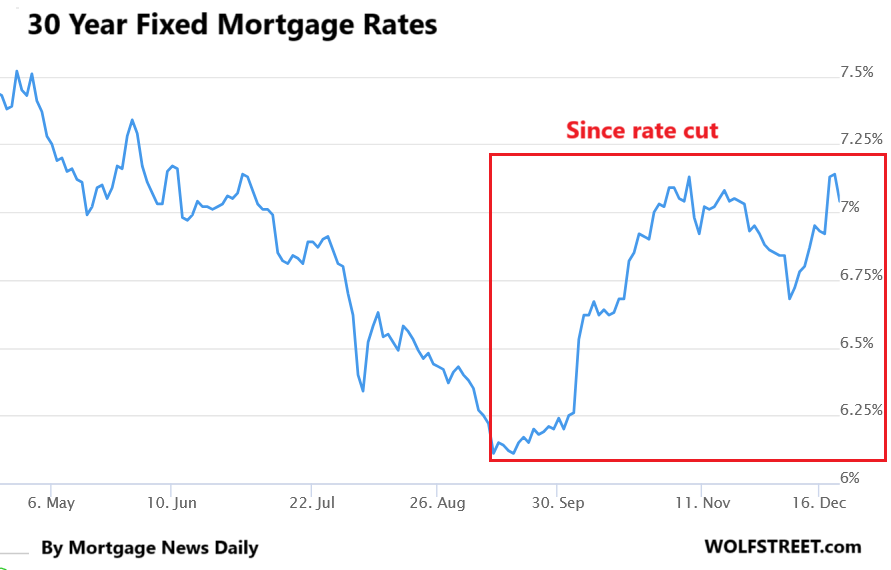

Loan charges again above 7%.

Because the preliminary charge minimize in September, the typical 30-year mounted loan charge has risen by way of just about 1 proportion level, from 6.11% to 7.04%, in keeping with the day by day measure from Loan Information Day by day.

It kind of parallels the 10-year yield, however is upper, and that unfold between them varies however is moderately large lately because of some elements that we analyzed right here. A much broader unfold and the next 10-year Treasury yield manner upper loan charges. So possibly it’s time to get re-used to most of these loan charges that had been customary ahead of 2008.

Experience studying WOLF STREET and wish to give a boost to it? You’ll be able to donate. I admire it immensely. Click on at the beer and iced-tea mug to learn how:

Do you want to be notified by the use of e-mail when WOLF STREET publishes a brand new article? Join right here.

![]()