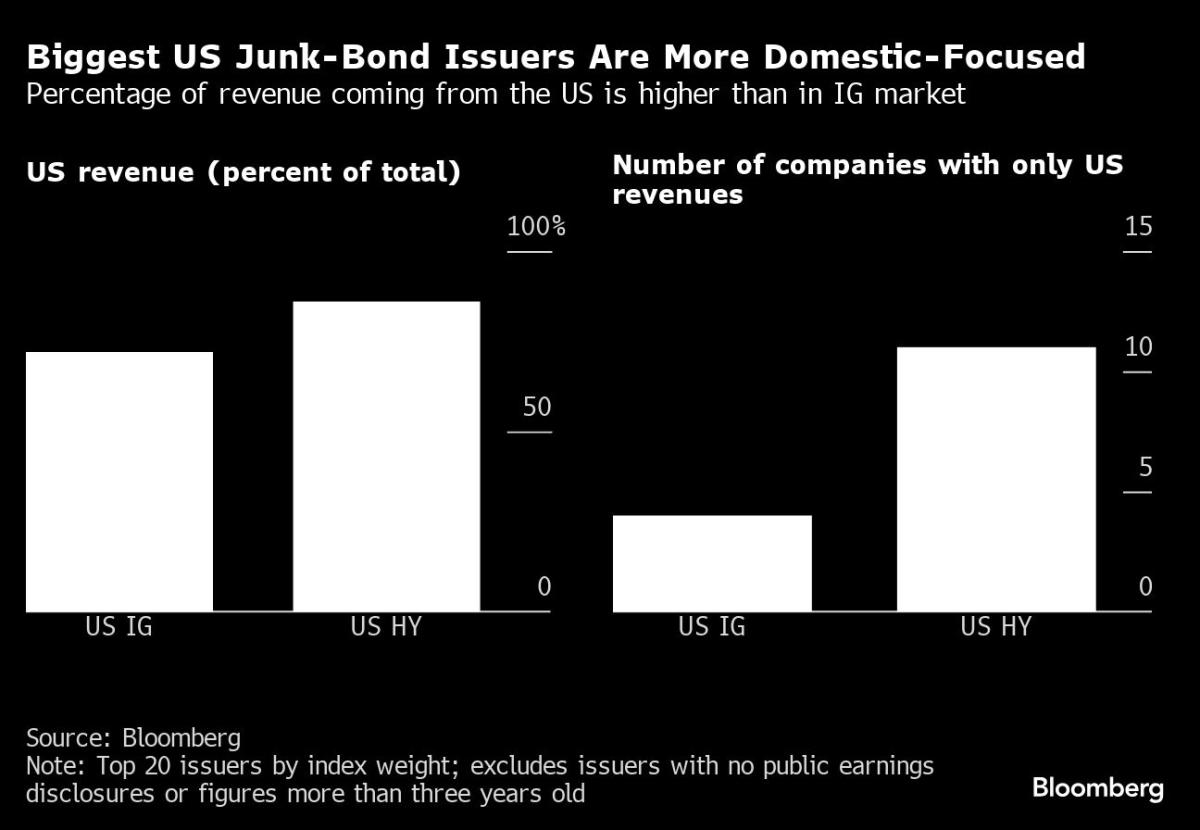

(Bloomberg) — The credit score global’s model of the “Trump business” is starting to take form: Purchase American high-yield bonds and keep away from the rest inflation-sensitive.Maximum Learn from BloombergCorporate bond traders around the globe have already began positioning to get pleasure from a possible Donald Trump election victory after an assassination try and the Republican Nationwide Conference boosted his place in polls. Spreads on US high-yield bonds bolstered when compared with their euro opposite numbers previously week and junk budget globally noticed a surge in inflows.“US excessive yield is the business,” stated Al Cattermole, a portfolio supervisor at Mirabaud Asset Control. “It’s extra domestic-focused and uncovered to US financial job.”In a past due June interview with Bloomberg Businessweek, Trump stated he desires to deliver the company tax charge all the way down to as little as 15%. That decrease expense may give a boost to the creditworthiness of weaker corporations. US corporations may additionally get pleasure from protectionist insurance policies that can see excessive price lists slapped on imports if the Republican nominee is victorious.US junk is sexy to cash managers as a result of, when financials are excluded, greater than part of best junk-rated debtors handiest have home revenues, in step with a Bloomberg Information research. That compares with only a 5th within the high-grade area. The knowledge excludes corporations that don’t publicly expose the tips.Home producers may additionally get pleasure from price lists and looser legislation.“We’ve got been including US industrials that will get pleasure from a pro-business stance from a brand new executive,” stated Catherine Braganza, senior excessive yield portfolio supervisor at Perception Funding. “Firms that get pleasure from commercial production, specifically, those who maintain spare portions” are sexy, she stated.Yield CurveSome fund managers are as a substitute specializing in the form of the yield curve, in particular as company bond spreads appear to have little room to fall additional after nearing their tightest stage in additional than two years.“We’ve got lowered length by means of having shorter-dated bonds, the usage of futures and in addition the usage of steepener trades,” stated Gabriele Foa, a portfolio supervisor at Algebris Investments’ international credit score crew, relating to wagers that get advantages when the space between short- and long-dated yields widens.Tale continuesEven even though this unfold has widened this 12 months, it stays some distance beneath ranges noticed prior to main central banks began elevating rates of interest to take on runaway inflation. Nowadays, bondholders obtain a measly 30 foundation issues in additional yield by means of keeping seven- to 10-year international company bonds as a substitute of shorter-term corporate notes, in step with Bloomberg indexes, when compared with 110 simply prior to Trump left place of business in 2021.This offers the curve additional room to steepen, in particular if the previous President’s insurance policies — which can be anticipated to be inflationary and result in upper nationwide debt — are matched by means of interest-rate cuts by means of the Federal Reserve.To make certain, now not all cash managers are switching to a Trump portfolio simply but. It’s now not but a certain factor that he’s going to win, and even though he does, it’s now not utterly transparent what he’s going to do in place of business.“It’s slightly too early to regulate your portfolio in keeping with ‘what ifs’ when Donald Trump is in place of business,” stated Joost de Graaf, co-head of the credit score crew at Van Lanschot Kempen Funding Control. “We nonetheless be expecting to peer slightly of summer season grind tighter in spreads.”If Trump does win, markets touchy to better rates of interest, inflation and price lists are anticipated to be extra unpredictable.“Upper for longer is dangerous for rising markets, and also you’ll get weaker financial enlargement because of price lists,” stated Mirabaud’s Cattermole. “We might be expecting that Eu excessive yield underperforms within the subsequent 9 months.”Week in ReviewJPMorgan Chase, Wells Fargo, Goldman Sachs and Morgan Stanley bought US investment-grade securities this week, after posting income. Monetary corporations extensively ruled issuance, and about 76% of the newly issued high-grade notes therefore traded tighter within the secondary marketplace, in step with Hint.Defaulted builder Sino-Ocean Workforce Conserving Ltd. is operating to garner sufficient reinforce to lend a hand safe popularity of its debt restructuring plan, however stays some distance in need of the wanted backing amid opposition from a key bondholder staff.Yield-hungry insurance coverage corporations are adopting an unconventional technique: they’re skipping mortgage-backed bonds and purchasing the underlying complete loans outright.Non-public credit score’s push to lift budget from retail shoppers is beginning to put power on their income.Lenders led by means of Ares Control Corp. are set to supply a kind of $1.8 billion debt package deal to reinforce Genstar Capital’s acquire of a stake in bills processor AffiniPay.A German debt marketplace is opening again up for firms past Germany, with extra French and Italian debtors elevating financing in 2024 than over the entire of final 12 months.Banks and personal credit score budget are competing to supply up to £1.75 billion ($2.3 billion) to again a conceivable take-private of Hargreaves Lansdown.Non-public credit score fund managers are collectively arranging a debt package deal of round €1 billion for French device corporate Orisha, after Francisco Companions bought exclusivity to shop for a stake within the enterprise.Leveraged mortgage issuers are capitalizing on robust investor call for to push for provisions that will decrease their long run borrowing prices and provides them a buffer if the Federal Reserve helps to keep rates of interest increased.Oaktree Capital Control is partnering with Lloyds Banking Workforce Plc to give you the banking large’s deepest fairness shoppers with loans to fund their buyouts, the newest signal that conventional lenders are looking for ingenious techniques to get into deepest credit score.Lombard Odier Funding Managers will extend publicity to Indian high-yield buck credit score in its $2 billion Asian bond technique, after the sphere helped the product change into a best performer by means of beating 96% of its friends this 12 months.At the MoveElliott Funding Control has employed Jordan Bryk from Marathon Asset Control to lend a hand bolster the company’s deepest credit score efforts.Murad Khaled, who heads Financial institution of The united states Corp.’s leveraged finance capital markets enterprise in Europe, Center East and Africa, has left the company.Deutsche Financial institution AG has employed Daniel Rossi from UBS Workforce AG as a director in its investment-grade credit score buying and selling unit.Siebert Williams Shank & Co. is recruiting Roberto De Leon and Paul Shapiro because it continues to develop its taxable fixed-income crew.Refrain Capital Control Ltd. employed Penny Tan from hedge fund ArrowMark Companions because the call for for mavens at the scorching subject of vital chance transfers continues to upward push.Financial institution of Montreal promoted Mark Spadaccini to go of North American investment-grade origination and tapped Sean Hayes as international head of syndicate, amid different organizational adjustments in its debt capital markets enterprise.Aptior Capital, an funding company that makes a speciality of distressed debt and rescue finance, has recruited Taos Huskey, who was once maximum lately a foremost at Glendon Capital Control.–With the aid of Abhinav Ramnarayan, Andrew Kostic and Dan Wilchins.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Trump Business Sees Buyers Snap Up Junk Debt and Industrials