Since Trump Media & Generation Crew (DJT) debuted at the NASDAQ in March 2024, following an extended and sophisticated merger with a SPAC, its inventory efficiency has been pushed extra through hypothesis surrounding former president Donald Trump—its greatest shareholder—than through the corporate’s trade basics. The ones basics shape the foundation of my bearish outlook on DJT.For the reason that DJT’s major asset is the social media platform Reality Social, with annual revenues lower than $5 million, it’s laborious to validate an endeavor price above $2 billion. Whilst a possible Trump election victory may spark an ultra-bullish surge within the inventory, that is still a extremely speculative situation with a risk-reward profile that I in finding unjustifiable.DJT: A Wager on Trump Emblem and Reality SocialAlthough I take care of a bearish place on DJT inventory, it’s necessary to emphasise {that a} important supply of the hype and greater volatility in its proportion payment stems from President Trump’s symbol, each as a political candidate and as a (allegedly) billionaire businessman.The Trump identify is a globally identified emblem, with DJT essentially tied to Reality Social, a social media platform that, among different issues, opposes “cancel tradition”. Whilst emblem reputation is tricky to quantify, Trump Media & Generation Crew is prone to amplify past Reality Social. One possible expansion street is the TMTG+ streaming carrier, which objectives to advertise loose speech to an international target market, unbiased of main tech firms.Regardless of the numerous execution dangers tied to those initiatives, particularly Reality Social, it’s plain that Trump’s emblem a great deal boosts the trade. On the other hand, Donald Trump’s observe document as an entrepreneur is blended. Whilst he has completed some luck, in particular in media, he has additionally confronted setbacks together with real-estate and on line casino bankruptcies and important debt issues.DJT Inventory Fluctuates with Election-Similar DevelopmentsAnother reason why for my skepticism about making an investment in DJT is the inventory’s prime volatility reaction to information and occasions connected to the approaching presidential election in November.All through this yr, many abrupt actions in DJT’s inventory payment have coincided with election-related occasions. As an example, on the finish of Might, stocks fell because of Trump’s prison conviction for trade fraud. Following Trump’s dismissal of the federal case in Florida regarding categorised paperwork on July 15, DJT stocks surged 30% the following day, even if this momentum temporarily pale. DJT stocks have noticed a number of 50%+ pullbacks prior to now yr. Just lately, DJT stocks fell 12% following the Trump’s debate with Vice President Kamala Harris.Tale continues

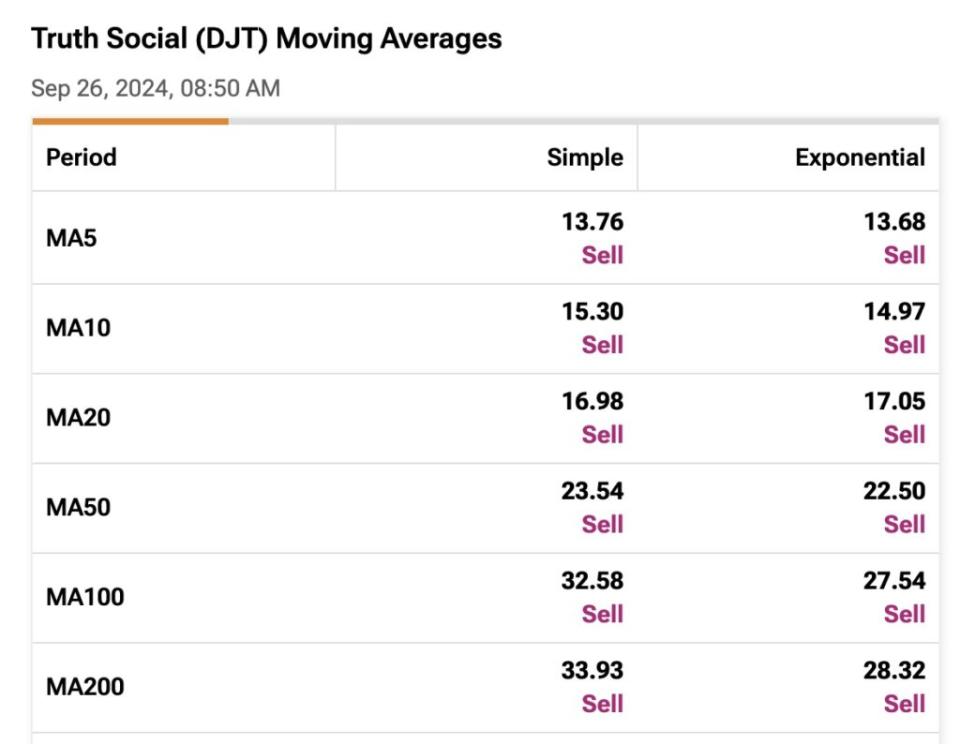

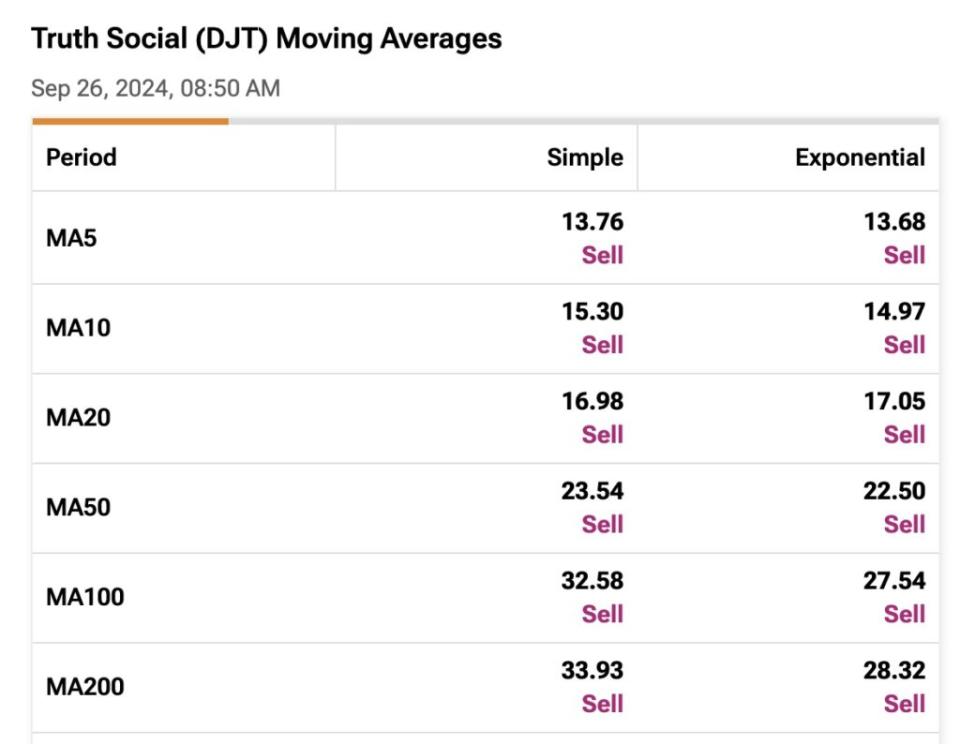

Historical past means that DJT inventory is extra intently correlated with expectancies about Trump’s possible go back to the White Space than with Reality Social’s trade efficiency. Whilst this affiliation won’t maintain itself ultimately, it creates the main short-to-medium-term threat for the bearish thesis. An election victory may probably propel DJT inventory to a height that surpasses earlier ranges.The Disconnect Between DJT’s Basics and ValuationThe number one reason why for my bearish stance on DJT is the numerous problem in seeking to justify its valuation from trade basics.DJT reported simply $3.4 million in income during the last 365 days, accompanied through an running lack of $125.4 million. Regardless of those susceptible figures, the corporate has an endeavor price of $2.2 billion and an astonishing price-to-sales ratio of just about 500x. In the latest quarter (Q2), revenues had been minimum, totaling best $837,000. Moreover, Reality Social’s consumer base declined to roughly 113,000 in April, representing a 19% drop year-over-year in line with the to be had information.On a good word, DJT has a robust steadiness sheet, with $344 million in money and no debt, which generates a significant quantity of passion source of revenue. In truth, passion source of revenue accounted for almost all of the corporate’s inflows in the newest quarter. The company’s massive money reserve is prone to diminish as the corporate expands past Reality Social, in particular with initiatives like its deliberate streaming carrier.To a big stage, DJT’s valuation and buying and selling resemble that of a meme inventory. The percentage payment is essentially influenced through volatility from momentum investors transacting on skinny signs. The absence of significant income makes it just about inconceivable to estimate the corporate’s truthful price at this time. About 10.7% of DJT’s go with the flow is lately Quick, which may make the inventory liable to a short-squeeze.DJT’s Downtrend Is Prone to RemainTo additional strengthen my bearish stance on DJT inventory, a technical research unearths that the inventory is buying and selling beneath its transferring averages, lending further reason why to be pessimistic.

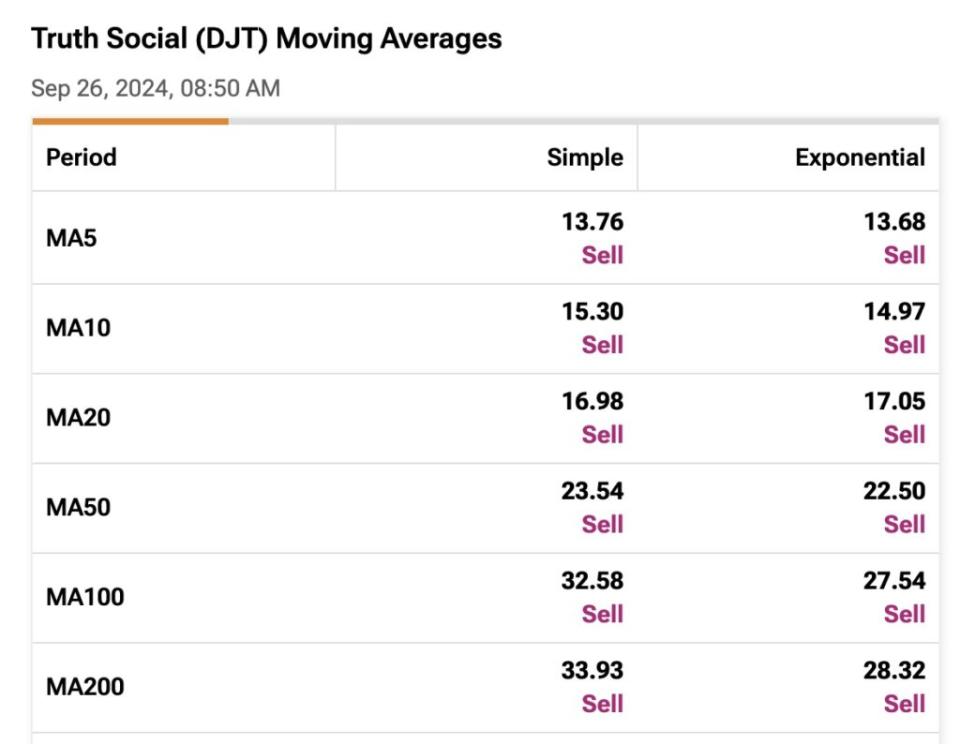

Historical past means that DJT inventory is extra intently correlated with expectancies about Trump’s possible go back to the White Space than with Reality Social’s trade efficiency. Whilst this affiliation won’t maintain itself ultimately, it creates the main short-to-medium-term threat for the bearish thesis. An election victory may probably propel DJT inventory to a height that surpasses earlier ranges.The Disconnect Between DJT’s Basics and ValuationThe number one reason why for my bearish stance on DJT is the numerous problem in seeking to justify its valuation from trade basics.DJT reported simply $3.4 million in income during the last 365 days, accompanied through an running lack of $125.4 million. Regardless of those susceptible figures, the corporate has an endeavor price of $2.2 billion and an astonishing price-to-sales ratio of just about 500x. In the latest quarter (Q2), revenues had been minimum, totaling best $837,000. Moreover, Reality Social’s consumer base declined to roughly 113,000 in April, representing a 19% drop year-over-year in line with the to be had information.On a good word, DJT has a robust steadiness sheet, with $344 million in money and no debt, which generates a significant quantity of passion source of revenue. In truth, passion source of revenue accounted for almost all of the corporate’s inflows in the newest quarter. The company’s massive money reserve is prone to diminish as the corporate expands past Reality Social, in particular with initiatives like its deliberate streaming carrier.To a big stage, DJT’s valuation and buying and selling resemble that of a meme inventory. The percentage payment is essentially influenced through volatility from momentum investors transacting on skinny signs. The absence of significant income makes it just about inconceivable to estimate the corporate’s truthful price at this time. About 10.7% of DJT’s go with the flow is lately Quick, which may make the inventory liable to a short-squeeze.DJT’s Downtrend Is Prone to RemainTo additional strengthen my bearish stance on DJT inventory, a technical research unearths that the inventory is buying and selling beneath its transferring averages, lending further reason why to be pessimistic.

The percentage payment downtrend has worsened in contemporary weeks, with DJT hitting all-time lows, in large part because of the tip of the limited proportion lock-up length. That six-month lock-up length, following the inventory’s debut in March, averted former president Donald Trump and different early traders from promoting their stocks.Trump has just lately said that he has no plans to promote his stake in Trump Media. So long as that is still the case, a pointy sell-off is not going, even if DJT inventory may proceed to slowly lose extra price.Conclusions on DJT StockFrom a trade basics and valuation standpoint, it’s just about inconceivable to justify the present $2.75 billion marketplace capitalization for Reality Social. The inventory’s speculative nature has drawn important passion from investors, leading to volatility essentially tied to Trump’s presidential marketing campaign traits relatively than any trade achievements. Given my view that DJT inventory actions happen totally on hypothesis, I’d advise traders in opposition to the temptation to catch this falling knife.No Wall Side road analysts duvet Trump Media & Generation GroupDisclosureDisclaimer

The percentage payment downtrend has worsened in contemporary weeks, with DJT hitting all-time lows, in large part because of the tip of the limited proportion lock-up length. That six-month lock-up length, following the inventory’s debut in March, averted former president Donald Trump and different early traders from promoting their stocks.Trump has just lately said that he has no plans to promote his stake in Trump Media. So long as that is still the case, a pointy sell-off is not going, even if DJT inventory may proceed to slowly lose extra price.Conclusions on DJT StockFrom a trade basics and valuation standpoint, it’s just about inconceivable to justify the present $2.75 billion marketplace capitalization for Reality Social. The inventory’s speculative nature has drawn important passion from investors, leading to volatility essentially tied to Trump’s presidential marketing campaign traits relatively than any trade achievements. Given my view that DJT inventory actions happen totally on hypothesis, I’d advise traders in opposition to the temptation to catch this falling knife.No Wall Side road analysts duvet Trump Media & Generation GroupDisclosureDisclaimer