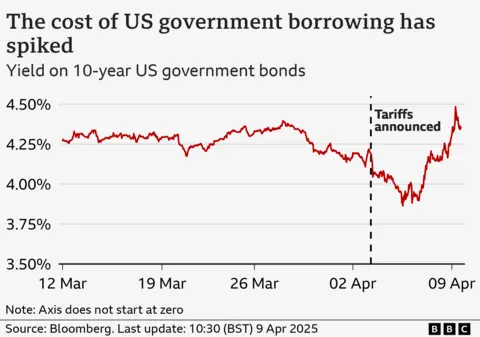

Michael RaceBusiness reporter, BBC Information Getty ImagesConfidence in america financial system is plummeting as traders dumped executive debt amid rising considerations over the have an effect on of Donald Trump’s price lists.On Wednesday, the yield – or rate of interest – on US bonds spiked sharply to the touch the easiest stage since February at 4.5%.The federal government promote bonds – necessarily an IOU – to boost cash from monetary markets and those are seen as a secure funding, which means america generally does no longer want to be offering top charges to draw patrons.Trump has long gone forward with sweeping price lists on items being imported into america, whilst Washington’s business warfare with Beijing has escalated.After america applied a 104% tariff on merchandise from China at nighttime on Wednesday, Beijing hit again with 84% levy on American merchandise.Inventory markets had been falling sharply over the last few days in response to Trump urgent forward with price lists.Alternatively, the sale of bonds poses a significant issue for the sector’s greatest financial system. Whilst the speed is identical stage as a few months in the past, the rates of interest for US borrowing over 10 years has spiked sharply up to now couple of days up from 3.9%.”Emerging bond yields imply upper prices for corporations to borrow, and naturally governments too,” mentioned Laith Khalaf, head of funding research at AJ Bell.”Bonds must do neatly in occasions of turmoil as traders flee to protection, however Trump’s business warfare is now undermining america debt marketplace,” he added.Some analysts recommended that america Federal Reserve may well be compelled to step in if turbulence continues, in a transfer harking back to the Financial institution of England’s emergency motion in 2022 following Liz Truss’s mini-Price range. “We see no different choice for the Fed however to step in with emergency purchases of US Treasuries to stabilise the bond marketplace,” mentioned George Saravelos, world head of FX analysis at Deutsche Financial institution.”We’re getting into uncharted territory,” he mentioned, including that it was once “very arduous” to expect how markets would react within the coming days because the bond marketplace recommended traders had “misplaced religion in US property”.

Getty ImagesConfidence in america financial system is plummeting as traders dumped executive debt amid rising considerations over the have an effect on of Donald Trump’s price lists.On Wednesday, the yield – or rate of interest – on US bonds spiked sharply to the touch the easiest stage since February at 4.5%.The federal government promote bonds – necessarily an IOU – to boost cash from monetary markets and those are seen as a secure funding, which means america generally does no longer want to be offering top charges to draw patrons.Trump has long gone forward with sweeping price lists on items being imported into america, whilst Washington’s business warfare with Beijing has escalated.After america applied a 104% tariff on merchandise from China at nighttime on Wednesday, Beijing hit again with 84% levy on American merchandise.Inventory markets had been falling sharply over the last few days in response to Trump urgent forward with price lists.Alternatively, the sale of bonds poses a significant issue for the sector’s greatest financial system. Whilst the speed is identical stage as a few months in the past, the rates of interest for US borrowing over 10 years has spiked sharply up to now couple of days up from 3.9%.”Emerging bond yields imply upper prices for corporations to borrow, and naturally governments too,” mentioned Laith Khalaf, head of funding research at AJ Bell.”Bonds must do neatly in occasions of turmoil as traders flee to protection, however Trump’s business warfare is now undermining america debt marketplace,” he added.Some analysts recommended that america Federal Reserve may well be compelled to step in if turbulence continues, in a transfer harking back to the Financial institution of England’s emergency motion in 2022 following Liz Truss’s mini-Price range. “We see no different choice for the Fed however to step in with emergency purchases of US Treasuries to stabilise the bond marketplace,” mentioned George Saravelos, world head of FX analysis at Deutsche Financial institution.”We’re getting into uncharted territory,” he mentioned, including that it was once “very arduous” to expect how markets would react within the coming days because the bond marketplace recommended traders had “misplaced religion in US property”. ‘US recession a coin toss’Simon French, leader economist at Panmure Liberum, informed the BBC that the Fed may just come to a decision to chop rates of interest in a bid to give protection to US jobs via making it more uncomplicated for companies to borrowing money as they face upper prices from price lists.He mentioned it was once a “coin toss” over whether or not america would input a recession.That is outlined as a chronic and well-liked decline in financial job generally characterized via a soar in unemployment and fall in earning.JP Morgan, the funding banking massive, has raised the possibility of a US recession from 40% to 60% and warned that American coverage was once “tilting clear of expansion”.Trump’s creation of price lists, that are charged on items imported from international locations in a foreign country, threatens to upend many world provide chains.US-based corporations that carry the international items into the rustic pays the tax to the federal government.Companies would possibly make a selection to cross on some or all the value of price lists to consumers, which might push up inflation. Trump’s plan is aimed toward protective American companies from international pageant and in addition to spice up home production.Questions stay over the dimensions and what form of traders are dumping US bonds.There may be been hypothesis some international international locations, reminiscent of China which owns some $759bn of US bonds, may well be promoting them. Mr Saravelos mentioned: “There may be little room now left for an escalation at the business entrance. “The following section dangers being an outright monetary warfare involving Chinese language possession of US property.”However he warned: “There may also be no winner to the sort of warfare. The loser would be the world financial system.”Watch: Is america heading right into a recession? 3 caution indicators to observe

‘US recession a coin toss’Simon French, leader economist at Panmure Liberum, informed the BBC that the Fed may just come to a decision to chop rates of interest in a bid to give protection to US jobs via making it more uncomplicated for companies to borrowing money as they face upper prices from price lists.He mentioned it was once a “coin toss” over whether or not america would input a recession.That is outlined as a chronic and well-liked decline in financial job generally characterized via a soar in unemployment and fall in earning.JP Morgan, the funding banking massive, has raised the possibility of a US recession from 40% to 60% and warned that American coverage was once “tilting clear of expansion”.Trump’s creation of price lists, that are charged on items imported from international locations in a foreign country, threatens to upend many world provide chains.US-based corporations that carry the international items into the rustic pays the tax to the federal government.Companies would possibly make a selection to cross on some or all the value of price lists to consumers, which might push up inflation. Trump’s plan is aimed toward protective American companies from international pageant and in addition to spice up home production.Questions stay over the dimensions and what form of traders are dumping US bonds.There may be been hypothesis some international international locations, reminiscent of China which owns some $759bn of US bonds, may well be promoting them. Mr Saravelos mentioned: “There may be little room now left for an escalation at the business entrance. “The following section dangers being an outright monetary warfare involving Chinese language possession of US property.”However he warned: “There may also be no winner to the sort of warfare. The loser would be the world financial system.”Watch: Is america heading right into a recession? 3 caution indicators to observe

Trump price lists spark US executive debt sell-off

-SOURCE-Simon-Hill.jpg)