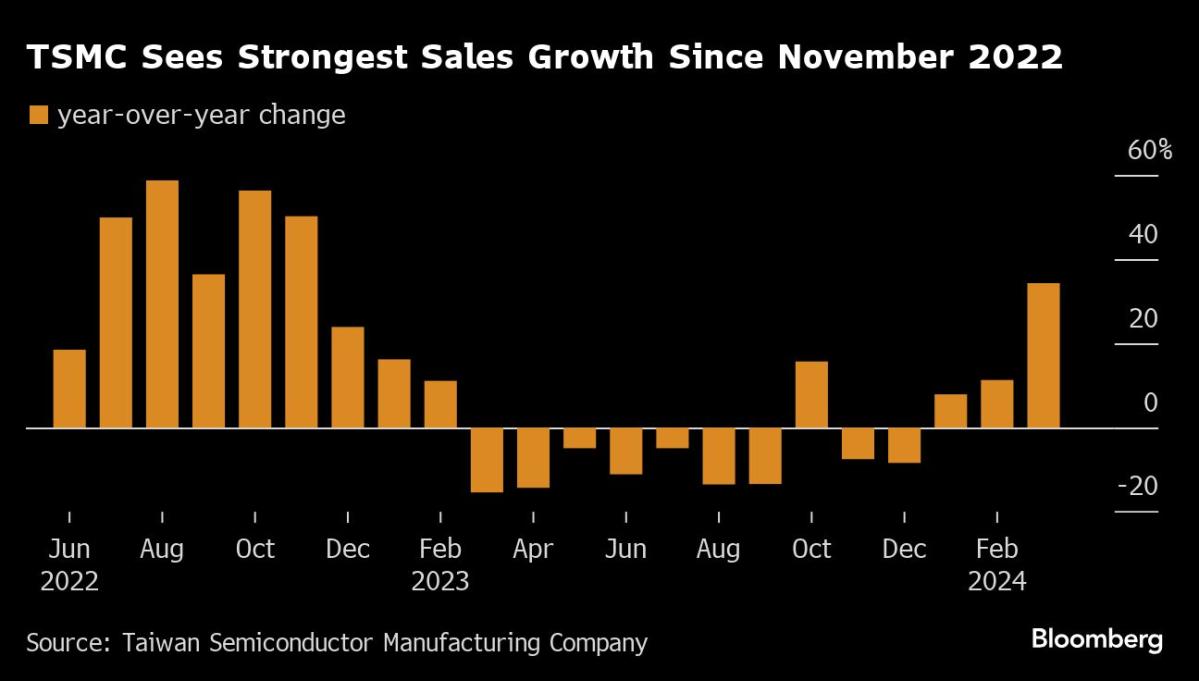

(Bloomberg) — Taiwan Semiconductor Production Co. delivered a better-than-projected income outlook and glued with plans to spend up to $32 billion in 2024, shoring up expectancies of sustained expansion in AI call for.Maximum Learn from BloombergThe forecast adopted its first quarterly benefit upward thrust in a 12 months, after robust AI call for revived expansion at Asia’s largest corporate. The primary chipmaker to Nvidia Corp. and Apple Inc. expects income of $19.6 billion to $20.4 billion within the June quarter, beating estimates for roughly $19.1 billion.That outlook would possibly assist assuage some traders apprehensive that AI call for gained’t dangle up, or {that a} smartphone restoration is also longer in coming. TSMC handiest final week disclosed its quickest gross sales expansion since 2022, suggesting call for for the chips that boost up synthetic intelligence construction is starting to offset the fallout from a smartphone marketplace stoop. Apple, which accounted for roughly 1 / 4 of TSMC’s income in 2023, began the 12 months with a deep decline in iPhone gross sales.Alternatively, TSMC Leader Government Officer C. C. Wei stated the corporate used to be revising downward its expectancies for 2024 semiconductor marketplace expansion — apart from reminiscence chips — to about 10%, from above that determine. He additionally trimmed his expansion forecast for the foundry sector, which TSMC leads. However it clung to predictions for spending of between $28 billion and $32 billion on capability enlargement and upgrades this 12 months.“Having a look at 2024 as a complete, macroeconomic and geopolitical uncertainty persists, doubtlessly weighing on client sentiment and end-market call for,” Wei informed analysts on a convention name.For a liveblog on TSMC’s income, click on right here.TSMC continues to be expecting income to develop through no less than 20% this 12 months as the wider semiconductor marketplace recovers, although uncertainty persists given international macroeconomic volatility. Key provider ASML Maintaining NV — the only real supplier of the sector’s maximum complicated chipmaking machines — reported a 22% omit on first-quarter bookings Wednesday.The Taiwanese chipmaker stated it’ll start mass manufacturing of next-generation 2nm chips within the final quarter of 2025, executives stated, narrowing its time frame from subsequent 12 months normally. And Wei added that TSMC’s car trade will fall this 12 months, as opposed to earlier projections for a upward thrust, with out elaborating.Tale continuesTSMC has won about $340 billion of marketplace worth since an October 2022 trough, using bets it’ll turn out to be probably the most clearest winners of a world increase in AI construction. On Thursday, it recorded a better-than-projected 9% upward thrust in web source of revenue to NT$225.5 billion ($7 billion) for the March quarter.Executives stated the earthquake that rocked Taiwan this month broken some wafers utilized in its chip manufacturing, miserable gross margins through about 50 foundation issues or 0.5 proportion level within the June quarter.Learn Extra: TSMC Says Quake Broken Some Wafers, Resulting in Small Benefit HitLonger time period, traders be expecting AI-focused chips to regularly soak up a bigger share of income. TSMC’s AI income is rising at a charge of fifty% once a year, the corporate stated in January.Nonetheless, some traders have warned that the present degree of AI chip call for is unsustainable over the longer term. Others stay cautious given the uncertainty placing over the Taiwan Strait — the slim frame of water between China and an island it perspectives as a part of its territory.“The call for may be very prime, extraordinarily prime, and we’ll do our perfect to extend our capability to relieve the lack,” Wei stated of AI call for. “Most certainly no longer sufficient this 12 months, however for subsequent 12 months we’ll check out very arduous.”–With the help of Gao Yuan, Mayumi Negishi, Ville Heiskanen and Cindy Wang.(Updates with capex and govt’s feedback from the second one paragraph)Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

TSMC Outlook Beats Estimates After AI Call for Fuels Industry