Q1 and Q2 performances dictating why traders are allocating extra to memecoins – Survey

PEPE, WIF, BONK costs would possibly hit new highs, however respondents be expecting BTC to do the similar

After chatting with 557 respondents from other portions of the sector, AMBCrypto’s unique survey published that 53.7% of investors, traders, and analysts would select memecoins over Bitcoin [BTC]. And but, an important quantity consider that Bitcoin will hit the $100,000-level earlier than the tip of 2024. The results of this find out about would possibly no longer come as a marvel to lively avid gamers available in the market even though, and the explanations are obtrusive.

Are memecoins this cycle’s hedge?

First off, Bitcoin’s worth has risen via 53.32% on a Yr-To-Date (YTD) foundation. Alternatively, this is not anything in comparison to the efficiency of memecoins — Particularly the ones in keeping with Solana’s [SOL] blockchain.

As an example, dogwifhat’s [WIF] price has jumped via a mind-blowing 1,768% this yr, whilst Bonk [BONK] recorded a 123% hike. Some other notable memecoin has been PEPE. In spite of Ethereum’s [ETH] lagging conduct, this memecoin registered features of 945%.

Alternatively, the respondents didn’t simply say this out of need. As an alternative, AMBCrypto’s survey discovered that they’re striking their cash the place their mouth is. Particularly, 36.8% of all respondents have allotted some a part of their portfolio to memecoins.

Some other 25.5% have executed so for AI-themed tokens, with DeFi and GameFi sectors discovering a spot inside the holdings of 25.5% and 15.4% of the entire respondents. This, in spite of the second one quarter (Q1) of the yr beginning at a slower tempo in comparison to Q1.

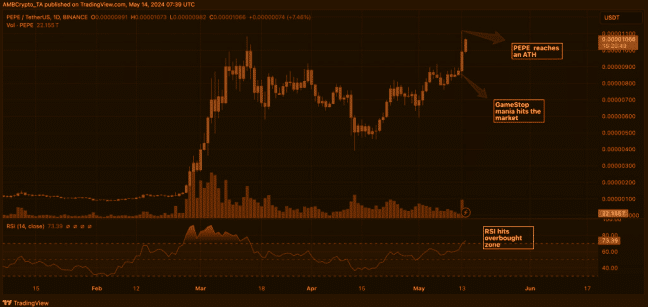

As Q2 started, memecoins shed a excellent a part of their Q1 features. Alternatively, the resurgence of the GameStop (GME) inventory put costs again at the uptrend. This used to be one of the crucial causes PEPE looked as if it would surpass its all-time prime nearly each and every week.

Supply: TradingView

Supply: TradingView

Bitcoin remains to be within the dialog

Without reference to the bullish conviction round memecoins, 65.5% of the respondents owned Bitcoin – An indication that the coin stays a large wager, in spite of the humming narrative.

Moreover, AMBCrypto’s record additionally published that the majority consider BTC may just hike via 80% via December 2024. If this occurs, then the cost of Bitcoin might be value $121,953 via the tip of the yr.

The place does that depart memecoins even though? Past the record, AMBCrypto seemed on the collection of holders and sentiment round a few of these frog and dog-themed tokens.

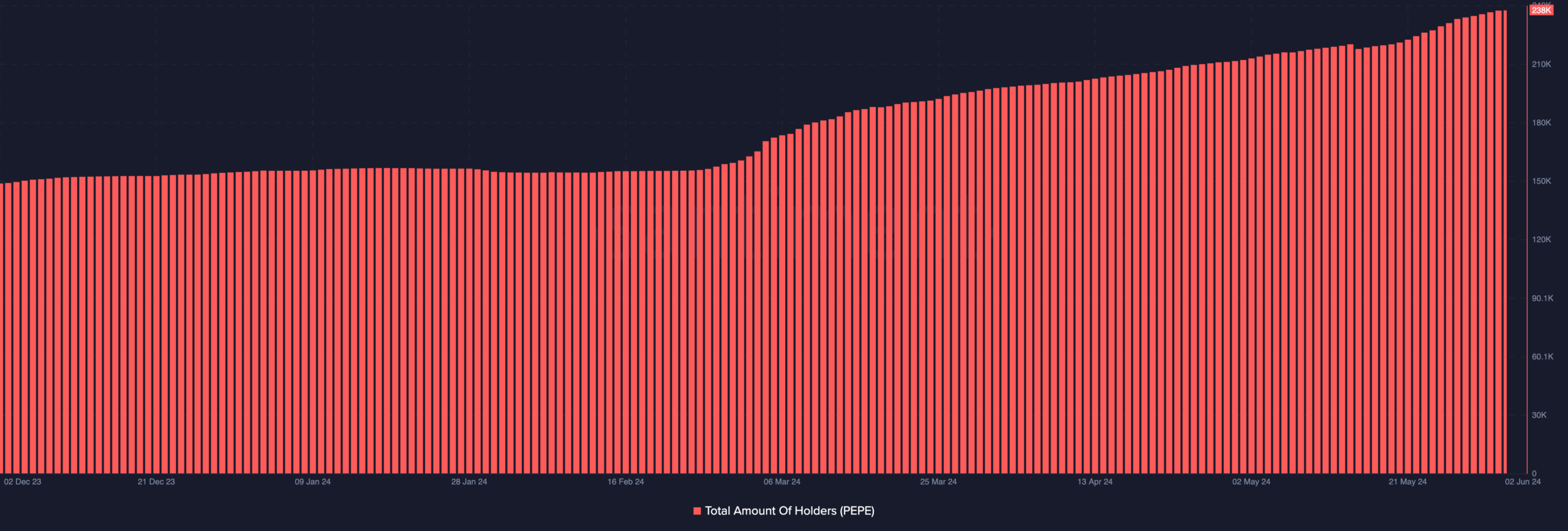

In keeping with knowledge from Santiment, the collection of PEPE holders in February used to be not up to 160,000. At press time even though, that quantity had risen to 238,000.

Supply: Santiment

Supply: Santiment

A nearly 50% hike in not up to 3 months is also proof that the memecoin supercycle would possibly no longer forestall anytime quickly. Will have to this be the case, different altcoins with real-world application may well be starved of liquidity.

After all, AMBCrypto’s record found out that the emergence of SocialFi has been one thing to be careful for. As an example, platforms like Pal.tech and Delusion.Most sensible had been accruing tens of millions of bucks in buying and selling quantity.

Sensible or no longer, right here’s PEPE’s marketplace cap in BTC phrases

In spite of the notable uptick in cash flows, memecoins would possibly proceed to draw extra marketplace members over every other sector available in the market. Nonetheless, this doesn’t mean that ETH would proceed to lag or BTC would fail to hit $100,000.