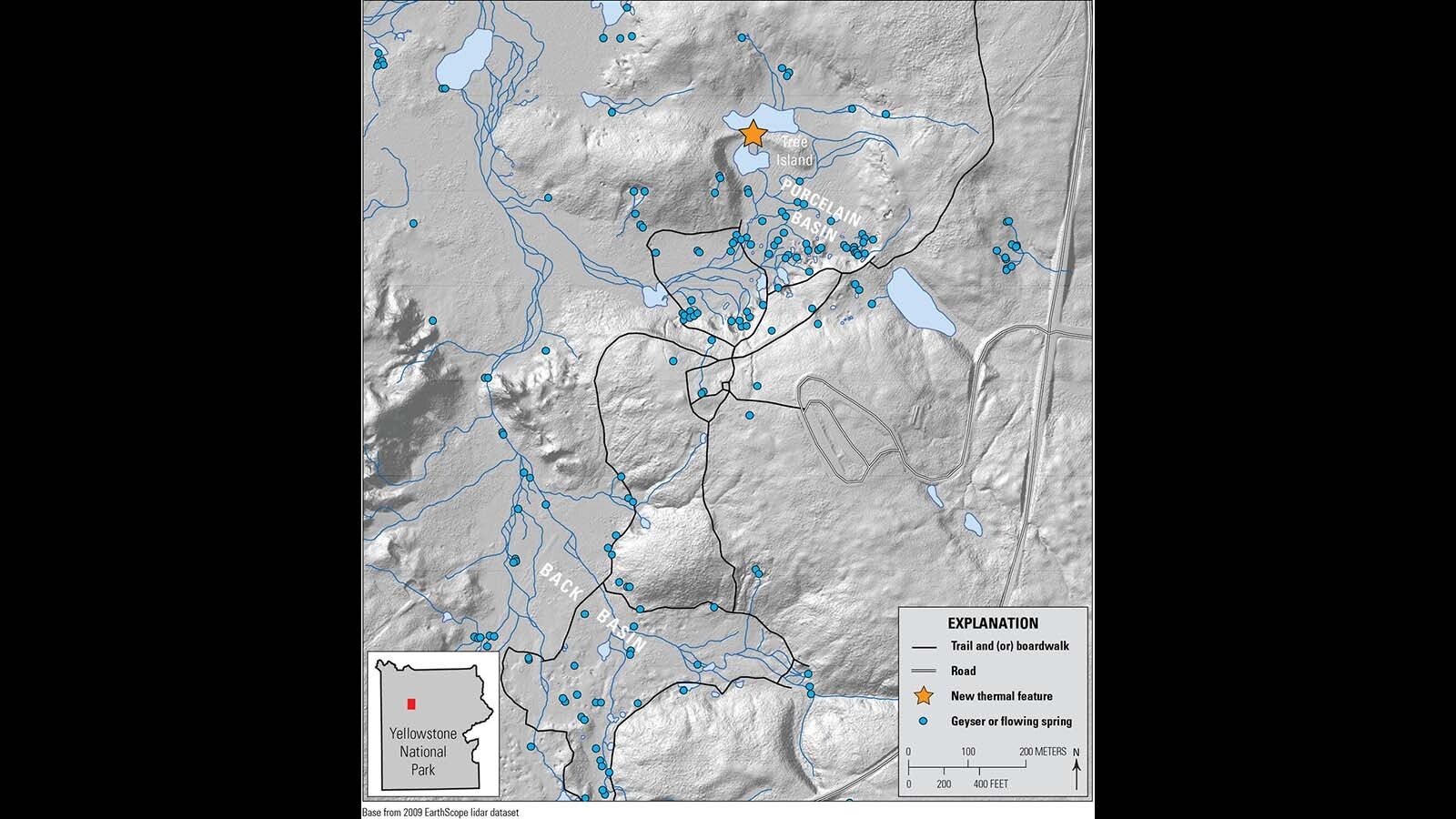

Keep knowledgeable with unfastened updatesSimply signal as much as the United States inflation myFT Digest — delivered at once in your inbox.US core inflation rose remaining month, bolstering arguments by way of the United States Federal Reserve that rates of interest might wish to stay on hang for months to come back.Figures printed on Tuesday, an afternoon ahead of the Fed is anticipated to vote on borrowing prices, confirmed US core costs rose 0.3 in keeping with cent right through November, whilst the year-on-year core price remained flat at 4 in keeping with cent.The yearly core measure, observed as a bellwether for longer-term inflation, strips out adjustments within the costs of power and meals. The headline price edged decrease to three.1 in keeping with cent, in keeping with expectancies and marginally beneath October’s 3.2 in keeping with cent price.After the knowledge’s newsletter, traders scaled again their expectancies for rate of interest cuts. “The Fed helps to keep telling us they don’t believe that they are able to say with walk in the park that inflation goes to [its target of] 2 in keeping with cent anytime quickly,” stated Omair Sharif, president of forecasting crew Inflation Insights. “I don’t suppose that self assurance can also be there after nowadays’s numbers.”He added that the figures didn’t sign “an all transparent”.Analysts took the core inflation information as an indication that the trail to bringing the determine down subsequent 12 months will probably be a bumpy one.Whilst the marketplace nonetheless anticipates a quarter-point lower in rates of interest by way of subsequent Would possibly, investors trimmed their expectancies after the knowledge liberate.Fed officers are anticipated to vote on Wednesday to stay rates of interest at their present vary of five.25 in keeping with cent to five.5 in keeping with cent.US shares ended upper, with the S&P 500 emerging 0.5 in keeping with cent to its perfect final degree since January 2022. That leaves it about 3 in keeping with cent beneath its file prime from previous that month.The United States executive bond marketplace gave the impression calm, with yields on shorter-dated Treasury notes about flat at the day, whilst the ones on longer-dated tools had been somewhat decrease.You’re seeing a snapshot of an interactive graphic. That is in all probability because of being offline or JavaScript being disabled for your browser.

Robust US jobs information printed remaining week led some traders to revise their expectancies of a spherical of price cuts starting in March.However Alan Detmeister, a former Fed economist now at UBS, stated the most recent information was once “in step with typically slowing inflation”.He added it was once nonetheless imaginable the central financial institution would narrow charges in March to make sure rates of interest didn’t grow to be too restrictive for families and companies as soon as inflation moved nearer to focus on. Further reporting by way of Nicholas Megaw in New York

Robust US jobs information printed remaining week led some traders to revise their expectancies of a spherical of price cuts starting in March.However Alan Detmeister, a former Fed economist now at UBS, stated the most recent information was once “in step with typically slowing inflation”.He added it was once nonetheless imaginable the central financial institution would narrow charges in March to make sure rates of interest didn’t grow to be too restrictive for families and companies as soon as inflation moved nearer to focus on. Further reporting by way of Nicholas Megaw in New York

Upward push in US core inflation highlights cussed value pressures