US DOLLAR FORECAST – EUR/USD, USD/JPY, GBP/USDThe U.S. greenback weakens around the board because the Federal Reserve alerts a large number of charge cuts for subsequent yearThe FOMC’s dovish coverage outlook sends Treasury yields tumblingThis article makes a speciality of the technical outlook for EUR/USD, USD/JPY and GBP/USD within the wake of the Fed’s tentative pivotMost Learn: Fed Remains Put, Sees 3 Price Cuts in 2024; Gold Costs Leap as Yields PlungeThe U.S. greenback, as measured by means of the DXY index, plummeted just about 0.9% on Wednesday, dragged decrease by means of the huge plunge in U.S. Treasury charges after the Federal Reserve’s steerage stunned at the dovish aspect, catching traders, who had been expecting a unique end result, off guard and at the unsuitable aspect of the business.For context, the U.S. central financial institution these days concluded its closing assembly of the yr. Despite the fact that policymakers stored borrowing prices unchanged at multi-decade highs, they gave the primary indicators of an drawing close technique pivot by means of embracing a extra benevolent characterization of inflation and admitting that speak of charge cuts has begun.Will the United States greenback stay falling or opposite upper? Get all of the solutions in our quarterly outlook!

Really useful by means of Diego Colman

Get Your Loose USD Forecast

The Fed’s Abstract of Financial Projection bolstered the view {that a} coverage shift is at the horizon, with the dot plot appearing 75 foundation issues of easing subsequent yr, way over pondered in September. Whilst Wall Boulevard’s rate-cut wagers were excessive, the Fed’s forecasts are slowly converging towards the marketplace’s outlook – this will have to be bearish for the buck and yields shifting into 2024.With the wider U.S. greenback in a tailspin, EUR/USD soared against the 1.0900 deal with whilst GBP/USD jumped previous crucial ceiling close to 1.2600. In the meantime, USD/JPY nosedived, abruptly falling against its 200-day easy shifting moderate – the closing defensive position towards a bigger retreat.This text makes a speciality of the technical outlook for main U.S. greenback pairs reminiscent of EUR/USD, USD/JPY and GBP/USD, inspecting key worth ranges after Wednesday’s outsize strikes within the FX house.For a whole assessment of the euro’s technical and basic outlook, obtain your complimentary buying and selling forecast now!

Really useful by means of Diego Colman

Get Your Loose EUR Forecast

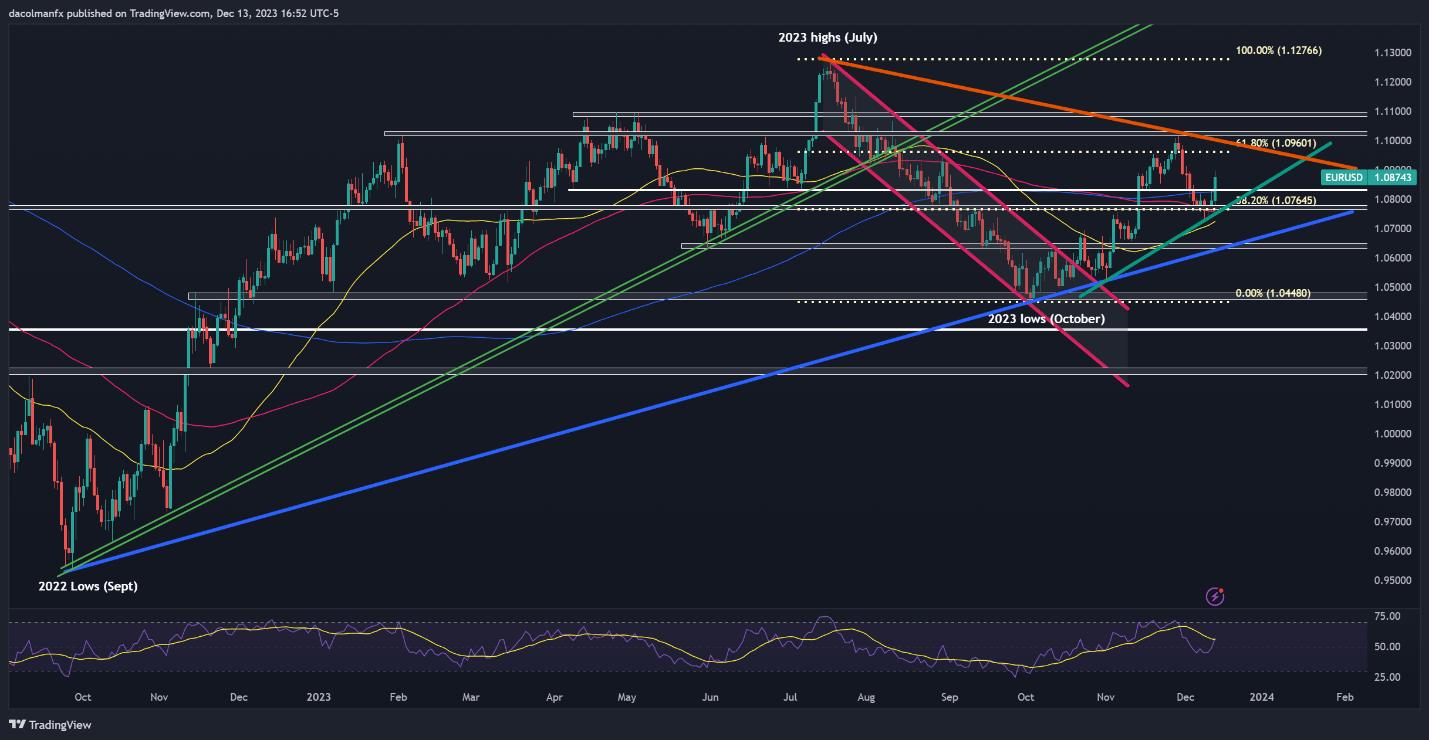

EUR/USD TECHNICAL ANALYSISEUR/USD jumped on Wednesday, clearing technical resistance close to 1.0830, similar to the 200-day easy shifting moderate. If this bullish transfer is continued within the coming days, the upside momentum may boost up, environment the level for a rally against 1.0960, the 61.8% Fib retracement of the July/October decline. On additional power, consideration would shift against 1.1015, closing month’s prime.Then again, if the upward impetus fades and costs resume their descent, the primary fortify to observe is situated at 1.0830, however additional losses may well be in retailer for the pair on a push beneath this threshold, with the following space of hobby at 1.0765. Persisted weak point may draw center of attention against trendline fortify, recently traversing the 1.0640 area.EUR/USD TECHNICAL CHART EUR/USD Chart Ready The usage of TradingViewFor pointers and professional insights on how one can business USD/JPY, obtain the yen’s information!

EUR/USD Chart Ready The usage of TradingViewFor pointers and professional insights on how one can business USD/JPY, obtain the yen’s information!

Really useful by means of Diego Colman

How you can Industry USD/JPY

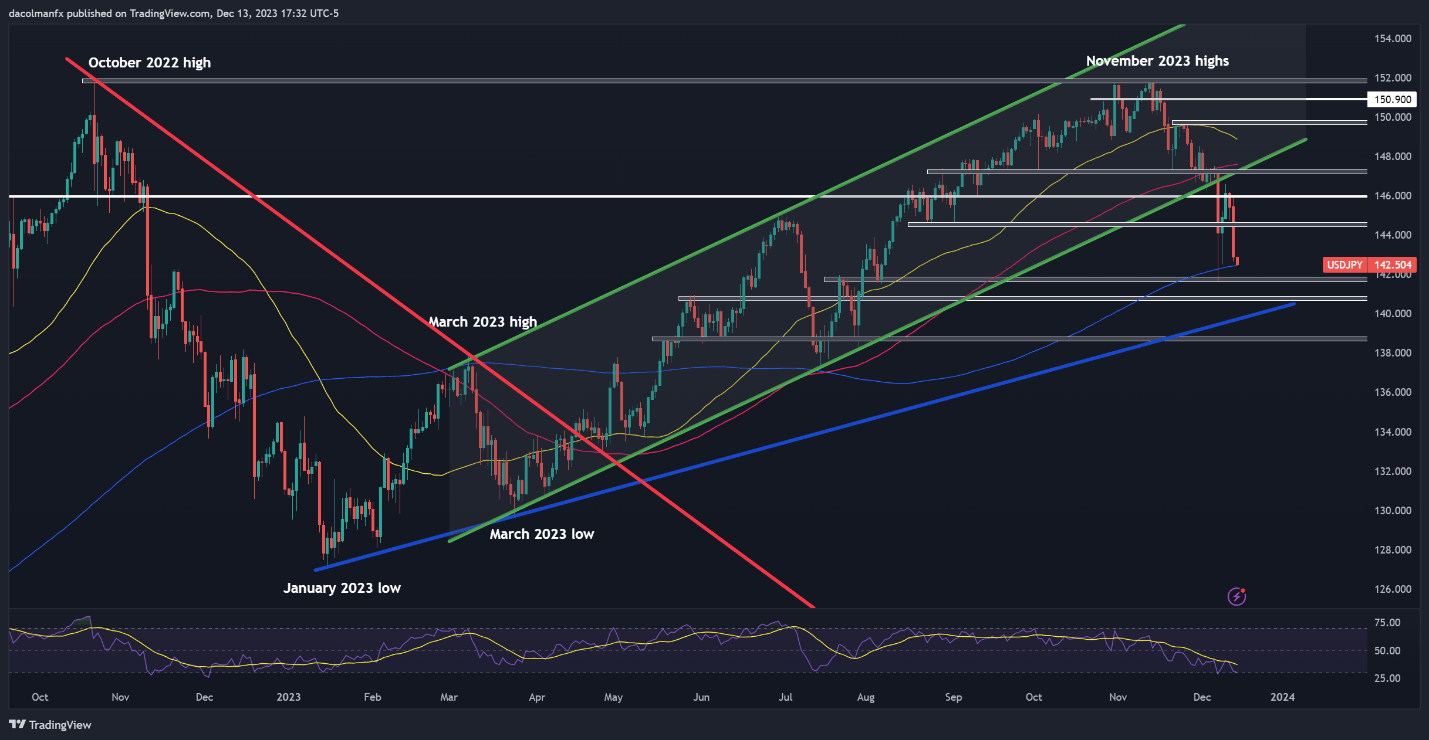

USD/JPY TECHNICAL ANALYSISUSD/JPY noticed an rise previous this week, however this ascent hit an abrupt halt on Wednesday when the Fed precipitated an enormous U.S. greenback selloff. This drove the pair sharply decrease, sending the alternate charge against its 200-day SMA, the following main ground to observe. Bulls will wish to staunchly shield this ground; failure to take action may spark a drop against 141.70 and 140.70 thereafter.Conversely, if USD/JPY resumes its rebound, technical resistance looms at 144.50. Patrons will have a troublesome time breaching this barrier, but when they set up to pressure costs above this ceiling, lets see a rally against the 146.00 deal with. On additional power, all eyes can be on 147.20.USD/JPY TECHNICAL CHART USD/JPY Chart Created The usage of TradingViewKeen to know the function of retail positioning in GBP/USD’s worth motion dynamics? Our sentiment information delivers all of the crucial insights. Get your unfastened replica now!

USD/JPY Chart Created The usage of TradingViewKeen to know the function of retail positioning in GBP/USD’s worth motion dynamics? Our sentiment information delivers all of the crucial insights. Get your unfastened replica now!

of purchasers are internet lengthy.

of purchasers are internet brief.

Exchange in

Longs

Shorts

OI

Day-to-day

-8%

0%

-4%

Weekly

-11%

-5%

-8%

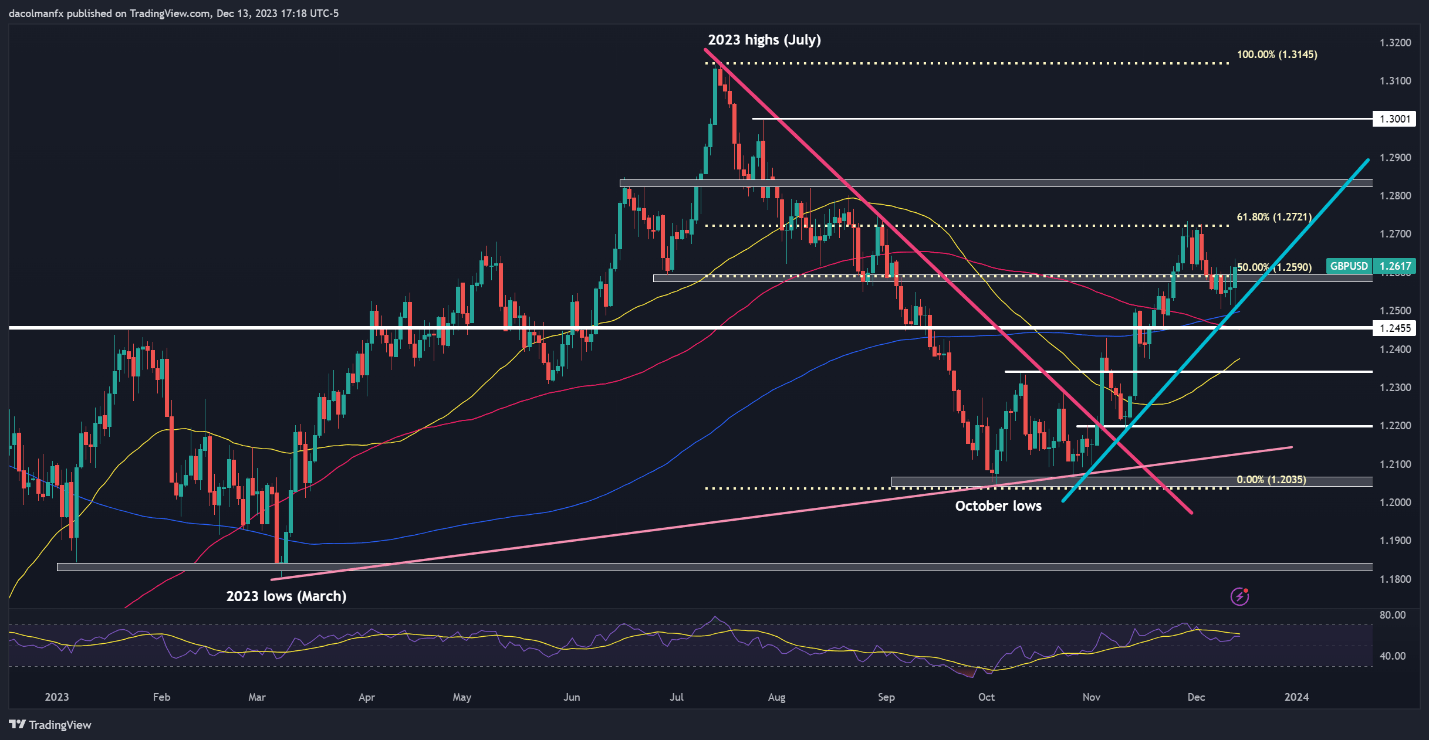

GBP/USD TECHNICAL ANALYSISGBP/USD climbed and driven previous resistance at 1.2590 on Wednesday after bouncing off trendline fortify close to 1.2500, with the improvement bolstered by means of the wider U.S. greenback downturn. If the pair manages to carry onto fresh good points and consolidates to the upside bit by bit, lets quickly see a retest of one.2720 stage, the 61.8% Fib of the July/October retracement. Additional up, all eyes can be on 1.2800.Then again, if dealers go back and cause a bearish reversal, preliminary fortify seems at 1.2590, adopted by means of 1.2500, close to the 200-day easy shifting moderate. Taking a look decrease, the focal point turns to at least one.2455. Cable is prone to stabilize on this area on a pullback earlier than mounting a imaginable comeback, however within the tournament of a breakdown, a transfer down to at least one.2340 turns into a believable state of affairs.GBP/USD TECHNICAL CHART GBP/USD Chart Created The usage of TradingView component within the component. This may not be what you intended to do!

GBP/USD Chart Created The usage of TradingView component within the component. This may not be what you intended to do!

Load your utility’s JavaScript package within the component as a substitute.