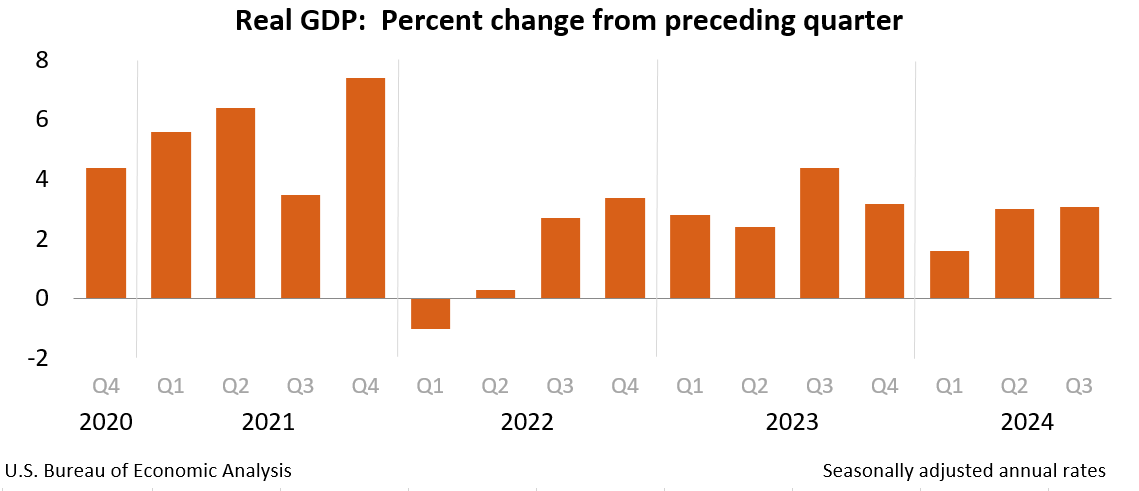

By means of Lucia MutikaniWASHINGTON (Reuters) -The collection of American citizens submitting new claims for unemployment advantages held secure at a low stage final week, pointing to a nonetheless quite tight hard work marketplace that are supposed to proceed to underpin the financial system in the second one quarter.Economists in large part shrugged off different knowledge from the Hard work Division on Thursday appearing expansion in employee productiveness virtually stalled within the first quarter, noting that the fashion in productiveness remained cast. Additionally they argued that there used to be a seasonal quirk, which tended to bias gross home product and productiveness decrease within the first quarter.At face price, the pointy slowdown in productiveness and accompanying surge in hard work prices would lift considerations about inflation pressures build up in addition to benefit margins being squeezed, which might affect call for for hard work.”We consider such fears are out of place,” mentioned Conrad DeQuadros, senior financial consultant at Brean Capital. “Now we have known residual seasonal adjustment bias within the quarterly GDP expansion measures that depress first-quarter expansion, and because productiveness is measured through the sphere’s GDP divided through hours labored, this bias additionally depresses productiveness.”Preliminary claims for state unemployment advantages had been unchanged at a seasonally adjusted 208,000 for the week ended April 27. Economists polled through Reuters had forecast 212,000 claims in the newest week. Claims had been bouncing round in a 194,000-225,000 vary this 12 months.Even though call for for hard work is softening, with process openings falling to a three-year low in March, layoffs stay very low as firms dangle directly to their employees following demanding situations discovering hard work all the way through and after the COVID-19 pandemic.The Federal Reserve on Wednesday stored the U.S. central financial institution’s benchmark in a single day rate of interest unchanged within the present 5.25%-5.50% vary, the place it’s been since July.Fed Chair Jerome Powell advised journalists on Wednesday that growth reducing inflation had stalled. Powell described the hard work marketplace as having remained “quite tight,” but in addition famous that “provide and insist stipulations have come into higher stability.” He driven again in opposition to chatter of stagflation and the central financial institution wanting to lift charges once more.Since March 2022, the Fed has hiked its coverage fee through 525 foundation issues. Hard work prices and inflation jumped within the first quarter.LOW LAYOFFSThe collection of folks receiving advantages after an preliminary week of help, a proxy for hiring, used to be additionally unchanged at a seasonally adjusted 1.774 million all the way through the week finishing April 20, the claims record confirmed.Tale continuesThe claims knowledge haven’t any relating April’s employment record, which is scheduled to be revealed on Friday. Nonfarm payrolls most likely larger through 243,000 jobs in April after a achieve of 303,000 in March, in step with a Reuters survey of economists. The unemployment fee is forecast unchanged at 3.8%.In a separate record on Thursday, the Hard work Division’s Bureau of Hard work Statistic mentioned nonfarm productiveness, which measures hourly output consistent with employee, larger at a nil.3% annualized fee within the first quarter after emerging at a three.5% tempo within the October-December duration.The federal government on Friday corrected productiveness knowledge from 2019 via 2023 because of a computation error.Economists had forecast productiveness would building up at a nil.8% fee. Productiveness complex at a 2.9% tempo from a 12 months in the past. Economists are maintaining a tally of productiveness to gauge how temporarily hard work prices can upward thrust with out re-igniting inflation.Unit hard work prices – the cost of hard work consistent with unmarried unit of output – jumped to a 4.7% fee within the January-March quarter after being unchanged within the prior quarter. Hard work prices larger at a 1.8% tempo from a 12 months in the past.Repayment shot up at a 5.0% fee final quarter after emerging at a three.5% tempo within the October-December quarter. It larger at a 4.7% fee from a 12 months in the past.”The underlying pattern in productiveness expansion nonetheless seems to be very wholesome,” mentioned Ian Shepherdson, leader economist atPantheon Macroeconomics. “The 1.8% year-over-year expansion in unit hard work prices is well in step with the (2%) inflation goal and helps the Fed’s view that the hard work marketplace has moved into higher stability.”(Reporting through Lucia Mutikani; Enhancing through Chizu Nomiyama and Paul Simao)

US hard work marketplace nonetheless tight; productiveness falters in first quarter