Through Stephen Culp NEW YORK (Reuters) -Wall Boulevard shares headed decrease on Thursday and U.S. benchmark Treasury yields scaled the perfect degree since April in mild, post-Christmas buying and selling. The modest however broad-based sell-off pulled all 3 main U.S. inventory indexes modestly decrease regardless of the so-called Santa Claus rally, by which shares continuously get a vacation season spice up from low liquidity, tax loss harvesting and funding of year-end bonuses. Uncertainties round President-elect Donald Trump’s insurance policies lifted gold costs and helped ship the 10-year Treasury yield to a just about eight-month top. “It is mild quantity and now we’re improving some previous losses because of some benefit taking from Tuesday’s rally,” stated Peter Cardillo, leader marketplace economist at Spartan Capital Securities in New York. “I believe we are within the Santa Claus rally, with a bit little bit of a bump within the highway right here as of late, and it is most likely secure to mention the year-end rally will proceed.” With just a handful of buying and selling days final within the yr, the Nasdaq, S&P 500 and the Dow have scored respective beneficial properties of 33%, 26% and 14% in 2024. The most important issues for 2025 are the level of the Federal Reserve’s financial easing, Trump’s price lists and different insurance policies, and more than a few geopolitical tensions. At the financial entrance, new claims for unemployment advantages got here in quite under analysts’ estimates, whilst ongoing claims jumped to their biggest quantity since November 2021, suggesting laid off staff are having expanding problem discovering new jobs. The Dow Jones Business Moderate fell 28.97 issues, or 0.07%, to 43,268.06, the S&P 500 slid 4.50 issues, or 0.07%, to six,035.54 and the Nasdaq Composite dropped 18.10 issues, or 0.09%, to twenty,013.03. MSCI’s broadest index of Asia-Pacific stocks out of doors Japan edged 0.1% decrease however remained not off course for a weekly achieve. Global shares seemed on track to wrap up the yr with a 2nd consecutive annual achieve of greater than 17%, unfazed through escalating geopolitical tensions and financial headwinds. Ecu markets had been closed for Boxing Day. MSCI’s gauge of shares around the globe fell 0.29 issues, or 0.03%, to 856.30. Rising marketplace shares fell 1.47 issues, or 0.14%, to one,084.39. MSCI’s broadest index of Asia-Pacific stocks out of doors Japan closed 0.15% decrease at 574.40, whilst Japan’s Nikkei rose 437.63 issues, or 1.12%, to 39,568.06. The ten-year U.S. Treasury yield resumed its uphill climb. “We are most likely on a method to 4.75% to five.0% at the 10-year word and the cause of this is that the bond marketplace is filled with uncertainties, whilst the inventory marketplace is filled with enthusiasm,” Cardillo stated. “The bond marketplace is projecting a hawkish Fed going into most likely the primary part of the yr.” Tale Continues The benchmark U.S. 10-year word yield rose 3.2 foundation issues to 4.619%, from 4.587% overdue on Tuesday. The 30-year bond yield rose 2.5 foundation issues to 4.7863% from 4.76% overdue on Tuesday. The two-year word yield, which usually strikes in line with rate of interest expectancies, rose 2.3 foundation issues to 4.353%, from 4.33% overdue on Tuesday. The greenback edged upper in opposition to a basket of worldwide currencies on expectancies that the buck stands to take pleasure in the insurance policies of the incoming Trump management. The greenback index, which measures the buck in opposition to a basket of currencies together with the yen and the euro, rose 0.09% to 108.20, with the euro up 0.04% at $1.0409. Towards the Eastern yen, the greenback reinforced 0.4% to 158.03. Oil used to be necessarily unchanged, giving up previous energy because of China stimulus hopes and an business file which confirmed a decline in U.S. inventories. U.S. crude rose 0.01% to $70.11 a barrel and Brent rose to $73.61 in line with barrel, up 0.04% at the day. Gold complex on safe-haven call for as traders awaited additional alerts at the U.S. financial system’s well being. Spot gold rose 0.76% to $2,633.19 an oz. U.S. gold futures rose 0.3% to $2,627.90 an oz. (Reporting through Stephen Culp; Modifying through Richard Chang)

US shares dip as “Santa Claus rally” stalls, 10-year Treasury yields contact 8-month top

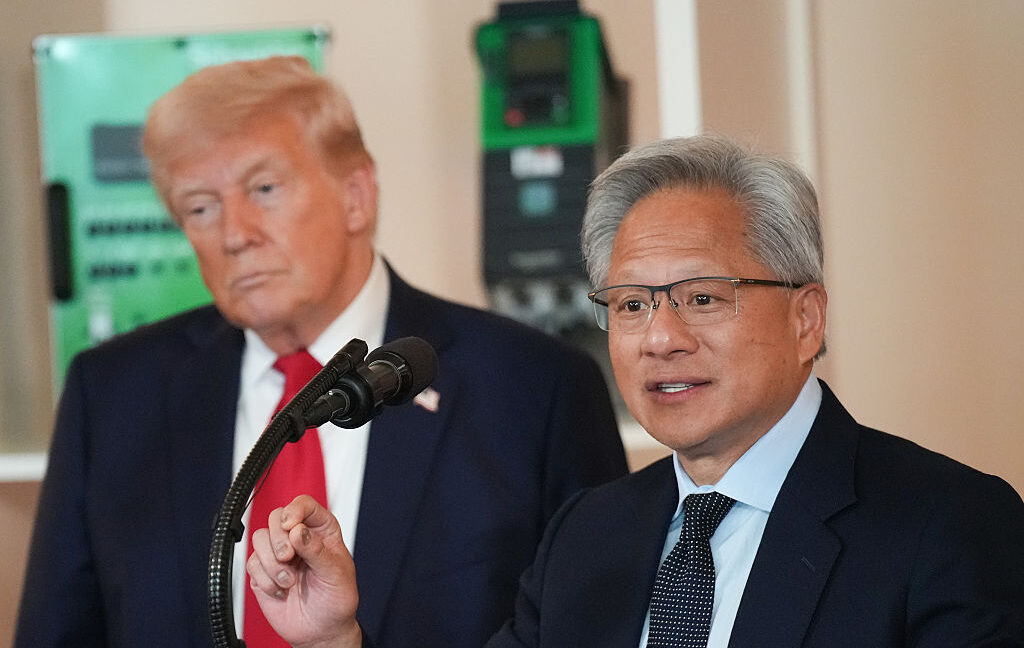

:max_bytes(150000):strip_icc()/GettyImages-2226490793-c5e9f8c574474ef69232a57d4031cedf.jpg)