Virtuals Protocol (VIRTUAL) received through 42% in 24 hours after list at the Bithumb trade.

Open hobby additionally larger through 90% in spite of a upward thrust in brief liquidations.

Virtuals Protocol (VIRTUAL) hit a recent all-time prime of $1.42 on twenty ninth November. At press time, the bogus intelligence (AI) crypto had retraced reasonably to business at $1.29, with 24-hour positive factors of 42%. Its marketplace capitalization has additionally surged to $1.28 billion.

Knowledge from CoinMarketCap displays that during 24 hours, VIRTUAL’s buying and selling volumes larger through greater than 100% to $166 million. Those volumes have been most probably pushed through the altcoin’s list at the Bithumb trade, the place it is going to be open for buying and selling with Korean Received buying and selling pairs.

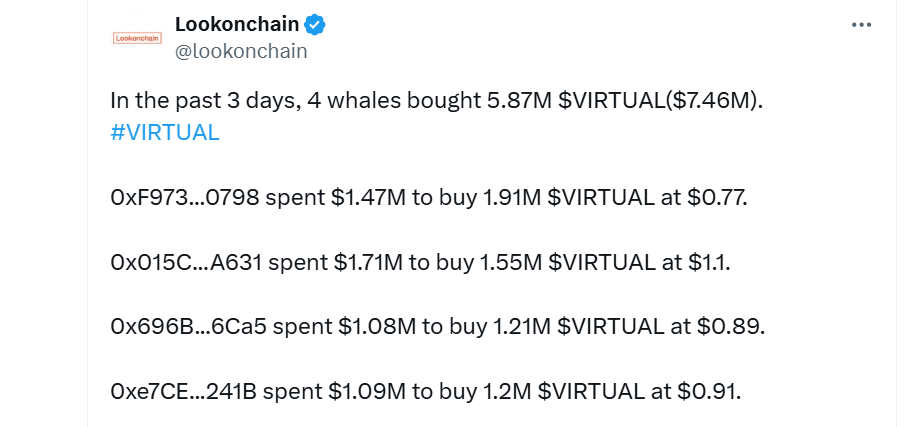

Whale hobby in VIRTUAL has additionally risen prior to now 4 days. In keeping with Lookonchain, 4 whale addresses bought 5.87 million tokens within the closing 3 days.

Supply: X

Supply: X

As VIRTUAL outperforms the wider cryptocurrency marketplace amid emerging whale process and buying and selling volumes, will the altcoin maintain the bullish momentum, or will the fashion opposite?

Technical signs display robust bullish indicators

VIRTUAL crypto’s four-hour chart displays that bullish developments are gaining energy with the sure Directional Indicator (DI) trending above the unfavourable DI.

The huge hole between the sure DI and unfavourable DI along the emerging Moderate Directional Index (ADX) additional displays that the uptrend is powerful.

Supply: Tradingview

Supply: Tradingview

The Cash Waft Index (MFI) at 85 additional displays that purchasing power is intense, and VIRTUAL will have reached overbought ranges. Investors must be careful for a decline within the MFI as it is going to point out that dealers are coming into the marketplace to take income.

If the purchasing process continues, VIRTUAL may most probably turn its earlier ATH and hit new highs. Conversely, if the uptrend weakens, a a very powerful strengthen zone lies at $1.04, with a drop beneath set to boost up the downtrend.

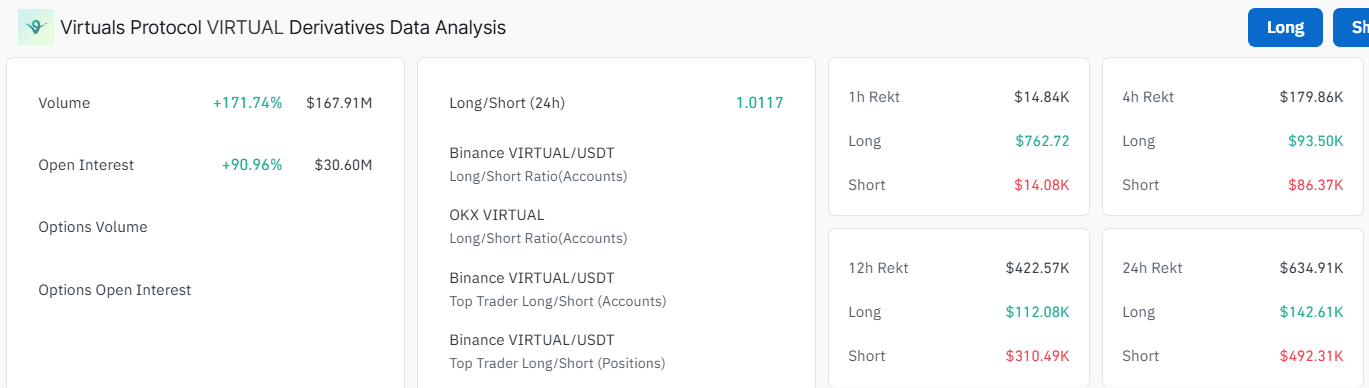

VIRTUAL crypto’s open hobby soars through 90%

The derivatives marketplace may be fuelling positive factors for VIRTUAL. At press time, VIRTUAL’s open hobby (OI) had surged through 90% to $30M. Moreover, by-product buying and selling volumes have been up through 171% to $167M.

Supply: Coinglass

Supply: Coinglass

The emerging OI amid the cost positive factors is a bullish signal suggesting by-product buyers are opening new positions on VIRTUAL. Then again, it would additionally lead to a spike in volatility.

Liquidations round VIRTUAL have additionally larger within the closing 24 hours to $634,000 at press time. Leveraged brief positions noticed $492,000 liquidations, which may have pushed additional positive factors for VIRTUAL crypto because of compelled purchasing.

AI cryptos lead marketplace positive factors

The AI crypto sector, at press time, had outperformed the remainder of the wider marketplace after the overall marketplace capitalization for AI Brokers cryptos surged through 18% in 24 hours to $7 billion in keeping with CoinMarketCap.

VIRTUAL now ranks because the second-largest AI Agent after Synthetic SuperIntelligence Alliance (FET). Its emerging dominance on this sector may bode smartly for the token’s long term positive factors.

Subsequent: FET crypto’s new burn mechanism: May just this gasoline a worth surge?