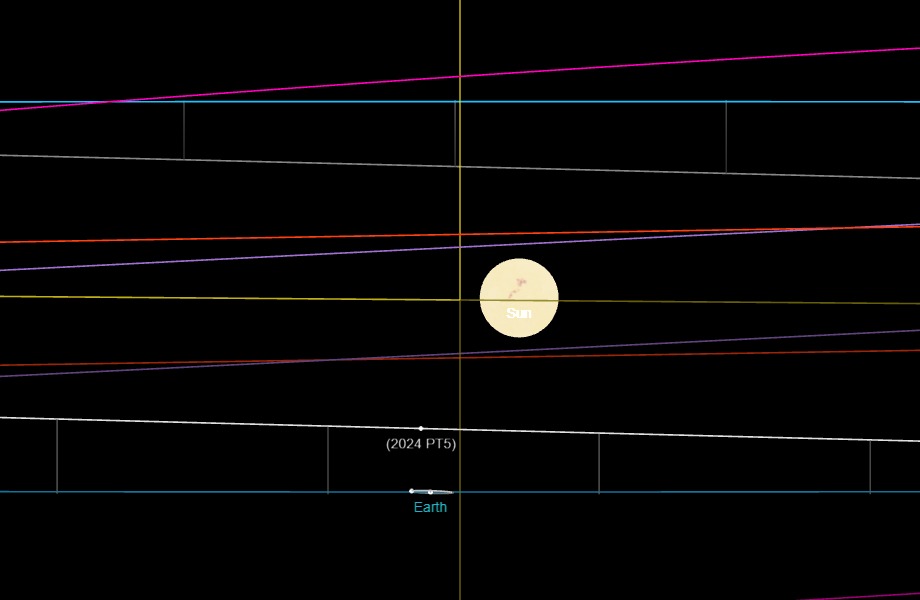

CBOE volatility index (VIX) weekly chartThe VIX has greater than doubled in price as of late, emerging to hit the 50.00 mark now. That is the best stage for the reason that pandemic and that is the most important day-to-day leap since February 2018, when there was once the entire fiasco involving the XIV and a broader marketplace selloff amid a rout within the bond marketplace on the time.Finally, the heightened studying we are seeing above speaks to the worry and angst this is gripping markets presently. For some time there, it appeared like we may’ve settled right into a length of low volatility. The VIX had earlier than this contact its lowest since earlier than the pandemic as traders had been feeling moderately assured about broader marketplace sentiment.How briefly the tables have became in only one week, eh?Feelings are working prime now and it is a testomony to that. The rout in equities will prevent when it stops. On the other hand, the renewed volatility signifies that it’s going to a minimum of take some time for the nerves to calm down once more. As for marketplace avid gamers, it method wanting a while to regain their grit and vigour within the temporary.That interprets to a probability that we will see a extra bumpy street in equities shifting ahead. No less than surely no longer the one-way site visitors within the first seven months this yr.

Volatility is again with a bang | Forexlive