This 12 months’s rally has in reality trusted seven shares that Wall Boulevard refers to as ‘The Magnificent Seven’: Apple, Amazon, Alphabet, NVDIA, Meta, Microsoft and Tesla

Michael M. Santiago/Getty Photographs

cover caption

toggle caption

Michael M. Santiago/Getty Photographs

This 12 months’s rally has in reality trusted seven shares that Wall Boulevard refers to as ‘The Magnificent Seven’: Apple, Amazon, Alphabet, NVDIA, Meta, Microsoft and Tesla

Michael M. Santiago/Getty Photographs

The 12 months began with numerous anxiousness a couple of possible recession, however it is finishing with Wall Boulevard on a tear. The S&P 500, a broad-based workforce of shares that comes with lots of the international’s greatest and best-known corporations, is up greater than 21% up to now this 12 months.

This is exceptional given how a lot the Federal Reserve has hiked rates of interest and what kind of uncertainty stays concerning the economic system. However the S&P 500’s features, eye-popping as they’re, have not been extensively shared — and that’s making some other folks anxious. In truth, because it seems, the S&P 500’s spectacular efficiency is in fact thank you virtually totally to only a handful of shares: “The Magnificent Seven,” as they’re referred to on Wall Boulevard. In combination, Apple, Amazon, Alphabet, NVIDIA, Meta, Microsoft, and Tesla are up round 70% 12 months so far. And when you have been to take them out of the S&P 500, the index can be up round 6%.

Over-dependence on the sort of slender set of shares may also be dangerous, leaving markets liable to a downturn if the fortunes of the Magnificent Seven have been to falter. Here is a take a look at those seven shares and the position they have got performed in markets up to now this 12 months. What are “The Magnificent Seven”? Michael Hartnett, Financial institution of The usa’s leader funding strategist, got here up with the moniker previous this 12 months. It is a nod to the Western from 1960, starring Yul Brynner and Steve McQueen. “I am a large fan of the movie,” he says.

A film poster for the 1960 vintage Western ‘The Magnificent Seven.’ Wall Boulevard has used the time period this 12 months to consult with a gaggle of 7 shares which might be noticed as having large benefit possible.

Film Poster Symbol Artwork / Contributor/Moviepix

cover caption

toggle caption

Film Poster Symbol Artwork / Contributor/Moviepix

A film poster for the 1960 vintage Western ‘The Magnificent Seven.’ Wall Boulevard has used the time period this 12 months to consult with a gaggle of 7 shares which might be noticed as having large benefit possible.

Film Poster Symbol Artwork / Contributor/Moviepix

In Would possibly, a couple of months after OpenAI debuted its ChatGPT software, Hartnett spotted buyers have been channeling their enthusiasm for synthetic intelligence right into a small basket of established tech corporations. NVIDIA, which is headquartered in Santa Clara, Calif., designs high-end microchips for the supercomputers that energy AI. This 12 months, it has outperformed Wall Boulevard’s expectancies many times, and its proportion value is up greater than 230%. Then there are Alphabet and Microsoft, two family names that experience their very own AI gear, Bard and Bing (Microsoft additionally invested $10 billion in OpenAI in January). Each have carried out strongly this 12 months, with Alphabet, the mum or dad corporate of Google, up virtually 50% this 12 months, whilst Microsoft is up 56%. However no longer each member of the Magnificent Seven suits well into the “AI frenzy” theme. Tesla is an automaker, after all, even though its CEO, Elon Musk, is fascinated about AI ventures.

“The truth of it’s those are very distinctive and distinct corporations you are speaking about,” says Eric Freedman, the executive funding officer within the asset control workforce at U.S. Financial institution. What unites them, he argues, is they’re all cutting edge. What position have they performed on this 12 months’s inventory markets? Harnett says he could not have predicted how smartly the Magnificent Seven would carry out over the process this 12 months. However, he notes, “they have been magnificent as a result of the entirety else used to be tragic.” Within the first part of 2023, considerations concerning the economic system, or what Hartnett calls “macro ambiguity,” forged a shadow over the inventory marketplace, and plenty of corporations could not break out it. The Federal Reserve hiked rates of interest aggressively, making the price of borrowing cash a lot more dear. Consequently, Wall Boulevard shied clear of banks and different monetary services and products corporations. And as loan charges rose, actual property funding trusts, or REITs, was much less common. Regardless that the Magnificent Seven aren’t utterly resistant to an atmosphere with upper rates of interest, they’re nonetheless situated to do higher than different corporations.

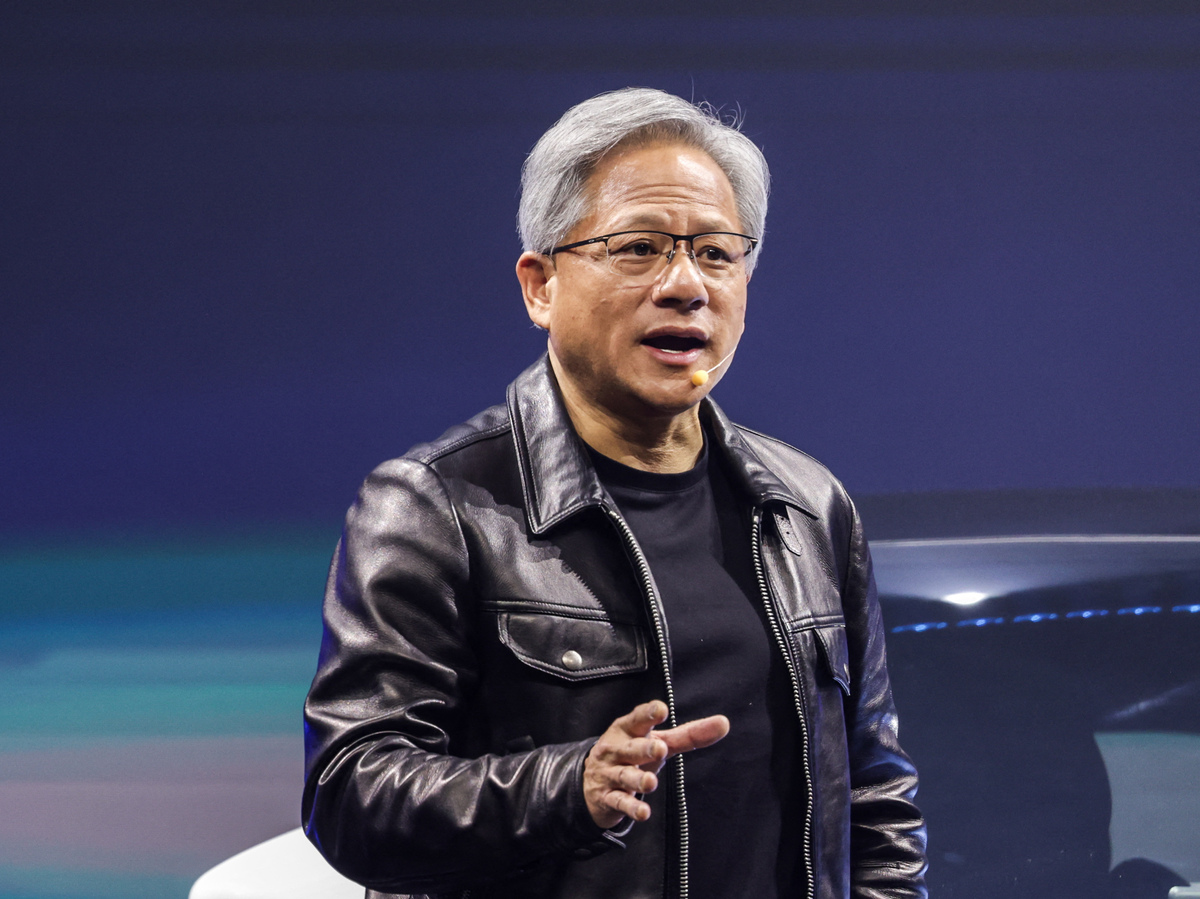

Jensen Huang, co-founder and CEO of NVIDIA, a chip maker, speaks all over the Hon Hai Tech Day in Taipei, Taiwan, on Oct. 18, 2023. NVIDIA stocks have surged this 12 months as buyers were desperate to wager on synthetic intelligence.

I-Hwa Cheng/AFP by the use of Getty Photographs

cover caption

toggle caption

I-Hwa Cheng/AFP by the use of Getty Photographs

Jensen Huang, co-founder and CEO of NVIDIA, a chip maker, speaks all over the Hon Hai Tech Day in Taipei, Taiwan, on Oct. 18, 2023. NVIDIA stocks have surged this 12 months as buyers were desperate to wager on synthetic intelligence.

I-Hwa Cheng/AFP by the use of Getty Photographs

No longer handiest are the seven shares noticed as having giant benefit possible, in addition they have relatively wholesome steadiness sheets. Each and every of them sits on tens of billions of bucks in money. That is a bonus when borrowing prices upward push, given the Magnificent Seven can finance their very own enlargement with out taking over debt. The seven shares also are established companies — pillars of nowadays’s international economic system. That is made Wall Boulevard assured they may not lose their marketplace proportion and that they are able to climate an financial downturn. What are the dangers of getting the sort of restricted driving force of features? A inventory marketplace rally that’s not broad-based can backfire, in step with Hartnett. “Slender, concentrated markets are at all times prone,” he warns. A large, exogenous surprise — a recession or any other pandemic or one thing worse — can be extremely painful as a result of maximum buyers these days personal inventory in a minimum of one of the most Magnificent Seven.

Some other chance is that those corporations, which many buyers say are already richly valued or dear, may transform overrated, elevating fears of a bubble that would burst. Hartnett has been fascinated by what took place within the overdue Nineties, when the inventory marketplace’s features have been pushed by means of any other small basket of giant tech corporations: Cisco, Dell, Intel and Microsoft. Wall Boulevard nicknamed that workforce “The 4 Horsemen,” and the promise of the Web again then drove the ones shares upper — so excessive that the features in the end fueled a marketplace frenzy. Buyers purchased into a wide variety of Web-related, speculative start-ups akin to Pets.com. “And you know the way that grew to become out,” Hartnett jokes. What resulted used to be one of the crucial widely recognized crashes in marketplace historical past, when the dot.com bubble burst in 2000. Nonetheless, analysts warning it’s too early to make significant comparisons. Consistent with Freedman, the Magnificent Seven corporations are sturdier, and their industry fashions are extra various — even though he recognizes the dangers of marketplace features tied to at least one tale — on this case, AI. “As any individual who resided in San Francisco, California, in March of 2000, used to be operating within the business, I might say that this isn’t an atmosphere that we predict is a right away parallel,” Freedman says. “However we unquestionably may get to that time.” Will this proceed? Irrespective of how one feels about AI’s possible to grow to be the arena, even the Magnificent Seven are not immune to greater financial forces. Analysts say that, for this bull marketplace to proceed, extra shares want to enroll in the Magnificent Seven — and that may rely in large part at the economic system and whether or not the Federal Reserve can get inflation right down to its 2% goal with out triggering a recession. In contemporary weeks, buyers have grown extra positive that there can be a “cushy touchdown” — a situation wherein the Fed is in a position to carry down inflation with out triggering a recession.

That is elevating some hope that the rally may develop out by means of subsequent 12 months, easing the marketplace’s dependence at the Magnificent Seven, a construction that many buyers would welcome.