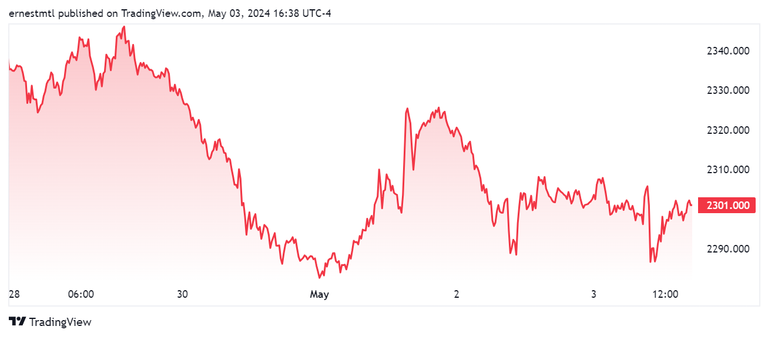

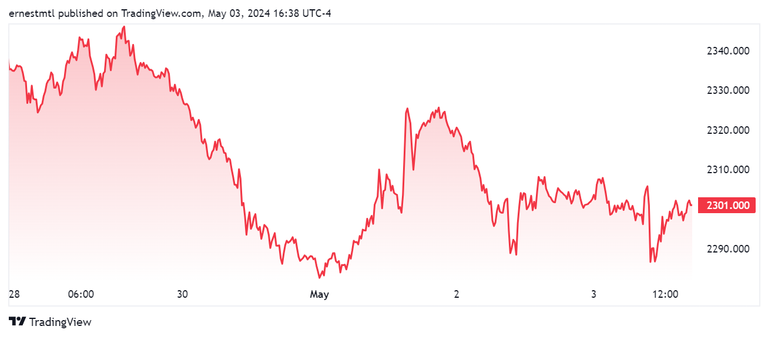

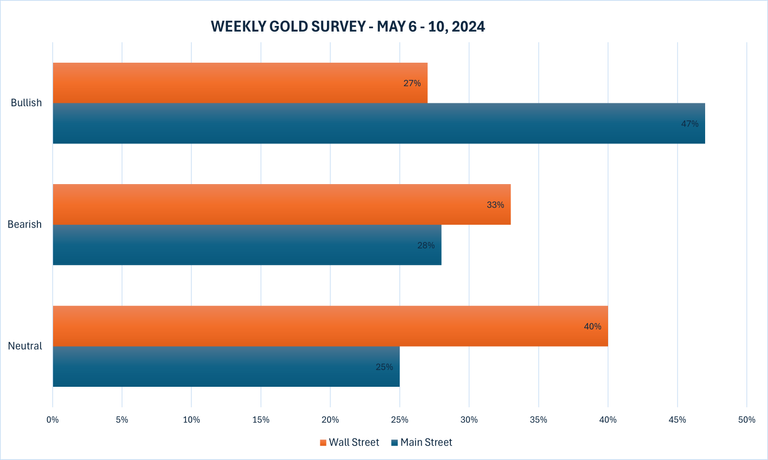

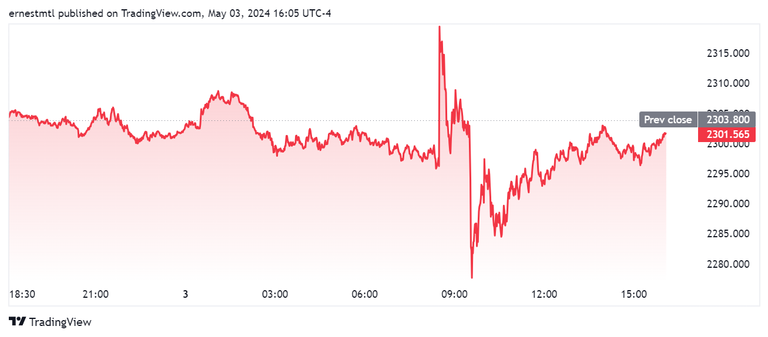

(Kitco Information) – The gold marketplace had lots to digest this week, with production and services and products sector information, nonfarm payrolls, and the FOMC charge resolution, and whilst treasured metals costs did see a spice up from the Fed that successfully dominated out a hike and left room for a minimize in Q2, the full trajectory was once down as Asian call for cooled fairly and Mideast tensions fell off the entrance pages altogether.After opening the week above $2,335 in step with ounce, spot gold two times failed to carry above $2,340 on Monday, and by means of the afternoon, it had begun its stable slog downward, hitting a weekly low underneath $2,283 at precisely midday Wednesday.Then sure momentum returned to the marketplace, and the discharge of the Federal Reserve’s rate of interest announcement and Fed Chair Powell’s press convention within the afternoon introduced gold again above $2,325 in step with ounce.However after a 2nd try to breach that stage, bullish momentum dissipated as soon as once more, and markets noticed gold slide backpedal to enhance round $2,300 in step with ounce, the place aside from the occasional check of $2,290, it languished for the remainder of the week. The most recent Kitco Information Weekly Gold Survey has mavens as pessimistic as they’ve been in a while about gold’s near-term potentialities, whilst maximum retail buyers nonetheless see gold costs falling or reducing sideways.FXTM Senior Analysis Analyst Lukman Otunuga stated the alerts are bearish for bullion within the coming days. “Gold costs are flashing purple, surrendering preliminary features from the downbeat US jobs record,” he famous.Adrian Day, President of Adrian Day Asset Control, was once amongst those that nonetheless imagine in gold for the approaching week.“Gold’s resilience within the face of delays in reducing charges, by means of the Federal Reserve essentially in addition to another central banks, is strong and telling,” Day stated. “Whoever is purchasing gold – and we all know that it’s essentially world central banks and Chinese language savers – is purchasing for causes as opposed to the standard macro-economic elements that will result in the next gold value. This purchasing is in large part value agnostic, and more likely to proceed.”Marc Chandler, Managing Director at Bannockburn International the Forex market, sees the stability of near-term buying and selling tilted to the disadvantage subsequent week, as he expects to peer Asian call for dialing again.“Gold consolidated in fresh days and the important thing factor is whether or not this can be a consolidation trend or a bottoming formation,” he stated. “I think the yellow steel could have every other leg decrease towards $2250-60.”Chandler stated stepped forward enhance for the yuan might additional melt Chinese language retail call for for gold. “Additionally be aware that HK shares and mainland shares that business in HK have exploded for the previous week and a part and this will scale back the urgency of in quest of the protection of gold for some buyers,” he added. “The restoration of the yen might also gradual the native call for.”For his section, Adam Button, Head of Forex Technique at Forexlive.com, expects Chinese language call for to pick out up after home buyers go back in drive.“China is again from vacation subsequent week and can most probably resume purchasing,” he stated.This week, 15 Wall Boulevard analysts participated within the Kitco Information Gold Survey, and after two weeks of downward consolidation, maximum see gold sliding additional within the close to time period. Best 4 mavens, or 27%, anticipated to peer gold costs climb greater subsequent week, whilst 5 analysts, representing 33%, predicted a worth drop. Six mavens, or 40% of respondents, see gold proceeding to business sideways.In the meantime, 217 votes had been forged in Kitco’s on-line ballot, with just a minority of Primary Boulevard buyers anticipating costs to transport greater within the close to time period. 102 retail buyers, representing 47%, seemed for gold to upward push subsequent week. Some other 61, or 28%, predicted it could be decrease, whilst 54 respondents, or 25%, be expecting the dear steel to pattern sideways within the week forward.

The most recent Kitco Information Weekly Gold Survey has mavens as pessimistic as they’ve been in a while about gold’s near-term potentialities, whilst maximum retail buyers nonetheless see gold costs falling or reducing sideways.FXTM Senior Analysis Analyst Lukman Otunuga stated the alerts are bearish for bullion within the coming days. “Gold costs are flashing purple, surrendering preliminary features from the downbeat US jobs record,” he famous.Adrian Day, President of Adrian Day Asset Control, was once amongst those that nonetheless imagine in gold for the approaching week.“Gold’s resilience within the face of delays in reducing charges, by means of the Federal Reserve essentially in addition to another central banks, is strong and telling,” Day stated. “Whoever is purchasing gold – and we all know that it’s essentially world central banks and Chinese language savers – is purchasing for causes as opposed to the standard macro-economic elements that will result in the next gold value. This purchasing is in large part value agnostic, and more likely to proceed.”Marc Chandler, Managing Director at Bannockburn International the Forex market, sees the stability of near-term buying and selling tilted to the disadvantage subsequent week, as he expects to peer Asian call for dialing again.“Gold consolidated in fresh days and the important thing factor is whether or not this can be a consolidation trend or a bottoming formation,” he stated. “I think the yellow steel could have every other leg decrease towards $2250-60.”Chandler stated stepped forward enhance for the yuan might additional melt Chinese language retail call for for gold. “Additionally be aware that HK shares and mainland shares that business in HK have exploded for the previous week and a part and this will scale back the urgency of in quest of the protection of gold for some buyers,” he added. “The restoration of the yen might also gradual the native call for.”For his section, Adam Button, Head of Forex Technique at Forexlive.com, expects Chinese language call for to pick out up after home buyers go back in drive.“China is again from vacation subsequent week and can most probably resume purchasing,” he stated.This week, 15 Wall Boulevard analysts participated within the Kitco Information Gold Survey, and after two weeks of downward consolidation, maximum see gold sliding additional within the close to time period. Best 4 mavens, or 27%, anticipated to peer gold costs climb greater subsequent week, whilst 5 analysts, representing 33%, predicted a worth drop. Six mavens, or 40% of respondents, see gold proceeding to business sideways.In the meantime, 217 votes had been forged in Kitco’s on-line ballot, with just a minority of Primary Boulevard buyers anticipating costs to transport greater within the close to time period. 102 retail buyers, representing 47%, seemed for gold to upward push subsequent week. Some other 61, or 28%, predicted it could be decrease, whilst 54 respondents, or 25%, be expecting the dear steel to pattern sideways within the week forward. Subsequent week will likely be some of the lightest of the yr for financial information releases. The principle highlights, corresponding to they’re, will likely be Wednesday’s 10-year bond public sale, the Financial institution of England’s financial coverage resolution and the Treasury’s 30-year bond public sale on Thursday, and the Friday free up of Initial College of Michigan shopper sentiment.Chandler famous the absence of main signs at the docket for subsequent week, and stated he’ll be gazing the sovereign bond marketplace for clues available on the market’s attainable route. “After the FOMC and jobs information, subsequent week seems to be quiet, however massive Tsy provide with expenses and quarterly refunding,” he stated. Darin Newsom, Senior Marketplace Analyst at Barchart.com, was once reflecting in this week’s bumper crop of monetary signs.“I do not believe we discovered anything else we did not already know in regards to the U.S. economic system,” Newsom stated. “The important thing takeaway for me this week is that the per 30 days employment information is exactly for leisure functions, and now not data. It is simply hilarious to look at it pop out each and every month and be masses of hundreds off from the quote-unquote mavens’ evaluations on what it will have to be.”“It’s an excessively high-profile recreation of pin the tail at the donkey, and no person performs it really well.”Newsom stated that different issues are revealing the actual state of the economic system. “There are some cracks appearing up within the U. S. economic system, in the end, that have not been in position for relatively a while,” he stated. “We noticed Starbucks profits are available in, and what was once attention-grabbing about Starbucks is it wasn’t simply gross sales had been down as a result of the upper value of the commodity itself, given the hot rally in espresso. It was once precise gross sales, folks within the door that had been down. U.S. shoppers would possibly if truth be told have began to switch a few of their behavior and reducing that six- to eight-dollar cup of espresso out each and every morning.”Some other signal that the U.S. shopper is also weakening was once the steep decline in call for for boxed pork remaining month. “We noticed a pointy drop-off there at a time when those markets most often are going up as outlets are purchasing forward of the summer season grilling season, the largest call for time of the yr,” Newsom stated. “Are U.S. shoppers in the end beginning to tighten the belt after years of everybody telling them how horrible the location was once? Have they in the end began tightening the belt to the place they are reducing out that tumbler of espresso on a daily basis, the place they are now not purchasing the pricy cuts of meat?”“Those to me had been the 2 key issues that we noticed this week,” he stated. “The whole thing else simply have compatibility with what we already knew: there is nonetheless inflation, either side of the aisle are going to argue, it is bullish, it is bearish, no matter. However our reads on what a few of these key shopper markets are doing, I feel it is extra essential.”As for what all this implies for the gold marketplace, Newsom sees some exhaustion at the facet of the bulls, which he thinks is comprehensible given gold’s fresh run-up.“June gold is with reference to completing off its non permanent downtrend noon Friday,” he stated. “This implies a bullish technical reversal is imaginable both nowadays or Monday. The marketplace is technically oversold non permanent as neatly.”“The quick-term drawback goal continues to be $2,268 with June sitting close to $2,300 Friday.”Newsom when put next gold’s present place to every other in style commodity. “I indubitably cannot make a pleasant sizzling cup of it, however to me, it rings a bell in my memory of cocoa,” he stated. “Cocoa ran up so excessive on elementary elements that it ran out of patrons and has collapsed.”“Gold went to new all-time highs,” Newsom famous. “And whilst there is all the time going to be Center East pressure, there is all the time going to be some kind of foreign money questions around the globe, and inflation hasn’t long gone away, it merely ran out of patrons. There was once a vacuum beneath the marketplace, which is why when it in the end gave some non permanent technical alerts that had been bearish, it indubitably appears to be what is performed out [earlier this week].”He underlined, then again, that there are nonetheless quite a few medium and longer-term elements supporting gold call for.“We nonetheless have inflation,” he stated. “It nonetheless looks as if rates of interest are going to be minimize once or more this yr, that are meant to weaken the U.S. greenback and will have to create extra of an inflationary setting. And the Center East is not going away. As I have stated for relatively a while, the nearer the U.S. will get to its subsequent election, the extra chaos around the globe we are going to proceed to peer in hopes of swaying the election somehow. So gold’s nonetheless going to be the play. I feel it’ll in finding some patrons down right here, I feel the algorithms are going to sit back in.”Taking all of this under consideration, Newsom stated that the long-term outlook for gold hasn’t modified. “It is nonetheless most probably the most productive hedge towards the entirety that is happening,” he stated. “It simply had to take a breather and hit a vacuum the place there wasn’t as a lot purchasing hobby.”And Kitco Senior Analyst Jim Wyckoff stated the technical image nonetheless helps excessive gold costs subsequent week. “Stable-higher as charts stay total bullish,” he stated.Spot gold remaining traded at $2,301.56 in step with ounce on the time of writing, down 0.10% at the day and down 1.56% at the week.

Subsequent week will likely be some of the lightest of the yr for financial information releases. The principle highlights, corresponding to they’re, will likely be Wednesday’s 10-year bond public sale, the Financial institution of England’s financial coverage resolution and the Treasury’s 30-year bond public sale on Thursday, and the Friday free up of Initial College of Michigan shopper sentiment.Chandler famous the absence of main signs at the docket for subsequent week, and stated he’ll be gazing the sovereign bond marketplace for clues available on the market’s attainable route. “After the FOMC and jobs information, subsequent week seems to be quiet, however massive Tsy provide with expenses and quarterly refunding,” he stated. Darin Newsom, Senior Marketplace Analyst at Barchart.com, was once reflecting in this week’s bumper crop of monetary signs.“I do not believe we discovered anything else we did not already know in regards to the U.S. economic system,” Newsom stated. “The important thing takeaway for me this week is that the per 30 days employment information is exactly for leisure functions, and now not data. It is simply hilarious to look at it pop out each and every month and be masses of hundreds off from the quote-unquote mavens’ evaluations on what it will have to be.”“It’s an excessively high-profile recreation of pin the tail at the donkey, and no person performs it really well.”Newsom stated that different issues are revealing the actual state of the economic system. “There are some cracks appearing up within the U. S. economic system, in the end, that have not been in position for relatively a while,” he stated. “We noticed Starbucks profits are available in, and what was once attention-grabbing about Starbucks is it wasn’t simply gross sales had been down as a result of the upper value of the commodity itself, given the hot rally in espresso. It was once precise gross sales, folks within the door that had been down. U.S. shoppers would possibly if truth be told have began to switch a few of their behavior and reducing that six- to eight-dollar cup of espresso out each and every morning.”Some other signal that the U.S. shopper is also weakening was once the steep decline in call for for boxed pork remaining month. “We noticed a pointy drop-off there at a time when those markets most often are going up as outlets are purchasing forward of the summer season grilling season, the largest call for time of the yr,” Newsom stated. “Are U.S. shoppers in the end beginning to tighten the belt after years of everybody telling them how horrible the location was once? Have they in the end began tightening the belt to the place they are reducing out that tumbler of espresso on a daily basis, the place they are now not purchasing the pricy cuts of meat?”“Those to me had been the 2 key issues that we noticed this week,” he stated. “The whole thing else simply have compatibility with what we already knew: there is nonetheless inflation, either side of the aisle are going to argue, it is bullish, it is bearish, no matter. However our reads on what a few of these key shopper markets are doing, I feel it is extra essential.”As for what all this implies for the gold marketplace, Newsom sees some exhaustion at the facet of the bulls, which he thinks is comprehensible given gold’s fresh run-up.“June gold is with reference to completing off its non permanent downtrend noon Friday,” he stated. “This implies a bullish technical reversal is imaginable both nowadays or Monday. The marketplace is technically oversold non permanent as neatly.”“The quick-term drawback goal continues to be $2,268 with June sitting close to $2,300 Friday.”Newsom when put next gold’s present place to every other in style commodity. “I indubitably cannot make a pleasant sizzling cup of it, however to me, it rings a bell in my memory of cocoa,” he stated. “Cocoa ran up so excessive on elementary elements that it ran out of patrons and has collapsed.”“Gold went to new all-time highs,” Newsom famous. “And whilst there is all the time going to be Center East pressure, there is all the time going to be some kind of foreign money questions around the globe, and inflation hasn’t long gone away, it merely ran out of patrons. There was once a vacuum beneath the marketplace, which is why when it in the end gave some non permanent technical alerts that had been bearish, it indubitably appears to be what is performed out [earlier this week].”He underlined, then again, that there are nonetheless quite a few medium and longer-term elements supporting gold call for.“We nonetheless have inflation,” he stated. “It nonetheless looks as if rates of interest are going to be minimize once or more this yr, that are meant to weaken the U.S. greenback and will have to create extra of an inflationary setting. And the Center East is not going away. As I have stated for relatively a while, the nearer the U.S. will get to its subsequent election, the extra chaos around the globe we are going to proceed to peer in hopes of swaying the election somehow. So gold’s nonetheless going to be the play. I feel it’ll in finding some patrons down right here, I feel the algorithms are going to sit back in.”Taking all of this under consideration, Newsom stated that the long-term outlook for gold hasn’t modified. “It is nonetheless most probably the most productive hedge towards the entirety that is happening,” he stated. “It simply had to take a breather and hit a vacuum the place there wasn’t as a lot purchasing hobby.”And Kitco Senior Analyst Jim Wyckoff stated the technical image nonetheless helps excessive gold costs subsequent week. “Stable-higher as charts stay total bullish,” he stated.Spot gold remaining traded at $2,301.56 in step with ounce on the time of writing, down 0.10% at the day and down 1.56% at the week. Disclaimer: The perspectives expressed on this article are the ones of the creator and would possibly not replicate the ones of Kitco Metals Inc. The creator has made each and every effort to make sure accuracy of knowledge equipped; then again, neither Kitco Metals Inc. nor the creator can ensure such accuracy. This newsletter is exactly for informational functions most effective. It’s not a solicitation to make any trade in commodities, securities or different monetary tools. Kitco Metals Inc. and the creator of this text don’t settle for culpability for losses and/ or damages coming up from using this e-newsletter.

Disclaimer: The perspectives expressed on this article are the ones of the creator and would possibly not replicate the ones of Kitco Metals Inc. The creator has made each and every effort to make sure accuracy of knowledge equipped; then again, neither Kitco Metals Inc. nor the creator can ensure such accuracy. This newsletter is exactly for informational functions most effective. It’s not a solicitation to make any trade in commodities, securities or different monetary tools. Kitco Metals Inc. and the creator of this text don’t settle for culpability for losses and/ or damages coming up from using this e-newsletter.

Wall Boulevard joins Primary Boulevard within the endure cave for subsequent week as gold’s value momentum wanes