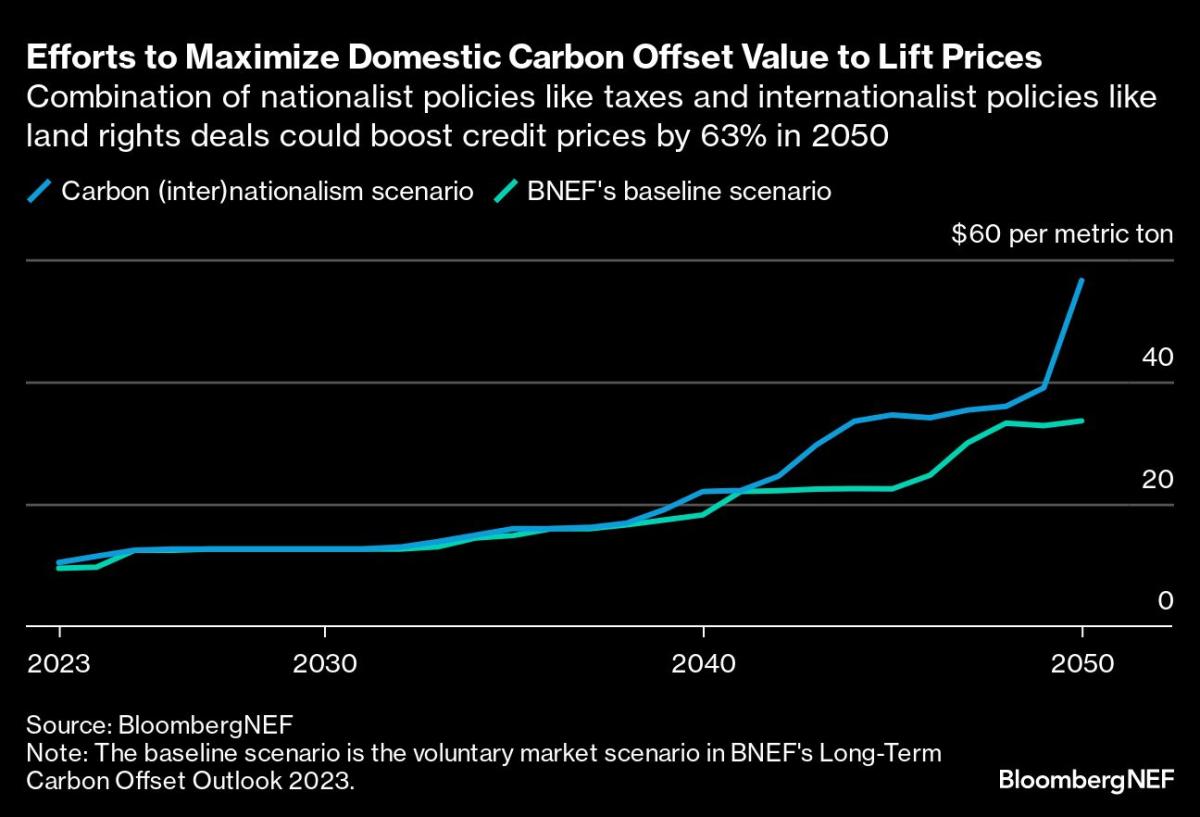

(Bloomberg) — Because the carbon offset marketplace will get a brand new rent on existence from the COP28 local weather summit in Dubai, bankers from Wall Boulevard and the Town of London are positioning themselves to get a piece of the dealmaking they are saying is coming.Maximum Learn from BloombergBanks which were increase carbon buying and selling and finance desks come with Goldman Sachs Workforce Inc., Citigroup Inc., JPMorgan Chase & Co. and Barclays Plc. They’re having a look to finance the advance of carbon sequestration initiatives, to industry credit and to advise company purchasers purchasing offsets. They’re additionally willing to enhance native initiatives in rising markets that these days lack the monetary clout to scale up their paintings.“A large number of challenge builders don’t have massive steadiness sheets and feature issue elevating cash,” mentioned Sonia Battikh, Citi’s world head of carbon offsets buying and selling. “Understanding the best way to bridge that financing hole and channel cash to initiatives is the place a financial institution like Citi can play a task.”Wall Boulevard is racing to get a foothold in a marketplace that has the possible to achieve up to $1 trillion, as offsets be offering some way for firms to hit internet 0 with out in reality getting rid of all their emissions. Wealthy Gilmore, the executive govt of funding supervisor Carbon Enlargement Companions, mentioned it’s already transparent there’ll quickly be an acute under-supply of top of the range credit, given the call for.Towards that backdrop, “the Wall Boulevard giants will wish to steadiness pace to marketplace with a deep working out of the principles, norms and expectancies” of the way the voluntary carbon marketplace is evolving, he mentioned.For now, it’s a marketplace that’s nonetheless looking to emerge from an extended listing of controversies.Tale continuesMany of the credit generated have drawn complaint from local weather scientists for his or her ostensible failure to are living as much as the environmental claims made via the ones promoting them. Ultimate month, the executive govt of South Pole — the arena’s largest supplier of carbon offsets — stepped down as the corporate pledged to appear into allegations of greenwashing and “be told from the enjoy.”Bankers learning the marketplace say such episodes can’t be allowed to erode self belief one day of carbon offsetting. “It might be a disgrace if the complaint, despite the fact that well-meaning, undermines cash flows to those initiatives,” mentioned Kiru Rajasingam, head of Ecu energy, gasoline and emissions buying and selling at Citi.And talking on the COP28 summit in Dubai, John Kerry, US local weather negotiator, described himself as “a company believer within the energy of carbon markets to power ambition and motion.”Ingmar Grebien, who runs the Commodities Sustainable Answers unit at Goldman Sachs, mentioned the markets he appears to be like at “stay fragmented and of their infancy in relation to potency and transparency.”At Goldman, which employed former Gazprom govt Leigh Smith final 12 months with a remit that incorporates buying and selling carbon credit, the “focal point is on increasing buying and selling and financing answers throughout sustainable commodities corresponding to carbon, renewables and different nascent environmental merchandise,” Grebien mentioned.JPMorgan employed its first dealer for voluntary credit in Houston previous this 12 months, in line with an individual acquainted with the subject who requested to not be named discussing knowledge they’re now not approved to expose. A JPMorgan spokesperson, who declined to call the brand new rent, mentioned the company is “including carbon buying and selling functions.”The largest US financial institution provides buying and selling in carbon credit along side capital, advisory and market-making services and products. It’s an “more and more vital” house of focal point for JPMorgan, the spokesperson mentioned.For some, the arriving of worldwide banks in a marketplace that has but to be correctly regulated marks a being worried construction.“After a 12 months of revelations about how terrible the voluntary woodland carbon initiatives were,” it’s “superb persons are once more announcing we’d like this and not using a entire overhaul,” mentioned Michael Sheren, a former senior adviser on the Financial institution of England who’s now a fellow on the Cambridge Institute for Sustainability Management.“The VCM is sort of a multi-headed serpent that rose once more at COP28,” he mentioned.Even though local weather scientists have lengthy warned towards depending on offsets to succeed in internet 0 emissions, in addition they recognize that such merchandise are crucial in terms of tackling residual emissions in hard-to-abate sectors.Restricting world warming to one.5C above pre-industrial ranges “calls for vital carbon discounts,” Carbon Direct, a carbon control company, mentioned in its annual file. The voluntary carbon marketplace “is a very powerful instrument in bringing carbon dioxide answers to scale,” it mentioned.And within the title of exorcising the ghosts of the previous, a brand new generation of collaboration took grasp right through the primary week of COP28. The largest voluntary carbon usual setters agreed to align best possible practices and enhance transparency, whilst key organizations plan to ascertain a complete integrity framework for carbon crediting systems.The United States Commodities Futures Buying and selling Fee, which regulates derivatives markets, used the COP28 summit to unveil requirements for prime integrity carbon offsets futures buying and selling. United Countries officers on the talks in Dubai are anticipated to announce new guardrails across the voluntary carbon marketplace that will probably be in line with pointers drafted via professionals final month.And with the COP28 summit now in its ultimate stretch, carbon fans will probably be scanning for any breakthroughs in finalizing the principles for a carbon marketplace overseen via the United Countries. Beneath Article 6 of the 2015 Paris Local weather Settlement, countries agreed to paintings towards a brand new world machine of exchanging allowances overlaying greenhouse gases.Voluntary carbon credit “aren’t going to unravel the local weather disaster,” Rajasingam mentioned. “However on the similar time, we don’t need treasured initiatives to head unfunded as a result of reputational stigma.”For now, carbon costs are at ancient lows. Ultimate 12 months noticed a 12% stoop in call for, with an additional 5% decline noticed in 2023, in line with BloombergNEF.“However the elementary drivers underpinning call for haven’t modified,” BNEF’s Layla Khanfar wrote in a contemporary analysis word.Drivers come with the mere proven fact that many corporations won’t be able to fulfill internet 0 objectives with out the use of offsets, along side the chance of nationwide restrictions. Such dynamics set the level for a substantial value bump via mid-century, BNEF estimates.How Do Offsets Paintings:The purpose of the voluntary carbon offset marketplace is to generate carbon credit, which can be then in most cases purchased via corporations to offset their emissions. A carbon credit score is a paper safety that’s intended to constitute one ton of CO2 decreased or got rid of from the ambience, generated via initiatives like wind farms or planting timber. Undertaking builders crew up with middlemen corresponding to South Pole to promote the credit. Consumers can industry the devices or use them to offset their very own emissions, by which case they will have to retire the credit score to steer clear of it getting used two times.Citi’s carbon markets crew these days is composed of 4 investors primarily based in London and 4 gross sales other folks overlaying the voluntary carbon marketplace. Barclays employed an business veteran from Shell Plc, Oliver Morning, to run its carbon buying and selling operations, Bloomberg reported final month.Some of the lengthy listing of unknowns surrounding the carbon offset marketplace is the part of technological innovation, which would possibly all of sudden turbo-charge the sector of carbon removals. That may make probably the most challenge finance really feel extra like “mission capital-style possibility,” Rajasingam mentioned.“Carbon credit are best possible when costs and methodologies are established, and now not for applied sciences which are nonetheless rising,” he mentioned. “That mentioned, we intend to be very actively concerned about removals when it scales.”Michael R. Bloomberg, the founder and majority proprietor of Bloomberg LP, dad or mum corporate of Bloomberg Information, is the UN secretary normal’s particular envoy for local weather ambition and answers. Bloomberg Philanthropies frequently companions with the COP Presidency to advertise local weather motion.Bloomberg LP, the dad or mum of Bloomberg Information, companions with South Pole to buy carbon credit to offset world go back and forth emissions.(Provides context from COP28 talks in twenty first paragraph.)Maximum Learn from Bloomberg Businessweek©2023 Bloomberg L.P.

Wall Boulevard Will get In a position to Money In on $1 Trillion Local weather Marketplace