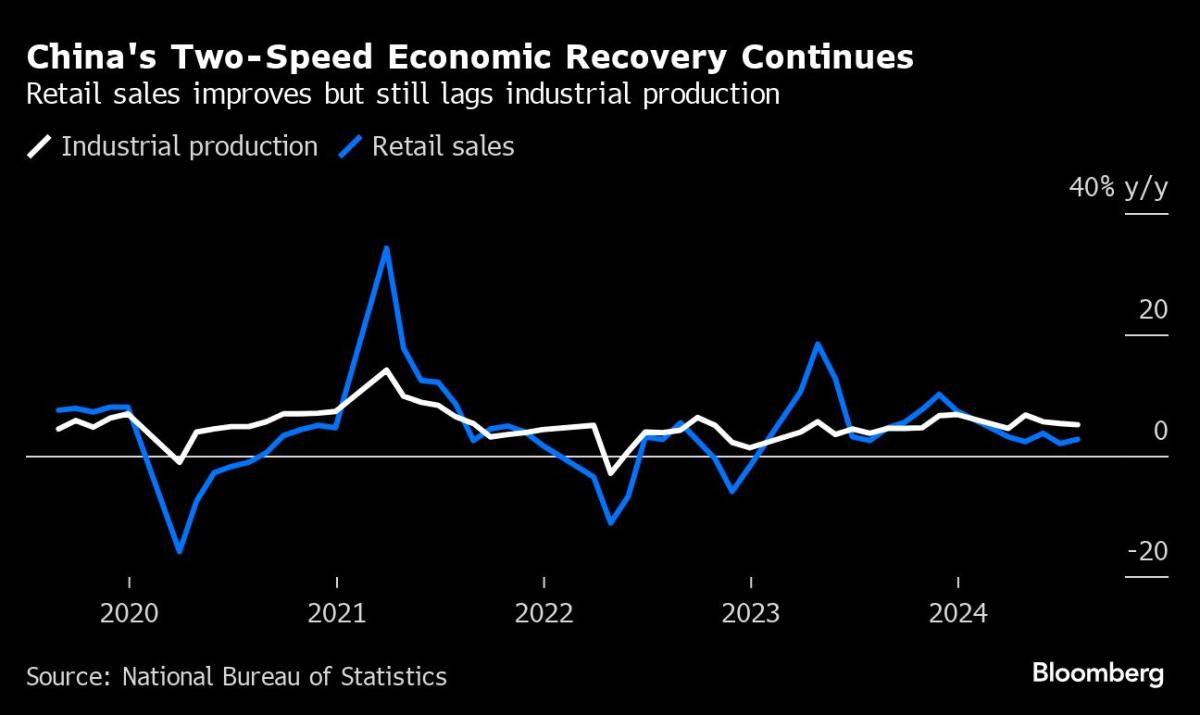

(Bloomberg) — Walmart Inc. is looking for to boost up to $3.74 billion by means of promoting its stake in Chinese language e-commerce company JD.com Inc., finishing an eight-year partnership in a key retail area now plagued by means of an financial downturn and intense festival.Maximum Learn from BloombergThe US store is providing 144.5 million stocks in a $24.85 to $25.85 worth vary, other people aware of the subject stated. Morgan Stanley is the broker-dealer dealing with the providing, they added, asking to not be recognized for the reason that knowledge is personal. That’s a cut price of up to 11.8% to Tuesday’s shut, in step with Bloomberg calculations.JD.com’s Hong Kong-listed stocks fell 11%, main a broader selloff in Chinese language e-commerce and tech shares. The envisioned deal comes as Walmart refines its technique on the planet’s second-largest economic system, the place retail is ruled by means of on-line platforms similar to Alibaba Workforce Preserving Ltd. and Temu-owner PDD Holdings Inc. The deal comes as a belongings disaster, marketplace volatility and unsure activity possibilities take a toll on Chinese language intake.Representatives for Walmart, JD.com and Morgan Stanley didn’t instantly reply to requests for remark.Walmart’s Sam’s Membership has been an extraordinary shiny mild for the corporate. In China, the unit gives top rate items with a club fashion and has been a good fortune within the grocery store industry. Then again, the corporate’s different shops are suffering as competitors chase cash-strapped consumers.Ultimate week, Alibaba — lengthy a barometer for the trade — shocked buyers when it published its primary trade industry in reality shrank within the June quarter.The patron surroundings usually is worsening and enlargement is evaporating given the industrial uncertainty. JD.com’s June-quarter effects beat expectancies — even if earnings grew a trifling 1.2%. That prolonged a string of single-digit quarters relationship again to 2022, a length of malaise that’s halved its marketplace worth because the get started of remaining 12 months.The proportion sale would mark the top of a partnership between the 2 firms that began when Walmart got a 5% stake within the Chinese language corporate in 2016.That deal additionally concerned JD.com taking on Walmart’s Yihaodian on-line market, which excited about promoting groceries to higher-end feminine consumers in primary Chinese language towns, the corporations stated then. Later that 12 months, Walmart larger its holdings in JD.com to ten.8%.–With the aid of Edwin Chan and Daniela Wei.Tale continues(Updates with Hong Kong stocks in 3rd paragraph)Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Walmart Is In quest of As much as $3.74 Billion in Sale of JD.com Stake