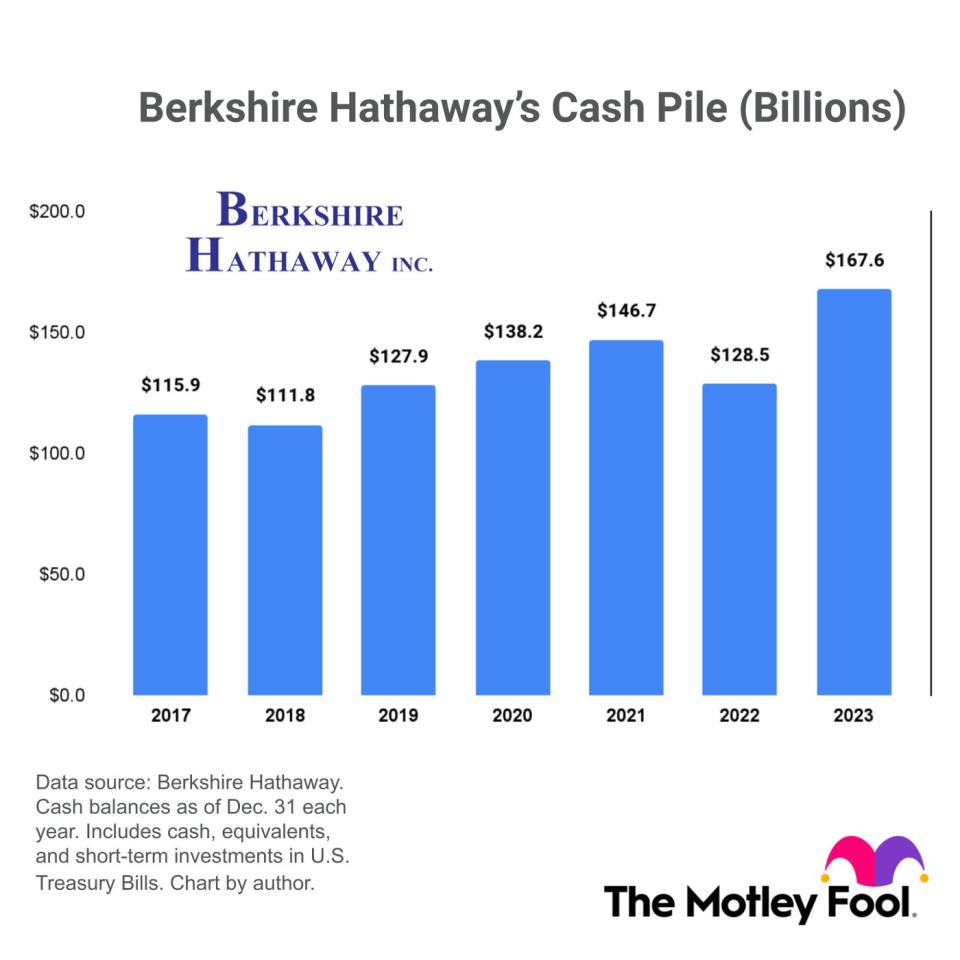

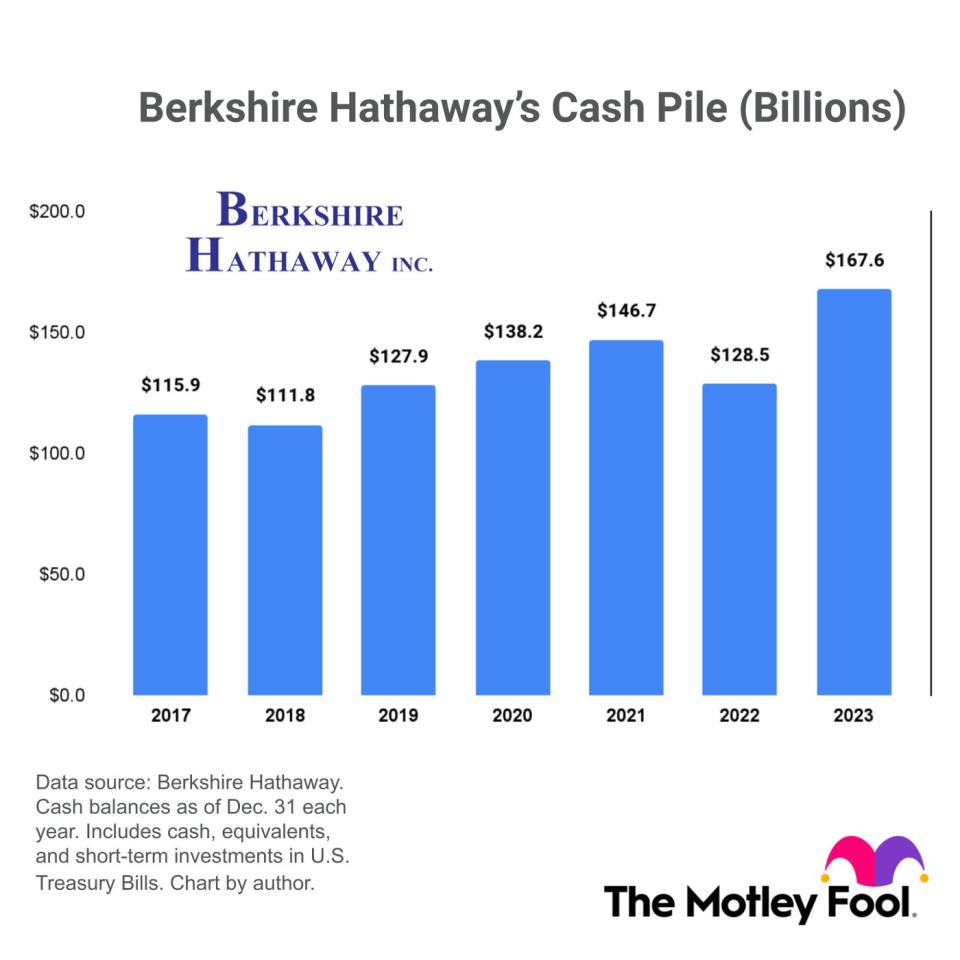

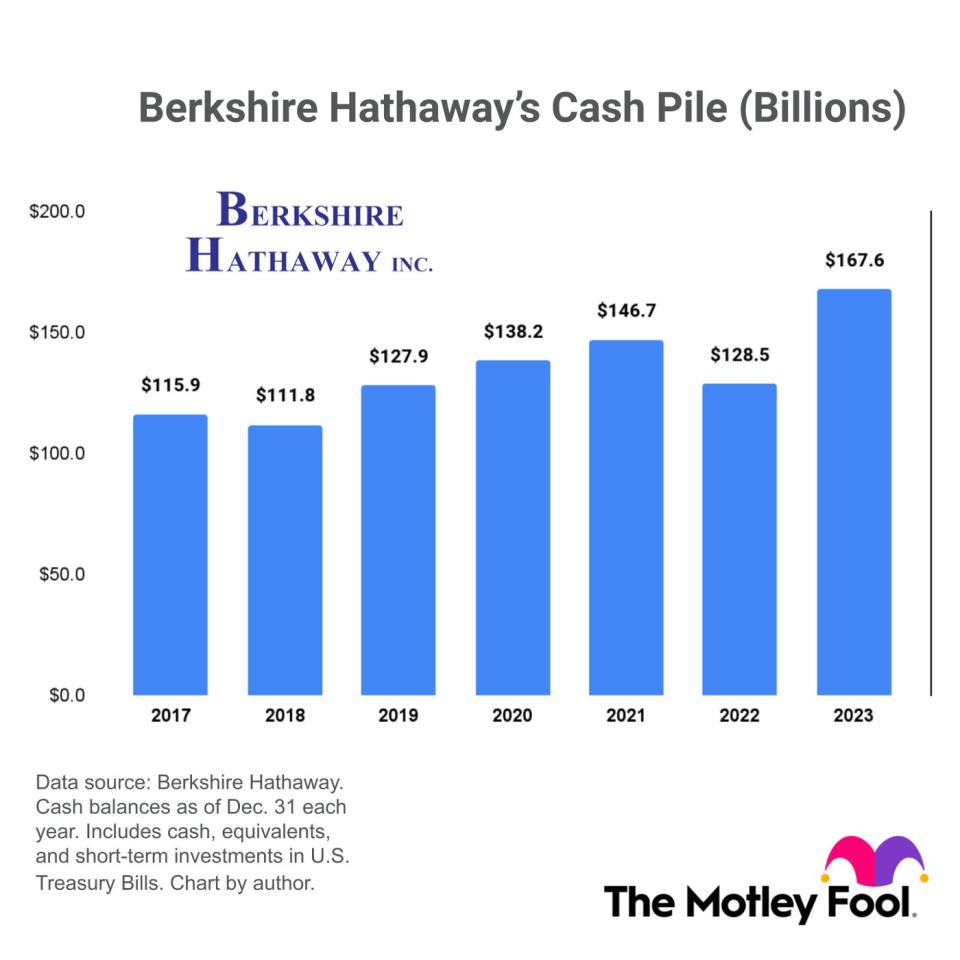

Warren Buffett bought textiles corporate Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) in 1965, and he transformed it right into a conserving car for more than a few investments. As of late, it owns a number of non-public firms and 47 publicly traded securities.Berkshire inventory has delivered a compound annual go back of nineteen.8% since Buffett took the helm in 1965, which is two times the go back of the S&P 500 index. He follows a easy making an investment technique which comes to purchasing winning companies with stable enlargement and powerful control groups. He particularly likes firms returning cash to shareholders thru dividends and inventory buybacks, which is helping Berkshire compound its cash extra briefly.Berkshire has constructed a fort stability sheet over the last 58 years with a file $167.6 billion in money, equivalents, and non permanent investments available on the finish of 2023:

A chart appearing Berkshire Hathaway’s money pile from 2017 to 2023. An inventory of businesses Berkshire may just (theoretically) purchase outrightTo put Berkshire’s money pile into standpoint, listed below are 10 globally identified firms these days value lower than $167.9 billion:Normal Electrical: $166.8 billionUber: $162.4 billionNike: $160.1 billionMorgan Stanley: $142.1 billionUnited Parcel Carrier: $126.7 billionBoeing: $122.5 billionBlackrock: $120.8 billionAT&T: $120.1 billionSony: $108.9 billionAirbnb: $97.3 billionTo be transparent, neither Buffett nor Berkshire have expressed pastime in purchasing any of the ones firms. Alternatively, the truth the conglomerate can manage to pay for to take action is a testomony to its implausible good fortune.Berkshire’s present top-three holdings come with Apple, Financial institution of The united states, and American Categorical. In combination, they account for 62.7% of the entire worth of Berkshire’s portfolio of publicly traded shares. They’re a just right position to begin for buyers in search of to imitate Buffett’s returns.Must you make investments $1,000 in Berkshire Hathaway presently?Before you purchase inventory in Berkshire Hathaway, imagine this:The Motley Idiot Inventory Marketing consultant analyst staff simply known what they imagine are the 10 absolute best shares for buyers to shop for now… and Berkshire Hathaway wasn’t considered one of them. The ten shares that made the minimize may just produce monster returns within the coming years.Tale continuesStock Marketing consultant supplies buyers with an easy-to-follow blueprint for good fortune, together with steering on development a portfolio, common updates from analysts, and two new inventory alternatives every month. The Inventory Marketing consultant provider has greater than tripled the go back of S&P 500 since 2002*.See the ten shares*Inventory Marketing consultant returns as of February 26, 2024Bank of The united states is an promoting spouse of The Ascent, a Motley Idiot corporate. American Categorical is an promoting spouse of The Ascent, a Motley Idiot corporate. Anthony Di Pizio has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Airbnb, Apple, Financial institution of The united states, Berkshire Hathaway, Nike, and Uber Applied sciences. The Motley Idiot recommends United Parcel Carrier and recommends the next choices: lengthy January 2025 $47.50 calls on Nike. The Motley Idiot has a disclosure coverage.Warren Buffett Is Sitting on a Report $167.6 Billion Money Pile. Listed below are 10 Shares Berkshire Hathaway May Purchase Outright. used to be at first revealed by way of The Motley Idiot

A chart appearing Berkshire Hathaway’s money pile from 2017 to 2023. An inventory of businesses Berkshire may just (theoretically) purchase outrightTo put Berkshire’s money pile into standpoint, listed below are 10 globally identified firms these days value lower than $167.9 billion:Normal Electrical: $166.8 billionUber: $162.4 billionNike: $160.1 billionMorgan Stanley: $142.1 billionUnited Parcel Carrier: $126.7 billionBoeing: $122.5 billionBlackrock: $120.8 billionAT&T: $120.1 billionSony: $108.9 billionAirbnb: $97.3 billionTo be transparent, neither Buffett nor Berkshire have expressed pastime in purchasing any of the ones firms. Alternatively, the truth the conglomerate can manage to pay for to take action is a testomony to its implausible good fortune.Berkshire’s present top-three holdings come with Apple, Financial institution of The united states, and American Categorical. In combination, they account for 62.7% of the entire worth of Berkshire’s portfolio of publicly traded shares. They’re a just right position to begin for buyers in search of to imitate Buffett’s returns.Must you make investments $1,000 in Berkshire Hathaway presently?Before you purchase inventory in Berkshire Hathaway, imagine this:The Motley Idiot Inventory Marketing consultant analyst staff simply known what they imagine are the 10 absolute best shares for buyers to shop for now… and Berkshire Hathaway wasn’t considered one of them. The ten shares that made the minimize may just produce monster returns within the coming years.Tale continuesStock Marketing consultant supplies buyers with an easy-to-follow blueprint for good fortune, together with steering on development a portfolio, common updates from analysts, and two new inventory alternatives every month. The Inventory Marketing consultant provider has greater than tripled the go back of S&P 500 since 2002*.See the ten shares*Inventory Marketing consultant returns as of February 26, 2024Bank of The united states is an promoting spouse of The Ascent, a Motley Idiot corporate. American Categorical is an promoting spouse of The Ascent, a Motley Idiot corporate. Anthony Di Pizio has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Airbnb, Apple, Financial institution of The united states, Berkshire Hathaway, Nike, and Uber Applied sciences. The Motley Idiot recommends United Parcel Carrier and recommends the next choices: lengthy January 2025 $47.50 calls on Nike. The Motley Idiot has a disclosure coverage.Warren Buffett Is Sitting on a Report $167.6 Billion Money Pile. Listed below are 10 Shares Berkshire Hathaway May Purchase Outright. used to be at first revealed by way of The Motley Idiot

:max_bytes(150000):strip_icc()/Brown-vs-white-egg-shells-FT-BLOG0125-4eafeb90fd804a95b7e4cc694f68af00.jpg)