For just about six many years, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been dazzling Wall Boulevard along with his making an investment prowess. Even if he and his crew are not going to be proper 100% of the time, the power to find plain-as-day values has resulted in an combination go back on Berkshire’s Magnificence A stocks (BRK.A) of more than 5,000,000% since turning into CEO within the mid-Nineteen Sixties.Skilled and retail buyers generally tend to pay explicit consideration to Berkshire Hathaway’s quarterly 13F filings, which offer a snapshot of what Buffett and his crew had been purchasing and promoting, in addition to Berkshire’s quarterly working studies, which provide perception into how Buffett and his crew have deployed their corporate’s capital, as a complete.Even supposing the $371 billion portfolio Buffett and his making an investment aides, Todd Combs and Ted Weschler, oversee at Berkshire Hathaway has been a supply of inspiration for buyers spanning the process many many years, the ultimate 5 quarters (since Oct. 1, 2022) have given optimists little to cheer about.

Berkshire Hathaway CEO Warren Buffett. Symbol supply: The Motley Idiot.Warren Buffett’s momentary movements and long-term mindset are not at all times alignedIf there is one lovely constant takeaway from the 47 years of shareholder letters the Oracle of Omaha has written to his buyers, it is that having a bet on The usa to thrive over lengthy sessions is a brilliant transfer. Buffett has at all times gravitated towards companies with robust manufacturers, time-tested control groups, and sustained aggressive benefits. It is why he is been preserving steady stakes in firms like Coca-Cola and American Categorical since 1988 and 1991, respectively.However simply because Warren Buffett would not guess in opposition to The usa, it does not imply he is prepared to overpay for perceived-to-be top of the range companies.All the way through the December-ended quarter, Berkshire Hathaway bought $7.32 billion in fairness securities. By means of comparability, Buffett’s corporate bought $7.845 billion in fairness securities. Despite the fact that this works out to “simply” $525 million in net-equity gross sales, it is been a theme for Buffett and his aides for 5 consecutive quarters. As an example:Tale continuesFor the quarter ended Sept. 30, 2023, Buffett was once a net-seller of $5.253 billion of equities.For the quarter ended June 30, 2023, Buffett and his crew oversaw $7.981 billion in net-equity safety gross sales.For the quarter ended March 31, 2023, Buffett and his aides finished $10.41 billion in net-equity safety gross sales.For the quarter ended Dec. 31, 2022, Buffett’s crew was once a net-seller of $14.64 billion of equities.Added in combination, Buffett, Combs, and Weschler have overseen an combination of $38.8 billion in net-equity safety gross sales in a 15-month stretch. That is a more or less $39 billion silent caution that Wall Boulevard seems to be ignoring these days.Shares are dear, and Warren Buffett desires no a part of the “on line casino”It is no secret why the Oracle of Omaha and his crew had been urgent the promote button way more steadily than the purchase button since October 2022: Shares are dear.Even supposing Buffett is not the kind of investor to make problem predictions within the inventory marketplace, his newest annual letter to shareholders speaks volumes. Stated Buffett:Despite the fact that the inventory marketplace is hugely better than it was once in our early years, as of late’s lively individuals are neither extra emotionally strong nor higher taught than I used to be in class. For no matter causes, markets now show off way more casino-like habits than they did when I used to be younger. The on line casino now is living in many houses and day by day tempts the occupants.To reiterate, Warren Buffett would by no means, ever suggest buyers guess in opposition to The usa. However he lovely obviously specified by his newest shareholder letter why he and his crew are not being extra competitive with their capital: Specifically, there are not many just right offers.

Berkshire Hathaway CEO Warren Buffett. Symbol supply: The Motley Idiot.Warren Buffett’s momentary movements and long-term mindset are not at all times alignedIf there is one lovely constant takeaway from the 47 years of shareholder letters the Oracle of Omaha has written to his buyers, it is that having a bet on The usa to thrive over lengthy sessions is a brilliant transfer. Buffett has at all times gravitated towards companies with robust manufacturers, time-tested control groups, and sustained aggressive benefits. It is why he is been preserving steady stakes in firms like Coca-Cola and American Categorical since 1988 and 1991, respectively.However simply because Warren Buffett would not guess in opposition to The usa, it does not imply he is prepared to overpay for perceived-to-be top of the range companies.All the way through the December-ended quarter, Berkshire Hathaway bought $7.32 billion in fairness securities. By means of comparability, Buffett’s corporate bought $7.845 billion in fairness securities. Despite the fact that this works out to “simply” $525 million in net-equity gross sales, it is been a theme for Buffett and his aides for 5 consecutive quarters. As an example:Tale continuesFor the quarter ended Sept. 30, 2023, Buffett was once a net-seller of $5.253 billion of equities.For the quarter ended June 30, 2023, Buffett and his crew oversaw $7.981 billion in net-equity safety gross sales.For the quarter ended March 31, 2023, Buffett and his aides finished $10.41 billion in net-equity safety gross sales.For the quarter ended Dec. 31, 2022, Buffett’s crew was once a net-seller of $14.64 billion of equities.Added in combination, Buffett, Combs, and Weschler have overseen an combination of $38.8 billion in net-equity safety gross sales in a 15-month stretch. That is a more or less $39 billion silent caution that Wall Boulevard seems to be ignoring these days.Shares are dear, and Warren Buffett desires no a part of the “on line casino”It is no secret why the Oracle of Omaha and his crew had been urgent the promote button way more steadily than the purchase button since October 2022: Shares are dear.Even supposing Buffett is not the kind of investor to make problem predictions within the inventory marketplace, his newest annual letter to shareholders speaks volumes. Stated Buffett:Despite the fact that the inventory marketplace is hugely better than it was once in our early years, as of late’s lively individuals are neither extra emotionally strong nor higher taught than I used to be in class. For no matter causes, markets now show off way more casino-like habits than they did when I used to be younger. The on line casino now is living in many houses and day by day tempts the occupants.To reiterate, Warren Buffett would by no means, ever suggest buyers guess in opposition to The usa. However he lovely obviously specified by his newest shareholder letter why he and his crew are not being extra competitive with their capital: Specifically, there are not many just right offers.

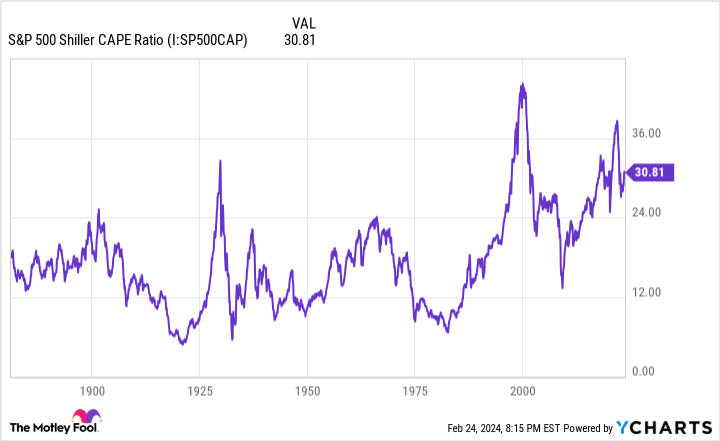

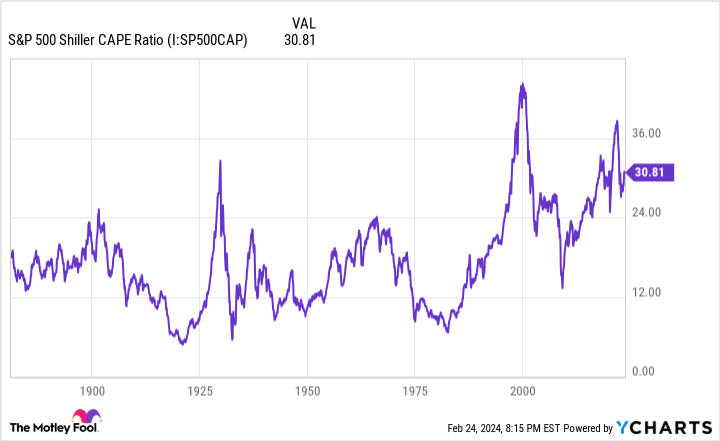

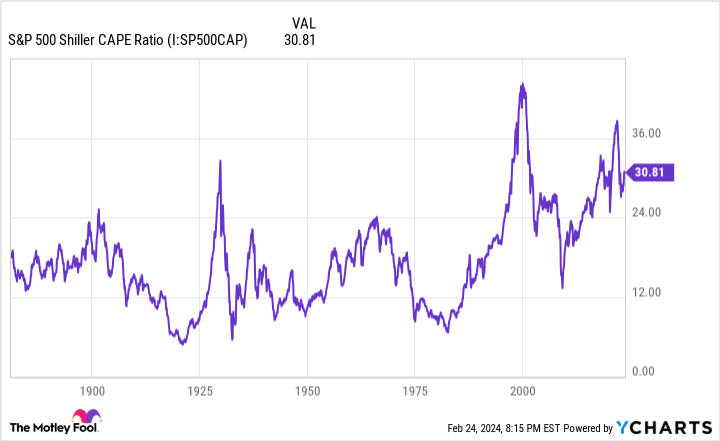

S&P 500 Shiller CAPE Ratio ChartThe maximum telling valuation indicator that means equities may well be in bother is the S&P 500’s Shiller price-to-earnings (P/E) ratio, which is sometimes called the cyclically adjusted price-to-earnings ratio (CAPE ratio). It is a valuation device in line with reasonable inflation-adjusted revenue from the former 10 years, which means that it is helping to easy out one-time occasions, such because the COVID-19 pandemic.For greater than 150 years, the Shiller P/E has averaged a studying of 17.09. On Feb. 23, it closed at more or less double this worth (34.25). It is one of the crucial easiest readings throughout a bull marketplace rally in historical past.What is much more telling is what is came about the former 5 instances the S&P 500’s Shiller P/E surpassed 30 throughout a bull marketplace rally. In the end, the S&P 500 and/or Dow Jones Business Reasonable went directly to lose 20% to 89% in their respective worth following each and every prior example. Even supposing the Shiller P/E ratio is not a timing device and can not forecast when the wider marketplace will head decrease, historical past means that a dear marketplace sooner or later corrects decrease in a large approach.Whilst Buffett hardly, if ever, thinks quick time period, 5 consecutive quarters of net-selling from Berkshire Hathaway speaks volumes.

S&P 500 Shiller CAPE Ratio ChartThe maximum telling valuation indicator that means equities may well be in bother is the S&P 500’s Shiller price-to-earnings (P/E) ratio, which is sometimes called the cyclically adjusted price-to-earnings ratio (CAPE ratio). It is a valuation device in line with reasonable inflation-adjusted revenue from the former 10 years, which means that it is helping to easy out one-time occasions, such because the COVID-19 pandemic.For greater than 150 years, the Shiller P/E has averaged a studying of 17.09. On Feb. 23, it closed at more or less double this worth (34.25). It is one of the crucial easiest readings throughout a bull marketplace rally in historical past.What is much more telling is what is came about the former 5 instances the S&P 500’s Shiller P/E surpassed 30 throughout a bull marketplace rally. In the end, the S&P 500 and/or Dow Jones Business Reasonable went directly to lose 20% to 89% in their respective worth following each and every prior example. Even supposing the Shiller P/E ratio is not a timing device and can not forecast when the wider marketplace will head decrease, historical past means that a dear marketplace sooner or later corrects decrease in a large approach.Whilst Buffett hardly, if ever, thinks quick time period, 5 consecutive quarters of net-selling from Berkshire Hathaway speaks volumes.

Symbol supply: Getty Pictures.Persistence has paid off handsomely for Warren Buffett and Berkshire Hathaway’s shareholdersAs of the top of 2023, Berkshire’s money pile swelled to an all-time report $167.6 billion. Having this a lot capital that may be put to paintings and no longer doing so is also seen as a big sadness via Berkshire’s shareholders and the making an investment neighborhood as a complete. However within the eyes of Warren Buffett and his crew, which till lately integrated the affably named “Architect of Berkshire Hathaway,” Charlie Munger, there is cast reasoning at the back of this manner.In Warren Buffett’s lately launched letter to shareholders, he reiterated an making an investment rule that his corporate merely is not going to destroy:One funding rule at Berkshire has no longer and won’t exchange: By no means possibility everlasting lack of capital. Because of the American tailwind and the ability of compound hobby, the world by which we perform has been — and will probably be — rewarding if you are making a few just right selections throughout a life-time and steer clear of critical errors.Even if Berkshire’s brightest funding minds are smartly conscious that downturns within the U.S. financial system and inventory marketplace are completely standard, they acknowledge that sessions of expansion for the U.S. financial system ultimate considerably longer. While no recession because the finish of Global Warfare II has surpassed 18 months in duration, two sessions of monetary enlargement have reached the last decade mark throughout this span. This demonstrates the ability of the “American tailwind,” in addition to the worth of time and standpoint at the a part of particular person buyers.

Symbol supply: Getty Pictures.Persistence has paid off handsomely for Warren Buffett and Berkshire Hathaway’s shareholdersAs of the top of 2023, Berkshire’s money pile swelled to an all-time report $167.6 billion. Having this a lot capital that may be put to paintings and no longer doing so is also seen as a big sadness via Berkshire’s shareholders and the making an investment neighborhood as a complete. However within the eyes of Warren Buffett and his crew, which till lately integrated the affably named “Architect of Berkshire Hathaway,” Charlie Munger, there is cast reasoning at the back of this manner.In Warren Buffett’s lately launched letter to shareholders, he reiterated an making an investment rule that his corporate merely is not going to destroy:One funding rule at Berkshire has no longer and won’t exchange: By no means possibility everlasting lack of capital. Because of the American tailwind and the ability of compound hobby, the world by which we perform has been — and will probably be — rewarding if you are making a few just right selections throughout a life-time and steer clear of critical errors.Even if Berkshire’s brightest funding minds are smartly conscious that downturns within the U.S. financial system and inventory marketplace are completely standard, they acknowledge that sessions of expansion for the U.S. financial system ultimate considerably longer. While no recession because the finish of Global Warfare II has surpassed 18 months in duration, two sessions of monetary enlargement have reached the last decade mark throughout this span. This demonstrates the ability of the “American tailwind,” in addition to the worth of time and standpoint at the a part of particular person buyers.

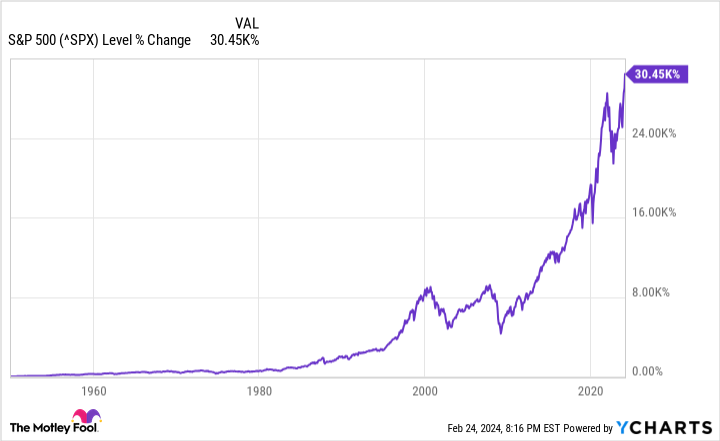

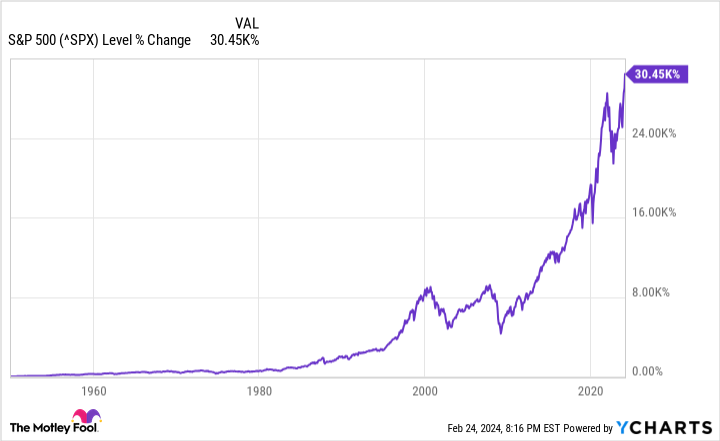

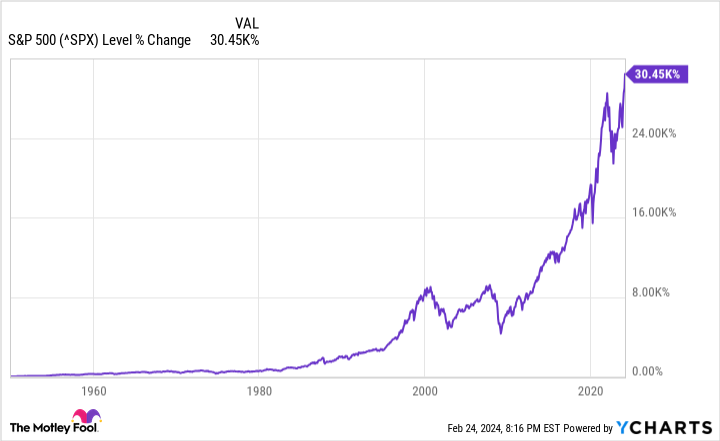

^SPX ChartIt’s a an identical tale for the wider marketplace. In keeping with knowledge launched ultimate yr via researchers at Bespoke Funding Staff, the typical S&P 500 undergo marketplace has lasted simply 286 calendar days because the get started of the Nice Despair in September 1929. By means of comparability, the standard S&P 500 bull marketplace has caught round 1,011 calendar days, which is 3.5 instances longer than the typical undergo marketplace.Moreover, the Oracle of Omaha is not taking a look to make smaller investments. He and his aides are after needle-moving, superb firms at a perceived-to-be truthful payment. They are prepared to sit down on their fingers till a large-scale alternative gifts itself.Even supposing Warren Buffett being a net-seller of shares over the last 5 quarters won’t had been on many buyers’ bingo playing cards, he and his crew have a boatload of money that are supposed to sooner or later get put to paintings.Must you make investments $1,000 in Berkshire Hathaway at this time?Before you purchase inventory in Berkshire Hathaway, imagine this:The Motley Idiot Inventory Consultant analyst crew simply known what they consider are the 10 absolute best shares for buyers to shop for now… and Berkshire Hathaway wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.Inventory Consultant supplies buyers with an easy-to-follow blueprint for luck, together with steerage on development a portfolio, common updates from analysts, and two new inventory alternatives each and every month. The Inventory Consultant provider has greater than tripled the go back of S&P 500 since 2002*.See the ten shares*Inventory Consultant returns as of February 26, 2024American Categorical is an promoting spouse of The Ascent, a Motley Idiot corporate. Sean Williams has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Berkshire Hathaway. The Motley Idiot has a disclosure coverage.Warren Buffett Simply Despatched a $39 Billion Silent Caution to Wall Boulevard was once at the start revealed via The Motley Idiot

^SPX ChartIt’s a an identical tale for the wider marketplace. In keeping with knowledge launched ultimate yr via researchers at Bespoke Funding Staff, the typical S&P 500 undergo marketplace has lasted simply 286 calendar days because the get started of the Nice Despair in September 1929. By means of comparability, the standard S&P 500 bull marketplace has caught round 1,011 calendar days, which is 3.5 instances longer than the typical undergo marketplace.Moreover, the Oracle of Omaha is not taking a look to make smaller investments. He and his aides are after needle-moving, superb firms at a perceived-to-be truthful payment. They are prepared to sit down on their fingers till a large-scale alternative gifts itself.Even supposing Warren Buffett being a net-seller of shares over the last 5 quarters won’t had been on many buyers’ bingo playing cards, he and his crew have a boatload of money that are supposed to sooner or later get put to paintings.Must you make investments $1,000 in Berkshire Hathaway at this time?Before you purchase inventory in Berkshire Hathaway, imagine this:The Motley Idiot Inventory Consultant analyst crew simply known what they consider are the 10 absolute best shares for buyers to shop for now… and Berkshire Hathaway wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.Inventory Consultant supplies buyers with an easy-to-follow blueprint for luck, together with steerage on development a portfolio, common updates from analysts, and two new inventory alternatives each and every month. The Inventory Consultant provider has greater than tripled the go back of S&P 500 since 2002*.See the ten shares*Inventory Consultant returns as of February 26, 2024American Categorical is an promoting spouse of The Ascent, a Motley Idiot corporate. Sean Williams has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Berkshire Hathaway. The Motley Idiot has a disclosure coverage.Warren Buffett Simply Despatched a $39 Billion Silent Caution to Wall Boulevard was once at the start revealed via The Motley Idiot

/cdn.vox-cdn.com/uploads/chorus_asset/file/25427869/fubo.jpg)