Key Takeaways

Nvidia stocks slumped just about 9% closing week as buyers scaled again bets in a few of this 12 months’s best acting AI chipmakers over mounting issues about more difficult industry restrictions and geopolitical dangers.Nvidia stocks stay in a long-term uptrend, however volumes have declined for the reason that inventory reached its document top closing month, doubtlessly indicating slowing momentum, or in all probability only a pause within the development.A hang above the $116 stage would possibly shape the root for any other trending leg upper to round $195 in accordance with a bars development extracting the fashion from April to June and making use of it to this preliminary strengthen space.Different key strengthen ranges on Nvidia’s chart come with $97 and $75, the place the inventory may draw in purchasing hobby close to trendlines connecting essential worth issues.

Nvidia (NVDA) stocks slumped just about 9% closing week as buyers scaled again bets in a few of this 12 months’s best acting synthetic intelligence (AI) chipmakers over mounting issues about more difficult industry restrictions and geopolitical dangers.

Underneath, we take a better have a look at the AI darling’s technicals and indicate essential worth ranges to eye amid the potential of heightened volatility.

Quantity Trending Decrease

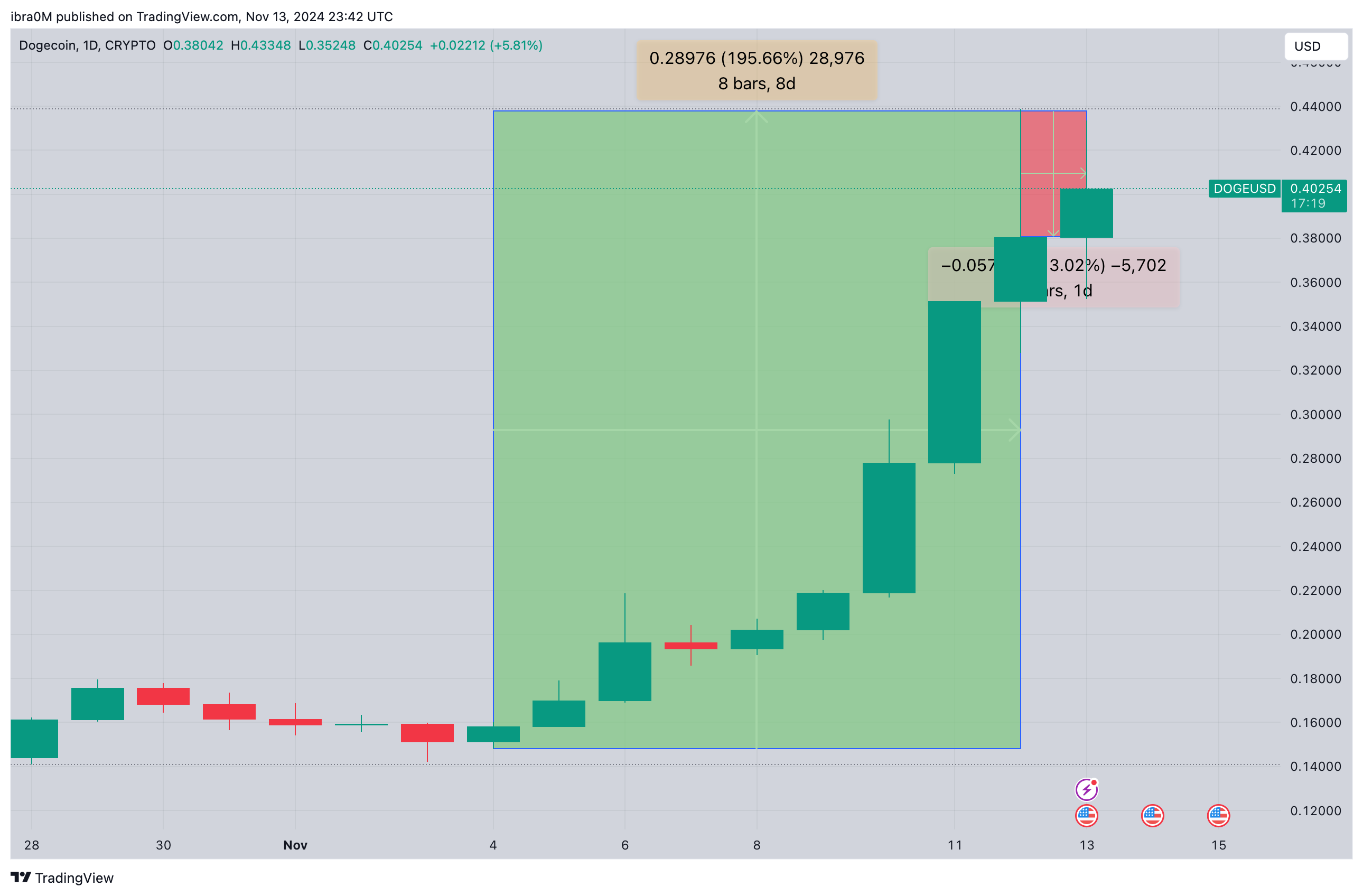

Nvidia stocks stay in a long-term uptrend, with the 50-day transferring reasonable (MA) sitting with ease above the 200-day MA. Then again, the AI chipmaker’s inventory has traded sideways to decrease after atmosphere its document top closing month.

Importantly, quantity has additionally trended decrease since that point, doubtlessly indicating slowing momentum, or in all probability only a pause within the development, after the inventory’s groundbreaking good points fueled via insatiable undertaking call for for chips that energy AI infrastructure.

Watch Those Essential Value Ranges

Over the approaching weeks, buyers will have to watch a number of key spaces on Nvidia’s chart that would come into play.

The primary sits round $116, the place marketplace members shall be looking at if consumers can shield a temporary horizontal line that connects a chain of new worth motion and the 50-day MA.

If the inventory can hang this essential space, it’s going to shape the root for any other trending leg upper to round $195 in accordance with a bars development extracting the fashion from April to June and making use of it to this preliminary strengthen stage.

A breakdown underneath the $116 space may open the door to a retest of the $97 stage, a location at the chart that can stumble upon strengthen close to a trendline linking two distinguished worth peaks in March and a length on consolidation previous to the overdue Would possibly profits hole.

A deeper correction within the inventory may see a decline to the $75 stage, these days 36% underneath Friday’s shut, the place the fee may draw in discount hunters close to a horizontal line that hyperlinks a pause within the uptrend between January and March with the April swing low.

Traders will have to additionally regulate the relative energy index (RSI). There’s a better probability that Nvidia’s worth may resume its longer-term uptrend from the degrees defined above if the indicator reaches oversold stipulations on the similar time.

The feedback, reviews, and analyses expressed on Investopedia are for informational functions best. Learn our guaranty and legal responsibility disclaimer for more information.

As of the date this text was once written, the creator does no longer personal any of the above securities.