Key Takeaways

Tesla stocks persevered their prolonged post-election rally on Monday, rallying to a brand new document prime after Wedbush boosted its value goal at the EV maker’s inventory.The stocks have trended sharply upper after breaking out from an ascending triangle, regardless that the relative power index alerts extraordinarily overbought prerequisites, which might result in momentary profit-taking.Bars development research, which extracts the inventory’s sharp trending transfer from past due June to early July and overlays it from the ascending triangle’s most sensible trendline, forecasts a bullish goal of round $510.Buyers will have to observe key give a boost to ranges on Tesla’s chart close to $360, $300, and $265.

Tesla (TSLA) stocks persevered their prolonged post-election rally on Monday, rallying to a brand new document prime after Wedbush boosted its value goal at the EV maker’s inventory.

The funding company lifted its value goal to $515 from $400 however famous that the inventory may just succeed in as prime as $650 by means of the top of subsequent yr, arguing that the incoming Trump management will give the legacy EV maker’s self-driving and synthetic intelligence (AI) tasks a spice up.

Via Monday’s shut, Tesla stocks have surged about 85% for the reason that get started of the yr, with maximum of the ones beneficial properties coming after the Nov. 5 election on optimism that CEO Elon Musk’s shut ties with President-elect Donald Trump will streamline the automaker’s approval processes.

The inventory received 6% in common buying and selling Monday and added every other 2% in prolonged hours, buying and selling round $472.

Under, we wreck down the technicals on Tesla’s chart and indicate key chart ranges that traders is also staring at because the EV maker’s inventory continues to make new highs.

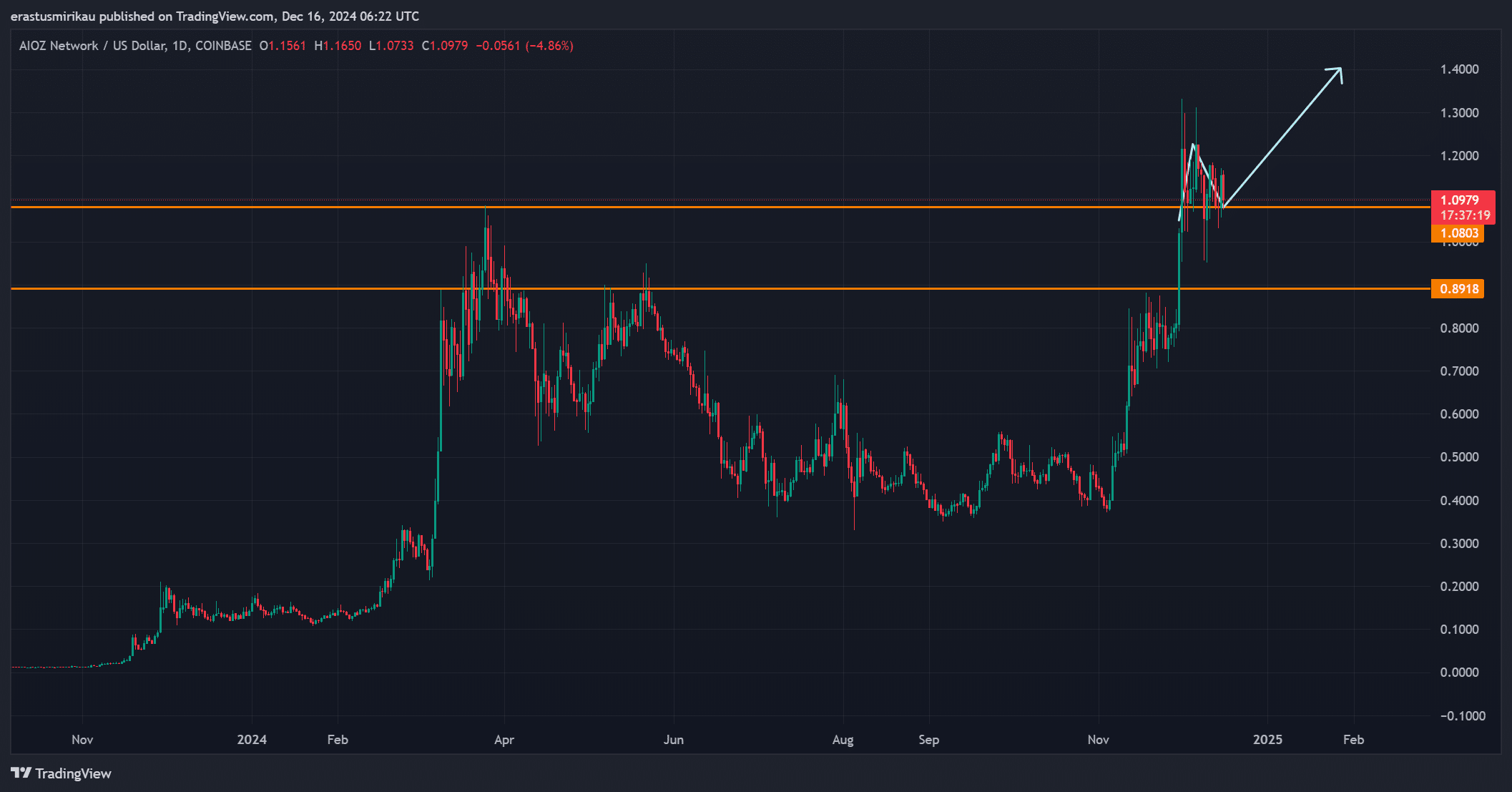

Bullish Pattern Strikes Additional into Overbought Territory

Since breaking out from an ascending triangle previous this month, Tesla stocks have trended sharply upper, with expanding buying and selling volumes supporting the rally.

Whilst the relative power index (RSI) confirms bullish value momentum, the indicator additionally alerts closely overbought prerequisites, opening the door to momentary profit-taking as some traders money in at the inventory’s prolonged post-election beneficial properties.

Let’s flip to technical research to supply perception as to the place the inventory’s present impulsive transfer upper is also headed subsequent and determine key give a boost to ranges that can come into play right through pullbacks.

Chart-Based totally Bullish Goal to Watch

To forecast a bullish goal in Tesla stocks, traders can use bars development research, a method that research historic tendencies to are expecting how long term directional strikes would possibly play out..

When making use of the instrument to Tesla’s chart, we extract the inventory’s sharp trending transfer from past due June to early July and overlay it from the ascending triangle’s most sensible trendline. This tasks a bullish goal round $510, a location the place traders would possibly come to a decision to fasten in income if the present transfer upper replicates the prior sturdy development analyzed.

Key Reinforce Ranges to Observe

Throughout retracements, traders will have to to begin with regulate the $360 stage, a location at the chart the place the stocks would possibly come across give a boost to on a retest of the ascending triangle’s most sensible trendline.

A detailed beneath this space may just see the stocks fall to across the mental $300 stage. Buyers would possibly search for purchasing alternatives on this area close to the distinguished July 2023 swing prime and close by 50-day transferring reasonable.

In any case, a vital correction in Tesla stocks would possibly result in retest of decrease give a boost to close to $265. This stage would most probably draw in purchasing pastime close to a trendline that connects a couple of peaks at the chart over a 12-month duration between October 2023 and October this yr.

The feedback, reviews, and analyses expressed on Investopedia are for informational functions simplest. Learn our guaranty and legal responsibility disclaimer for more information.

As of the date this newsletter used to be written, the writer does no longer personal any of the above securities.

:max_bytes(150000):strip_icc()/TSLAChart-62037684d10543e1abfcf7017e3edb40.gif)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25792993/2155632147.jpg)