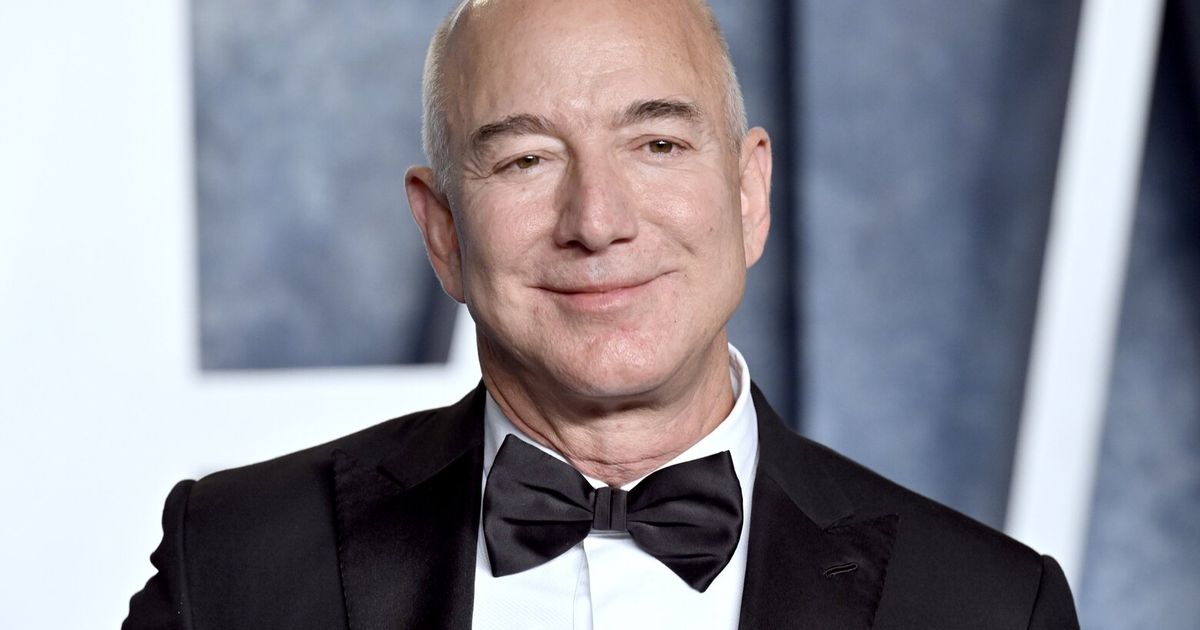

When Jeff Bezos posted a heartfelt good-bye to Seattle, he additionally inadvertently left a parting reward: a reignited debate about Washington’s taxes.Bezos, Amazon’s founder, former CEO and present government chairman, introduced Thursday he used to be leaving Seattle after just about 30 years within the area. Bezos began Amazon within the storage of his Bellevue house in 1994. In an Instagram submit Thursday, Bezos stated he’s shifting to Miami to be nearer to his folks, who just lately moved again to Bezos’ native land, and nearer to Cape Canaveral, the place Bezos’ rocket corporate Blue Foundation is growing a brand new rocket type. Whilst Bezos didn’t point out Washington’s politics or taxes within the announcement, the inside track straight away sparked hypothesis that the state’s new capital beneficial properties tax and new wealth tax will have driven The united states’s second-richest individual out.“Jeff Bezos introduced a transfer to Miami, and someplace, a Washington state income reputable used to be more than likely moved to tears,” Jared Walczak, vp of state initiatives on the Tax Basis wrote in a weblog submit Friday morning. The Tax Basis, a right-leaning assume tank, has been a vocal critic of Washington’s capital beneficial properties tax.With an estimated internet price of $161 billion, Bezos is the third-richest individual on the planet, in keeping with Bloomberg’s Billionaires Index. He ranks simply above Microsoft co-founder (and Washington resident) Invoice Gates, who has an estimated internet price of $126 billion. Tesla multi-millionaire Elon Musk and Bernard Arnault, the CEO of luxurious retail logo LVMH, outrank each Washington billionaires.

Washington’s Ideal Courtroom upheld the arguable capital beneficial properties tax in March, after years of prison demanding situations. The measure applies a 7% tax at the sale of monetary property, equivalent to shares and bonds. It applies best to income over $250,000 and does no longer follow to actual property or retirement accounts. In Might, early estimates prompt Washington may herald $849 million in its first 12 months of gathering the tax. Democrats first handed the capital beneficial properties tax in 2021, with plans to spend the income on early-childhood teaching programs. It’s no longer transparent how a lot of Bezos’ doable tax invoice contributed to that estimate, and Washington’s Division of Earnings is not able to touch upon how one particular person might have an effect on the full. There are a number of deductions and exemptions that might scale back the taxable quantity of long-term beneficial properties, the dept stated, making it tricky to estimate. Bezos has bought just about 2.7 million stocks of Amazon inventory this 12 months, in keeping with information from S&P International Marketplace Intelligence. That’s considerably lower than final 12 months, when Bezos bought greater than 6.6 million stocks.In Might, Bezos dumped greater than 1.3 million stocks however purchased one percentage valued at about $115. Bezos holds just about 1 billion stocks in Amazon.

Washington regulators have additionally proposed a wealth tax that might follow to people who have greater than $250 million. After two previous makes an attempt to move an identical taxes failed, Democrats offered the measure once more in January as a part of a national marketing campaign, with seven state legislatures launching an identical efforts. Sen. Noel Body, D-Seattle, who subsidized the wealth tax regulation this 12 months, estimated it will have an effect on about 700 Washingtonians. Neither Washington nor Florida have state source of revenue taxes. Bezos’ new house state, managed through a Republican legislature and governor, doesn’t have a capital beneficial properties tax and used to be no longer a part of the cluster of states that proposed a wealth tax previous this 12 months.Bezos purchased a waterfront mansion in Florida in August after which purchased the neighboring house in October. He paid $68 million for the primary sale, an property in Indian Creek, a synthetic barrier island within the better Miami space. He paid some other $79 million for the seven-bedroom mansion subsequent door.But even so the Indian Creek properties, Bezos has properties in Washington, D.C.; a 9-acre Beverly Hills mansion; a ranch in Texas; an property in Maui; and houses in New York and Seattle. He additionally owns one of the crucial international’s costliest superyachts, the Koru, which introduced this 12 months and price an estimated $500 million to construct.

Bezos’ choice to start out Amazon in Seattle — on the time, the corporate used to be nonetheless simply a web-based bookshop — will have all the time been partially about taxes. Tom Alberg, an early Amazon investor and influential determine in Seattle’s tech ecosystem, advised The Seattle Occasions that Bezos arrange store within the area to be just about engineering ability at Microsoft and the College of Washington.However, through finding the corporate outdoor California, Bezos may additionally promote into that giant marketplace with out gathering gross sales tax from consumers there, giving Amazon a value merit over bodily bookstores. Now, Amazon has grown from a one-garage store to an organization with greater than 65,000 staff on two campuses in Seattle and Bellevue, workplaces all over the world and a moment headquarters in Arlington, Va. In 2014, after Amazon made the verdict to aggressively make bigger its South Lake Union campus, Bezos wrote to shareholders: “Despite the fact that I will be able to’t turn out it, I additionally consider an city headquarters will lend a hand stay Amazon colourful, draw in the best ability and be nice for the well being and wellbeing of our staff and town of Seattle.”On Thursday, in pronouncing his choice to transport away, Bezos wrote “as thrilling because the transfer is, it’s an emotional one for me. Seattle, you’ll all the time have a work of my center.”In 2000, Bezos began Blue Foundation, an aerospace production corporate with headquarters in Kent, with hopes of opening up house tourism. Bezos stated Thursday he’s additionally shifting to Miami to be nearer to Cape Canaveral, an area hub about 3 hours away the place Blue Foundation is growing its New Glenn rocket. The rocket’s release has been behind schedule for years however might take off subsequent 12 months.

Amazon declined to touch upon what Bezos’ transfer might imply for the corporate. Blue Foundation may no longer be reached for remark. Thomas Gilbert, a finance professor on the College of Washington, stated Washington’s taxes will have performed a task in Bezos’ choice to transport — however that the insurance policies had been most likely no longer the main motivator. As an alternative, Gilbert predicted, Bezos is also setting apart himself from the corporate to offer CEO Andy Jassy house to make his mark.Bezos stepped down as CEO of Amazon in 2021 and passed the reins to Jassy, the previous head of the winning cloud computing department Amazon Internet Services and products. Bezos remains to be Amazon’s government chairman and stays engaged with the corporate, Jassy advised The New York Occasions in September, including that the 2 leaders speak about as soon as per week. Gilbert stated it may be tricky for a brand new CEO to be triumphant if the corporate’s founder or former CEO remains to be closely all in favour of choices.“I feel it used to be transparent to Jeff to mention, ‘Smartly, Andy is now in rate. I want to step away,’” Gilbert stated. “I imply bodily, mentally and timewise. ‘He’s now operating Amazon and I’m doing one thing else, like taking pictures rockets into house.’”

What Amazon founder Jeff Bezos’ transfer from Seattle has to do with taxes