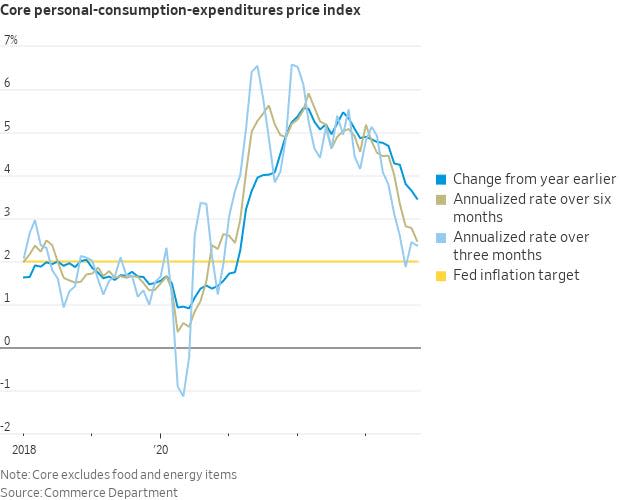

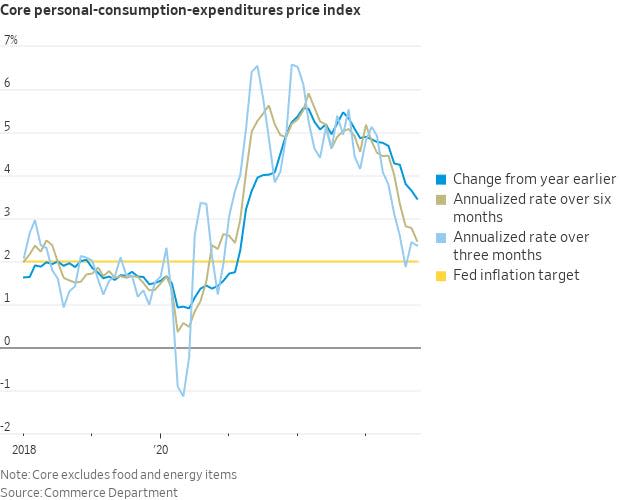

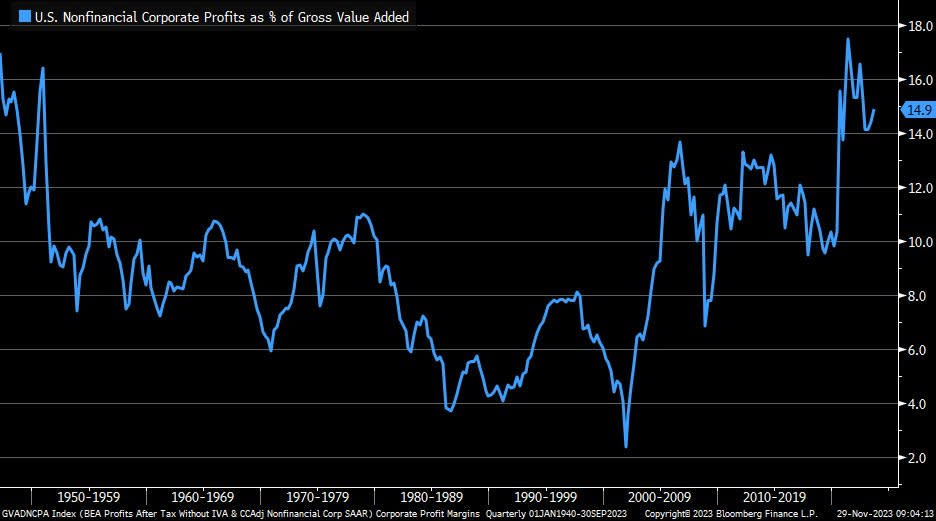

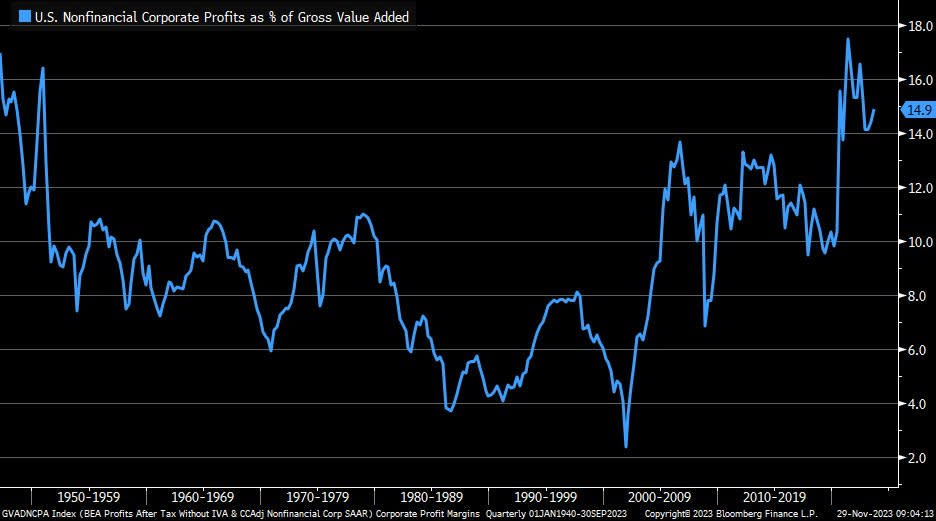

Notice: A model of this newsletter used to be revealed on Tker.co.Wall Boulevard 2024 TKer targetsStocks climbed closing week, with the S&P 500 emerging 0.8% to near at 4,594.63. The index is now up 19.7% 12 months to this point, up 28.4% from its October 12, 2022 last low of three,577.03, and down 4.2% from its January 3, 2022 file last top of four,796.56.It’s that point of 12 months when Wall Boulevard’s most sensible strategists inform shoppers the place they see the inventory marketplace heading within the 12 months forward. In most cases, the common forecast for the gang predicts the S&P 500 mountain climbing through about 10%, which is in keeping with historic averages.This 12 months, strategists are providing a horny wide selection of perspectives. Some see weak spot. Some see power. The objectives vary from 4,200 to five,500. This means returns between -8.5% and +19.7% from Friday’s shut. For what it’s price, the forecasts aren’t as skewed to the disadvantage as they had been closing 12 months.Sooner than we transfer on, I’d warning in opposition to placing an excessive amount of weight into one-year objectives. It’s extraordinarily tough to expect momentary strikes available in the market with any accuracy. Few on Wall Boulevard have ever been in a position to do that effectively. I do then again assume the analysis, research, and observation at the back of those forecasts will also be informative.That stated, right here’s what’s riding Wall Boulevard’s perspectives for 2024:The economists that those inventory marketplace forecasters paintings with are cut up on whether or not the U.S. financial system will pass into recession a while all over the 12 months, which has implications for earnings amongst different issues. Those that predict persevered enlargement be expecting enlargement to be modest, and the ones searching for a recession be expecting any downturn to be temporary and shallow. (Scroll down for: Wall Boulevard’s 2024 U.S. financial outlook )Apparently, maximum strategists nonetheless be expecting S&P 500 income to develop in 2024 regardless of lackluster GDP enlargement forecasts. This may occasionally must do with the expectancy that shopper spending shifts again towards items from services and products and the truth that the S&P has better publicity to the products sector, while U.S. GDP has better publicity to the services and products sector.Analysts be expecting file income in 2024. (Supply: FactSet)Due to progressed working efficiencies, many — however no longer all — strategists be expecting benefit margins to stick top, which might lend a hand magnify income enlargement even with modest earnings enlargement.Benefit margins had been conserving up. (Supply: BMO)Whilst maximum S&P 500 corporations have low rates of interest on their money owed locked in for years, increasingly companies will nonetheless must refinance at marketplace charges, which proceed to hover at their absolute best ranges in years. Upper hobby expense is a headwind for income enlargement.Due to refinancing job when charges had been low, the hobby massive corporations are paying stay low. (Supply: BofA)Maximum strategists agree that the worst of the inflation disaster is at the back of us. This implies that are meant to financial prerequisites become worse considerably, the Federal Reserve might as soon as once more to find itself loosening monetary prerequisites with rate of interest cuts. Whilst an financial downturn can be unwelcome, it’s nonetheless just right information that the Fed turns out to have room to stimulate the financial system.Strategists also are cut up on whether or not valuations are cheap or whether or not they’re somewhat wealthy. This debate gained’t pass away anytime quickly as valuations have traditionally signaled little or no about momentary marketplace strikes.Whilst maximum strategist agree that valuations are increased, no longer all imagine that may save you costs from going upper. (Supply: Deutsche Financial institution)On valuations, no less than one strategist argues that pleasure for synthetic intelligence applied sciences may just persist into the brand new 12 months, and the marketplace may well be within the early levels of a bubble.Tale continuesThe 2024 S&P 500 worth targetsBelow is a roundup of 12 of those 2024 forecasts for the S&P 500, together with highlights from the strategists’ observation.JPMorgan: 4,200, $225 EPS (as of Nov. 29) “With a stepdown in financial enlargement subsequent 12 months (US enlargement to gradual to 0.7% YoY through 4Q24 from 2.8% 4Q23), eroding family extra financial savings and liquidity, and tightening credit score, we see 2024 consensus hockey-stick EPS enlargement of eleven% as unrealistic… Adverse company sentiment must be a catalyst for sharply decrease estimates early subsequent 12 months.”Morgan Stanley: 4,500, $229 EPS (as of Nov. 13) “Close to-term uncertainty must give option to an income restoration… Our 2024 EPS estimate [of $229] is in line with output from our main income fashions, which display a restoration in enlargement subsequent 12 months in addition to our economists’ expectancies for enlargement subsequent 12 months… 2025 represents a powerful income enlargement surroundings (+16p.cY) as sure working leverage and tech-driven productiveness enlargement (AI) result in margin enlargement. At the valuation entrance, we forecast a 17.0x ahead P/E more than one on the finish of subsequent 12 months (20-year moderate P/E is 15.6x; these days 18.1x).”UBS: 4,600, $228 EPS (as of Nov. 8) “Our 2024 goal is in response to a YE 2024E more than one of 18.5x (a -0.7x more than one level contraction) implemented to 2025E EPS of $249. Whilst UBS anticipates a steep decline in yields over this era, upper fairness chance premiums must offset this get advantages.”Wells Fargo: 4,625, $235 EPS (as of Nov. 27) “With VIX low, credit score spreads tight, equities rallying, and price of capital upper/unstable, it is time to downshift. Be expecting a unstable and in the end flattish SPX in 2024 (4625), as valuation limits upside and fee uncertainty elevates drawback chance.”Goldman Sachs: 4,700, $237 EPS (as of Nov. 15) “Our baseline assumption all over the following 12 months is the U.S. financial system continues to extend at a modest tempo and avoids a recession, income upward push through 5%, and the valuation of the fairness marketplace equals 18x, on the subject of the present P/E degree. Our forecast falls reasonably under the everyday 8% go back all over presidential election years.”Societe Generale: 4,750, $230 EPS (as of Nov. 20) “The S&P 500 must be in ‘buy-the-dip’ territory, as main signs for income proceed to fortify. But, the adventure to the top of the 12 months must be a long way from easy, as we predict a gentle recession in the course of the 12 months, a credit score marketplace sell-off in 2Q and ongoing quantitative tightening.”Barclays: 4,800, $233 (as of Nov. 28) “Whether or not ‘new standard’ or ‘outdated,’ a curler coaster 2023 proved that this cycle is anything else however. We think US equities to ship single-digit returns subsequent 12 months as easing inflation is offset through modest financial deceleration.”Financial institution of The us: 5,000, $235 EPS (as of Nov. 21) “The fairness chance top class may just fall additional, particularly ex-Tech: we’re previous most macro uncertainty. The marketplace has absorbed vital geopolitical shocks already and the excellent news is we’re speaking concerning the unhealthy information. Macro alerts are muddled, however idiosyncratic alpha larger this 12 months. We’re bullish no longer as a result of we predict the Fed to chop, however as a result of what the Fed has achieved. Corporations have tailored (as they’re wont to do) to raised charges and inflation.”RBC: 5,000, $232 EPS (as of Nov. 22) “Whilst the November rally has most probably pulled ahead a few of 2024’s features, we stay optimistic at the U.S. fairness marketplace within the 12 months forward. Our valuation and sentiment paintings are sending optimistic alerts, in part offset through headwinds from a slow financial system and uncertainty across the 2024 Presidential election. Our paintings additionally means that the better enchantment of bonds might finally end up being a dampener of US fairness marketplace returns however no longer essentially a derailer of them.”Deutsche Financial institution: 5,100, $250 (as of Nov. 27) “Are valuations top? We don’t assume so. If inflation returns to two%, as economists forecast and is priced in throughout asset categories, whilst payout ratios stay increased, honest worth in our studying is 18x, with a spread of 16x-20x, which they’ve been in for the closing 2 years. If income enlargement continues to get well as we forecast, valuations will stay neatly supported.”BMO: 5,100, $250 EPS (as of Nov. 27) “[W]e imagine U.S. shares will reach any other 12 months of sure returns in 2024, albeit whilst demonstrating extra sanguine, widely disbursed, and basically outlined efficiency relative to the decade or so. In different phrases, standard and standard.”Capital Economics: 5,500 (as of Dec. 1) “Nonetheless time for the S&P 500 to celebration adore it’s 1999 …it has come some distance in recent times, thank you each to a upward push in its valuation and to an building up in expectancies for long term income. …This partially displays traders’ enthusiasm about AI generation. …if AI enthusiasm is inflating a bubble within the S&P 500, it’s one this is nonetheless in its early levels. We expect the index may just due to this fact make additional features: our end-2024 forecast is 5,500, ~20% above its present degree.”Two issues about one-year worth targetsMost of the fairness strategists TKer follows produce extremely rigorous, high quality analysis that displays a deep working out of what drives markets. Because of this, essentially the most treasured issues those professionals have to supply have little to do with one-year objectives. (And in my years of interacting with many of those people, no less than a couple of of them don’t deal with the workout of publishing one-year objectives. They do it as it’s well liked by shoppers.)So first off, don’t brush aside their paintings simply because their one-year goal is off the mark.2d, I’ll repeat what I at all times say when discussing momentary forecasts for the inventory marketplace:It’s extremely tough to expect with any accuracy the place the inventory marketplace shall be in a 12 months. Along with the numerous collection of variables to imagine, there also are the definitely unpredictable traits that happen alongside the way in which.Strategists will continuously revise their objectives as new knowledge is available in. In reality, one of the most numbers you spot above constitute revisions from prior forecasts.For many of y’all, it’s most certainly ill-advised to overtake all of your funding technique in response to a one-year inventory marketplace forecast.However, it may be a laugh to practice those objectives. It is helping you get a way of the more than a few Wall Boulevard companies’ degree of bullishness or bearishness.Just right good fortune in 2024!For older forecasts, learn: Wall Boulevard’s 2023 outlook for shares 🔭. and Wall Boulevard’s 2022 outlook for stocksWall Boulevard’s 2024 U.S. financial outlookBelow is a sampling of what Wall Boulevard is announcing concerning the financial system in 2024.JPMorgan: “Even supposing the financial system has it seems that controlled to flee recession this 12 months, we imagine the chance of a downturn in ‘24 stays increased. Fading post-pandemic tailwinds, construction financial headwinds, and dwindling fiscal offsets must all give a contribution to conserving enlargement under style, and we mission actual GDP to extend 0.7% within the coming 12 months (4Q/4Q).”Morgan Stanley: “Top charges for longer purpose a continual drag, greater than offsetting the fiscal impulse and bringing enlargement sustainably under doable from 3Q24. We handle our view that the Fed will reach a comfortable touchdown, however weakening enlargement will stay recession fears alive. We forecast that GDP slows from an estimated 2.5% 4Q/4Q (2.4p.cY) in 2023 to at least one.6% (1.9%) in 2024, and 1.4% (1.4%) in 2025.”UBS: “We think financial enlargement to gradual sharply in the following couple of quarters, with a gentle contraction price part a proportion level in the course of the 12 months.”Wells Fargo: “There already are some cracks which are starting to seem within the financial system, and those traces most probably will accentuate within the coming months as financial restraint stays in position. Our base case is that actual GDP will contract modestly beginning in mid-2024.”Goldman Sachs: “With the extra daunting issues in large part solved, the prerequisites for inflation to go back to focus on in position, and the heaviest blows from financial and financial tightening neatly at the back of us, we now see just a traditionally moderate 15% chance of recession over the following 365 days.”Societe Generale: “In the USA, the long-predicted recession will in our view belatedly materialise in 2024, perhaps all over the center quarters of the 12 months, regardless that it stands to be temporary and shallow.”Barclays: “Base Case: Comfortable Touchdown”BofA: “We see a comfortable touchdown – a duration of sure however below-trend enlargement – because the perhaps state of affairs”RBC: “Inflation information is not off course. Mounting headwinds must result in slower enlargement and softer exertions markets however forestall in need of recession.”BMO: “But when [a recession] does happen, we might borrow an acronym from the political lexicon to explain its most probably severity – RINO or recession in title simplest since exertions marketplace information continues to stay remarkably resilient and employment ranges are what nearly at all times decide how just right or unhealthy issues get within the financial system from our point of view.”Deutsche Financial institution: “Our forecast of a gentle recession in H1 2024 is thus little modified since our closing replace in October.”Reviewing the macro crosscurrentsThere had been a couple of notable information issues and macroeconomic traits from closing week to imagine:Inflation charges cool. The private intake expenditures (PCE) worth index in October used to be up 3.0% from a 12 months in the past, down from the three.4% building up in September. The core PCE worth index — the Federal Reserve’s most popular measure of inflation — used to be up 3.5% all over the month after coming in at 3.7% upper within the prior month.On a month over month foundation, the core PCE worth index used to be up 0.16%. For those who annualized the rolling three-month and six-month figures, the core PCE worth index used to be up 2.4% and a pair of.5%, respectively.

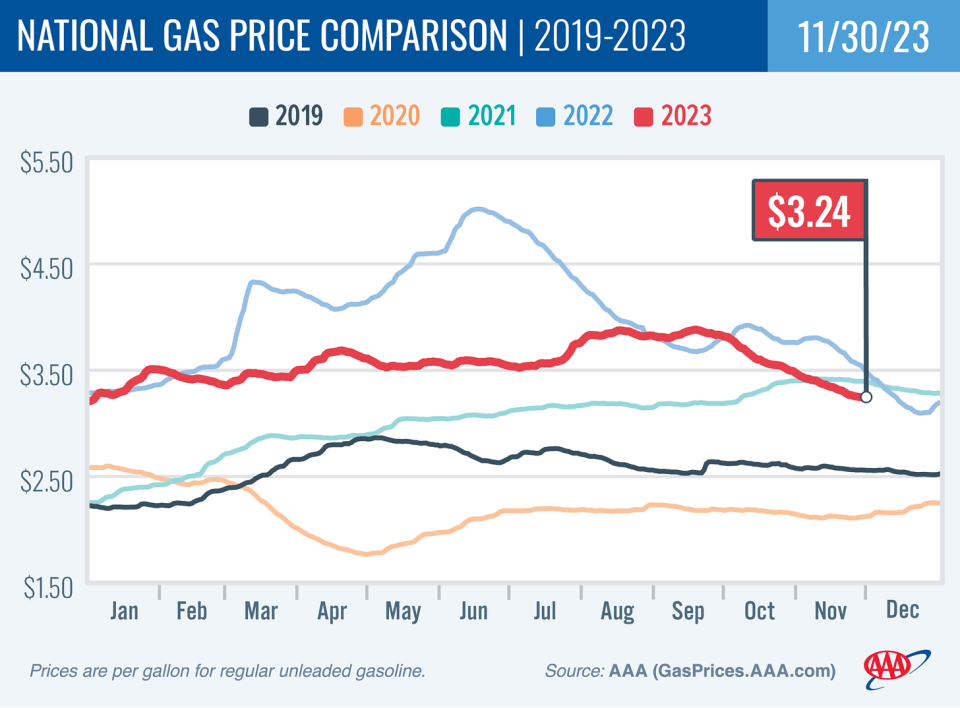

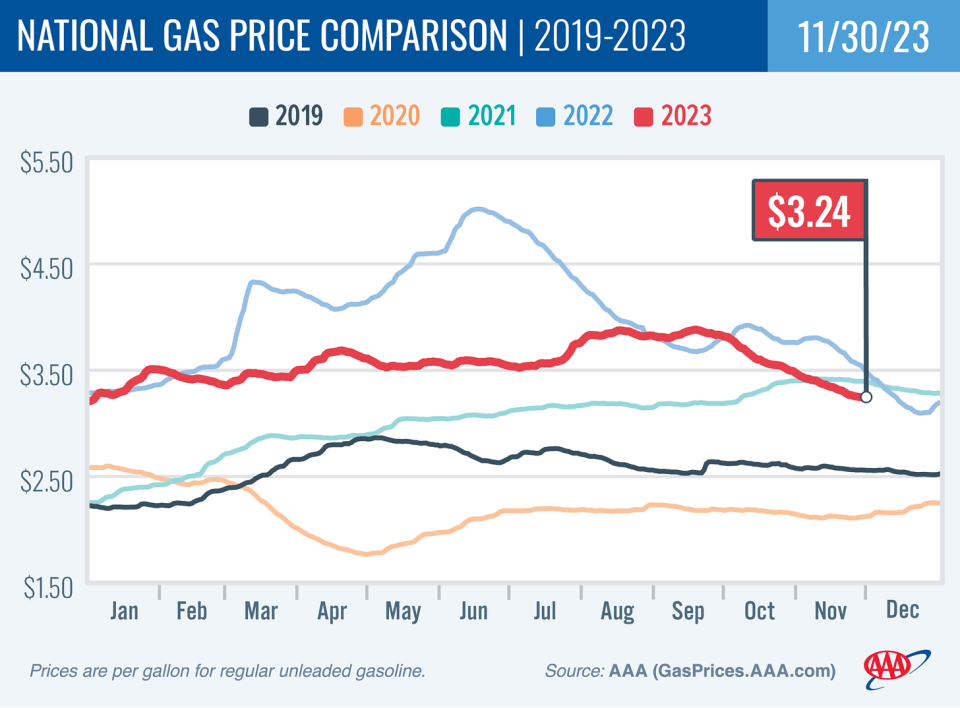

Whilst inflation charges stay above the Federal Reserve’s 2% goal, they’re obviously trending in that course.Gasoline costs are down. From AAA: “Regardless of not up to stellar home call for, the nationwide moderate for a gallon of fuel fell simplest two cents since closing week. The principle offender is the price of oil, which is creeping nearer to $80 a barrel. Since oil is the primary factor in gas, upper oil prices have a tendency to position upward power on pump costs… Nowadays’s nationwide moderate of $3.24 is 26 cents not up to a month in the past and 26 cents not up to a 12 months in the past.”

Whilst inflation charges stay above the Federal Reserve’s 2% goal, they’re obviously trending in that course.Gasoline costs are down. From AAA: “Regardless of not up to stellar home call for, the nationwide moderate for a gallon of fuel fell simplest two cents since closing week. The principle offender is the price of oil, which is creeping nearer to $80 a barrel. Since oil is the primary factor in gas, upper oil prices have a tendency to position upward power on pump costs… Nowadays’s nationwide moderate of $3.24 is 26 cents not up to a month in the past and 26 cents not up to a 12 months in the past.”

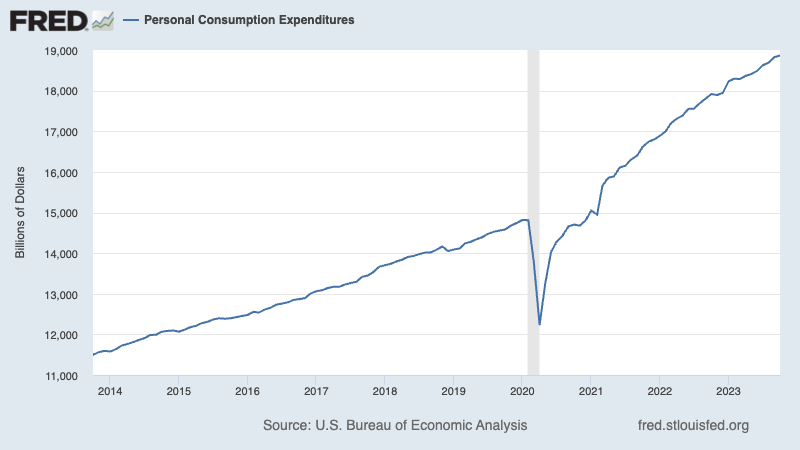

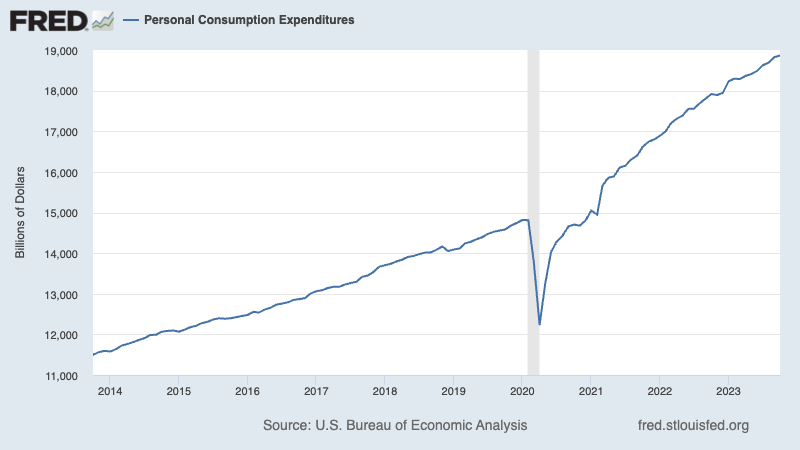

Shoppers are spending. In step with BEA information, non-public intake expenditures larger 0.2% month over month in October to a file annual fee of $18.86 trillion.

Shoppers are spending. In step with BEA information, non-public intake expenditures larger 0.2% month over month in October to a file annual fee of $18.86 trillion.

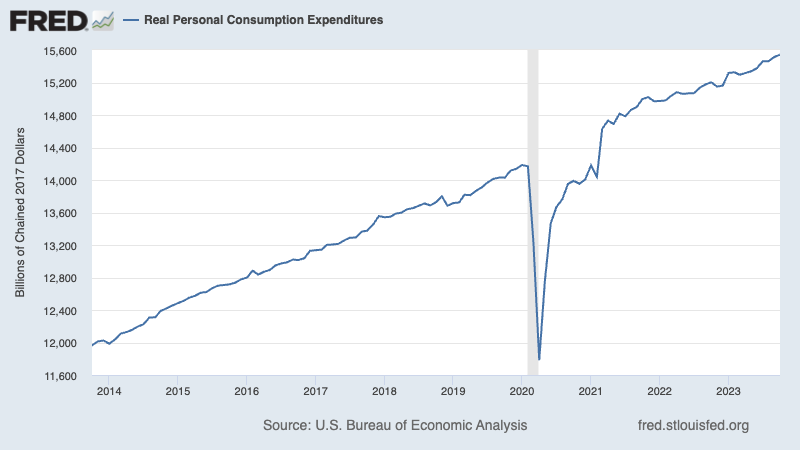

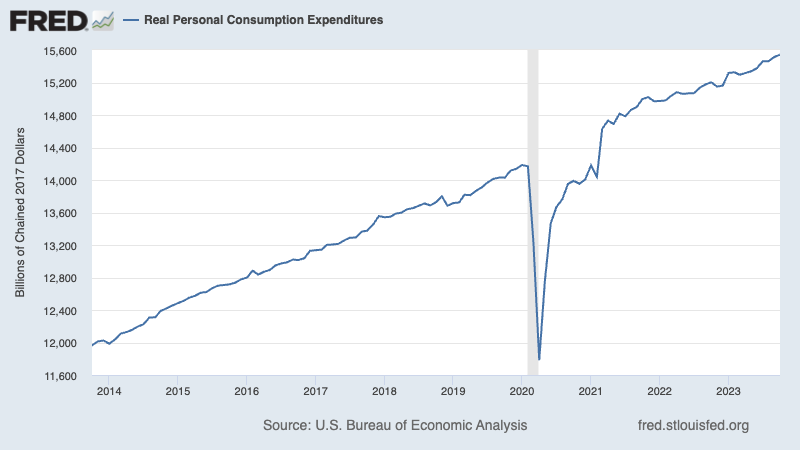

Adjusted for inflation, actual non-public intake expenditures additionally rose to a brand new file.

Adjusted for inflation, actual non-public intake expenditures additionally rose to a brand new file.

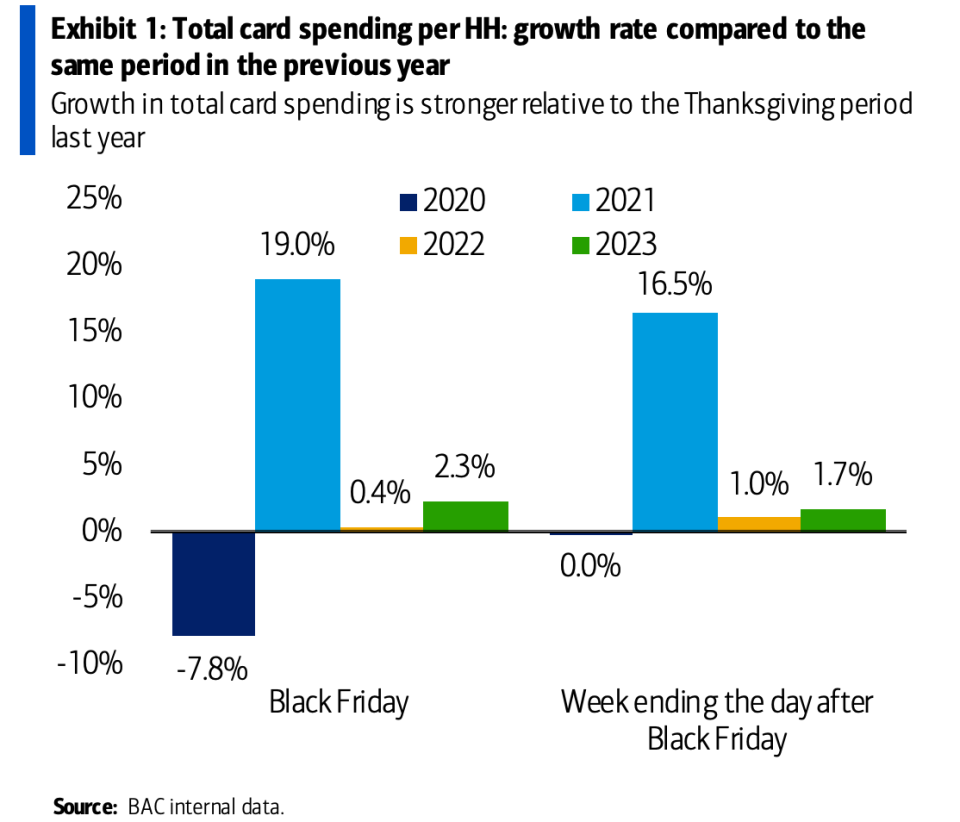

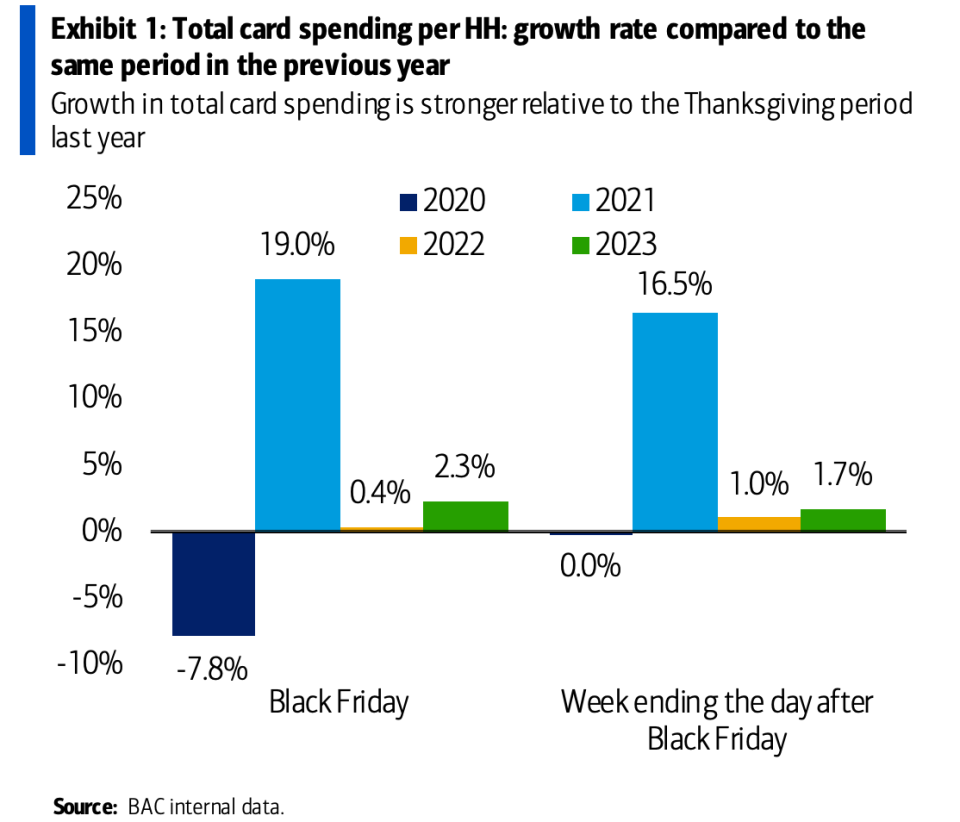

Vacation buying groceries season is off to a powerful get started. From BofA: “Card spending in line with family (HH), as measured through BAC aggregated credit score and debit playing cards, used to be up 2.3% on Black Friday (November 24), in comparison to the Black Friday in 2022.”

Vacation buying groceries season is off to a powerful get started. From BofA: “Card spending in line with family (HH), as measured through BAC aggregated credit score and debit playing cards, used to be up 2.3% on Black Friday (November 24), in comparison to the Black Friday in 2022.”

That is in keeping with different information from non-public companies appearing Black Friday and Cyber Monday spending emerging to file ranges.Eating place spending is cooling. From Apollo World’s Torsten Slok: “Signs of eating place job proceed to turn indicators of weak spot, see chart under. This isn’t sudden. The Fed is making an attempt to decelerate the financial system, and weak spot is now beginning to seem in shopper services and products.”

That is in keeping with different information from non-public companies appearing Black Friday and Cyber Monday spending emerging to file ranges.Eating place spending is cooling. From Apollo World’s Torsten Slok: “Signs of eating place job proceed to turn indicators of weak spot, see chart under. This isn’t sudden. The Fed is making an attempt to decelerate the financial system, and weak spot is now beginning to seem in shopper services and products.”

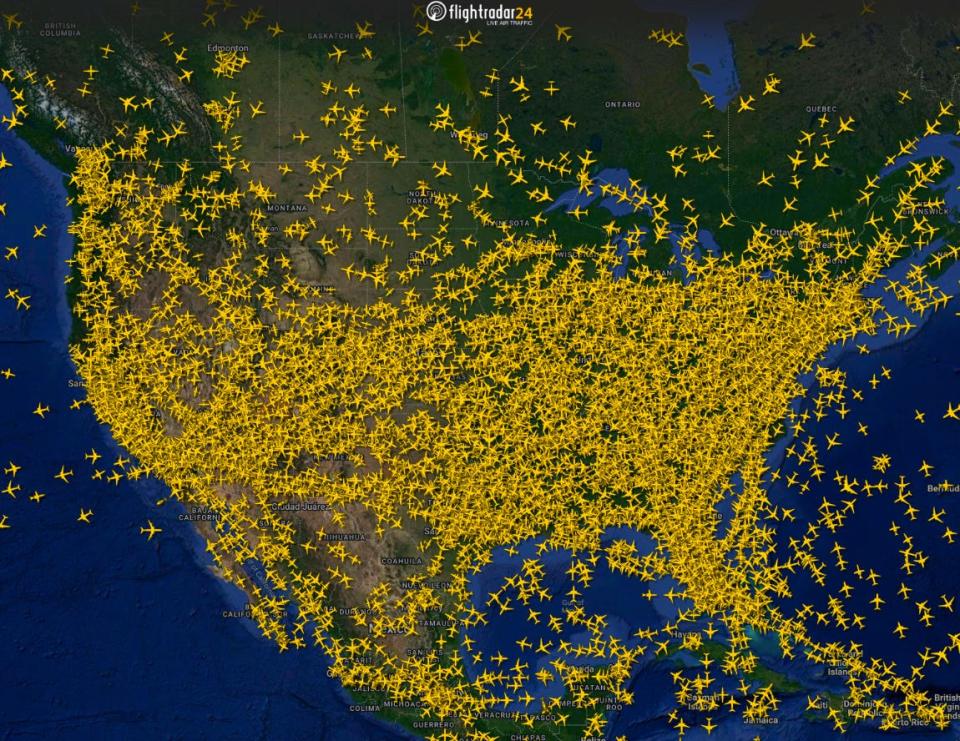

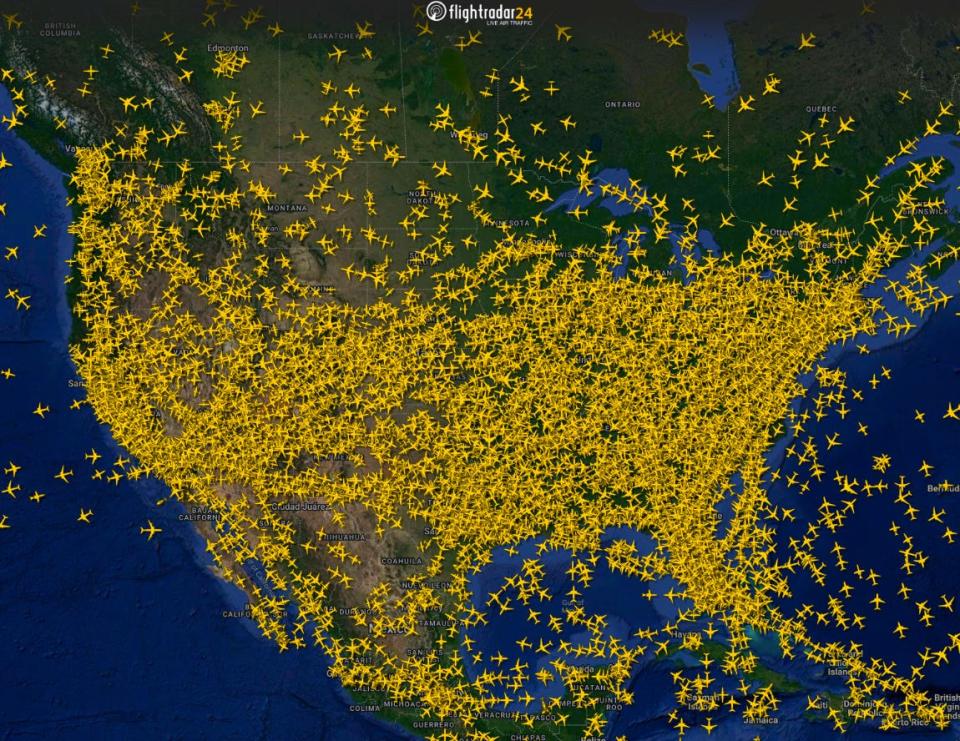

Air shuttle’s busiest day. From the TSA: “The day past (Nov. 26), TSA screened simply over 2.9M folks at airports national, which represents an company file – the busiest day ever for air shuttle.”

Air shuttle’s busiest day. From the TSA: “The day past (Nov. 26), TSA screened simply over 2.9M folks at airports national, which represents an company file – the busiest day ever for air shuttle.”

Unemployment claims upward push. Preliminary claims for unemployment advantages larger to 218,000 all over the week finishing November 25, up from 209,000 the week prior. Whilst that is up from a September 2022 low of 182,000, it continues to style at ranges related to financial enlargement.

Unemployment claims upward push. Preliminary claims for unemployment advantages larger to 218,000 all over the week finishing November 25, up from 209,000 the week prior. Whilst that is up from a September 2022 low of 182,000, it continues to style at ranges related to financial enlargement.

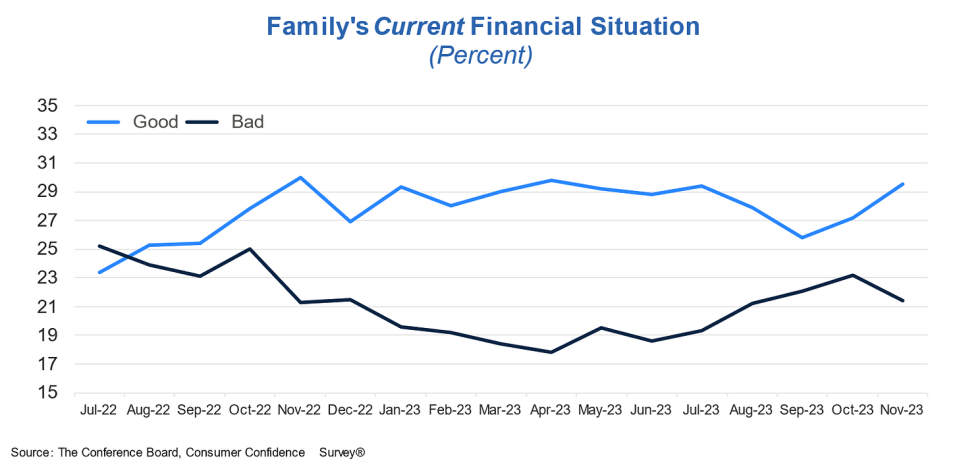

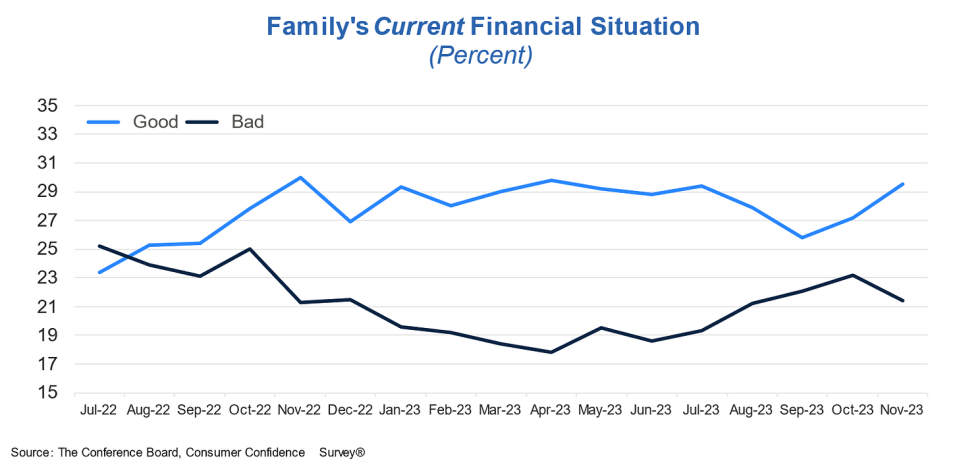

Shopper self assurance improves. On Tuesday, we discovered The Convention Board’s Shopper Self assurance Index larger in November. From the company’s Dana Peterson: “Normal enhancements had been observed around the spectrum of source of revenue teams surveyed in November. However, write-in responses published customers stay preoccupied with emerging costs on the whole, adopted through battle/conflicts and better rates of interest… Exams of the current state of affairs ticked down in November, pushed through much less constructive perspectives on present activity availability, which outweighed reasonably progressed perspectives at the state of industrial prerequisites.”

Shopper self assurance improves. On Tuesday, we discovered The Convention Board’s Shopper Self assurance Index larger in November. From the company’s Dana Peterson: “Normal enhancements had been observed around the spectrum of source of revenue teams surveyed in November. However, write-in responses published customers stay preoccupied with emerging costs on the whole, adopted through battle/conflicts and better rates of interest… Exams of the current state of affairs ticked down in November, pushed through much less constructive perspectives on present activity availability, which outweighed reasonably progressed perspectives at the state of industrial prerequisites.”

In the meantime, “Shoppers’ overview in their Circle of relatives’s Present Monetary Scenario progressed in November.”

In the meantime, “Shoppers’ overview in their Circle of relatives’s Present Monetary Scenario progressed in November.”

And, “Shoppers’ overview in their Circle of relatives’s Anticipated Monetary Scenario, Six Months Therefore used to be additionally extra constructive in November.”

And, “Shoppers’ overview in their Circle of relatives’s Anticipated Monetary Scenario, Six Months Therefore used to be additionally extra constructive in November.”

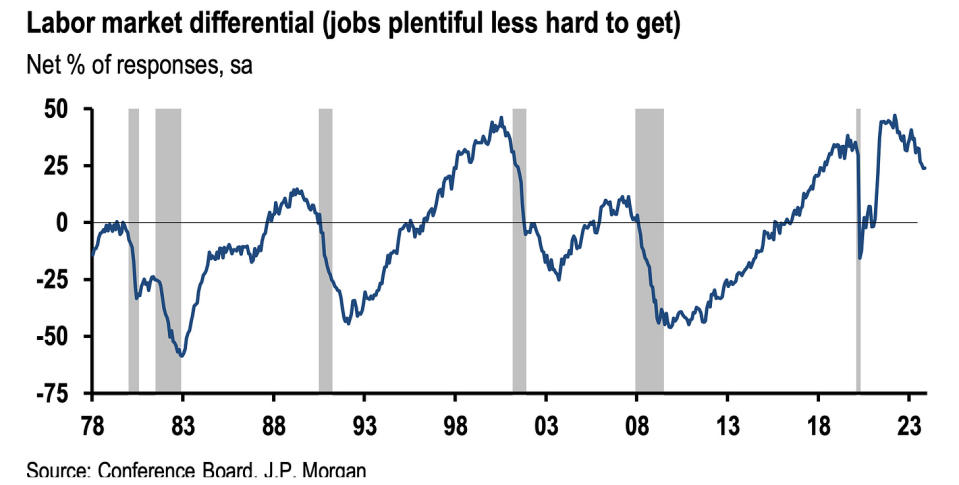

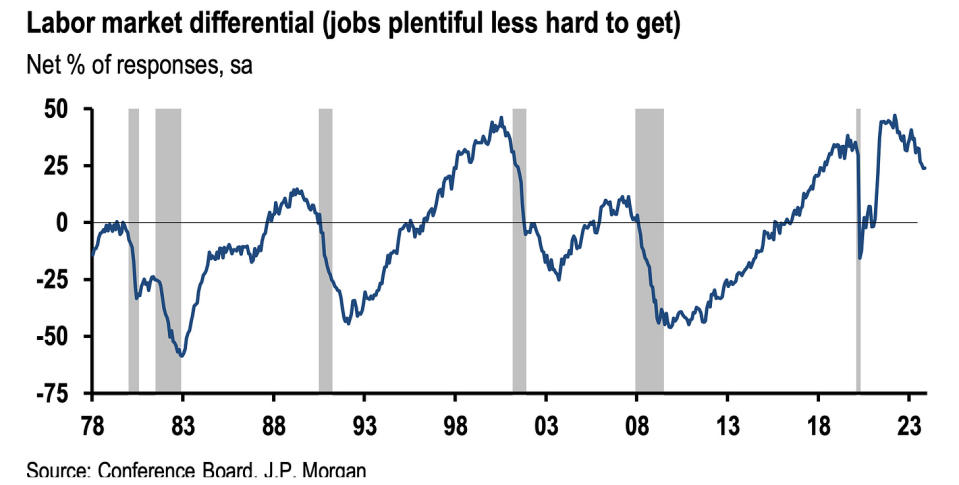

Exertions marketplace self assurance improves reasonably however style displays cooling. From The Convention Board’s September Shopper Self assurance survey: “39.3% of shoppers stated jobs had been ‘ample,’ up reasonably from 37.9% in October. Alternatively, 15.4% of shoppers stated jobs had been ‘laborious to get,’ up from 14.1%.”Many economists observe the unfold between those two percentages (a.okay.a., the exertions marketplace differential), and it’s been reflecting a cooling exertions marketplace.

Exertions marketplace self assurance improves reasonably however style displays cooling. From The Convention Board’s September Shopper Self assurance survey: “39.3% of shoppers stated jobs had been ‘ample,’ up reasonably from 37.9% in October. Alternatively, 15.4% of shoppers stated jobs had been ‘laborious to get,’ up from 14.1%.”Many economists observe the unfold between those two percentages (a.okay.a., the exertions marketplace differential), and it’s been reflecting a cooling exertions marketplace.

American citizens’ sentiment is indifferent from truth. From the FT: “American citizens are constantly mistaken within the adverse course on nearly each and every measure we polled. Through large margins, they imagine inflation remains to be emerging (it’s falling), that it has outstripped salary enlargement (wages have outpaced costs), and that they’ve change into much less rich (they’ve change into a lot wealthier)… My recommendation: if you wish to know what American citizens actually bring to mind financial prerequisites, have a look at their spending patterns. In contrast to wary Europeans, US customers are again at the pre-pandemic trendline and purchasing extra stuff than ever.”Loan charges decline. In step with Freddie Mac, the common 30-year fixed-rate loan fell to 7.22%. From Freddie Mac: “The present trajectory of charges is an encouraging construction for doable homebuyers, with acquire software job lately emerging to the similar degree as mid-September when charges had been very similar to nowadays’s ranges. The modest uptick in call for during the last month alerts that there will probably be extra pageant in a marketplace that continues to be starved for stock.”

American citizens’ sentiment is indifferent from truth. From the FT: “American citizens are constantly mistaken within the adverse course on nearly each and every measure we polled. Through large margins, they imagine inflation remains to be emerging (it’s falling), that it has outstripped salary enlargement (wages have outpaced costs), and that they’ve change into much less rich (they’ve change into a lot wealthier)… My recommendation: if you wish to know what American citizens actually bring to mind financial prerequisites, have a look at their spending patterns. In contrast to wary Europeans, US customers are again at the pre-pandemic trendline and purchasing extra stuff than ever.”Loan charges decline. In step with Freddie Mac, the common 30-year fixed-rate loan fell to 7.22%. From Freddie Mac: “The present trajectory of charges is an encouraging construction for doable homebuyers, with acquire software job lately emerging to the similar degree as mid-September when charges had been very similar to nowadays’s ranges. The modest uptick in call for during the last month alerts that there will probably be extra pageant in a marketplace that continues to be starved for stock.”

House costs upward push. In step with the S&P CoreLogic Case-Shiller index, house costs rose 0.3% month-over-month in September. From SPDJI’s Craig Lazzara: “On a year-to-date foundation, the Nationwide Composite has risen 6.1%, which is easily above the median complete calendar 12 months building up in additional than 35 years of information. Even supposing this 12 months’s building up in loan charges has indisputably suppressed the amount of houses offered, the relative scarcity of stock on the market has been a cast give a boost to for costs. Except upper charges or exogenous occasions result in basic financial weak spot, the breadth and power of this month’s document are in line with an constructive view of long term effects.”

House costs upward push. In step with the S&P CoreLogic Case-Shiller index, house costs rose 0.3% month-over-month in September. From SPDJI’s Craig Lazzara: “On a year-to-date foundation, the Nationwide Composite has risen 6.1%, which is easily above the median complete calendar 12 months building up in additional than 35 years of information. Even supposing this 12 months’s building up in loan charges has indisputably suppressed the amount of houses offered, the relative scarcity of stock on the market has been a cast give a boost to for costs. Except upper charges or exogenous occasions result in basic financial weak spot, the breadth and power of this month’s document are in line with an constructive view of long term effects.”

New house gross sales fall. Gross sales of newly constructed properties fell 5.6% in October to an annualized fee of 679,000 devices.

New house gross sales fall. Gross sales of newly constructed properties fell 5.6% in October to an annualized fee of 679,000 devices.

Benefit margins had been up in Q3. From Schwab’s Liz Ann Sonders: “Company benefit margins rebounded in 3Q23, serving to opposite a few of previous 12 months’s decline.”

Benefit margins had been up in Q3. From Schwab’s Liz Ann Sonders: “Company benefit margins rebounded in 3Q23, serving to opposite a few of previous 12 months’s decline.”

Production surveys don’t glance just right. From S&P World’s November Production PMI document: “U.S. producers reported but any other tricky month in November. Output slightly rose as inflows of latest paintings confirmed a renewed decline, hinting at little – if any – contribution to fourth quarter GDP from the goods-producing sector.”

Production surveys don’t glance just right. From S&P World’s November Production PMI document: “U.S. producers reported but any other tricky month in November. Output slightly rose as inflows of latest paintings confirmed a renewed decline, hinting at little – if any – contribution to fourth quarter GDP from the goods-producing sector.”

In a similar fashion, the ISM’s July Production PMI signaled contraction within the sector for the thirteenth consecutive month.

In a similar fashion, the ISM’s July Production PMI signaled contraction within the sector for the thirteenth consecutive month.

Those negative survey effects proceed to come back as laborious wide measures of the financial system proceed to carry up.It’s price remembering that comfortable information just like the PMI surveys don’t essentially replicate what’s if truth be told occurring within the financial system.Production development is booming. Development spending information from the Census Bureau suggests the state of producing is way more potent than implied through the comfortable survey information.

Those negative survey effects proceed to come back as laborious wide measures of the financial system proceed to carry up.It’s price remembering that comfortable information just like the PMI surveys don’t essentially replicate what’s if truth be told occurring within the financial system.Production development is booming. Development spending information from the Census Bureau suggests the state of producing is way more potent than implied through the comfortable survey information.

Close to-term GDP enlargement estimates are cooling. The Atlanta Fed’s GDPNow fashion sees actual GDP enlargement mountain climbing at a 1.2% fee in This fall.

Close to-term GDP enlargement estimates are cooling. The Atlanta Fed’s GDPNow fashion sees actual GDP enlargement mountain climbing at a 1.2% fee in This fall.

Hanging all of it togetherWe proceed to get proof that shall we see a bullish “Goldilocks” comfortable touchdown state of affairs the place inflation cools to manageable ranges with out the financial system having to sink into recession.This comes because the Federal Reserve continues to make use of very tight financial coverage in its ongoing effort to convey inflation down. Whilst it’s true that the Fed has taken a much less hawkish tone in 2023 than in 2022, and that almost all economists agree that the overall rate of interest hike of the cycle has both already took place or is close to, inflation nonetheless has to chill extra and keep cool for a short time earlier than the central financial institution is happy with worth balance.So we must be expecting the central financial institution to stay financial coverage tight, which means that we must be ready for tight monetary prerequisites (e.g., upper rates of interest, tighter lending requirements, and decrease inventory valuations) to linger. All this implies financial coverage shall be unfriendly to markets in the intervening time, and the chance the financial system slips right into a recession shall be slightly increased.On the identical time, we additionally know that shares are discounting mechanisms — that means that costs may have bottomed earlier than the Fed alerts a significant dovish flip in financial coverage.Additionally, it’s vital to understand that whilst recession dangers could also be increased, customers are coming from an excessively sturdy monetary place. Unemployed individuals are getting jobs, and the ones with jobs are getting raises.In a similar fashion, trade funds are wholesome as many firms locked in low rates of interest on their debt in recent times. At the same time as the specter of upper debt servicing prices looms, increased benefit margins give firms room to soak up upper prices.At this level, any downturn is not likely to turn out to be financial calamity for the reason that the monetary well being of shoppers and companies stays very sturdy.And as at all times, long-term traders must understand that recessions and undergo markets are simply a part of the deal while you input the inventory marketplace with the purpose of producing long-term returns. Whilst markets have had a horny tough couple of years, the long-run outlook for shares stays sure.Notice: A model of this newsletter used to be revealed on Tker.co.

Hanging all of it togetherWe proceed to get proof that shall we see a bullish “Goldilocks” comfortable touchdown state of affairs the place inflation cools to manageable ranges with out the financial system having to sink into recession.This comes because the Federal Reserve continues to make use of very tight financial coverage in its ongoing effort to convey inflation down. Whilst it’s true that the Fed has taken a much less hawkish tone in 2023 than in 2022, and that almost all economists agree that the overall rate of interest hike of the cycle has both already took place or is close to, inflation nonetheless has to chill extra and keep cool for a short time earlier than the central financial institution is happy with worth balance.So we must be expecting the central financial institution to stay financial coverage tight, which means that we must be ready for tight monetary prerequisites (e.g., upper rates of interest, tighter lending requirements, and decrease inventory valuations) to linger. All this implies financial coverage shall be unfriendly to markets in the intervening time, and the chance the financial system slips right into a recession shall be slightly increased.On the identical time, we additionally know that shares are discounting mechanisms — that means that costs may have bottomed earlier than the Fed alerts a significant dovish flip in financial coverage.Additionally, it’s vital to understand that whilst recession dangers could also be increased, customers are coming from an excessively sturdy monetary place. Unemployed individuals are getting jobs, and the ones with jobs are getting raises.In a similar fashion, trade funds are wholesome as many firms locked in low rates of interest on their debt in recent times. At the same time as the specter of upper debt servicing prices looms, increased benefit margins give firms room to soak up upper prices.At this level, any downturn is not likely to turn out to be financial calamity for the reason that the monetary well being of shoppers and companies stays very sturdy.And as at all times, long-term traders must understand that recessions and undergo markets are simply a part of the deal while you input the inventory marketplace with the purpose of producing long-term returns. Whilst markets have had a horny tough couple of years, the long-run outlook for shares stays sure.Notice: A model of this newsletter used to be revealed on Tker.co.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821863/dal_a321_neo_624.jpg)