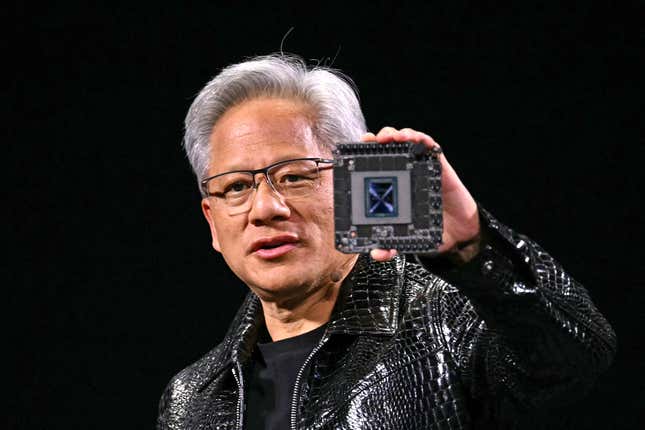

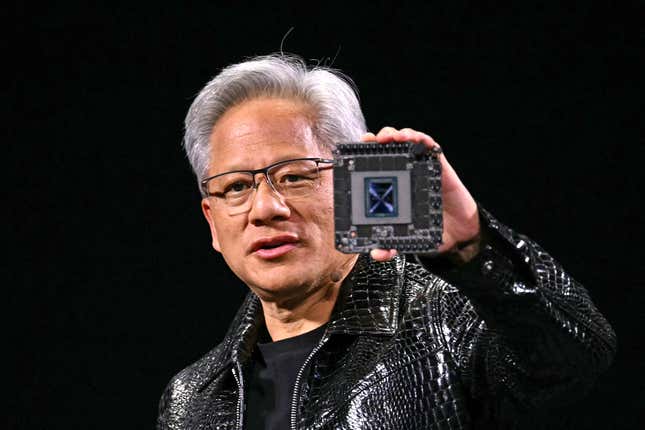

Nvidia CEO Jensen Huang right through his keynote deal with on the Shopper Electronics Display (CES) in Las Vegas, Nevada on January 6, 2025.Photograph: Patrick T. Fallon/AFP (Getty Photographs)In This StoryNvidia (NVDA-3.69%) leader government Jensen Huang doesn’t have arduous emotions for Chinese language synthetic intelligence startup DeepSeek.Amazon takes ingenious keep an eye on of the James Bond film franchiseAfter the Hangzhou-based AI startup spooked traders in January, Nvidia’s inventory plunged 17%, wiping out just about $600 billion in worth — a document loss for a U.S. corporate — amid a world selloff of tech shares.In December, DeepSeek stated it used a cluster of just below 2,050 of Nvidia’s reduced-capability H800 chips to coach its DeepSeek-V3 type — a lot not up to the tens of 1000’s of extra complex Nvidia chips U.S. corporations are the use of to coach similarly-sized fashions. The AI startup’s fashions, which it demonstrated to be on par with the ones from OpenAI and Meta (META-1.66%), caused questions over the tens of billions of greenbacks its U.S. opponents are spending on state of the art chips and AI infrastructure. Right through an interview with DataDirect Networks leader government Alex Bouzari, Huang stated he thinks DeepSeek’s reasoning fashions, R1, which it launched in January forward of the inventory rout, will result in extra call for for computing energy, as a result of reasoning is “moderately compute extensive.”“I believe the marketplace answered to R1 as in ‘Oh my gosh, AI is completed. It dropped out of the sky, we don’t want to do any computing anymore,’” Huang stated. “It’s precisely the other.”Huang additionally famous that R1 is “the sector’s first reasoning type that’s open-source,” which means builders and customers can freely use it.“It’s so extremely thrilling, the power around the globe on account of R1 turning into open-sourced. Improbable,” Huang stated.Previous this month, JPMorgan U.S. Fairness Analysis (JPM-1.01%) analysts stated in a document that DeepSeek is prone to have a favorable affect on Nvidia. DeepSeek’s demonstration of cost-efficiency and AI innovation will result in “robust call for” for higher-performance graphics processing gadgets, or GPUs, the analysts stated. Due to this fact, Nvidia’s management in complex AI chips “will have to allow them to liberate new use-cases.”Nvidia is anticipated to document fiscal fourth quarter income subsequent week.

Nvidia CEO Jensen Huang right through his keynote deal with on the Shopper Electronics Display (CES) in Las Vegas, Nevada on January 6, 2025.Photograph: Patrick T. Fallon/AFP (Getty Photographs)In This StoryNvidia (NVDA-3.69%) leader government Jensen Huang doesn’t have arduous emotions for Chinese language synthetic intelligence startup DeepSeek.Amazon takes ingenious keep an eye on of the James Bond film franchiseAfter the Hangzhou-based AI startup spooked traders in January, Nvidia’s inventory plunged 17%, wiping out just about $600 billion in worth — a document loss for a U.S. corporate — amid a world selloff of tech shares.In December, DeepSeek stated it used a cluster of just below 2,050 of Nvidia’s reduced-capability H800 chips to coach its DeepSeek-V3 type — a lot not up to the tens of 1000’s of extra complex Nvidia chips U.S. corporations are the use of to coach similarly-sized fashions. The AI startup’s fashions, which it demonstrated to be on par with the ones from OpenAI and Meta (META-1.66%), caused questions over the tens of billions of greenbacks its U.S. opponents are spending on state of the art chips and AI infrastructure. Right through an interview with DataDirect Networks leader government Alex Bouzari, Huang stated he thinks DeepSeek’s reasoning fashions, R1, which it launched in January forward of the inventory rout, will result in extra call for for computing energy, as a result of reasoning is “moderately compute extensive.”“I believe the marketplace answered to R1 as in ‘Oh my gosh, AI is completed. It dropped out of the sky, we don’t want to do any computing anymore,’” Huang stated. “It’s precisely the other.”Huang additionally famous that R1 is “the sector’s first reasoning type that’s open-source,” which means builders and customers can freely use it.“It’s so extremely thrilling, the power around the globe on account of R1 turning into open-sourced. Improbable,” Huang stated.Previous this month, JPMorgan U.S. Fairness Analysis (JPM-1.01%) analysts stated in a document that DeepSeek is prone to have a favorable affect on Nvidia. DeepSeek’s demonstration of cost-efficiency and AI innovation will result in “robust call for” for higher-performance graphics processing gadgets, or GPUs, the analysts stated. Due to this fact, Nvidia’s management in complex AI chips “will have to allow them to liberate new use-cases.”Nvidia is anticipated to document fiscal fourth quarter income subsequent week.

What Nvidia’s CEO thinks about DeepSeek forward of income